Money Category

Money in the news and how you are going to pay and pay and pay

Football and betting: Stop using Liverpool, Spurs and Chelsea to advertise your own sound morals

Stop promoting 1xBet or else. News is that the Russian gambling company has no licence to operate in the UK. The Gambling Commission tells the Sunday Times it has written to Spurs, Chelsea and Liverpool, warning them to sever tis with 1xBet. The penalty for non-compliance, according to the paper: unlimited fines and up to 51 week’s prison. Spurs have terminated the deal.

The Sunday Times investigation into the firm’s global operations found that 1xBet was promoting a casino featuring topless croupiers, taking bets on children’s sports, advertising on illegal websites and cockfighting live streams emblazoned with the three club’s logos. In response to the findings, the Gambling Commission confirmed it had launched an investigation.

Some of the clubs’ top players, including Roberto Firmino, Willian and Olivier Giroud, have all fronted campaigns for the Russian company, which is now based in Cyprus.

xBet are quoted:

“We take very seriously the allegation that 1xBet’s brand has been promoted on prohibited sites, which is strictly against our policies, and we have launched an investigation. Pending the outcome . . . we believe it is responsible to temporarily suspend our advertising activity in the UK.”

Has the company been unlucky? The Times links to a wider issue, telling readers of a “growing backlash over the bankrolling of football by the gambling industry”. There is from our knowing betters. “Players need to start using their considerable power to reject gambling’s influence on football,” opined Church of England gambling spokesperson Dr Alan Smith, the Bishop of St Albans in reaction to Wayne Rooney striking deal with betting firm 32Red. And this from Labour MP Carolyn Harris, chair of the all-party parliamentary group on gambling: “When will celebrities realise that involvement in gambling is not right or moral? Many people look to Wayne Rooney as a role model and yet he is prepared to sell his soul.”

When did Wazza become employed by Public Heath England?

Troy Deeney, the Watford skipper, had a word on the tosh about role models: “I don’t like the word role model, first and foremost. The role model should be in the house at all times… What are we basing the role model on? Because we’re in the limelight. I don’t like that.”

One thing you can bet on: politicians scurrying around for a cause and sense of purpose by which to showcase their sound morals and protect the poor from themselves will keep hammering football and footballers. It’s a dead cert.

Posted: 1st, September 2019 | In: Money, News, Sports | Comment

Chinese fakery : goods rebranded ‘Made In Vietnam’

Last week US President Donald Trump pledged a hike in tariffs on Chinese imports to the US. Trump accuses China of bad trading practices and intellectual property theft. USA Today has news of a Chinese work-around:

“Dozens” of products have been identified, Hoang Thi Thuy, a Vietnamese Customs Department official, told state-run media, and goods like textiles, fishery products, agricultural products, steel, aluminum, and processed wooden products were most vulnerable to the fraud.

Vietnamese state media noted that in 2017, the Customs Department exposed a company called INTERWYSE for trying to rebrand 600 Chinese-made speakers and phone chargers with a “Made in Vietnam” label.

“It will sabotage Vietnamese brands and products and it will also affect consumers. We could even get tariff retribution from other countries, and if that happens, it will hurt our economy,” Foreign Minister Pham Binh Minh told the Vietnamese National Assembly last week.

Vietnam does not have any legal requirements for certification of the “Made in Vietnam” label. The country’s current regulations require that goods be produced partly or completely in Vietnam, but does not provide a mechanism for determining the veracity of the label.

What price that big US trade deal Trump’s promising for a post-Brexit UK features American goods as ‘Made in Britain’?

Posted: 26th, August 2019 | In: Money, News, Politicians | Comment

Multi-millionaire Jeremy Corbyn attacks Boris Johnson’s ‘Millionaire Friends’

Jeremy Corbyn never made it to the big Google climate shindig. As a man with an estimated net worth of £3million, chances are he wasn’t rich enough to afford a private jet and thus matter. As the right sort of stinking rich attempt to buy their way into Heaven by offsetting carbon and preaching from an exclusive, sun-kissed holiday spot, Corbyn was busy bashing the wrong sort of stinking rich. The first version of a recent video lambasted Boris Johnson’s millionaire friends. But Jez came across as a bit self-hating. So he changed it to Boris’s ‘billionaire’ friends.

And he got that wrong, too.

A 2016 investigation by Greenpeace revealed that some of the biggest recipients of EU grants that year included Queen Elizabeth (£557,707) and the UK’s youngest billionaire, the Duke of Westminster (£437,434). Other aristocrats earning hundreds of thousands of pounds from the EU – just because they own farmland – included the Earl of Moray and the Earl of Plymouth. Billionaire Brexiteer Sir James Dyson was also among the top 100 recipients of EU farm money.

Where there’s muck, there’s gold.

PS: Corbyn’s billionaire mates are the good sort.

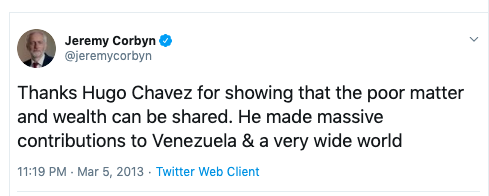

According to a Forbes article in 2015, Chavez was worth an “estimated $2 billion at the time of his death [in 2013]. It is not known how many trees he planted.

Posted: 9th, August 2019 | In: Money, News, Politicians | Comment

Common business crimes and how to void them

Most common types of business crimes and how to avoid them

Businesses can deal with a number of white-collar crimes that are non-violent but are committed for financial gains. Small businesses, as well as large ones, can be at risk and taking several preventive measures is key, along with having a general risk assessment and management plan. In this article, we highlight some of the most common types of business crimes and provide information on how to avoid them.

Fraud

Included here are a series of deceitful acts committed for the purpose of obtaining money from the victim. This is a broader category that includes insurance fraud or Ponzi schemes, however, we will be referring to business or corporate fraud. This occurs when a company issues false statements or produces false documents that are used to hide the losses or illegal transactions. Maintaining a good internal control policy, training your employees to avoid fraud and working with good accountants are methods of avoiding business fraud.

If companies are accused of having committed acts that can be categorized as business fraud, a team of experienced criminal law solicitors in London can help entrepreneurs with business crime representation, as required.

Embezzlement

The act of taking money from a corporation, this can be enacted by employees who can find a manner in which they can use business funds or assets for their personal gain. Knowing your employees, as well as supervising the inventory, purchase orders and cash receipts are manners in which this action can be prevented. When needed, employers can also install security measures.

Tax evasion

Failure to pay the due taxes results in tax evasion, which is subject to penalties, as per the local tax laws. Companies can avoid being accused of tax evasion by working with a professional accountant who will file the tax returns accordingly. Tax evasion is different from tax minimization, which can be accomplished by legally using available tax deductions.

Money laundering

Money laundering schemes target businesses to make illegally sourced money legitimate through a transaction performed with an unsuspecting company. Businesses can avoid this by not accepting payments from unreliable sources and by implementing an anti-money laundering strategy that can include no-cash policies on transactions above a certain amount.

Protecting your business is possible by implementing a set of strategies and preventive practices as well as being aware of the possible risks.

The bizarre world of the Twitch millionaires

Money for playing games?

When Metro ran a story earlier this year that gaming is now bigger than the movie and music industries combined, it caused more than a few raised eyebrows. However, if you thought that simply meant people are sitting in their living rooms playing FIFA or Fortnite instead of catching a movie or listening to their Neil Sedaka CDs, think again.

In short, there is more to the gaming sector than gaming – just as there is more to the sports sector than playing sport. The eSport phenomenon has brought about the concept of gaming as a spectator activity, and the live streaming channel Twitch provides the platform for gamers to perform for their fans, often for long hours every day.

$500,000 per month for playing Fortnite

The name Richard Blevins probably means very little to anyone, but this unassuming 27-year-old from the Chicago suburbs is the man behind Ninja, the most famous Twitch streamer on the planet. Ninja started streaming in 2011, playing a variety of games, but it is as a Fortnite streamer that his fame has skyrocketed. He has more than ten million followers on Twitch, plus 7.5 million on YouTube. Ninja earns more than $500,000 per month from his streams.

Anyone who knows a little about the world of competitive gaming might well find this surprising. Sure, Fortnite is phenomenally popular as a game, but has not taken off to any significant extent as an eSport. Ninja’s streaming success shows just how complex this area of the gaming sector is becoming. People are not just watching Ninja’s streams to see how a game pans out, they are following him in almost a literal sense, to pick up tips and, perhaps, to emulate his success. In many respects, Ninja’s success is no different to that of many other social media influencers.

Streaming success and failure

Ninja might be the best known, but he is only one of a growing number of Twitch millionaires. While most are famous for streaming games like Fortnite, Overwatch, PlayerUnknown’s Battlegrounds and the like, the phenomenon is rapidly spreading to other areas of gaming. For example, playing casino online is immensely popular and is one area in which a little expert help could, literally, pay dividends. Little wonder, then, that casino streaming has become the latest growth sector on Twitch.

UK streamer Rocknrolla, for example, built a reputation as the biggest name in casino streaming on Twitch, with more than 20,000 subscribers. However, he also serves as an example of both the best and the worst of Twitch streaming.

Rocknrolla’s decision to run a 24-hour stream to raise money for charity was one he would ultimately regret. Having raised more than £16,000, everything went wrong in the final hours when an internet troll managed to get under his skin. The result? Rocknrolla lost his rag and his outburst led to a permanent ban on Twitch. Just like in the real world, living in the public eye in cyberspace can come at a cost.

The Future of Netflix: Competition Does Not Sleep

158 million – the number of Netflix subscribers around the world, not counting all the passwords exchanged, shared accounts, and collective visions. Netflix is the home of global entertainment, not only of movies but of TV series as well. In the first quarter of 2019, Netflix scored positively in all aspects, especially considering the growing number of new customers. However, the outlook of this streaming service does not look quite so good, as we have to take into consideration the competition.

Competition is an important and tricky topic in any sector. Customers are always testing new platforms and new products, even if they have a favourite one. This is the case not only of streaming services, but also of online casinos where players test games with no deposit bonus codes, or of new music streaming platforms, such as Spotify & Co., where fans search for their favourite artists.

The History of Netflix

Founded in 1997, Netflix’ main and original activity was the DVD and video game rental. People could book disks on the internet and receive them directly at home by mail. In 2000, Blockbuster, a leading company in the field of video rental stores, offered 50 million to buy Netflix, but the latter refused the offer and continued its own business path.

Since 2008, Netflix has activated an online streaming service on demand, accessible by subscription. This is the beginning of the challenge between the two companies. The end of the story is known, with Blockbuster declaring bankruptcy in 2010, while Netflix continues to grow exponentially.

Netflix: What now?

Netflix expects slower user growth after a strong start this year. The world’s leading online video service, which has made a name for itself with series successes such as “House of Cards” and movies like “Bird Box”, is facing a heightened competition. In addition to established rivals like Amazon or Hulu, Disney and Apple are pushing new adversaries into the booming market of Internet television. And even worse: In this critical phase, Netflix is raising prices – definitely a risky manoeuvre. But Chief Executive Reed Hastings is not afraid.

So far, there is no real reason for it. In the first quarter, Netflix had 9.6 million new subscriptions. Overall, Netflix had nearly 149 million paid memberships by the end of March 2019. However, the trend is now sinking, due also to the price increase announcements. This will noticeably slow down user growth in the current and next quarters.

For instance, Netflix announced 5 million new memberships in this current quarter, disappointing experts’ expectations. This was not a good thing for investors; for instance, the stock of the company went down. However, Netflix had a good run with a stock price increase of about 34 percent since the beginning of the year, so that the market reaction is – for now – not very meaningful. The profit of Netflix indeed climbed from 290 million to 344 million dollars in the first quarter of 2019.

Netflix: New Competitors, Fewer Users?

Nevertheless, it can not be ignored that the market environment for Netflix should be more uncomfortable in the future. With Disney and Apple new rivals – also financially very strong – that will attack the streaming market leader, the situation will not be easy. Both the Mickey Mouse group from Hollywood and the iPhone giant from the Silicon Valley recently presented competing offers that leave no doubt about their big ambitions. In addition, also WarnerMedia attacks with its renowned pay-TV channel HBO under the corporate roof of Telecom AT&T.

Netflix boss Hastings is clear about what is going on in his company but is combative. In his letter to shareholders, he described Apple and Disney as “world-class brands” against which Netflix would like to compete. Moreover, he does not expect the new counterparties to impact the growth of Netflix significantly. “We believe we’ll all continue to grow as we each invest more in content and improve our service and as consumers continue to migrate away from linear viewing,” said Hastings. The top manager had already emphasised in the past that the streaming market was big enough for several competitors.

The two-year period 2019-2020 will probably be important and decisive to define the future of the platform and in general of the use of home and personal entertainment. No one is a magician or a fortune teller, so predicting today what the impact of this increase in services will be complicated, if not impossible. The consumer is in danger of finding himself lost among so many proposals, with the difficulty of choosing what to subscribe to and for how long, trying to chase what will be the current fashion. Today is Netflix, tomorrow who knows.

Posted: 26th, April 2019 | In: Money, TV & Radio | Comment

Barking teenager extorted millions from porn users

Zain Qaiser was quite the bedroom entrepreneur until the law caught up with him. Qaiser, a student from Barking, London, is estimated to have made £4m blackmailing pornography enthusiasts. Hit the wrong site, press the wrong button (often disguised as an advert on a legal porn site) and trigger malware to download. You read the message demanding money on pain of never being able to access your computer / aide to masturbation again, which has suddenly frozen. Habitual onanists might see this as a blessing.

For added punch an on-screen messages would issue an additional threat, saying something like: “HALT! This is the FBI. You have broken the law. Face jail or pay a fine. We have webcam footage of your disgusting self-abuse and will not hesitate to use it in a court of law and publish details in the Rotary Club newsletter”

Fearful of being exposed as a tossers, the threatened victim pays up and stays schtumm. And that was where the sophistication ended. Qaiser was, of course, the biggest tosser of the bunch (you have to know your victims’ flaws intimately to be an adept blackmailer) spending his cash – estimates are that he cleared £550,000 – on a vulgar and predicable Rolex watch, prostitutes (natch.), drugs and gambling, including around £70,000 at a casino in what one site calls “an upmarket shopping centre”.

Can it happen again? Not if we get our porn licences and everyone knows that everyone else is looking at smut. Of course, we already do know. Take this from 2011, in which Craig Brown harks back to the 1960s, spotting Harold Pinter, Vivien Merchant, Peter Cook, Wendy Cook, Lord Snowdon and Princess Margaret watching a post-prandial porn movie at Kenneth Tynan’s pad. The film, for you buffs, is Un Chant d’Amour by Jean Genet:

Peter Cook saves the day by starting to speak over the images. Tynan is thankful: ‘He supplied a commentary, treating the movie as if it were a long commercial for Cadbury’s Milk Flake chocolate and brilliantly seizing on the similarity between Genet’s woodland fantasies and the sylvan capering that inevitably accompanies, on TV, the sale of anything from cigarettes to Rolls-Royces. Within five minutes, we were all helplessly rocking with laughter, Princess M included.’

No sex tape was made. Or was it? Send £250 to the usual address and await further details.

Posted: 9th, April 2019 | In: Key Posts, Money, News | Comment

Lottery winner Ade Goodchild saves us from Brexit

You can’t come out from under there yet. And go easy on those provisions you’ve stored and planned to live on until March 29 when you could re-emerge into society. And save some of the Buffalo mozzarella – that stuff could be worth more than gold in post-Brexit Islington. Brexit is being delayed, well, it will be if Theresa May can get permission from the EU – you know, the body the country rejected in favour of being sovereign. There, there. Hush. Banging your head into the wall won’t help in the long run. And by the time you come out, the Polish repair team will have left for China. Here, to keep you going is a copy of the Daily Star.

There’s little talk of Brexit on planet Star. The paper focuses on breasts and factory worker Ade Goodchild, who has won £71m in the EuroMillions lottery. He was the only winner of the £71,057,439 prize on Friday. The BBC says he’ll travel the world and buy a home with a swimming pool.

You cares what colour your passport is when you’ve loadsa money? Good for Ade. And his fortune might be better news for our MPs, too, because Ade is looking for staff. If he needs a boat, Chris Grayling Ferries can sort him out; John ‘ORDER!’ Bercow is handy in restaurants; and Jeremy Corbyn is a shoo-in as a travel agent, fixing trips to Iran, Russia and Venezuela.

And what millionaire doesn’t need a life-size weather house? Call me, Mrs May, I have ideas…

Posted: 21st, March 2019 | In: Key Posts, Money, News, Politicians, Tabloids | Comment

Comic Relief: David Lammy shamed whites into not giving

Two stories about Comic Relief, the BBC’s tired telethon. What is about the BBC that shows are celebrated chiefly for their longevity? And those presenters who go on for eons – but at least Dr Who gets to regenerate his genitalia every couple of years. Maybe it’s about institutions needing other institutions to make the mob bow to their edifices of permanency and legacy? Or maybe it’s just laziness?

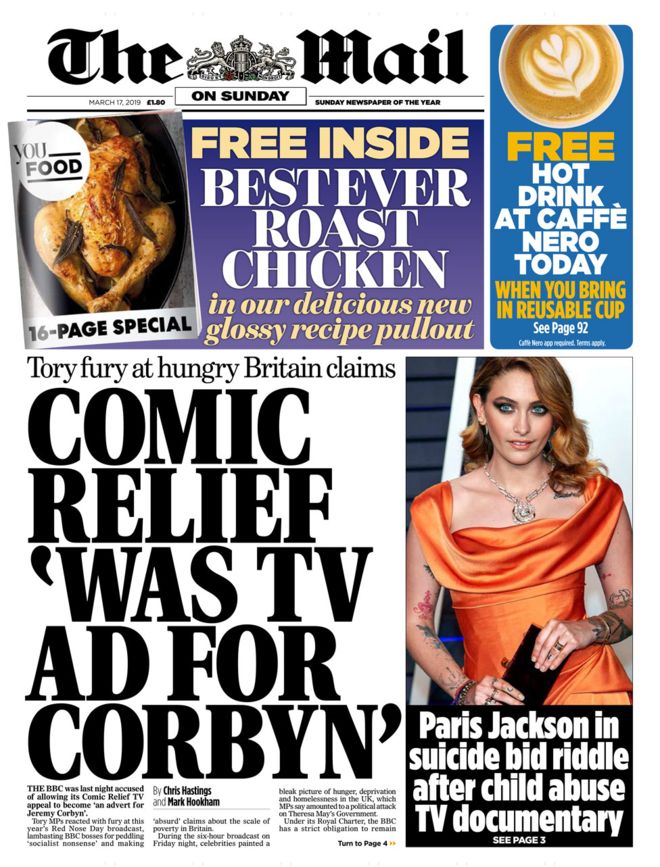

The first Comic Relief story is that some Tory MPs are angry (natch.) that the fundraiser dresses to the Left. The Mail on Sunday calls it an “AD FOR CORBYN”. In which case, hard cheese, Jezza, because the Sunday Times says Comic Relief raised £8m less than last year – £63m compared with £71.3m.

The blame for less cash is apparently rooted in Labour MP David Lammy citing tin rattlers for their “white saviour” complex. When the Beeb’s pro-celeb dance champion and journalist Stacey Dooley, 32, uploaded a photo of herself posing with a young African child in Uganda she captioned it “Obsessed!”, “as if she was plugging a new face cream, not holding an unhappy Ugandan child.” Lammy saw it and tweeted: “The world does not need any more white saviours.”

The Times notes today: “Others said they had decided not to donate this year because they did not want to be accused of acting like a “white saviour”.” Nice one, Dave. Middle-class whites with spare cash will spend it on something else. What does Jess Phillips spend her money on? Farrow & Ball paint, festival tickets and Waitrose, possibly.

So how can we redistribute the world’s wealth and keep narcissistic politicians and celebs happy? Fair trade coffee, au pairs, cocaine and Filipino maids are a start. But this is about giving and who gets to give freely. We don’t tick a box declaring our race when donating money to Comic Relief, but maybe we should. In the current climate of identity politics, the State can use the data to work out which sort of people give the least and which give the most. Much fairer that way, right?

Africa’s poor will be waiting.

Posted: 17th, March 2019 | In: Celebrities, Key Posts, Money, News, TV & Radio | Comment

College bribery scam: the education system is a game; Hallmark sacks actress; rich kids are just donors-in-waiting

Hallmark Channel has severed business dealings with actress Lori Loughlin. Hallmark dims the lights to a 20watt soft-focus in rose-pink, tilts its head, and says it’s “saddened” by news of the allegations that Lori pays to game the college system.

Who knew? We thought America was a meritocracy. The fact that Ivy League schools take in more children of families in the top 1 per cent of the income distribution than from the bottom 60 per cent was surely just a weird quirk.

Loughlin, previously seen on Full House, the Garage Sale Mysteries films and When Calls the Heart, and her husband, fashion designer Mossimo Giannulli, are accused of bribing college officials to get their children into decent schools. They and others are implicated in a scam to pass their progeny off as bright and able, often as budding athletic stars.

The FT:

The children of the accused parents were presented as nationally ranked athletes in tennis (Georgetown), pole-vaulting and rowing (University of Southern California), women’s soccer (Yale), and sailing (Stanford); but these “sailors” didn’t know a tiller from a toolbox. In some cases, photographs of athletes were Photoshopped to look like the applicants.

I sail therefore I math.

(Has anyone actually seen Prince Edward play real tennis? The Earl of Wessex scored a C and two Ds at A level. He was given a place at Cambridge to read history – a course kids with less hidden talents needed 3 As to attend.)

Investigators claim Loughlin and Giannulli agreed to pay $500,000 in bribes to help their daughters get into the University of Southern California, by pretending they were crew-team recruits… The fallout has also extended to Loughlin’s daughters, Olivia Jade Giannulli and Isabella Rose Giannulli. Sephora dropped its partnership with Olivia, a YouTube star and social media influencer. Critics are now calling for USC to expel both of the young women.

Not their fault, though, right, that their neurotic, vain, insecure and needy parents look like skinflints? Reports suggest Jared Kushner, Donald Trump’s son-in-law, got into Harvard after his father made the school a $2.5m donation. Look not at my thicko daughter’s apathy, dead headmaster, but consider instead the state of the taps in your bathroom and how solid gold ones never rust.

The system is flawed. A USA Today writer opines: “As Stanford and Yale and the University of Southern California scramble to distance themselves from these criminal corruptions, perhaps we might all consider all the legal corruptions of the entire college admissions process.”

Tyler Cowan adds: “First, these bribes only mattered because college itself has become too easy, with a few exceptions. If the bribes allowed for the admission of unqualified students, then those students would find it difficult to finish their degrees. Yet most top schools tolerate rampant grade inflation and gently shepherd their students toward graduation. That’s because they realize that today’s students (and their parents) are future donors (and potential complainers on social media). It is easier for professors and administrators not to rock the boat. What does that say about standards at these august institutions of higher learning?”

It all says one thing: school’s a racket. Learn a trade. Do a job.

Posted: 15th, March 2019 | In: Celebrities, Key Posts, Money, News | Comment

Corbyn’s Blue Period: Laura Murray, Minted Aristocrats and a £50m Picasso

Gabriel Pogrund has huge news. A scoop! “EXCLUSIVE: The mystery of who sold Picasso’s “Child with a Dove” for £50M in 2013, one of the most expensive artworks ever, is today solved.” Who?! “It was the family of Laura Murray, Corbyn’s top aide, who also gifted her a £1.4m house. By me & @ShippersUnbound.”

A tale of minted former communists, nepotism, huge sums of cash, the randy Spanish goat and the man who would lead the nation. What a story this promises to be. A little aside before we tuck in: Laura Murray us being sued by Rachel Riley, co-presenter of ITV’s Countdown, for alleged libel. Now read on in the Times…

Today it can be revealed that her family was behind the anonymous sale of one of the most expensive artworks in history, Pablo Picasso’s L’Enfant au Pigeon (Child with a Dove), which was sold for £50m in 2013. She also owns a share of a £1.3m north London property transferred to her by her mother, reportedly saving up to £500,000 in inheritance tax.

Murray is the daughter of Andrew Murray, 60, a key Corbyn adviser who comes from Scottish aristocracy and whose grandfather served as the imperial governor of Madras. He left the Communist Party after 40 years in 2016.

Who dares say socialism doesn’t pay? These people sound like a well-stocked elite. If we vote for them, do we all get to be their equals? Bread today – Picasso’s and pricey London pads tomorrow!

The Times adds:

Laura Murray, great-granddaughter of the 2nd Baron Aberconway, an Eton-educated Edwardian industrialist, and Lady Aberconway, his wife, who was bequeathed Picasso’s masterpiece by the art collector rumoured in the family to have been her lover, Samuel Courtauld. The Aberconway family’s decision to pull the work from public display at the Courtauld Gallery in London and put it up for sale through Christie’s, the auction house, in 2012 became a cause célèbre.

Get those Bullingdon Club application forms in the post. Corbyn and chums can yet be saved. If Picasso’s Blue Period is good enough for them, so too is Boris Johnson’s.

The identity of the seller was a mystery at the time, although speculation pointed to the branch of the family that still owns Baron Aberconway’s 5,000-acre estate in north Wales. In fact, the transaction was overseen by Laura Murray’s mother, Susan Michie, an academic, and her uncle, Jonathan Michie, an Oxford economist and university friend of Labour’s communications director, Seumas Milne. Both declined to comment.

But is it a scoop, really? In 2010, the Guardian told us:

The painting came to London in 1924 with Mrs RA Workman who was, along with her husband, a major collector of impressionist and post-impressionist art. She sold it a few years later to Samuel Courtauld, and on his death in 1947 he left it to his friend Lady Aberconway, and it had been in her family ever since.

The facts were known for years. And a quick look at a family tree could trace a line from the toff to the Trots. But the timing of the Times’ report is interesting.

Comment from Murray and the Labour Party features there none.

Posted: 10th, March 2019 | In: Money, Politicians, The Consumer | Comment

Matt Kuchar should have paid his caddie the correct rate

Matt Kuchar has earned well over $45m in prize money playing golf. Last November he did something the judgemental among us can enjoy. Kuchar, 40, won the Mayakoba Golf Classic in Mexico and banked the $1,296,000 winner’s cheque. His regular caddie was unavailable. So Kuchar hired local man David Ortiz. Caddies typically get 10% of first-prize winnings. Kuchar gave Ortiz $5,000. “He was definitely my lucky charm,” Kuchar said. “He brought me good luck and certainly some extra crowd support and did a great job as well. He did just what I was hoping for and looking for.”

Fair pay? In a way, it was. Kuchar and Ortiz had agreed a $4000 payment for a Top 10 finish. The extra $1000 was a bonus. Kuchar recognised that the $4,000 was low, so he topped it up by 25%. But that was a low act.

And then it got worse. Ortiz politely asked Kucha’s management to dig deeper. How much would be enough? Ortiz gave the figure: $50,000 – still less than half what a regular caddie could expect. Kuchar’s agent offered him $15,000. Ortiz then did the smart thing: he talked to the media. Journalist Michael Bamberger spoke to Kuchar. His reply is worth repeating. “I kind of think someone got in his ear,” said Kuchar. “For a guy who makes $200 a day, a $5,000 week is a really big week.” Bang! Bamberger had a story of greed and entitlement anyone can tuck into.

Faced with bad press, Kuchar spoke about the matter:

“It’s kind of too bad that it’s turned into a story. I really didn’t think it was a story because we had an arrangement when I started. I ended up paying him $5,000 and I thought that was more than what we agreed upon. So I certainly don’t lose sleep over this. This is something that I’m quite happy with, and I was really happy for him to have a great week and make a good sum of money. Making $5,000 is a great week.”

Oh dear. But then after more unfavourable reaction to the stinginess and reports of heckling at a subsequent tournament – “Go low, Kuch…just not on the gratuity!” yelled one spectator off the sixth tee. Fans cheered a missed putt on the 12th, and chants of “Mooch” could be heard throughout the day” – an apology finally arrived. Kuchar agreed to pay Ortiz $50,000:

“This week, I made comments that were out of touch and insensitive, making a bad situation worse. They made it seem like I was marginalising David Ortiz and his financial situation, which was not my intention. I read them again and cringed. That is not who I am and not what I want to represent. In this situation, I have not lived up to those values or to the expectations I’ve set for myself. I let myself, my family, my partners and those close to me down, but I also let David down. I plan to call David, something that is long overdue, to apologise for the situation he has been put in, and I have made sure he has received the full total that he has requested.”

When you tell the media first that you plan to call someone you short-changed and belittled, it’s all about the publicity. Kuchar pressed on:

“I never wanted to bring any negativity to the Mayakoba Golf Classic. I feel it is my duty to represent the tournament well, so I am making a donation back to the event, to be distributed to the many philanthropic causes working to positively impact the communities of Playa del Carmen and Cancun.For my fans, as well as fans of the game, I want to apologise to you for not representing the values instilled in this incredible sport.”

Screw the eponymous donation to the needy and the grandstanding. Just pick up the phone to Ortiz, apologise and on the quiet pay the guy the full whack. Don’t stop at $50,000. Pay him the $120,000.

Kuchar’s regular caddie, John Wood, then chimed in: “Nobody’s perfect. All we can do when a mistake is made is reconsider, apologise and make amends… To crucify for one mistake feels wrong.”

It does. But when anyone hears the name Matt Kuchar, they’ll always remember him for what he did wrong.

Posted: 19th, February 2019 | In: Key Posts, Money, Sports | Comment

Phone lottery scammer tried to con former CIA and FBI boss William Webster; scammer lost

Keniel A Thomas, 29, was a scammer who could not fail – not until he called William Webster (born March 6, 1924), the man who served as chief of the CIA and FBI. Thomas is now serving a six-year sentence. “Everybody’s vulnerable every grandmother, every grandfather,” said the former spy chief’s wife, Lynda Webster. “It seemed to me that something wasn’t quite right,” said Webster, 94. “This was pretty obvious to me that there was something fishy about it.”

The calls to the Webster home started in March 2014, with various men calling to tell William Webster he had won the lottery. In June, Thomas began calling, identifying himself as “David Morgan,” a manager with Mega Millions. However, Webster saw that he had an email address of keniel.thomas@outlook.com. He asked “Morgan” to stop calling, but Thomas not only continued to call but also sent more than 20 emails to Webster. At one point in July 2014, Thomas called Lynda Webster and told her that he knew no one was at her home the previous night. In another call, Thomas told Lynda Webster, “So easy that we go set your house ablaze, how is that? … You can be taken care of that easy.”

The FBI was able to link the Websters to other victims who had reported sending funds to Thomas or interacting with “David Morgan,” or who had sent funds to American middlemen who were also victims. Agents tracked payments through Western Union and MoneyGram to Thomas or members of his family, court records show. One California man reported receiving certified checks in exchange for sending “fees” to Jamaica, and wound up sending $85,000 to the scammers even though the certified checks all bounced.

Spotter: Washington Post

Posted: 13th, February 2019 | In: Key Posts, Money, News | Comment

The Pool RIP: people will pay for what they enjoy reading

Claire Woodward looks at the end of The Pool, the website for women by women that ran up crippling costs in quick time. Harking back to the era when magazines were must-haves for any teenager, she recalls hours spent devouring Pippin, Twinkle, Bunty, Jinty, Jackie, Whizzer and Chips, Cor!, Smash Hits, Disco 45, Look-In, The Beano, The Dandy, Melanie, Pink, Blue Jeans.

I used to read everything and anything – Tiger, Blue Jeans, Whizzer & Chips, Just 17, MAD, Resale Weekly (a trade magazine for plant machinery), my dad’s old Laugh comics from the 1950s, Punch and Women’s Own. Says Woodward:

This is a long-winded way of saying how said I was to read of the demise of women’s website The Pool, which went into administration yesterday. It was a bold, funny, relevant website for women that used a lot of great freelance writers, but it was all available for free, like the content of BuzzFeed, who announced editorial cutbacks this week. The Pool, like comedian Sarah Millican’s online women’s mag Standard Issue, found it couldn’t survive online without a subscription model (although Standard Issue is still available as a podcast).It’s tragic, really. Writer Andy Dawson and I were lamenting The Pool’s demise on Twitter, and he wrote: “People think nothing of spending £3 for a coffee but shit their pants at the thought of forking out for something that’ll amuse and inform them for an hour.”

I’ve been thinking a lot about how to make websites pay. Flashbak, WhoAteAllThePies, Spiked-Online all need money to thrive. How do you do it?

Mathew Ingram lost his job at Gigaom in 2015. He talked to Poynter:

“You join these things because you’re committed to them as an idea, not just oh, hey, this would be a cool paycheck and maybe I’ll get some equity out of it,” Ingram said. “It is a lot more like a relationship than a job.” … “Maybe be prepared,” he said, “because it could happen at any time.”

A few ideas to consider. Be prepared for bad news. Wonder why you didn’t have a go yourself. Realise that magazines were always a good way to burn through cash. Journalism is not all speaking truth to power – sometimes it’s about selling shoes. People will pay modest amounts for something they enjoy. Not everyone expects everything for free. The trick is to keep costs low, be ready to go part-time on your labour of love and enjoy it.

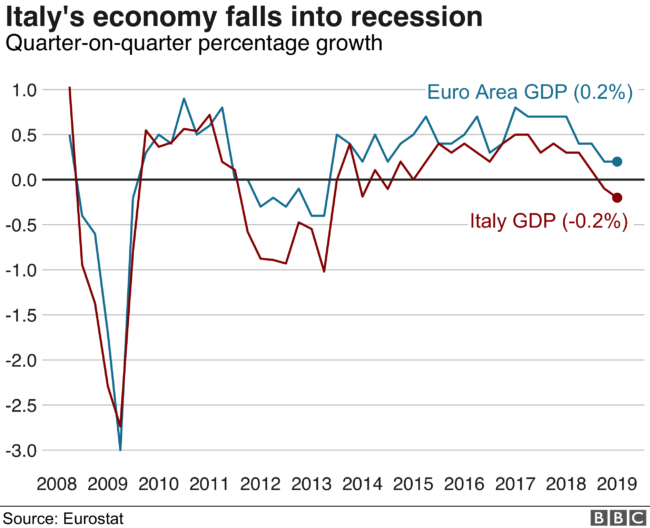

Italy dips into recession; UK out-performs EU; BBC ignores figures

Something is missing from the BBC’s report on the Italian economy slipping into recession. In the final quarter of 2018, the Italian economy shrank by 0.2%. That followed a 0.1% decline in the third quarter. The BBC tells us:

Growth in the euro area remained at 0.2% in the final quarter of 2018, the same as the previous quarter and in line with analysts’ expectations.

Bad news, then. Time to leave the EU. But hold on because the BBC has more news:

The figures, issued by the Eurostat agency, showed that in the 28-nation EU as a whole, fourth-quarter growth was 0.3%.

That figure includes the UK – which is leaving the EU. But the BBC doesn’t mention the UK’s economy anywhere in its report. It only says:

In contrast to Italy, some other eurozone economies expanded more than expected, with France and Spain posting growth rates of 0.3% and 0.7% quarter-on-quarter respectively.

In the third quarter of 2018, the UK economy grew by 0.6%. The next quarter looks to have produced a rise of 0.4%. Why doesn’t the BBC think this important to mention? Might it have something to do with Brexit, and how Remain-supporting MPs told us a vote for Leave was a vote for a deep recession? George Osborne told us every household would be £4,300 worse off by 2030 if we voted Leave. We didn’t. And we’re not.

Posted: 31st, January 2019 | In: Key Posts, Money, News | Comment

It cost Arsenal £17m to get shot of Arsene Wenger

It took more than placards and hashtags to defenestrate Arsene Wenger from Arsenal. Sky says it took £17.1m. Not that he got the lot. The Times says the £17m was paid to Wenger and his staff on condition of them leaving pronto.

Wenger had a year left on his contract when he sacked after 22 years in charge – and a decade at the helm of a club resting on its laurels. Of Wenger’s key staff, Steve Bould remained as assistant manager. You may wonder what the stalwart defender of George Graham’s fabled Arenal back four, one of the key exponents of ‘If in doubt, kick it out’ defending, is coaching the current feeble backline. Maybe in his head Bouldy was beating two players, shimmying past the ‘keeper and scoring for fun, and seeks to live out his dream in the unlikely shape of the insufferable and wholly useless Shkodran Mustafi. Arsenal fans will settle for the practicality of defenders taking out a man and ball in no-nonsense challenges and flicking it on at near post corners routines.

What Bouldy earns is not revealed. But the club’s latest accounts show that revenue dropped from £422.8 million to £388.2 million. And that Ivan Gazidis – aka Ivan The Terrible – got a pay rise before she legged it to AC Milan.

Posted: 29th, January 2019 | In: Arsenal, Back pages, Money, Sports | Comment

Brexit: On Corporation Tax and offshore UK

The Guardian has something to say about Corporation tax. If your company is based in the UK, it pays Corporation Tax on all its profits from the UK and abroad. The current rate is 19%. The Government is set to reduce it to 17% in 2020 – in line with Singapore, which just pulled Sir James Dyson. Because the tax based on companies’ profits this dynamic tax (one that responds very swiftly to change) is very difficult to forecast. But the Guardian is clueless about how it works:

Corporation tax receipts have increased since the financial crisis, although profits of firms have risen as the economy has recovered

“Although”?! No. Tax is up BECAUSE profits are up. That’s how Corporation Tax works. It also doesn’t work in isolation. There are other taxes, such as the banking levy. And economic growth leads to higher profits and thus higher levels of tax receipts. Of course, in the current political climate making any forecasts on company profits is set in water.

Carl Benjamin versus the bowdlerized Web

Carl Benjamin, aka Sargon of Akkad, is no longer appearing on Patreon, the funding platform self-explained as: “Patreon is a membership platform that makes it easy for artists and creators to get paid.” Or not. You only get on if you’re the right sort of artist making the right sort of art. And Benjamin is the wrong sort. He’s been booted from the platform for breaking the “community guidelines” on hate speech. And here’s the hook: the verboten content was found in an interview Benjamin gave to a YouTube channel. He’s heard calling a sneer (is that the word?) of alt-right trolls “niggers” and “faggots”. Patreon published the transcript of the video. Benjamin explains why he doesn’t like the alt-right crowd and compares them to “white niggers”.

Patreon added: “As a funding platform, we don’t host much content, but we help fund creations across the Internet. As a result, we review creations posted on other platforms that are funded through Patreon. Sargon is well known for his collaborations with other creators and so we apply our community guidelines to those collaborations, including this interview.”

Benjamin is tainted. In conversation with Fraser Myers, of Spiked, Benjamin says: “Ever since I started my YouTube channel, I’ve always been politically incorrect – it is what I do. I had never had a problem with Patreon before because its terms of service were quite specific. They said it had rules around hate speech on its platform, which I think is quite fair and so I didn’t want to break them.” Isn’t anyone who sets out to be politically incorrect less a champion of free speech than a narcissist trying to cause offence, defining themselves by what they are not rather than what they are? He adds: “I think Patreon is trying to sanitise its platform and looking to remove people who the mainstream politically correct establishment find offensive. (I am offensive, of course!)”

Free speech isn’t about being rude and seeking to cause offence for the sake of it. That’s puerile, crass and cheap. Free speech is simply speaking your mind and testing your thinking. Sharing only increases the goodness. But increasingly, the web is being divvied up into echo chambers. If Patreon isn’t for you, where is?

Fox has more:

A pair of influential Internet social and political commentators are putting their money where their mouths are, ditching crowd-funding site Patreon over its hate speech rules despite not having any viable alternative.

Dave Rubin raised money for his YouTube show, “The Rubin Report,” through Patreon until recently when he decided to fight back after the crowd-funding site banned participants who used language deemed offensive by the service. Best-selling author Jordan Peterson, a frequent Rubin guest whose lectures draw millions of views on YouTube and who gets funding from the service, joined Rubin in walking out on Patreon.

“The reason that Dr. Peterson and I are leaving Patreon on January 15, despite it being something like 70 percent of my company’s revenue, which I’m voluntarily giving up, is that it is time for someone to take a stand,” Rubin said Thursday on “Tucker Carlson Tonight.”

Surely the open market will create a new space:

“Dave Rubin and I (and others) have been discussing the establishment of a Patreon-like enterprise that will not be susceptible to arbitrary censorship, and we are making progress, but these things cannot be rushed without the possibility of excess error,” Peterson wrote last month.

As ever: follow the money.

Posted: 7th, January 2019 | In: Key Posts, Money, News | Comment

How to make money from immigration without a boat

Who makes money from jailing asylum seekers? Of the UK’s 10 immigration removal facilities just one is run by Her Majesty’s Prison and Probation Service. G4S, Mitie, Serco and US-owned GEO Group operate the other nine. So there must be money in it, right? The Government’s Contracts Finder site reveals the value of contracts when they were awarded – but not all figures are shown. But by way of an example, in 2018 Mitie secured a 10-year deal worth £525m to escort immigration detainees on removal flights to detainees’ home countries and manage airport holding rooms, reporting centres and two short term holding facilities. Mitie declared itself “delighted” at the deal.

The Daily Beast looks at how outsourcing immigration to private companies in the US pays:

“In 2018 alone, for-profit immigration detention was a nearly $1 billion industry underwritten by taxpayers and beset by problems that include suicide, minimal oversight, and what immigration advocates say uncomfortably resembles slave labor.”

Of course, that’s not to say no problems existed when the state ran immigration centres. It’s useful to ask why the service was outsourced in the fist place. But profit margins seem very generous. In 2017, the Guardian noted a 20.7% profit margin at Brook House in 2016. Brook House at London’s Gatwick Airport is run by G4S. The same company runs Tinsley House, also in Gatwick. The margin was a whopping 41.5%.

The Beast adds:

Expanding the number of immigrants rounded up into jails isn’t just policy; it’s big business. Yesica’s employer and jailer, the private prisons giant GEO Group, expects its earnings to grow to $2.3 billion this year. Like other private prison companies, it made large donations to President Trump’s campaign and inaugural.

GEO is involved in prison design and electronic tracking:

Pinning down the size and scope of the immigration prison industry is obscured by government secrecy. But the Daily Beast combed through ICE budget submissions and other public records to compile as comprehensive a list as possible of what for-profit prisons charge taxpayers to lock up a growing population, and how many people those facilities detain on average. The result: For 19 privately owned or operated detention centers for which The Daily Beast could find recent pricing data, ICE paid an estimated $807 million in fiscal year 2018.

Those 19 prisons hold 18,000 people—meaning that for-profit prisons currently lock up about 41 percent of the 44,000 people detained by ICE. But that’s not a comprehensive total, and the true figures are likely significantly higher.

Prison pays. Why shouldn’t it? Profits are not guaranteed. In 2015, profit margins for operators in the UK fells to between 5 and 7 per cent.

Richard Garside, director at the charity Centre for Crime and Justice Studies, takes a view: “If the state is going to detain someone, it should be under the auspices of state agencies, not the private sector.” Cynics would argue that Governments grew tired of botching immigration on their own so seduced private firms into the mess. The profits are compensation for reputation damage.

Posted: 3rd, January 2019 | In: Key Posts, Money, News | Comment

What Jose’s hotel cost Manchester United in rent

Freshly sacked by Manchester United, surly Jose Mourinho is back living at his London home. The Riverside Suite at Manchester’s Lowry Hotel, where he stayed since July 2016, is available to any new manager unwilling to commit to living in the city. But what was the bill for Mourinho’s stay?

The Sun: “Jose Mourinho hotel: Inside the exclusive Lowry where axed Man Utd manager lived for 895 days and spent £779,000 on rent.”

The Mail: “Jose Mourinho finally checks out of the Lowry Hotel… after 895 days and an astonishing £537,000 bill.” Although the Mail also notes: “What’s so special about the Special One’s £600,000 hotel suite? That’s the bill Jose Mourinho ran up in nearly three years.” Are we including tips?

Does the Lowry charge the Sun’s holidaymakers more than Mail guests? But the bill could have been higher. In January 2018, 442 magazine told us: “If Mourinho stays at the Lowry until July 1 2021, it will have cost him £1,489,200.” That figure is based on the rooms costing £816-a-night. But the Guardian can get the same digs for £600-a-night.

It pays to shop around.

Posted: 31st, December 2018 | In: Back pages, manchester united, Money, News, Sports | Comment

David Dimbleby and why the Posh live in a meritocracy

Are you posh? I’m asking for David Dimbleby, the hereditary BBC journalist, former Bullingdon Club member, pal to Prince Charles and whose son attended Eton College. His fellow BBC lifer John Humphrys asked Dimbers if he was a posho. Dimbleby thought the question not rhetorical and replied: “I come from Wales, as you do.” So he is Posh, then, at least as privileged as his nation’s prince. Of course, what Dimbleby’s doing is denying his poshness. The old sod pitches himself as an outsider, a man of the valleys and so very unlike those entitled and titled toffs in Berkshire (Thatcham) and London (Newham).

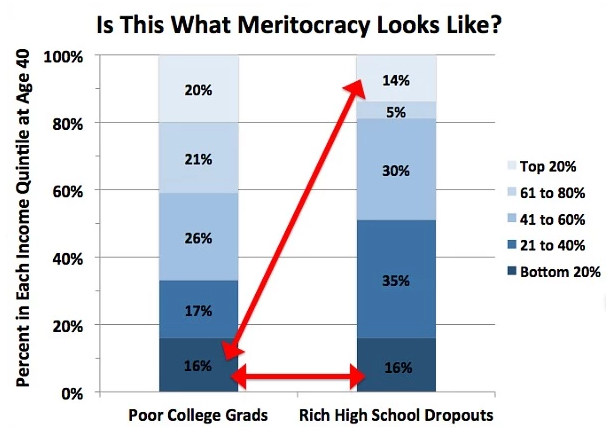

Kenan Malik cites Dimbleby’s egotism – that stated belief in success founded on merit rather than dumb luck and membership of an elite tribe – in his article on the rise of meritocracy and those who can afford to live in one. Dimbleby is the product of talent and hard work. His rank played no role. Now read on:

So entrenched as a social aspiration has meritocracy become that we often forget that the term was coined in mockery. In his 1958 satire, The Rise of Meritocracy, the sociologist Michael Young told of a society in which classes were sorted not by the hereditary principle but by the formula IQ + Effort = Merit.

In this new society, “the eminent know that success is a just reward for their own capacity”, while the lower orders deserve their fate. Having been tested again and again and “labelled ‘dunce’ repeatedly”, they have no choice but “to recognise that they have an inferior status”.

Young’s dystopian meritocracy doesn’t (yet) exist, but we have something perhaps worse: the pretence of a meritocracy. The pretence that talent will achieve its just rewards in a society in which class distinctions continue to shape educational outcomes, job prospects, income and health.

Malik argues that rank is now based on education. Is admission to top colleges a meritocratic process? It’s competitive. How do you get the edge? How do you know where the edge exists if you’ve no access to it?

Today, we simultaneously deride poshness and want to be seen as having the common touch (hence Dimbleby’s outrage at being called posh), while also showing contempt for those who are deemed too common and whose commonness exhibits itself in the refusal to accept the wisdom of expertise and in being in possession of the wrong social values.

Trump supporters, wrote David Rothkopf, professor of international relations, former CEO of Foreign Policy magazine and a member of Bill Clinton’s administration, are people “threatened by what they don’t understand and what they don’t understand is almost everything”. They regard knowledge as “not a useful tool but a cunning barrier elites have created to keep power from the average man and woman”. Much the same has been said about Brexit supporters…

Too true, of course. Tory MP Michael Gove says a second Brexit referendum would tell voters that they’re “too thick” to decide on issues. Labour MP Mr Sheerman, opined: “The truth is that when you look at who voted to Remain, most of them were the better educated people in our country.”

Matt O’Brien finds evidence that “poor kids who do everything right don’t do much better than rich kids who do everything wrong”:

You can see that in the above chart, based on a new paper from Richard Reeves and Isabel Sawhill, presented at the Federal Reserve Bank of Boston’s annual conference, which is underway. Specifically, rich high school dropouts remain in the top about as much as poor college grads stay stuck in the bottom — 14 versus 16 percent, respectively. Not only that, but these low-income strivers are just as likely to end up in the bottom as these wealthy ne’er-do-wells. Some meritocracy.

What’s going on?

Well, it’s all about glass floors and glass ceilings. Rich kids who can go work for the family business — and, in Canada at least, 70 percent of the sons of the top 1 percent do just that — or inherit the family estate don’t need a high school diploma to get ahead. It’s an extreme example of what economists call “opportunity hoarding.” That includes everything from legacy college admissions to unpaid internships that let affluent parents rig the game a little more in their children’s favor.

David Dimbleby’s dad worked at the BBC, where he hosted the long-running current affairs programme Panorama. David succeeded his father as presenter of Panorama in 1974. Maybe knowledge and know how is inherited, like cash and connections?

Posted: 30th, December 2018 | In: Key Posts, Money, News, Politicians | Comment

‘A physician’s letter to his wife’ – the most condescending letter ever written?

In “A physician’s letter to his wife” the self-styled “The Physician Philosopher” – an “anesthesiologist who blogs at his self-titled site, The Physician Philosopher” – writes an open letter to his wife. It looks like an online public display of affection, which, to my mind, are often precursors to divorce. You know, those irritating Facebook posts between husband and wife played out because a private conversation is too intimate for such kismet-kissed souls. He calls her “gorgeous”, “talented” and, in an egomaniacal bid at self-deprecation, “long suffering”. She laughs at his jokes. Narcissism rules.

And so to “The Physician Philosopher” who schools his wife what to do should he die before her. She should not punch the air, whoop, use bunting nor should she exclaim, “I pity anyone in the hereafter listening to that bore’s preachy horse shit”. He begins, as he must, at the beginning:

Let’s just start at the beginning.

If you’ve made it past that without rolling your eyes into your skull, read on…

When we first met, you thought I was arrogant and prideful. For two and a half years we would rarely talk while we walked past each other in our small college town. At the time, we never could have imagined that one day we would get married. In a twist of irony, two weeks before we started dating you still didn’t know as you told one of your best friends, “I could never date a guy like him. He is too sure of himself.”

Then something changed.

You wanted to talk late one night outside of your dorm. We even got yelled at for talking too late into the night. We first became friends, then we became best friends, and then you become the love of my life. Ten years of marriage and three kids later, you still have my heart and always will.

You made me a better me.

You are the most caring, compassionate, and forgiving person that I’ve ever met. I guess God knew that you’d need those qualities in order to be married to me – particularly that forgiveness part. When you make as many mistakes as I do, a lot of forgiveness is required.

I tell everyone every day that you are a better person than me, and I’ll continue to say that to the grave. But if I should make it to the grave prematurely, I want you to have this letter to guide you on exactly what you should do for our family.

And now it gets fist-bitingly awful:

Financial plan

When I die, you’re going to realize that you are immediately financially independent. If not, reading this will teach that to you.

Do one!

With the money, you’ll be able to pay off all of our debts and have more than enough to last as long as you and the kids live. That said, you are likely to have no idea what to do with it given that you’ve always trusted me with the big picture of our finances. (We need more money dates, apparently).

So, I’m going to walk you through exactly what you should do with it.

Furs. Diamonds. Unsuitable Men?

Cash in my life insurance

You need to get my term life insurance policy. It’s in the folder in my desk.

Call the insurance company up and tell them the bad news. And then call my workplace and do the same thing (I have a life insurance policy at work, too). Tell them you’d like to collect the full sum of money. I’ve done the math and this amount of money should allow you to do whatever you want to do with your life.

After you realize your awesome financial situation, make sure to change all the beneficiaries on your estate planning documents to the kids. I won’t need to be your beneficiary anymore for obvious reasons.

You still there? He hasn’t finished.

Cash in my life insurance

After you get the money in hand, you will be able to pay off all of our debt with ease, including our house. Hopefully, we’ve done well enough by the time that you need this that the mortgage is all that is left.

It’s worth saying twice: pay off the debt before you do anything else.

It will make life easier for you and the kids. Also, consider fully funding our kids college education by putting $100,000 into each kid’s 529 plan and letting it grow until they need it.

Nicole Cliff interjects: “If Steve left me a letter this condescending in his effects I would liquidate every single account and give all of it to lesbians. Just random lesbians. Then I would eat my children.”

You have to do some math

I know that you don’t like math, but you’ll have to do some.

I’m rich! I’ll hire a mathematician. Then shag him to deathbed on the solid gold sun lounger I bought.

After paying off all of our debt, you’ll have a certain amount of money left. If you multiply that number by 3% (Total money x 0.03), that is the amount of money that you can spend annually and rest assured it’ll last as long as you need it.

It should be a lot more than you need.

If you decide to keep working, because I know you – and that’s what you’ll likely do – just subtract your annual income from that number above and draw less out of the account. It’ll give you an even better chance that it’ll last long enough and you can give what is left to the kids someday.

Tom Jamieson interjects: “Teach the children how to make that lovely tea you insisted I drink every night before bed. The one that tasted faintly of burnt almonds my dearest, as each day I grew weaker and weaker until near the end, you had to hold the cup to my lips in your kind sweet uncomplicated way.”

You have to do some math

Take $100,000 of the money and put it into a Money Market Account for an emergency fund. This should cover any unexpected expenses that arise. Also, feel free to give me the cheapest funeral possible. No one will be looking at my casket when it’s underground ten years after I die. A wooden box will be just fine.

Put all of the rest of the money into a taxable account at Vanguard. Put 50% into the total stock market index fund (VTSAX), 25% into the total international stock market index fund (VTIAX), and 25% of the money into the tax-exempt bond index fund (VTEAX).

Take any money I have in my work retirement plans and simply roll it over into an IRA at Vanguard. Since the money in this account will hopefully be dwarfed by the money from my death that you’ve placed into a taxable account, you can put 100% of this money into the Vanguard Total Bond Market Index Fund (VBMFX).

If you need help, call Vanguard. They are great. If you still need help, call a fee-only financial advisor who operates as a fiduciary for a flat-fee.

Tom Jamieson has a word: “look after our children. You’ll find them in the smaller rooms adjacent to our master bedroom, They are called children’s bedrooms and that is where they sleep.”

Speaking of help

Ask our lawyer friend at church to help you make a trust for the kids and plan for our estate. Your money will likely grow while you are taking it out at 3%, and so you want to make sure that the kids won’t get hammered by massive estate taxes.

If you need help with the financial stuff, feel free to look at my recommended financial advisors list (coming soon!). I’ve vetted them myself. Or, I am sure, that many of my financial advisor friends will reach out to you to offer help.

Jennifer Van Goethem interjects: “So, looks like the lesson here is trust your first impressions.”

Speaking of help

You know one of my favorite things to do is to give to other people. And I know you’ll do the same. But it would make my heart happy if you found some people who really needed help and gave them a leg up in life.

Oh, and pay for the medical school to support someone who will start a curriculum to teach the students about money. It’s important stuff, and it just may save them from burnout so that they can save you and our kids someday.

Verity Reynolds interjects: “There are three children. That is more than two and less than four. I know how you hate math.”

Life plan

First of all, recognize that my death wasn’t too soon. It was right when it was supposed to be. You and I both know that there is a bigger calling in this life, and I hope that you continue to teach our kids the selfless love of Jesus.

I also hope that you find love again. This life is too short to live it alone. Just make sure he loves you, and loves our kids. (Also, make sure he signs a prenuptial agreement given all that money stuff we just talked about. 🙂 )

Continue to teach our kids to be selfless, respectful, and to put others first. Spend time with them and support their passions.

Brian Roemer interjects: “There’s not a jury in the world that would convict her.”

You may not realize this, but families who have money usually lose it by the third generation. So, don’t let our kids touch any of their non-college money until they are 24 at the youngest. Continue to teach them about money. Make sure they associate hard work with earning money. And make them give you a plan for what they want to do with it.

Tell our oldest little philosopher that she is brave, inquisitive, and sweet. I pray that she always continues to stay that way. And tell her that I am proud of the little woman she has become. My hope is that she stands up for those who can’t.

Hillary Rowe interjects: “Dear wife, I’m writing you this open letter to make sure the whole world knows that I (appear to be) financially controlling you, and I demand that same level of control after my untimely death.”

Tell our only son that, while I wasn’t always the best at understanding his emotions, I love his empathy. That is his gift – understanding others. Help him use it to serve others well. Make sure he knows that I am proud of him, and will always be proud of him no matter what he chooses to do with his life.

And to our fiesty Jack-Jack, teach her to harness all of that charisma and fervor. Teach her to love others with just as much passion. I hope that she always possesses a jealous and fierce love for her family.

Take home

To end this open letter to my wife – I want to point out that a chapter of our life has finished. We are selling the first home we had after getting married. The one where we brought home all three of our children, and created our life together over the past nine years. While this is bittersweet, I cannot wait for the memories that we have to come in our new house.

Know that I love you and that, if I die before you, I have cherished every moment we had together, even if I wasn’t always the best at showing it. Continue to love the kids the same way you loved me – unconditionally.

Love,

Your lesser half

Spotter: Nicole Cliffe

Posted: 15th, December 2018 | In: Key Posts, Money, Strange But True | Comment

Thick and Williams pays millions in tribute to Marvin Gaye

Fools and wannabes borrow. Geniuses steal. Robin Thicke and Pharrell Williams are now millions of dollars lighter in the trousers after Marvin Gaye’s family proved beyond any doubt that the pair’s hit song Blurred Lines owned much to Gaye’s 1977 song Got to Give it Up. Thicke and Williams appealed the ruling and lost. Yesterday a new amended judgement confirmed the settlement.

The singers jointly owe damages of $2,848,846.50. Thicke must pay an additional $1,768,191.88. Williams and his publishing company must pay a further $357,630.97.

The Gaye family is also entitled to prejudgment interest on the damages award and respective profits against each of the signers, totalling $9,097.51. They are also entitled to 50 per cent of the songwriter and publishing revenue.

Marvin Gaye died in 1984. According to reports, when he was killed Marvin’s estate was $9.2 million in debt.

Posted: 13th, December 2018 | In: Money, Music, News | Comment

Confessions of a Johnson & Johnson rectal thermometer tester

If you hate your job, think on. First buy a Johnson & Johnson rectal thermometer…

When you’ve had an absolute “I hate my job” day, try this:

On your way home from work, stop at your pharmacy and go to the thermometer section. You will need to purchase a rectal thermometer made by Johnson and Johnson. Be very sure you get this brand. When you get home, lock your doors, draw the drapes, and disconnect the phone so you will not be disturbed during your therapy. Change to very comfortable clothing, such as a sweat suit and lie down on your bed. Open the package and remove the thermometer. Carefully place it on the bedside table so that it will not become chipped or broken. Take out the material that comes with the thermometer and read it. You will notice that in small print there is a statement:“Every rectal thermometer made by Johnson and Johnson is personally tested”

Now close your eyes and repeat out loud five times: “I am so glad I do not work for quality control at the Johnson and Johnson Company”.

Have a nice day everyone and remember, there is always someone with a worse job than yours.

I thought they all worked for RyanAir?

Spotter: TheMetaPicturef

Posted: 7th, December 2018 | In: Money, The Consumer | Comment

Feminism is dead: campaigners say equalising pension ages discriminates against women

We’re really well into Alice in Wonderland territory here as we find out that men and women having equal pensions ages is discrimination against women. Which is odd, because women do live longer than men, thereby gaining their pensions for more years, but that’s not discrimination against men, no sirreee Bob! But raising women’s pensions ages to those of men are discrimination?

Older women were unfairly discriminated against by a £5 billion Treasury reform that increased the female pension age from 60 to 66, a court was told.

Three women who claim that they were not properly informed about the change won the first stage in their legal battle with the government yesterday.

The women, who were born between 1950 and 1953, claim the increase in the pension age discriminates against them on the grounds of their age and sex.

Note that the court hasn’t in fact said that it is discrimination. Only that it’s arguable that it is therefore they should be allowed to proceed with their case to see if they can prove it. But think through what that claim is.

Women had it good for decades, they had to work fewer years before they could retire. They then got their pensions for longer both because they started earlier and also because they lived longer. So, definitely discrimination in favour of women. Ending that is discrimination?

Actually, in this modern world that is how it works yes. You’ll have seen the claims that welfare changes are anti-women, that women lose most from them? Given that there is no gender in these payments, this means, obviously enough, that they must have got more than men under the old system. But that’s not discrimination, only removing that privilege is?

‘T’ain’t fair, is it?

Posted: 3rd, December 2018 | In: Key Posts, Money, News | Comment