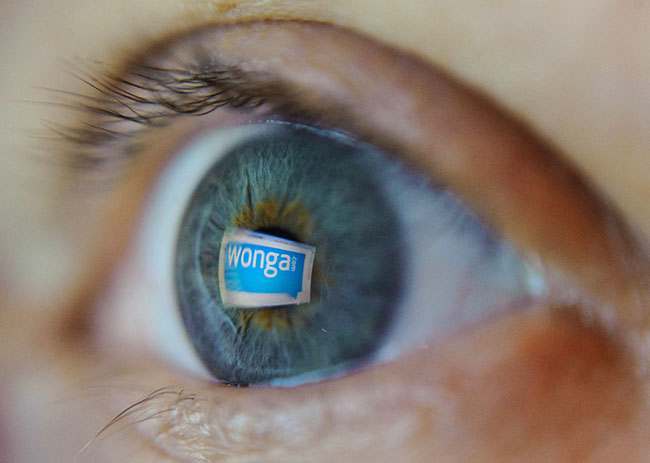

Wonga puts its lending rate up to 5,853 per cent

NOT that it actually means very much but it’ll give some campaigners something else to shout about:

Payday loan giant Wonga has increased the interest rate it uses to illustrate the cost of borrowing to 5,853 per cent – a rise of 1,600 per cent.

Sounds appalling, eh?

Wonga used to give the example of a £207 loan over 20 days, with interest and charges of £47.42 and an APR of 4,214 per cent.

But it now uses a new example of someone borrowing a smaller sum of £150 for 18 days, with interest and charges of £33.49 and an APR of 5,853 per cent.

The problem with this is that its an inevitable part of how an APR is calculated.

Start from the beginning: you lend money to someone then you’ve got to charge them interest. Some won’t pay it back, there’s a time value to money and so on. But you’ve also got to charge them an arrangement fee. You’ve got to have an office (even if it’s just a virtual one on the internet), staff and all the rest of it. An APR adds in that fee and that interest and then scales it up to an annual cost (the annual being the A in APR).

But because you’re borrowing a small amount that arrangement fee is going to be a large percentage of it: there’s certain minimum costs that just have to be paid whether you’re borrowing £100 or £10,000. Which is why a bank loan for the same period of time will be about the same cost: most banks will charge you £35 as an arrangement fee for a loan. But the APR then assumes that that fee is being paid every 18 days (in that second example) over the year. Which is how you get to those insane APRs.

The truth is that lending small sums of money to people for short periods of time is always, with this calculation method, going to be shockingly expansive. Doesn’t matter who does it: Wonga, a bank, a credit union. There just isn’t any way around it.

Posted: 24th, June 2013 | In: Money Comment | TrackBack | Permalink