Working Families Cheated By Tax Credits

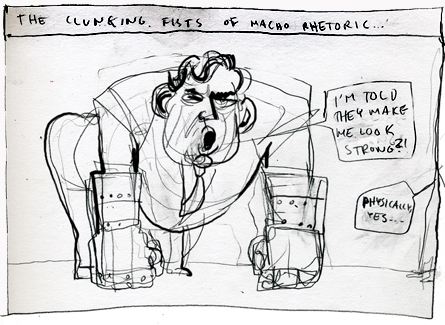

AS Gordon Brown prepares to take over as PM, one of his pet projects, the tax credits scheme, has come under even more fire, this time from former Labour minister Frank Field. (Pic: Poldraw)

AS Gordon Brown prepares to take over as PM, one of his pet projects, the tax credits scheme, has come under even more fire, this time from former Labour minister Frank Field. (Pic: Poldraw)

The scheme has been plagued by poor organisation, frequent overpayments and widespread fraud, but now, Field, in association with the think-thank Reform, has launched a damning critique of a system he claims “brutally discriminates” against two-parent families.

The study states that a single mother working 16 hours a week, after tax credits, earns a total weekly income of £487, while a two-parent family on the minimum wage would have to work 116 hours to earn the same amount.

Not surprisingly, the Treasury has been quick to deny the claims. A spokesman says: “Levels of financial support are determined by need – based on the number of children in the family and the household’s income. As a result of measures introduced by the Government, since 1997 households with children in the poorest fifth of the population are on average £3,500 better off per year in real terms.”

Still, Field’s claims that the present system is discouraging single parents from finding a partner or marrying will come as a major embarrassment to Brown in his final days as Chancellor.

What with rising interest rates, inflated mortgages and now this tax credits controversy, Gordie’s legacy is looking far less impressive these days. Bet he can’t wait to move next door to No. 10.

Posted: 14th, June 2007 | In: Money Comments (2) | TrackBack | Permalink