Saudi Arabia Can’t Solve Libya: The Myth Of Spare Oil Capacity

THE talk in the news is that if Libya’s oil stays offline – it’s the world’s 12th largest producer – Saudi Arabia can make up for any short fall. But it’s not that easy. Barclays Capital’s Amrita Sen explains:

THE talk in the news is that if Libya’s oil stays offline – it’s the world’s 12th largest producer – Saudi Arabia can make up for any short fall. But it’s not that easy. Barclays Capital’s Amrita Sen explains:

Firstly, the grades and quality of crude available from Saudi Arabia [are] likely to be different from Libya. For instance, the volume-weighted average of Libyan grades would have an API of around 37-38, while the current shut in Saudi production is biased towards medium crude. Moreover, Libyan crude is sweeter…

Prompt Brent markets have also flipped into slight backwardation, a trend we expect to continue in the short term, if sourcing immediate supplies is the concern. Moreover, the time taken to bring those Saudi barrels to the market is likely to be significantly longer compared to the ongoing Libyan production. Thus, the concept of a barrel for barrel replacement is not a correct one.

Gregor MacDonald explains spare capacity theory:

Of course, “everyone knows” that OPEC is sitting on lots of oil. However, as has been discussed here, at The Oil Drum, and elsewhere it remains decidedly unclear whether Saudi Arabia can indeed turn on extra taps at will. But the problems for world supply of oil do not merely end with production capacity. Even if OPEC is indeed sitting on 1-3 mbpd of spare capacity, it’s not clear for how long they can both increase production, and export that production to the world. Not only has Saudi Arabia’s production not increased in the past five years, but, Saudi is increasingly using its own oil for its own population. The result? Flat, to declining exports of oil from Saudi Arabia.

Spare Capacity Theory, therefore, looks alot like an unproven consensus reality. I’d like to define it as follows:

Spare Capacity Theory: the assumption among western bankers, policy makers, economists, and stock markets that OPEC producers can lift oil production at will, and, export all of that spare production to world consumers.

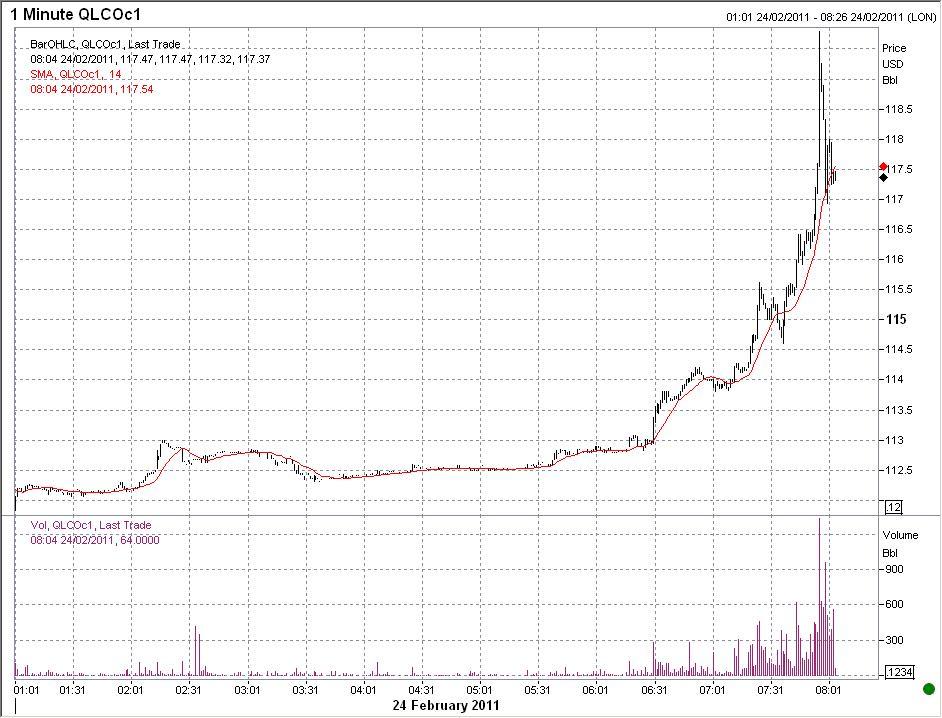

Graphic: Brent crude prices rise.

Spotter: FT

Posted: 24th, February 2011 | In: Money Comment (1) | TrackBack | Permalink