Panama Papers: the murky world of newspapers and dictators

You’ve heard news of the Panama Papers. The Guardian is hot for them:

In the files we have found evidence of Russian banks providing slush funds for President Vladimir Putin’s inner circle; assets belonging to 12 country leaders, including the leaders of Iceland, Pakistan and Ukraine; companies connected to more than 140 senior politicians, their friends and relatives, and to some 22 people subject to sanctions for supporting regimes in North Korea, Syria, Russia and Zimbabwe; the proceeds of crimes, including Britain’s infamous Brink’s-Mat gold robbery; and enough art hidden in private collections to fill a public gallery.

Can it be that the corrupt are corrupt? As the Guardian studiously ignores its own off-shore tax arrangements, the Mirror leads with David’s Cameron’s link to the Panama Papers. It asks: “So, do you STILL have family money stashed in a secret offshore tax haven, Prime Minister?” To which you might asks, “Does the Mirror have any investigative journalists or is it all clickbait?”

Before more on Cameron, a few words on the source. The 11.5 million documents were leaked by someone at Panama-based law company Mossack Fonseca, and shared with more than 370 journalists affiliated with the International Consortium of Investigative Journalists.

The ICIJ is the watchdog journalism branch of the Center for Public Integrity, a Washington nonprofit, nonpartisan investigative group.

And:

Founded in 1977, Mossack Fonseca is headquartered in Panama but has a presence in dozens of countries including known tax havens such as Switzerland, the British Virgin Islands and Seychelles. It specializes in helping companies and individuals set up offshore, tax exempt entities, according to its website, and is reportedly the world’s fourth largest provider of such services. According to the Guardian, one of the two U.K. publications that partnered with the ICIJ in the investigation, one of the firm’s partners said in a leaked memorandum that “ninety-five per cent of our work coincidentally consists in selling vehicles to avoid taxes.”

Mossack Fonseca has strongly denied any wrongdoing, saying in an initial statement to ICIJ that it conducts “a thorough due-diligence process” before helping to incorporate companies. The company also provided a more detailed response, which can be read in full here.

The leak is the biggest in history, greater than the cache of documents released by Wikileaks, and contains information from 1977 to December 2015, including the details of 214,000 entities, such as trusts, foundations and shell companies that can be used to hide the true ownership of assets.

Back to Cameron. The Times also leads with the Cameron link. And it’s a good read:

Blairmore Holdings, set up by Ian Cameron [Dave’s dad] in 1982, held board meetings abroad and allegedly placed up to 50 Caribbean officers including a lay bishop in executive positions to legally avoid being taxed as a British company.

The Bahamas-based investment fund, which managed tens of millions of pounds on behalf of wealthy families, used anonymous “bearer shares” to shield its clients from public view, according to a data leak that has implicated world leaders, celebrities and businessmen in offshore tax avoidance.

Bearer shares can be used to facilitate money laundering and tax evasion as they enable investors to hide ownership and transfer assets without a paper trail. The prime minister banned them last year and has called for an international crackdown on aggressive tax avoidance and evasion. Last night Mr Cameron said that his family’s tax affairs were a private matter. Downing Street would not be drawn on whether the Cameron family still had a stake in the fund.

The Mirror says they are not a private matter. Of course, what is and what is not private is far from being the Mirror’s special area of expertise, what with it being embroiled in phone hacking payouts for invading people’s privacy.

The row came after an unprecedented leak of 11.3 million documents from Mossack Fonseca, a Panamanian law firm. Jurisdictions such as Panama offer companies and individuals the chance to legally mitigate tax bills and maintain anonymity, but failure to declare assets to the taxman in their own country can be illegal.

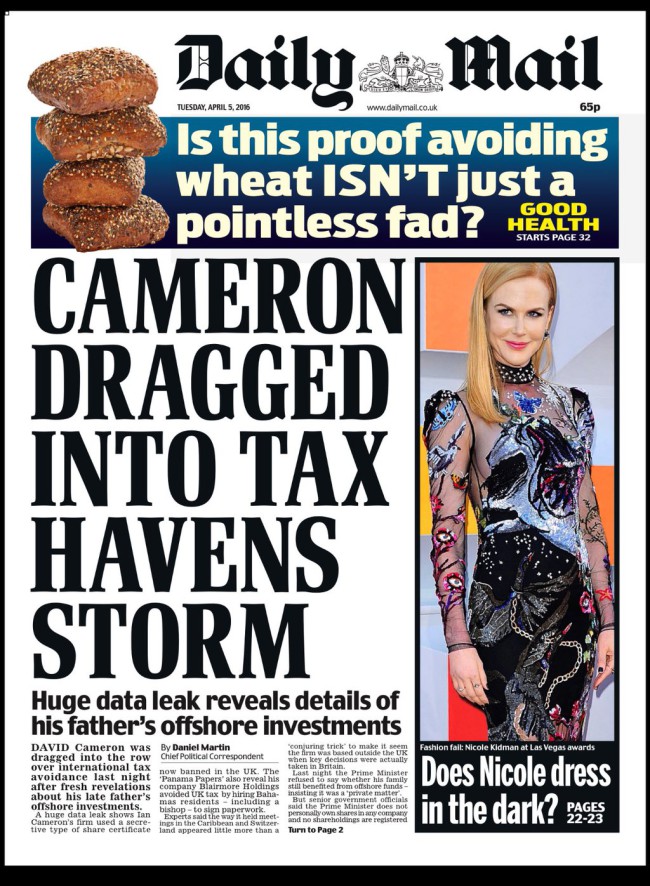

The Mail leads with much the same, although early on it points out that Bearer shares are now banned in the UK. Over on Page 9, the Mail looks Putin’s “£1.4bn if shady deals”. To which cynics might say, ‘and the rest of them aren’t?’

It’s all murky stuff. But given the levels of secrecy and massive wealth, the cast of billionaires, celebrities and global leaders, what do we expect to be the result of it all?

Posted: 5th, April 2016 | In: Money, Politicians, Reviews Comment | TrackBack | Permalink