Money Category

Money in the news and how you are going to pay and pay and pay

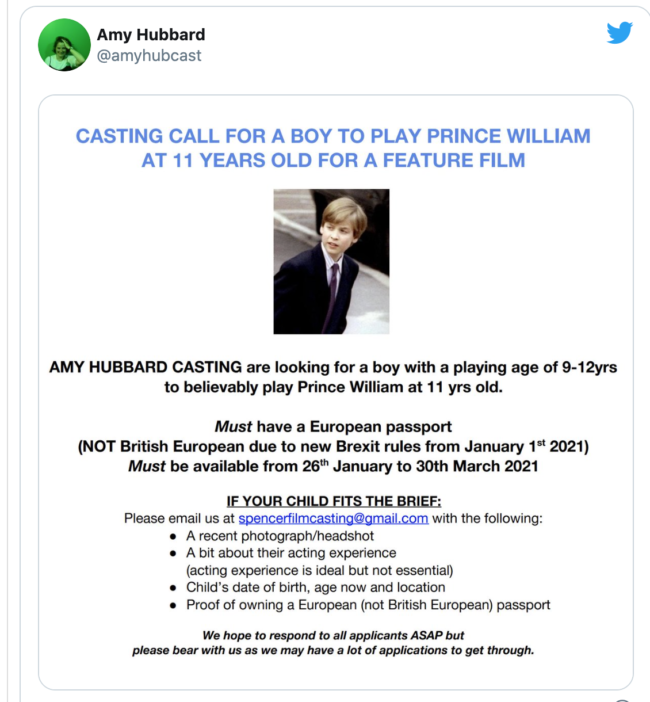

Prince William needs a German or Greek passport

A new biopic starring Kristen Stewart as Princess Diana needs a Prince William – and only actors with British-European passport holders can apply. If you’ve only got a post-Brexit British passport, you cannot audition for the tole. Apparently it’s something to do with the film’s financing.

But it doe make me wonder: does the future King William qualify for a German passport?

Posted: 26th, November 2020 | In: Film, Money, News, Politicians, Royal Family, Strange But True | Comment

The Gender Pay Gash

In the Times, talk turns to the gender pay gash, sorry, gap:

If you thought the days of the unreconstructed male needing to rule the financial roost in a marriage were long gone, it may be time to think again.

New research has found that husbands feel a thrill if a pay rise widens the gap between their earnings and those of their lower-paid wives — but women get no such kick if the roles are reversed.

The stereotype of the male breadwinner may still be “bigger than we give credit for”, said Vanessa Gash, a sociologist who co-authored the study of views of income by gender.

Spotter: The Times

Posted: 23rd, November 2020 | In: Broadsheets, Money, News | Comment

Bank wants children for its ‘WANK Coloring contest’

To Japan, where the Nishi-Nippon City Bank invited children in Nagasaki. to colour in the bank’s mascot. Just add come colours to Wank The Dog.

From the bank’s website:

The popular event “Wank Coloring Contest” , which was held at the West Japan City Bank last year and attracted more than 2,000 works , is coming to the city of Nagasaki this year! Whether you are familiar with Wank or not , be sure to wield your arm for a gorgeous prize !

The contest will be judged by Groovevisions, who created the “timeless” Wank The Dog. Entries are limited to one WANK per person.

Posted: 5th, November 2020 | In: Key Posts, Money, Strange But True | Comment

Octogenarian pizza delivery driver Derlin Newry is coining it in

Derlin Newey works a 30-hour week as a pizza delivery man in Utah. He’s 89. The Valdez family recored Newey delivering their pizzas and loaded the interactions on TikTok. A fanbase grew and people asks why Derlin was working? The answer is that he needs the money – social security payments aren’t enough to cover his bills. A cry for help went out and $12,069 was delivered to Newey’s house. “How do I ever say thank you? I don’t know what to say?” he responded.

This is, says CNN, proof of goodness of humanity. But the Guardian it’s a problem. The paper asks, “What sort of social security net forces an 89-year-old man to have to run around delivering pizza in his old age just so he can make rent?”

And then came the maths:

Americans who are his age and make the average US yearly income of $35,977, can expect to receive about $1,579 a month in social security payments; barely enough to make the average rent – or roughly the same amount as what Donald Trump pays in taxes across two years.

So you make around $36,000 a year in wages PLUS around $18,000 in social security cheques? The Guardian means “made” not “make”, of course. And with that one error the entire story changes meaning. And Mr Newey? He’s doing pretty well, no, enjoying life and working into his dotage? As for the pension (what the paper actually means), well, just under 50% of the working wage in the retirement years is not abysmal.

How to raise your IQ: afford to live near a green space

The results of the survey are in. The greener the urban child’s world, the higher their IQ. Boffins have produced a paper which looked at linking access to parkland and gardens with doing well in intelligence tests. The work begins:

Exposure to green space has beneficial effects on several cognitive and behavioral aspects. However, to our knowledge, no study addressed intelligence as outcome. We investigated whether the level of urbanicity can modify the association of residential green space with intelligence and behavior in children.

The child in the high-rise apartment is not doing as well as the child living in a house by the park? The Telegraph sees the results:

Being raised in a greener environment boosts urban children’s intelligence and makes them better behaved, a study has found.

Researchers in Belgium found that living near parks, sports fields or community gardens raised city-dwelling children’s IQ levels and that they also exhibited less difficult behaviour. The paper, published in the journal Plos Medicine, found that an 3.3 per cent increase in green space within 3,000 metres of a child’s home was associated with a 2.6 point rise in overall IQ.

Got that? And then take a look at the property prices in you area and wonder why the people who earn the most money choose to live by the greener spaces. Is it because they have higher IQs? Or do they have more money and bigger incomes?

Disaster prone Boeing 737 Max is gone; all hail the Boeing 737-8 (the same plane with a new name)

No need to worry, passengers. The Boeing’s 737 MAX jet, the not all that good plane grounded after two fatal crashes which killed 346 people – Boeing was accused of concealing information about the plane from regulators during the approval process – is no longer. It’s now a Boeing 737-8 aircraft. This year, customers have cancelled more than 400 orders for the 737. They can now order a much better 737-8, which is just like the other one but with a safer ‘8’ in the name.

It’s working! Boeing have issued a press release:

“Despite the current crisis, it is important to think about the future. To that end, we have agreed to order additional 737-8 aircraft. Following the rigorous checks that the 737 MAX is undergoing, I am convinced it will be the best aircraft in the world for many years to come,” said Grzegorz Polaniecki, general director and board member, Enter Air.

That’s two of the jets sold. Now to find people will to ride on them…

Loss-making Guardian sacks 70 journalists – chief executive earns £630,000 a year

Bad news in journalism as Guardian Media Group announced plans to let go 12% of its workforce. That’s 180 jobs, with 70 of those in editorial. The Guardian’s Saturday edition will be hit hard, with The Guide, Weekend, Review and Travel axed. The Press Gazette looks at the numbers:

The news came as Guardian Media Group published its financial results for the 12 months to 29 March… GMG reported a pre-tax loss of £36.8m versus a pre-tax profit of £31m the previous year. It made an operating loss of £17.5m versus an operating loss of £16.6m a year earlier.

Editor Kath Viner, who earned a 5% pay rise, saw her total pay and benefits for the last financial year rise to £391,000.

…outgoing chief executive David Pemsel received a pay-off of £184,275 when he left the company on 2 December last year. His successor, Annette Thomas, has the same salary: £630,000.

A statement published on the newspaper’s website tells readers:

The editor-in-chief, Katharine Viner, and the Guardian Media Group chief executive, Annette Thomas, said in a joint statement to staff that the pandemic had created an “unsustainable financial outlook for the Guardian” with revenues expected to be down by more than £25m on the year’s budget.

They said Guardian Media Group, the parent company of the Guardian and the Observer, was facing “unsustainable annual losses in future years unless we take decisive action” to reduce costs.

Viner and Thomas said they remained committed to keeping the Guardian free-to-read and not following the paywall model adopted by many rivals. Instead, they will concentrate on the Guardian’s digital growth and focus on its reader revenue model.

The Guardian ends every story with a call for a donation. What are you donating to – and does the chief executive need it?

Image: King George V being asked for spare change, 1920s.

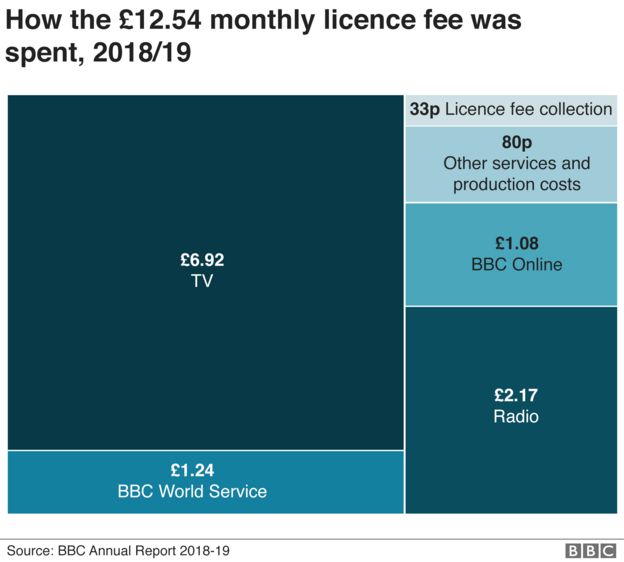

BBC will lock up you granny and other over 75s unless they pay the licence fee tax

Because no-one under the age of 70 watches the BBC, the State broadcaster will end free TV licences for most over-75s. More than three millions households will be fined and deemed criminals unless they pay the £157.50 fee from 1 August. You can escape the tax if someone in your household receives the Pension Credit benefit. The all-encompassing, local-newspapers thrashing BBC website quotes the BBC as saying this is “the fairest decision”. The Government calls it “deeply frustrating”. Teenagers says, “BB.. what?”

BBC Chairman and pensioner Sir David Clementi (born 25 February 1949; salary £450,000 a year plus perks) says the decision had “not been easy”. Which is, of course, bunkum. If the head of the corporation can’t find a reason to keep the organisation at the heart of people’s lives – and charging them makes them relevant – what’s his purpose? And then what of all those BBC jobs. Would he sacrifice them for the greater good? Sir David says the BBC is “under severe financial pressure”. The corporation must survive. And you must pay for it to do so.

So how is your dosh spent by the humungous BBC?

Did you watch much BBC telly? EastEnders, much? Newsnight? Is there any other news website you pay £1 a month to read – or else? Do you pay for radio? Listen to the World Service at all. Watch the BBC news? Or do you surf the web for free radio from Brazil, Japan or Florida, watch the less biased ITV News and binge on Netflix boxsets?

The BBC does a lot of terrific work. The 13 Minutes to the Moon podcast is worth paying for. Sport on the radio is excellent. Local radio can be very good. And.. Well, yeah. The BBC does radio really well. TV – meh. The Internet – you can get the same elsewhere. So why not make the BBC a subscription service? But – no – the BBC just says we should all pay for for it to do whatever it wants to do. We must pay for all of it bit just the bits we like. So you pay for EastEnders, 6 Music and documentaries on Charlemagne and his legacy, Why should we pay a tax in order to provide something of minority interest? Did anyone at the BBC think to ask what their customers over the age of 75 want?

Arsenal show their class as players agree reduced salaries to help the club

How is your football club responding to the coronavirus crisis? Liverpool and Spurs got greedy. Their plan to milk the State for staff wages upset fans, whose vociferous reaction caused both clubs to change direction and pay their staff in full. Manchester United expressed their view that a pandemic presented the chance for them to hammer smaller clubs. And Arsenal? Their players are the first in the Premier League to agree to a pay cut. The board has already agreed a more than 33% wage cut for the next 12 months.

The Gunners players will take a 12.5% wage cut but be reimbursed if they qualify for next season’s Champions League or the 2021-22 competition. They will get a £100,000 bonus for reaching next year’s Champions League. They will each reportedly earn £500,000 for winning the 2021 Champions League or £100,000 for the Europa League.

The Gunners are eight points off of a Champions League place with 10 games remaining. Their chances of reaching the Champions League are slim. Those wages will never be made up.

Posted: 18th, April 2020 | In: Arsenal, Money, Sports | Comment

Spurs relinquish title of world’s greediest football club

Tottenham will not be milking the State, taking advantage of the government’s furlough scheme for some non-playing staff during the coronavirus crisis. Following Liverpool’s belated relation that a corporation, sorry, football club, owned by a billionaire that makes millions in profits should not be seen to be so greedy, Spurs have seen the light. Says the Spurs chairman (pay: £7m a year):

“We regret any concern caused during an anxious time and hope the work our supporters will see us doing in the coming weeks, as our stadium takes on a whole new purpose, will make them proud of their club.”

More marketing guff dressed up as sport every day….

As for what the new Spurs stadium will be without football, how about a toilet paper silo?

Posted: 13th, April 2020 | In: Money, News, Sports, Spurs | Comment

Bonds and demand: Guardian get it wrong

In a story on the global bond market’s response to coronavirus, the Guardian tells its readers: “The global bond markets, which handle hundreds of billions of trades every day, are where governments and companies go to borrow funds from investors.” There are not hundreds of billions of trades in bonds every day. The hundreds of billions is the value of the bonds being traded not the number of trades.

We’re then told:

At the outset of the Covid-19 outbreak, bond markets froze as investors panic bought highly rated government bonds and the number of sellers shrank.

The US Federal Reserve, the Bank of England, the Bank of Japan and the European Central bank, which oversee the largest debt markets, stepped in to expand the number of bonds on offer and promised to meet demand while the crisis continued.

Demand has been supported by the Bank of England’s pledge to “create” £200bn of electronic funds to purchase more bonds as part of its quantitative easing programme, adding to the £435bn of assets on its balance sheet.

That’s not supporting demand. That’s meeting demand by enlarging supply.

As for the US, Bnaron’s notes:

“We have no idea how long this will be,” said Yousef Abbasi, global market strategist for U.S. institutional equities at INTL FCStone said. “Right now, fundamentals don’t matter because there is very little clarity as to when the economy can restart — and depending on how long this goes — what the economy will look like when it does restart.”

These uncertainties aside, there are several indicators that bolster the case that a recovery for the stock market may have begun, said Michael Arone, chief investment strategist at State Street Global Advisors.

“The severe indiscriminate selling we saw prior to last week has abated,” he said, noting that through last Monday, nearly every asset class, including gold, U.S. Treasury bonds and stocks were being sold off. “It was that classic capitulation move to cash,” whereas in more recent sessions, bonds have rallied when stocks retreated and vice-versa, typical of normal behavior in financial markets.

Cash is king.

Liverpool back down leaving Spurs to win title of world’s greediest football club

Liverpool have listened to the fans and media who decried their decision to place some non-playing staff on temporary leave and take advantage of the Government’s furlough scheme to let the taxpayer pay 80% of their wages. Liverpool – owned by a billionaire and posting profits last season of £43m – will muddle along some how. Newcastle United, Tottenham Hotspur, Bournemouth and Norwich City are sticking with their plans to furlough some non-playing staff. Bournemouth and Norwich are not big clubs. Newcastle are a basket case. But Spurs with that swanky new stadium and billionaire owner can afford it, surely? With Liverpool no longer doing the wrong thing, Spurs might be the world’s greediest football club. Finally, they win something.

Posted: 7th, April 2020 | In: Liverpool, Money, News, Sports, Spurs | Comment

Help the NHS fight Coronavirus in North London by donating to the Royal Free Charity Covid-19 Emergency Fund

In North London, the Royal Free London hospitals – the Royal Free Hospital, Barnet Hospital and Chase Farm Hospital – need your help. The Royal Free Charity has become the Royal Free Charity Covid-19 Emergency Fund to support NHS staff through the crisis. Clapping your hands for the NHS is all well and good but money is better.

Many of the staff at the three hospitals are now caring for patients with coronavirus, or are dealing with patients who are not unwell with the virus but still desperately need their help. Resources are stretched to the limit and they’re working under the most extreme pressure. It’s not just affected doctors and nurses; everyone, from ICU and the wards, to the porters, cleaners and support staff, is playing a role in the fight against the virus. As we all know, the situation is going to get even worse before things start to improve.

The aim is to get a complete support service in place as soon as possible. This will include the provision of care packages at the end of a very long shift, to psychological support and the creation of physical respite spaces, all of which have been suggested by staff. Every penny raises will make a real difference to their lives.

Please make a donation here.

Posted: 2nd, April 2020 | In: Key Posts, Money, News | Comment

Coylumbridge Hotel in Aviemore make staff homeless – blame it on admin error

The Colyumbridge Hotel new Aviemore, Scotland, has been making news. The “perfect escape for an unforgettable family vacation” has sent out a letter telling employees to get thee hence. Coronavirus is apparently behind the mass sacking in which some staff were told to leave the hotel accommodation immediately.

The hotel’s owners, Brittania Hotels, says it was all a misunderstanding. The company tell the Liverpool Echo: “With regards to the current situation regarding staff at our Coylumbridge Hotel and being asked to vacate their staff accommodation. Unfortunately, the communication sent to these employees was an administrative error. All affected employees are being immediately contacted. We apologise for any upset caused.”

You know how these errors go: a virus infects your world, types a letter and tells everyone to get out or else. Other companies should take note of this and increase their virus protection.

Posted: 21st, March 2020 | In: Money, News, The Consumer | Comment

Tampon tax is over: invest your saving in vagina candles and steamers

Good news, then. The State’s 5% rake on all sanitary products is to end. The sex-based “tampon tax” will be abolished from January. And you can thank Brexit for the end to it. It was an EU directive that meant the tax rate could not fall below 5%. And so long as the UK was in the bloc’s customs union, the country was legally bound to take a cut from every menstruating woman.

If you want to save money til January, best get what the Vagina Monologues termed “a wad of dry fucking cotton”. What you save on branded padding you can invest in other devices, such as the vagina steamer, trailed on Hollywood princess Gwyneth Paltrow’s blog GOOP thus: “You sit on what is essentially a mini-throne, and a combination of infrared and mugwort steam cleanses your uterus.” Afterwards you can see if your date wants to pull on a Hamzat suit and shag in a laboratory.

If things get too clean and you miss the old days, Paltrow also flogs a candle called ‘This Smells Like My Vagina’, which will ensure a fuller sensory experience to anyone dating a Gwyneth Paltrow love doll or indeed Gwyneth Paltrow.

Prince Harry and Meghan: ghost voters and big banks

In January, Prince Harry (not HRH) sat down for talks with Saad-Eddine El Othmani, prime minister of Morocco, Peter Mutharika, president of Malawi and Filipe Nyusi, president of Mozambique at the UK-Africa investment conference. It was one of his last jobs as a working royal. The Mail says that after the formal chats: “The VIPs then rushed to a private room at the Intercontinental Hotel for an informal ‘catch-up’ chat – but unusually they insisted no No 10 or Palace aides were present to ensure the talks were kept private.”

What could they have to talk about they don’t want the commoners to know? Private Eye reports that Mr Nyusi might not be everyone’s cup of fair-trade, organic tea. His election last year was, we’re told, marred by “violence and a climate of fear”. Votes in Gaza province “exceeded the number of dual inhabitant by 300,000”.

Observers noted several incidents across the country where people were found trying to enter polling stations with extra ballots marked for Frelimo.

On Friday, the US embassy expressed “significant concerns regarding problems and irregularities” during the voting and counting which “raise questions about the integrity of these procedures and their vulnerability to possible fraudulent acts.”

The European Union’s election observation mission said “an unlevel playing field was evident throughout the campaign. The ruling party dominated the campaign in all provinces and benefitted from the advantages of incumbency.”

The Eye quips: “Just the sort of ‘progressive’ type a modern real wants to rub shoulders with.” But, of course, Harry did it out of duty. It was a State-run function.

Another Harry appointment, one attended in a private capacity with his wife Meghan, was hosted by JP Morgan in Miami. A “source” told the New York Post’s Page Six, the couple “headlined” the bank’s Alternative Investment Summit. “It was all very hush-hush, with a lot of security,” we’re told. The Mirror says Harry and Meghan could have been paid £400,000 for supporting the event.

JP Morgan:

In November 2013, JPMorgan Chase, the nation’s largest bank, agreed to pay a then-record $13 billion fine to federal and state authorities in order to settle claims that it had misled investors in the years leading up to the financial crisis.

Trying to earn enough money to maintain your lifestyle might not be all that easy for post-royal Harry and Meghan, a couple so ethically right that he says buying fruit in plastic is “a dirty habit”. Spin the wheel, and hold your nose. Or retain as nurses.

Posted: 12th, February 2020 | In: Celebrities, Money, News, Politicians, Royal Family | Comment

Pitch@Palace loses the palace: Prince Andrew moves out

You can still see traces of Prince Andrew on the website for Pitch@Palace, his beauty show for budding entrepreneurs. News is that Andrew’s company has moved from its Buckingham Palace base into new office space. The name continues, however, suggesting that a new palace needs to be found to keep the brand alive. There’s the Palace Gentlemen’s Club in New Jersey, the Tower of London or inside a used mackintosh?

PS – on his website, the Duke of York is said to be a full-time working member of the Royal Family. He stepped down from royal duties last November over his relationship with the paedophile Jeffrey Epstein.

Posted: 10th, February 2020 | In: Money, News, Royal Family | Comment

Lie on your CV if you’re name ends with a vowel or you’re not called John

Funke Abimbola claims she was victim of “bias” when she tried to get into the legal profession. She tells the BBC: “I found a number of barriers to entering the profession because I had an African name and am a black woman, without any doubt. I had to make over 100 phone calls to get a foot in the door. I have experienced bias and situations where, being a black woman, I was judged more harshly over other colleagues. You are more likely to be noticed and are far more likely to have negative judgements made about you if you are part of an ethnic minority.”

Should you put a false name on your CV if it ends in a vowel or sounds ‘foreign’ to employers’ ears? My own family changed their name twice – once because the officials at the gates misspelt it and once from the Sephardic Benhamu to the more anglicised Benham.

Change your name or leave it off your CV? “Your name no longer matters on your CV,” the Daily Telegraph announced in 2015. CVs are going “name blind”. You can remove age, address, gender and educational background also. This will, at least, make the initial stage of the recruitment process more open, so the thinking goes. Until you get to the diversity box, that is, the one that asks applicants to declare their religion, ethnic roots, sexuality and disability status. Has this box-ticking helped job seekers from minority backgrounds? Has it helped end prejudice or discrimination aimed at someone on the basis of their race?

In 2017, the BBC told us:

A job seeker with an English-sounding name was offered three times the number of interviews than an applicant with a Muslim name, a BBC test found.

Inside Out London sent CVs from two candidates, “Adam” and “Mohamed”, who had identical skills and experience, in response to 100 job opportunities.

Adam was offered 12 interviews, while Mohamed was offered four.

Although the results were based on a small sample size, they tally with the findings of previous academic studies.

Meet ‘Honest John’:

Yogesh Khrishna Davé, 56, is the director for quality at a pharmaceutical company in Slough. It has taken him decades to reach this senior role.

During the journey up the ladder he suspected he was being consistently overlooked for jobs because of his name. So he secretly carried out his own experiment.

“I entered the job market in the 80s. I put my CV in and it was disappointing. I got rejection letters.

“Someone suggested: ‘Why don’t you put a very English name on your CV [as well as sending one in your own name]… and see who they might offer the job to?’ So I had my name, Yogesh, and John Smith. John Smith got the interview. I got rejected for the interview.”

None of this mans you’re going to ge the job, of course. The employer will still want to see you. The results of an independent review by Sir John Parker (that is his real name) into the ethnic diversity of UK boards is out. You can read it here.

Meet ‘Honest John II’ in the Times:

The Parker Review, which was launched in 2017, has found that 37 per cent of FTSE 100 boards still have all-white boards. Although the latest figures are an improvement on the 50 per cent that had no ethnic minority representation three years ago, its latest report said that progress had been slower than hoped.

Sir John Parker, who heads the review — and sits on an all-white board himself as chairman of Pennon Group, the water company — accused businesses of being complacent in their approach.

Look lively. It’s ‘Honest Jon III’:

Separate research by the Financial Reporting Council, the watchdog that sets the UK’s corporate governance code, found that most companies were failing to adequately report and set targets for ethnic diversity. More than half of FTSE 250 companies fail to mention ethnicity in the board diversity policy. Only 14 per cent of FTSE 100 companies and 2 per cent of FTSE 250 companies set measurable ethnicity targets.

Sir Jon Thompson, 55, chief executive of the regulator, said: “The UK’s record on boardroom ethnicity is poor. It is unacceptable that talented people are being excluded from succession and leadership simply because companies are failing to put in place appropriate policies on boardroom ethnicity.”

In conclusion: you can never have enough Johns in charge of fairness…

Posted: 5th, February 2020 | In: Key Posts, Money, News | Comment

City Trader accused of eating sandwiches

The BBC reports on a report in the Financial Times which alleges a City trader at Investment bank Citigroup was allegedly suspended for “stealing food from the staff canteen”. You will, of course have noticed the caveats in that opening line. The trader earns, reportedly, over £1m a year – more than enough to afford a pricey lawyer. Allegedly. It is alleged “he helped himself to sandwiches from the canteen at the bank’s London headquarters”.

Sandwiches.

Aviva treats every customer just like ‘Michael’

Cheap words at insurer Aviva, which undid the pretence that letters are tailored to each individual customer by addressing thousands of missives to just one: ‘Michael’.

The boss doesn’t sit on a big chair dictating a new letter for each customer. Someone in marketing simply cooks one up and a machine guffs them out. Aviva tells us: “We sent out some emails to existing customers, which, as a result of a temporary technical error in our mailing template, mistakenly referred to customers as ‘Michael’.”

We tell them it’s time to bring back the typing pool.

Posted: 28th, January 2020 | In: Money, News, The Consumer | Comment

Ant McPartlin doesn’t ‘give’ Lisa Armstrong anything – she earned it

Ant McPartlin “gives” his ex-wife Lisa Armstrong £31m, says the Sun. The paper claims the settlement was reached out of court. An unnamed source arrives to tell us: “Ant made a very generous settlement that works out to be more than half of everything that he has.”

Isn’t this about what ‘they’ had amassed during their long relationship and marriage? Didn’t she merely get what she was entitled to?

Why she walked away more than half we can only guess at, but no court date might mean less revelations that could damage his future earnings and that all-important image.

Posted: 16th, January 2020 | In: Celebrities, Money, Tabloids | Comment

BBC shortchange women : Samira Ahmed wins £700,000 backpay

Hold your ire about what the Royals cost, and know that the BBC have been forced by law to hand one its presenters, Samira Ahmed, £700,000 in backpay in a discrimination equal pay case.

Ahmed (female; £440 per episode) claimed she was underpaid for hosting audience write-in show Newswatch when compared with Jeremy Vine (male; £3,000 per episode)) who earned shedloads more for hosting audience write-in show Points of View. The Beeb said he gets more because he’s more widely known and so gets picked to present a more widely-watched show.

The judgment ruled: “Her work on Newswatch was like Jeremy Vine’s work on Points of View under section 65(1) of the Equality Act 2010… [the BBC] has not shown that the difference in pay was because of a material factor which did not involve subjecting the claimant [Ahmed] to sex discrimination”.

The BBC goes on the record: “We’ll need to consider this judgment carefully. We know tribunals are never a pleasant experience for anyone involved. We want to work together with Samira to move on in a positive way.”

Or to put it another way: the BBC made her sweat, spunked a load of cash on lawyers and then lost. And you, the licence-fee payer, funded it. Now wait for Samira’s predecessor, a man, to ask for his backpay. And the rest of us can wonder why Vine was paid so much.

Posted: 10th, January 2020 | In: Money, News, TV & Radio | Comment

Hypocrisy! France bemoans US trade tariffs; France wants British trade tariffs

France is upset that the US is thinking about imposing trade tariffs on French cheese, fizz, make-up and handbags. France wants to tax US business. A US ruling into French plans tells us:

The U.S. Trade Representative has completed the first segment of its investigation under section 301 of the Trade Act of 1974 and concluded that France’s Digital Services Tax (DST) discriminates against U.S. companies, is inconsistent with prevailing principles of international tax policy, and is unusually burdensome for affected U.S. companies. Specifically, USTR’s investigation found that the French DST discriminates against U.S. digital companies, such as Google, Apple, Facebook, and Amazon

Messy. And hypocritical of the French, mais no? If France believes tariffs are wrong, it should argue for free trade deal between the EU and the the post-Brexit UK. But it isn’t.

Posted: 4th, December 2019 | In: Money, News, Politicians | Comment

A little kitchen painting sells for $26.8million

‘Christ Mocked’ by Florentine artist Cimabue (Giotto’s teacher) was created around 1280. It’s been in someone’s kitchen in France was ages. And now it’s sold at auction for $26.8.

From Smithsonian Mag:

[Auctioneer Philomène] Wolf spotted the painting, titled “Christ Mocked,” on display between the woman’s open-plan kitchen and living room. While she immediately suspected it was a work of Italian primitivism, she “didn’t imagine it was a Cimabue.”

Wolf turned to Eric Turquin, a Paris-based art historian who had previously identified a painting unearthed in a French attic as a long-lost Caravaggio. According to Benjamin Dodman of France 24, Turquin and his colleagues concluded with “certitude” that the new find was a genuine Cimabue.

How certain can you be that it’s the real deal?

Posted: 28th, October 2019 | In: Money, The Consumer | Comment

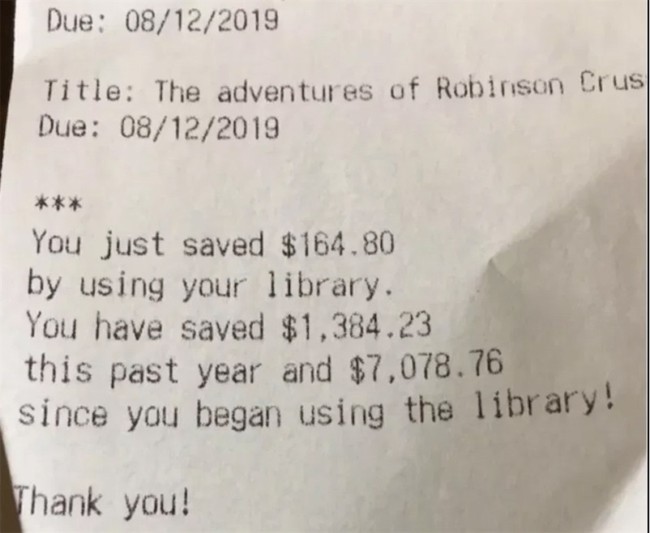

Public Library receipt shows how much cheaper it is to borrow than buy books

Save the libraries. They’re one of the few place you can go and sit without needing to buying anything. And you can read the books, too. But not everyone appreciates the library until the burghers say it no longer pays and it’s gone. Staff at the Wichita Public Library understand. They’ve come up with a great way to out a price on library services and show us their monetary value.

They write:

“Every time materials are borrowed from the Wichita Public Library (WPL) customers receive a receipt showing how much they have saved in that visit, the year to date, and their lifetime savings. The information is displayed on the receipt similar to the ways that retail stores show savings to club members or coupon users…

“So far this year, the highest dollar amount saved by a customer’s account is $64,734.12. And the highest dollar amount saved by a customer’s account since this feature was implemented is $196,076.21.”

Keep your local library up by using it.

Spotter: Flashbak, Open Culture

Posted: 11th, September 2019 | In: Key Posts, Money, News | Comment