Oil Wars: Saudi Arabian Terror And Obama’s Subservience Are At The Heart Of The IS Crisis

The President of the USA Barack Obama bows to King Abdullah of Saudi Arabia, before the official G20 photocall with the Queen at Buckingham Palace.

Picture date: Wednesday April 1, 2009.

IS Saudi Arabia at the heart of the IS crisis?

Last year, Syria’s Bashar al-Assad was the enemy. He had crossed Barack Obama’s “red line”, the President of America reasoning that shooting people in the face was not as bad as poisoining them.

The Saudis want Assad gone.

The WSJ noted a deal:

When Mr. Kerry [US Secretary of State JohnKerry] touched down in Jeddah to meet with King Abdullah on Sept. 11, he didn’t know for sure what else the Saudis were prepared to do. The Saudis had informed their American counterparts before the visit that they would be ready to commit air power—but only if they were convinced the Americans were serious about a sustained effort in Syria. The Saudis, for their part, weren’t sure how far Mr. Obama would be willing to go, according to diplomats.

The US needed a big Arab ally to get ISIS. So:

The Americans knew a lot was riding on a Sept. 11 meeting with the king of Saudi Arabia at his summer palace on the Red Sea. A year earlier, King Abdullah had fumed when President Barack Obama called off strikes against the regime of Syria’s Bashar al-Assad. This time, the U.S. needed the king’s commitment to support a different Syrian mission—against the extremist group Islamic State—knowing there was little hope of assembling an Arab front without it.

At the palace, Secretary of State John Kerry requested assistance up to and including air strikes, according to U.S. and Gulf officials. “We will provide any support you need,” the king said.

The US is not calling the shots:

Wary of a repeat of Mr. Obama’s earlier reversal, the Saudis and United Arab Emirates decided on a strategy aimed at making it harder for Mr. Obama to change course. “Whatever they ask for, you say ‘yes,'” an adviser to the Gulf bloc said of its strategy. “The goal was not to give them any reason to slow down or back out.”

Arab participation in the strikes is of more symbolic than military value. The Americans have taken the lead and have dropped far more bombs than their Arab counterparts. But the show of support from a major Sunni state for a campaign against a Sunni militant group, U.S. officials said, made Mr. Obama comfortable with authorizing a campaign he had previously resisted.

But what do the Saudis want? Why do they despise Assad?

For the Saudis, Syria had become a critical frontline in the battle for regional influence with Iran, an Assad ally. As Mr. Assad stepped up his domestic crackdown, the king decided to do whatever was needed to bring the Syrian leader down, Arab diplomats say. In the last week of August, a U.S. military and State Department delegation flew to Riyadh to lay the ground for a military program to train the moderate Syrian opposition to fight both the Assad regime and Islamic State—something the Saudis have long requested. The U.S. team wanted permission to use Saudi facilities for the training. Top Saudi ministers, after consulting overnight with the king, agreed and offered to foot much of the bill. Mr. Jubeir went to Capitol Hill to pressed key lawmakers to approve legislation authorizing the training.

But it’s got a lot to do with oil, wich is power:

Anadolu Agency explains how SAudi Arabia seeks to damage OPEC:

And:

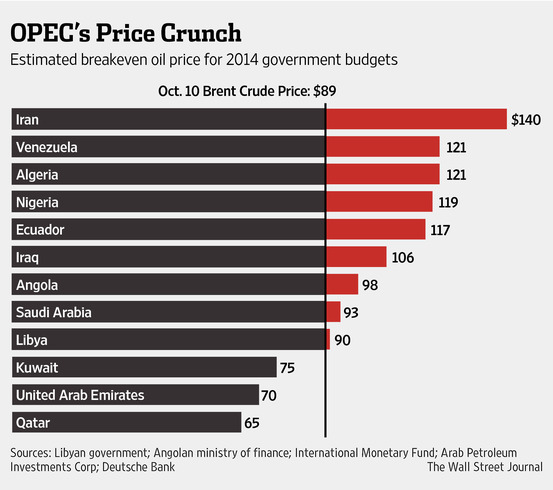

Saudi Arabia will force the price of oil down, in an effort to put political pressure on Iran and Russia, according to the President of Saudi Arabia Oil Policies and Strategic Expectations Center.

Saudi Arabia plans to sell oil cheap for political reasons, one analyst says.

To pressure Iran to limit its nuclear program, and to change Russia’s position on Syria, Riyadh will sell oil below the average spot price at $50 to $60 per barrel in the Asian markets and North America, says Rashid Abanmy, President of the Riyadh-based Saudi Arabia Oil Policies and Strategic Expectations Center. The marked decrease in the price of oil in the last three months, to $92 from $115 per barrel, was caused by Saudi Arabia, according to Abanmy.

With oil demand declining, the ostensible reason for the price drop is to attract new clients, Abanmy said, but the real reason is political. Saudi Arabia wants to get Iran to limit its nuclear energy expansion, and to make Russia change its position of support for the Assad Regime in Syria. Both countries depend heavily on petroleum exports for revenue, and a lower oil price means less money coming in, Abanmy pointed out. The Gulf states will be less affected by the price drop, he added.

The Organization of the Petroleum Exporting Countries, which is the technical arbiter of the price of oil for Saudi Arabia and the 11 other countries that make up the group, won’t be able to affect Saudi Arabia’s decision, Abanmy maintained.

The organization’s decisions are only recommendations and are not binding for the member oil producing countries, he explained.

So. The price of oil falls. With Syria is turmoil any slack is taken up by the Saudis, who demand customers buy the maximum shipments or get nothing.

The Wall Street Journal again:

Days after slashing prices in Asia, Saudi Arabia is now making an aggressive push in the European oil market, traders say. The kingdom is taking the unusual step of asking buyers to commit to maximum shipments if they want to get its crude. “The Saudi push is not just in Asia. It’s a global phenomenon,” one oil trader said. “They are using very aggressive tactics” in Europe too, the trader added.

This month, state-owned Saudi Aramco stunned the rest of the Organization of the Petroleum Exporting Countries by slashing its November prices to defend its market share in Asia’s growing market. The move, setting a price war in the oil-production group, was combined with a boost in the kingdom’s output in September.

But Riyadh is also moving to protect its sales to Europe, a declining market where it is facing rivalry from returning Libyan production. After cutting its November prices there, Saudi Aramco is also asking refiners to commit to full, fixed deliveries in talks to renew contracts for next year, the traders say. They say the Saudi oil company had previously offered a formula allowing flexibility of more or less 10% of contracted volumes, the most commonly used in the industry.

“They are threatening buyers” to discontinue sales if they don’t agree with the fixed deliveries, another trader said.

The Saudis have also sought to influence the Russians, another oil-rich cuntry.

ZeroHedge has more:

Prince Bandar, head of Saudi intelligence, allegedly confronted the Kremlin with a mix of inducements and threats in a bid to break the deadlock over Syria…

Courtesy of As-Safir (translated here), we learn all the gritty details about what really happened at the meeting, instead of just the Syrian motives and the Russian conclusion, and most importantly what happened just as the meeting ended, unsuccessfully (at least to the Saudi). And by that we mean Saudi Arabia’s threats toward Russia and Syria. First, some less well-known observations on who it was that was supporting the Muslim Brotherhood in Egypt even as US support was fading fast:

Bandar said that the matter is not limited to the kingdom and that some countries have overstepped the roles drawn for them, such as Qatar and Turkey. He added, “We said so directly to the Qataris and to the Turks. We rejected their unlimited support to the Muslim Brotherhood in Egypt and elsewhere. The Turks’ role today has become similar to Pakistan’s role in the Afghan war. We do not favor extremist religious regimes, and we wish to establish moderate regimes in the region. It is worthwhile to pay attention to and to follow up on Egypt’s experience. We will continue to support the [Egyptian] army, and we will support Defense Minister Gen. Abdel Fattah al-Sisi because he is keen on having good relations with us and with you. And we suggest to you to be in contact with him, to support him and to give all the conditions for the success of this experiment. We are ready to hold arms deals with you in exchange for supporting these regimes, especially Egypt.”

So while Saudi was openly supporting the Egyptian coup, which is well-known, it was Turkey and most importantly Qatar, the nation that is funding and arming the Syrian rebels, that were the supporters of the now failed regime.

Regarding Iran, Putin said to Bandar that Iran is a neighbor, that Russia and Iran are bound by relations that go back centuries, and that there are common and tangled interests between them. Putin said, “We support the Iranian quest to obtain nuclear fuel for peaceful purposes. And we helped them develop their facilities in this direction. Of course, we will resume negotiations with them as part of the 5P+1 group. I will meet with President Hassan Rouhani on the sidelines of the Central Asia summit and we will discuss a lot of bilateral, regional and international issues. We will inform him that Russia is completely opposed to the UN Security Council imposing new sanctions on Iran. We believe that the sanctions imposed against Iran and Iranians are unfair and that we will not repeat the experience again…”

Regarding the Turkish issue, Putin spoke of his friendship with Turkish Prime Minister Recep Tayyip Erdogan; “Turkey is also a neighboring country with which we have common interests. We are keen to develop our relations in various fields. During the Russian-Turkish meeting, we scrutinized the issues on which we agree and disagree. We found out that we have more converging than diverging views. I have already informed the Turks, and I will reiterate my stance before my friend Erdogan, that what is happening in Syria necessitates a different approach on their part. Turkey will not be immune to Syria’s bloodbath. The Turks ought to be more eager to find a political settlement to the Syrian crisis. We are certain that the political settlement in Syria is inevitable, and therefore they ought to reduce the extent of damage. Our disagreement with them on the Syrian issue does not undermine other understandings between us at the level of economic and investment cooperation. We have recently informed them that we are ready to cooperate with them to build two nuclear reactors. This issue will be on the agenda of the Turkish prime minister during his visit to Moscow in September.”

And Syria:

Regarding the Syrian issue, the Russian president responded to Bandar, saying, “Our stance on Assad will never change. We believe that the Syrian regime is the best speaker on behalf of the Syrian people, and not those liver eaters. During the Geneva I Conference, we agreed with the Americans on a package of understandings, and they agreed that the Syrian regime will be part of any settlement. Later on, they decided to renege on Geneva I. In all meetings of Russian and American experts, we reiterated our position. In his upcoming meeting with his American counterpart John Kerry, Russian Foreign Minister Sergey Lavrov will stress the importance of making every possible effort to rapidly reach a political settlement to the Syrian crisis so as to prevent further bloodshed.”

And then this allegation:

Bandar told Putin, “There are many common values and goals that bring us together, most notably the fight against terrorism and extremism all over the world. Russia, the US, the EU and the Saudis agree on promoting and consolidating international peace and security. The terrorist threat is growing in light of the phenomena spawned by the Arab Spring. We have lost some regimes. And what we got in return were terrorist experiences, as evidenced by the experience of the Muslim Brotherhood in Egypt and the extremist groups in Libya. … As an example, I can give you a guarantee to protect the Winter Olympics in the city of Sochi on the Black Sea next year. The Chechen groups that threaten the security of the games are controlled by us, and they will not move in the Syrian territory’s direction without coordinating with us. These groups do not scare us. We use them in the face of the Syrian regime but they will have no role or influence in Syria’s political future.”

A threat against Russia?

As soon as Putin finished his speech, Prince Bandar warned that in light of the course of the talks, things were likely to intensify, especially in the Syrian arena, although he appreciated the Russians’ understanding of Saudi Arabia’s position on Egypt and their readiness to support the Egyptian army despite their fears for Egypt’s future.

The head of the Saudi intelligence services said that the dispute over the approach to the Syrian issue leads to the conclusion that “there is no escape from the military option, because it is the only currently available choice given that the political settlement ended in stalemate. We believe that the Geneva II Conference will be very difficult in light of this raging situation.”

And that’s how trouble for the world looms…

Posted: 13th, October 2014 | In: Key Posts, Reviews Comments (2) | TrackBack | Permalink