Money Category

Money in the news and how you are going to pay and pay and pay

Cyprus insanity: You can trust the Eurocrats to do the wrong thing

OVER this Cyprus thing. They’ve decided that everyone who has their bank deposits guaranteed by the government of Cyprus must lose some of their bank deposits guaranteed by the government of Cyprus. Which is insane.

Here’s the real basic problem: banking is inherently unstable. No, I don’t mean casino banking, excessive trading and all that stuff. Because banks don’t keep your money in the vaults, they lend it out to other people. So if we all turn up one day demanding our cash the banks go bust simply because our cash is invested in Mrs. Miggins’ mortgage.

Read the rest of this entry »

Posted: 22nd, March 2013 | In: Money | Comments (3)

Amazingly, fracking is less polltuing than normal drilling for gas

WELL, along one dimension it is, fracking producing much less waste water (and polluted waste water) than normal drilling for gas does. It isn’t quite how we normally think of it of course, but it does seem to be true:

There is a perception that the hydraulic fracturing of rock to discharge natural gas produces inordinate volumes of wastewater. After all, millions of gallons of water mixed with chemicals are pumped at high pressure into the ground and a considerable portion of this fluid rushes back to the surface when the pressure is released.

Read the rest of this entry »

Posted: 22nd, March 2013 | In: Money, Reviews | Comments (2)

George Osborne wants house prices to remain in a bubble

THERE are bad budgets and then there are bad budgets. And this one is a true stinker in at least one respect. Osborne’s decided to try and pump up house prices. The simpleton fool:

A state-backed mortgage guarantee scheme worth £130billion will see the market flooded with 500,000 cheap loans.

The Government is to subsidise deposits and provide state backing for loans to help homebuyers get on the property ladder or move up.

But there were warnings that the scheme risks creating a house price bubble.

No, that last line is wrong, is too milquetoast.

Read the rest of this entry »

Posted: 21st, March 2013 | In: Money, Politicians | Comment

So why the heck do they want to build Bentleys in Bratislava?

HOT in from the Mail we have the news that VW are thinking of building their new Bentley SUV in Bratislava in Slovakia. And why in Buggery would anyone want to do that?

Bentley may build its new luxury off-roader in Bratislava rather than Britain, the firm’s bosses have revealed.

In a dramatic blow to its 4,000-strong British work-force – and to Chancellor George Osborne ahead of today’s Budget – the firm’s German chiefs announced at their annual results conference in London that they were considering manufacturing the £150,000 4X4 in the Slovakian capital in Eastern Europe.

Read the rest of this entry »

One of these things is not like the other: The EU on bankers’ bonuses and the Swiss on corporate pay

SADLY, all too many people seem to be thinking that these things are the same, or similar.

We’ve the EU trying to push through a limit on bankers’ bonuses. They can only get a bonus equal to 100% of their salary, or 200% if the shareholders agree. And then there’s the Swiss vote of yesterday about how fat cat corporate pay can be limited. The thing is, not only aren’t they roughly the same thing they’re actually opposites of each other:

Swiss vote to impose world’s strictest rules on executive pay after public outcry over fat cat bonuses

People in Switzerland have voted for strict controls on executive pay

68 per cent backed plans to veto pay-outs to bosses

Move sparked by anger over the big bonuses blamed for fuelling risky investments

It comes after the EU announced plan to cap bankers’ bonuses at a year’s pay

Read the rest of this entry »

The Guardian’s publishing flat out economic ignorance about Bill Gates, billionaires and capitalism

IT had to happen of course: that the Guardian would go from being partisan on the subject of economics (and why not?) to publishing stuff that is just flat out ignorant. Take this about Bill Gates for example:

One of the most peculiar but least understood developments of our time is the emergence of billionaires against capitalism. Even some of the greatest beneficiaries of the market system seem deeply disillusioned with it.

The same mistake is made throughout the piece. Capitalism and markets are not the same thing, not the same thing at all.

Read the rest of this entry »

The British Economy explained in a nutshell

THESE figures about growth in the UK economy really aren’t a surprise:

The data is likely to deepen concerns about the widening gulf between the capital’s “bubble” economy and the rest of the country. Between 2007 and 2011, London’s economy grew by 12.4pc, despite the painful impact of the financial crisis on the City.

That rate compared to growth elsewhere which ranged between 2.3pc in the East Midlands to 6.8pc in the South West, the Office for National Statistics (ONS) said. The South East, boosted by proximity to London, was close behind at 6.4pc.

A rough guide to the British economy is that it’s a middle of the road, middle ranking, European economy. Nothing very special about it in any direction: except for the presence of London. That’s a part of the Great Global Economy and so is influenced by what’s going on out there, not what’s happening at home. China growing at 8%, India at 6, hundresd of millions, billions even, climbing up out of destitution into the petit bourgeois delights of three square meals a day: these matter more to London than whatever the hell is happening in Bradford or Bingley.

It isn’t just banking either: accounting, law, arts, real estate and so on and on. London’s global in the way that New York, Singapore, Hong Kong are.

Maybe it shouldn’t be like this. Maybe we should do something so that it isn’t. But what is currently happening makes a great deal more sense if you think about the British economy in this manner. London really is entirely different from the rest of the UK economy.

Why do men fight and struggle to get rich? Answer: the babes

WHY do men fight to get rich? Because it gets the babes. Here’s George Soros and his former lover Adriana Ferreyr:

Soros’ papers state: ‘Soros and Ferreyr…engaged in a physically intimate relationship over the course of several years. [They] continued to date other people.

‘[At the time of the alleged assault in 2010] Soros was approximately 80 years old, and Ferreyr was approx 27 years old.’

Posted: 13th, March 2013 | In: Money | Comments (3)

The insane Czechs makes a hash of the 4G auction

THIS should be a spoof but unfortunately it isn’t: they’ve managed to get the economics of this situation entirely the wrong way around:

As bidding topped £680m, the Czech regulator pulled the plug on the 4G auction, saying that to continue would risk pushing cripplingly high prices onto the winner’s customers as well as delaying deployments – both to the detriment of the country’s citizens.

The Czech Republic was hoping for a fast deployment, and the regulator had placed a reserve of 7.4bn Czech Koruna (£250m) on the bands being auctioned off, but with four operators determined to divide the bands into three bundles, the bidding got out of hand and the regulator decided to pull the plug rather than taking the money.

This is insane.

Read the rest of this entry »

Posted: 12th, March 2013 | In: Money, Technology | Comment

Newspaper Shocker! Daily Mail Actually Helps Someone!

THE was an incredible piece in the Mail four months back. It was all about how a couple with kids on £75k a year just didn’t have any money, weren’t paying off the capital on their mortgage, didn’t have any savings and boo hoo hoo. At the time all of the comments were about just what it was they were doing: what simple damn mistake were they making? Sure, £75k’s not going to turn the head of any investment bankers but it’s still a decent enough chunk of change.

Read the rest of this entry »

Sock puppets: How the European Union spends your money

A GREAT little report out from the IEA today. No, I’m not saying so because I wrote it: I didn’t. But it shows quite how the EU spends some of that vast river of cash we send it each year.

- Citizens have not been consulted directly, however. Instead they have been ventriloquised through ‘sock puppet’ charities, think tanks and other ‘civil society’ groups which have been hand-picked and financed by the European Commission (EC). These organisations typically lobby for closer European integration, bigger EU budgets and more EU regulation.

- The composition of ‘civil society’ at the EU level is largely dictated by which groups the Commission chooses to fund. There has been a bias towards centre-left organisations, with a particular emphasis on those promoting policies that are unpopular with the public, such as increasing foreign aid, restricting lifestyle freedoms and further centralising power within EU institutions.

Read the rest of this entry »

Posted: 7th, March 2013 | In: Money, Politicians | Comment

The Labour Party and Greenpeace are just getting desperate over shale gas

THIS is an absurd complaint about shale gas:

The shale gas energy boom which critioooocs say will scar the countryside could line the pockets of foreign firms rather than boosting the British economy.

Most of the companies licensed to drill for the fuel using the controversial technique known as fracking are not UK-owned, it can be revealed.

Read the rest of this entry »

Put not your faith in Government promises: the solar panels fiasco

FOR governments will lie to you and lie to you again and again.

As the companies that make solar panels are finding out.

Only four years ago, hundreds of start-ups optimistically built factories and churned out solar panels to meet rising demand. Now, closures and failure loom for many.

The brutal shakeout is a dramatic reversal for an industry that has seen overall global growth of more than 30 percent annually over the past decade and this year will reach new records for solar panel sales.

Only a handful of manufacturers are now profitable in the face of too much capacity, which has contributed to a plunge in prices, and as government subsidies have been curbed. European banks that lent billions for solar installation have also pulled back as they struggle in the euro zone credit crisis, and debt-laden Chinese solar companies are in danger of burning up.

Read the rest of this entry »

Apple’s the best damn thing that’s ever happened to Chinese workers

YES, we all know the complaints. That those Chinese workers assembling the Apple products are paid a pittance, it’s all a shame and the company are capitalist bastards for exploiting the poor so.

Or we could look at the actual facts and decide that Apple’s the best thing that’s ever happened to the denizens of the perfumed east. For it is exactly that Apple and other companies expanding their operations there that is pushing up wages. Which is, I hope we’d all agree, what we’d actually like to happen? That the poor get rich?

Wages in Sichuan and Henan have surged 120 percent in six years because of economic growth, increasing local competition for labor and slower population-growth nationwide.

Read the rest of this entry »

Posted: 4th, March 2013 | In: Money, Technology | Comment

This is interesting about UK uncut: are they going after charities?

D’YE remember a little while back when UK Uncut was the new thing in town and all the cool kids were joining up? One of the things they did was have a little visit to Fortnum and Masons. Can’t remember exactly what they were whining about but it was something very important about people not paying taxes in some manner.

Which brings us to something from the financial pages:

Accounts for the holding company of the Weston family, Wittington Investments, show it recorded a sharp rise in revenues and profits last year thanks to the success of its sugar business and Primark.

Read the rest of this entry »

What we have done about banking and what we will do about banking

I KNOW, I know, I’m a shoddy apologist for the banksters and all other neoliberal thieves going. But I do keep trying to point to the effects of things.

I KNOW, I know, I’m a shoddy apologist for the banksters and all other neoliberal thieves going. But I do keep trying to point to the effects of things.

For example, you know we were all told that excessive speculation is what made prices jump around all over the place? And in one market at least, that speculation was stopped:

Trading volumes in sovereign CDS have plummeted as much as 50%, according to traders, four months on from a European Union-wide ban on speculative positions came into force.

Data from Citigroup and the DTCC showed that the net amount of outstanding CDS for all EU sovereigns has sunk 27% from around €124bn in mid-2012 to about €98bn. This follows the ban on “naked” short positions in sovereign CDS – that is positions that are not hedging an underlying position – having kicked in last November.

Read the rest of this entry »

The Great Chinese Green Energy Revolution

IT would appear that our Far Eastern cousins are actually doing something sensible about this green energy and saving Gaia bit:

Business is also more promising. By 2020 Jiuquan plans to increase wind power generation sixfold to 40GW. Wu predicts even faster growth between 2020 and 2030, when solar power starts to take off: “That’s when the technology will have matured and the generating costs will be lower. By 2030, I think China will get half its energy from renewable resources and Jiuquan will be famous around the world. People here are going to be rich.”

Read the rest of this entry »

Oooh! Yes please, let’s have local, politically connected banks!

YOU’VE heard the calls. It’s mad to have only a handful of banks that are too big to fail. We should have local and regional banks And put localy politicians, union leaders, on their boards as well. To make sure that the needs of society are catered to, not just shareholders.

YOU’VE heard the calls. It’s mad to have only a handful of banks that are too big to fail. We should have local and regional banks And put localy politicians, union leaders, on their boards as well. To make sure that the needs of society are catered to, not just shareholders.

Well, yes, that’s as maybe, But then let’s go and have a look at the end results of that sort of system:

Nationalised Spanish lender Bankia is expected to reveal a €19bn loss next week, the largest in the country’s corporate history.

Read the rest of this entry »

Posted: 28th, February 2013 | In: Money | Comment (1)

Economics is in absolutely everything, even having babies

THIS should’t come as too much of a surprise actually, that there’s economics in everything. For everything that we do, everything that happens, requires resrouces. As economics is the study of the allocation of scarce resources, there’s therefore economics in everything.

Yes, even in the having of babies:

The data was collected from individuals born in eight different Finnish parishes, covering the 17th to 20th centuries, when a mostly-agricultural society did not have access to modern birth-control or medical care.

Dr Helle said that a mother who had six sons would live for a further 32.4 years on average after the birth of her last child, while a woman who had daughters could expect to die 33.1 years after her final labour.

He said: ‘The research shows the more sons you have the lower post-reproductive survival was. Biologically, there is a bigger cost associated with having a boy than a girl, so that is one explanation for the shorter lifespan.’

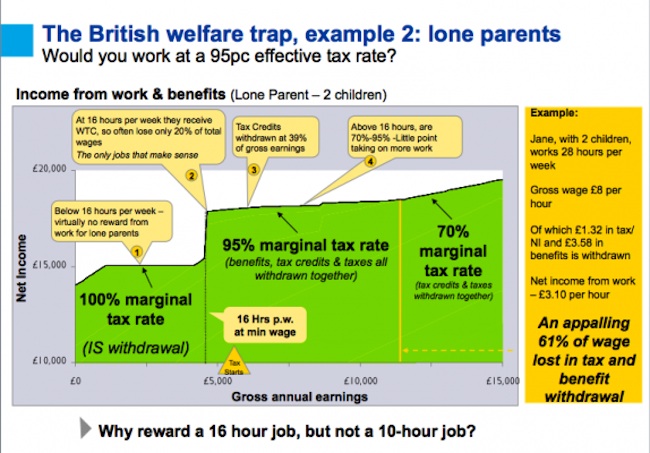

Why bother working at a 100% tax rate?

THERE’S this idea out there, this Laffer Curve thing. The idea is that at 0% tax you’ll not collect any tax revenue. Fairly obvious really. And at 100% tax rate no one will bother going to work. Also fairly obvious. At rates in between people will go to work: and there’s one tax rate somewhere that maximises the tax take.

Of course, everyone argues that we’re never going to have a 100% tax rate. Just not going to happen.

Read the rest of this entry »

That Olympics legacy: a ‘smoke and mirrors approach’ to Olympic ticket sales

THE Olympics Legacy:

The London 2012 organising committee has been criticised for a “smoke and mirrors approach” to Olympic ticket sales after figures revealed a significant number were obtained by VIPs rather than the public and some were not distributed evenly across individual price bands.

Golly, Gosh. Isn’t that shocking?

Read the rest of this entry »

The real problem after the Italian election: tell all those creditors to go screw

WELL, you can call it a problem if you like, personally I’d call it a godsend. But there are two things which should be making the European Union federast types very nervous right now. The first is that while neither of them actually won the election the winners in terms of doing really well were Berlusconi and Beppe Grillo. One’s a comedian and the other isn’t a billionaire on trial for under-aged whoring. But between the two of them this is true:

The projected results showed more than half of Italians had voted for the anti-euro platforms of Berlusconi and Grillo.

Read the rest of this entry »

Posted: 26th, February 2013 | In: Money, Politicians | Comment

BT’s worth more as scrap copper than it is as a telecoms company

BT’s worth more as scrap copper than it is as a telecoms company.Not that this will come as a huge surprise to anyone who has actually had to use BT of course. But from this it’s easy enough to calculate that BT is worth more as a mountain of scrap copper wire than it is as a functioning (ahem) telecoms company

BT’s network relies on more than 75 million miles of copper cable

Read the rest of this entry »

Don’t worry about the Bulgarians flooding the country

FOR a lot of them have already left Bulgaria. There aren’t that many left to leave.

As you may or may not know soon enough the Bulgarians and Romanians will be free to immigrate into the UK under the EU rules. They had to wait 7 years before they got the same freedom of movement that the rest of us have and those 7 years are just about up.

So, are we going to see a flood of Bulgarians similar to the flood of Poles we had a few years back? Many of whom have gone home again but not all.

Read the rest of this entry »

Posted: 25th, February 2013 | In: Money | Comment (1)