Money Category

Money in the news and how you are going to pay and pay and pay

Martin Lewis sues Facebook over scam ads; but who watches MoneySupermarket?

The added benefits of ‘money saving expert’ Martin Lewis suing Facebook for allowing fraudsters to use his name to trick money from people who trust him is that Facebook gets another kicking – good news for publishers jealous and wary of its power – and media-savy Lewis gets to be relevant. Lewis has built a very lucrative career advising people how to save cash. In 2012, he sold MoneySavingExert.com for £87m to MoneySupermarket.com, which runs an online price comparison service.

As the BBC reported at the time:

In the 12 months to the end of last October, MoneySavingExpert generated revenues of nearly £16m from 39 million users. Of this income, about 59% was earned from referral fees paid by MoneySupermarket.

It’s no mere tip-sheet.

In 2017, MoneySavingExpert reported:

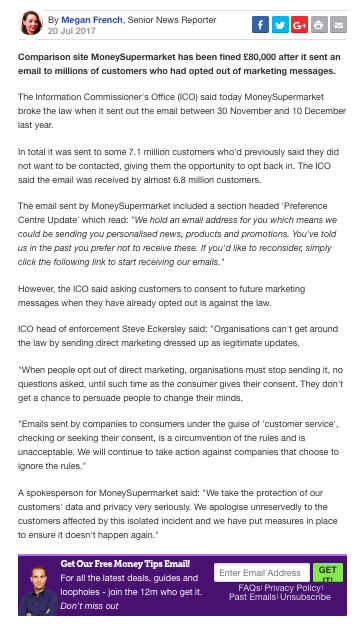

Comparison site MoneySupermarket has been fined £80,000 after it sent an email to millions of customers who had opted out of marketing messages.

The story on MoneySavingExpert.com makes no mention of the site’s relationship to MoneySupermarket. Is that fair?

Martin Lewis at the top of a story that makes no reference to the fact MoneySavingExpert is owned by MoneySupermarket.

Promoting financial products is a lucrative business.

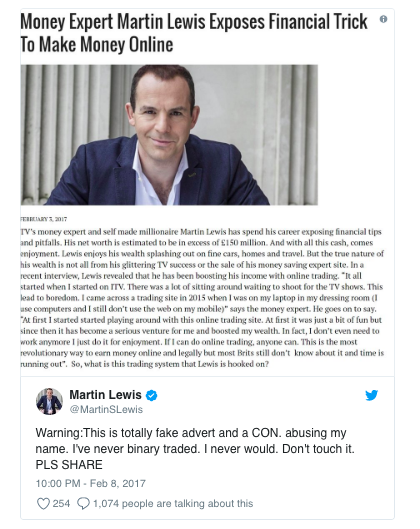

Lewis says Facebook earns money from the fake ads, making it is responsible for them. What’s odd and troubling is that Facebook, having taken the villains’ money, seems less bothered about punishing the crooks. How many of them just book another ad?

“It’s so distressing, when all my life I have campaigned against this kind of thing,” says Mr Lewis, whose face has appeared on over 50 different ads on Facebook, reports the Times. The social network does take them down – but as Lewis says: “It can take a couple of weeks and another one just pops up again. Why should I have to police this? Enough is enough. I’ve been fighting for over a year to stop Facebook letting scammers use my name and face to rip off vulnerable people – yet it continues. I feel sick each time I hear of another victim being conned because of trust they wrongly thought they were placing in me. One lady had over £100,000 taken from her.”

Someone invested £100,000 in a financial product they first saw on Facebook because it featured a photo of a bloke from the telly? What madness. No wonder conmen feel it’s worth having a go.

“I’ve told Facebook that,” adds Lewis. “Any ad with my picture or name in is without my permission. I’ve asked it not to publish them, or at least to check their legitimacy with me before publishing. This shouldn’t be difficult – after all, it’s a leader in face and text recognition. Yet it simply continues to repeatedly publish these adverts and then relies on me to report them, once the damage has been done.”

That seems fair. Why should the victim have to report the crime to the company promoting the scam and earning money from it? And what does Facebook do with money earned from these ads?

“It’s time Facebook was made to take responsibility,”Lewis continues. “It claims to be a platform, not a publisher, yet this isn’t just a post on a web forum, it is being paid to publish, promote what are often fraudulent enterprises. My hope is this lawsuit will force it to change its system. Nothing else has worked. People need protection. And of course, on a personal note, as well as the huge amount of time, stress and effort it takes to continually combat these scams, this whole episode has been extremely depressing – to see my reputation besmirched by such a big company, out of an unending greed to keep raking in its ad cash.”

Mark Lewis, a solicitor with Seddons law firm who is bringing the case, outlines the case:

“Facebook is not above the law – it cannot hide outside the UK and think that it is untouchable. Exemplary damages are being sought. This means we will ask the court to ensure they are substantial enough that Facebook can’t simply see paying out damages as just the ‘cost of business’ and carry on regardless. It needs to be shown that the price of causing misery is very high.”

A Facebook spokesman replies:

“We do not allow adverts which are misleading or false on Facebook and have explained to Martin Lewis that he should report any adverts that infringe his rights and they will be removed. We are in direct contact with his team, offering to help and promptly investigating their requests, and only last week confirmed that several adverts and accounts that violated our advertising policies had been taken down.”

Buyer beware.

Posted: 23rd, April 2018 | In: Key Posts, Money, News | Comment

Will Flickr go the way of Facebook under SmugMug?

Flickr, the useful and easy-to-use photography app, grew and then began dying on the vine under Yahoo!’s slack ownership. Under dire Verizon control it withered. Now it’s been taken over by family-owned photo sharing service Smugmug from Oath (the clunky Verizon vehicle).

Flickr and its vast archives of images has been great for sites like Flashbak, which features gems from the past. Through it you can contact users directly and see which images are open to free use with the Creative Commons stamp by each photo.

Smugmug CEO Don MacAskill tells USA Today:

“We don’t mine our customers’ photos for information to sell to the highest bidder, or to turn into targeted advertising campaigns. It sounds silly for the CEO not to totally know what he’s going to do, but we haven’t built SmugMug on a master plan either. We try to listen to our customers and when enough of them ask for something that’s important to them or to the community, we go and build it.”

It’s not all that clear, then, what Smugmug plan to do with Flickr. It’s always been about the data with social media companies, so why will SmugMug be any different? Ads revenues, protectionism and greed power the American-run Internet.

The only announcement sent to users tells them:

We think you are going to love Flickr under SmugMug ownership, but you can choose to not have your Flickr account and data transferred to SmugMug until May 25, 2018. If you want to keep your Flickr account and data from being transferred, you must go to your Flickr account to download the photos and videos you want to keep, then delete your account from your Account Settings by May 25, 2018.

Seems fair. But what a big loss to the web it will be people do just remove their images. Is there nowhere Flickr users can store their work for free elsewhere? Is everything we put on the web just a way for a big US company to make a buck?

Spotter: USA Today

Posted: 22nd, April 2018 | In: Money, Technology | Comment

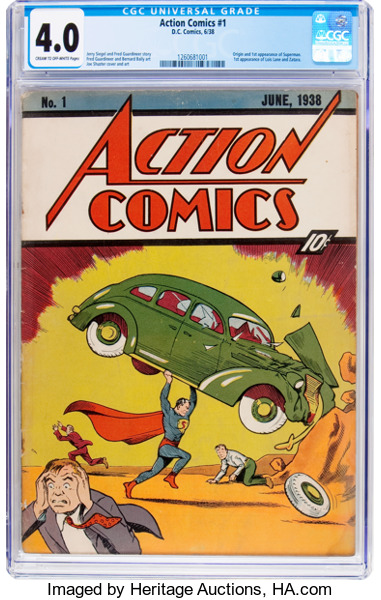

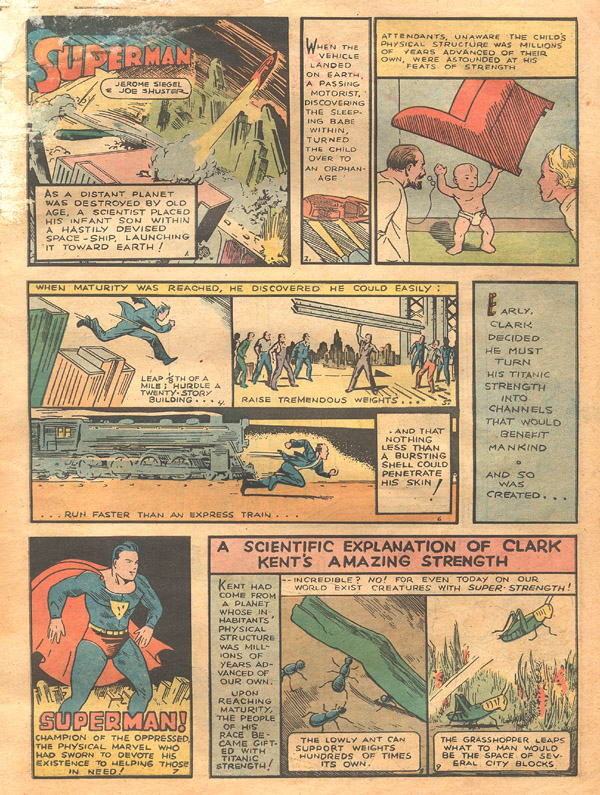

Action comics Number 1 yours for a bargain $300,001

To the attic in search of a pristine copy of Action Comics #1 (1938). It’s the magazine in which Superman appeared for the first time. On the Heritage Auction website, the top bid sits at an impressive $300k. The auction house hopes the bid will soar to double that figure at its Comics & Comic Art Auction May 10-12 in Chicago:

Form the auction house:

“This auction has a chance to be among the largest comics auctions of all time, if not the largest,” Heritage Auctions Comics Director of Operations Barry Sandoval said. “It will be in a vibrant city that is easy to reach from just about anywhere, and we have an extremely strong collection of valuable comic books that will draw the attention and interest of comics collectors from just about everywhere.”

Action Comics #1 (DC, 1938) CGC VG 4.0 Cream to off-white pages(est. $650,000+) is among the most coveted comic books in the hobby. The issue generates major interest regardless of its condition, and this is one of the highest-graded copies ever offered by Heritage Auctions. Ernst Gerber’s The Photo-Journal Guide to Comic Books rated it “scarce,” and CGC’s census lists just 40 unrestored copies. The first appearance of Superman launched the Golden Age of Comics, and every superhero that followed is in debt to the character created by writer Jerry Siegel and artist Joe Shuster (artist). The issue also sits atop Overstreet’s “Top 100 Golden Age Comics” list.

In 2014, a mint-condition of Action Comics No. 1 sold for a record $3,207,852 in an auction on eBay.

Spotter: Boing Boing, Flashbak

How The US Will Impose Russian Sanctions On British Banks

The Americans are really rather pissed off at the Russians these days. To the extent that they’ve decided to impose sanctions on a number of Russian oligarchs and their companies. Hmm, OK, well, that harms the Americans rather more than anyone else, right? Because it is those USians who cannot work with Russia, while the rest of the world is entirely free to do so. Sadly though, that’s not quite how it works. The secret is here:

A senior American official has warned that British banks will face “consequences” if they flout new sanctions against some of Russia’s wealthiest businessmen and biggest companies.

In words that are likely to cause concern in the boardrooms of financial services groups, Sigal Mandelker, under-secretary of the Treasury for terrorism and financial intelligence, said that US authorities would be on the lookout for any breaches of their Russian sanctions.

The penalties for banks caught doing business with those sanctioned could include heavy fines, as well as the loss of their US banking licence.

The way this does work is that the US claims authority over any business taking place in US dollars. They’re, well, just about right in this. People who swap cash dollars with each other aren’t covered. But anything which works through the banking system in dollars is. They proved this when they fined BNP Paribas billions for trading with Sudan. BNP is a French bank, Sudan’s not part of America either. There were US sanctions on not trading with Sudan. A French bank should not be covered then, should it? But it was and when caught it paid up too.

For the US says, as above, that transactions in dollars fall under US laws. The link being that in order to settle a transaction it will go through New York. That’s just the way the international banking system works. Transactions in £ sterling go through London, in Yen through Tokyo, in $ through New York. So, even if a French bank, in France, lends to Sudan, if they do it in $ then that’s a transaction that goes through New York and is subject to US law. Including those sanctions – pay up buddy for breaking them.

The same is true of these sanctions against Russia and Russians. Anything done in $ is regarded as being under US law. So, no one can deal with these Russians in $.

But it gets worse than that. For, obviously enough, this doesn’t cover people who deal with the Russians in £, or € or Yen. So, everyone can still deal with the Russians, right? Except no, and this is where the US gets a little controversial. For just about every bank even with pretensions to doing international business does some business in dollars, thus some business in the US. Meaning that they’ve got a US banking licence and a business in the US to protect.

What the US says is, yup, sure, strictly speaking our sanctions only apply to business in $ and if you work in another currency then you’re fine. Except that’s not the way we work, if you work in those other currencies then we’re going to have a good hard look at whether you can continue to do business in the US. And guess what, we bet we could find a reason why you can’t.

And that’s how the US will impose their Russian sanctions on British and global banks. You’ve sure got a nice US business here, be a shame if anything happened to it, wouldn’t it? The tactics of the Mob being used by a government, such a pleasant sight.

Amazon is now the world’s largest investor in research and development

One of the more amusing things that we’re told about the tax dodging by the internet giants is that the government needs all that money in order to be able to invest. We’ve got low productivity rises, this means that wages will rise slowly into the future – and it’s true that if productivity rises are slow then so will wage rises be. Thus the Treasury should get a goodly slice of the moolah so that those wise people in the House of Commons can invest it.

This rather fails with Amazon:

Amazon passed Volkswagen AG in late 2016 to become the world’s biggest corporate R&D spender, and its hold on the No. 1 spot has only grown more secure since.

Amazon doesn’t pay a dividend, the only share repurchases it does are to buy the stock that is then awarded to employees as part of their pay. It also doesn’t make much of a profit. Sure, the number can be large, but as a percentage of anything it has always been tiny. The reason being that any money they do make on one line of business is then sent off to be invested in some other line.

They’re actually doing what people claim they want companies to be doing, sending their profits back into investment so as to create more growth and more jobs with higher wages in the future. So this claim that they should pay more taxes so that government can invest the money is more than a little odd.

Of course, the claim that companies should pay more tax so that government can invest is ridiculous anyway. The company can invest it itself, or it can give it all to shareholders. Who then make the decision to either spend it – raising demand and thus wages- or invest it – raising future growth and future wages. There’s nothing else that can be done with money, you either spend it or invest it, that’s all that’s possible.

The real complaint here is that the politicians can see a pot of money and they’re pissed off that they don’t get to spend it. But then we knew that, right?

Posted: 12th, April 2018 | In: Money, News, Technology | Comment

London House Prices Are Falling, Hurrah!

Or is is hurrah at all? For if London house prices are falling doesn’t that mean lots of people are going to get screwed by their mortgages? And thus we get to one of the great economic problems, there is no way to please everyone.

House prices in parts of London that were once at the epicentre of the UK property boom have fallen as much as 15% over the past year in fresh evidence of the impact of the EU referendum.

Figures from Your Move, one of the UK’s biggest estate agency chains, reveal that the average home in Wandsworth – which includes much of Clapham, Balham and Putney – fell by more than £100,000 in value over the last 12 months.

So, start from what we all would say is the largest housing problem we’ve got in Britain – no one can afford the damn houses. At least no one normal, on a normal income, can afford to buy a house. Therefore we’d really rather like the price of houses to fall.

So, we vote for Brexit, all those foreigners get cold feet about living here and house prices fall, Huzzah!

But we all know what happens next, don’t we? There will now be endless complaints about negative equity, about how people are being bankrupted because their houses are going down in value. Thus we’ll get all the more usual cries that government must do something to keep house prices up.

We could just say this proves you can’t please all the people all the time but that would be trite. We actually want to know what it is that government should be doing about all of this. The answer being nothing. They cannot win, there’s no right thing for them to be doing. Better by far if they simply retreat from the whole sector. Just leaving houses and their prices to the markets and when asked the government can just shrug and insist “Nowt to do with us, is it?”

No, really, what else can they do?

Unilever be gone: Marmite maker leaving Britain don’t matter a damn

The maker of Marmite, Unilever, has announced that it is to give up its UK headquarters and move to Holland. This doesn’t matter a damn. No, really, it’s a triviality of no import at all. It’s also nothing to do with Brexit, They even say this themselves:

Unilever, the Anglo-Dutch group, said on Thursday that Brexit played no part in its decision to choose Rotterdam over London for its single legal base.

It’s always useful to take peoples’ word for such things.

Unilever has always been a slightly odd company anyway. It’s long been near half Dutch anyway. And it reports its results, does its internal accounting, in euros as well, something a bit odd for a UK company. But then no large multinational is really from or in any one country anyway. There’s some slight importance, mainly due to where the senior execs get to live, to where head office is. Other than that it doesn’t really make any difference.

The factories are going to remain where the factories are. That doesn’t change when HQ moves. The company will still have its shares listed in London. Because you don’t have to be a UK company to do that. In fact, there are FTSE100 members who don’t do any business at all in the UK, they just use the stock market as the place they’re listed and that’s it.

The change won’t even make any difference to taxes collected. Now, as it wasn’t in the past, we don’t tax foreign profits made by companies with an HQ in the UK. We tax only on the profits they make from business in the UK. And we tax companies without a UK HQ on exactly the same basis. Foreign profits aren’t taxed by us, profits made in the UK are.

Unilever moving HQ to Rotterdam makes very little difference therefore. Sure, a few wine bars will miss the spending of the top execs but other than that, pretty much nothing. No factories will move, tax collected won’t change, it’s all a bit of nothing in proper economic terms.

Shrug, have fun over there folks is the correct response.

Posted: 16th, March 2018 | In: Money, News, The Consumer | Comment

Stormy Daniels will reveal all about her candlelit romance with Trump if he returns $130,000 hush money

You know how it goes: you shag the billionaire and take his hush money. Then the billionaire becomes president of the US of And you realise you undervalued your services. And so it is that adult film star Stormy Daniels says she not longer wants the $130,000 she claims Donald Trump paid her to remain tight lipped about their affair. She thinks it best that she return the cash and place her story on the public record.

Daniels, nee Stephanie Clifford, has laid out her plan in a letter to Trump’s personal lawyer Michael Cohen. She has set a deadline of Friday for the return of the cash. She will then be at liberty to “speak openly and freely about her prior relationship with the president and the attempts to silence her and use and publish and text messages, photos and videos relating to the president that she may have in her possession, all without fear of retribution or legal liability.”

“This has never been about the money,” Clifford’s lawyer, Michael Avenatti, told NBC New. It’s the principle, right? “It has always been about Ms. Clifford being allowed to tell the truth. The American people should be permitted to judge for themselves who is shooting straight with them and who is misleading them. Our offer seeks to allow this to happen.”

Generous it is, indeed. And should Trump fall into a a trap marked ‘TRAP’ with huge arrow pointing at it, we can all marvel at how a man who outlined his mating ritual as “Grab her by the pussy” really treats women he fancies.

You can read Daniels’ letter in full here.

Posted: 13th, March 2018 | In: Celebrities, Money, News, Politicians | Comment

25% of People in Wales Are in Poverty – Nonsense If We Count Properly

A new report out insisting that 25% of the Welsh are living in poverty. Our conclusion might therefore be that we’d not like to have Labour running the UK as they have been Wales these past few decades. But that would be partial, extreme and unfair. The truth being that we’re measuring what poverty is wrongly:

Growing numbers of Welsh families are at risk of being trapped in poverty, a major report warns today.

Research by the Joseph Rowntree Foundation shows Wales has a higher rate of poverty than England, Scotland and Northern Ireland.

What poverty is depends upon how we measure poverty. For the world as a whole we use the World Bank’s measure, $1.90 a day. There is no one at all in the UK living at this standard, not one single person.

Within the UK we use something called “relative” poverty. This is less than 60% of median household income. If you live in a household which gets less than 60% of £25,000 or so a year then you’re in poverty. Sure, it’s not great riches but it sure ain’t the same as that global poverty. Also, note that this is after benefits, this is total income, not just that from work. But note one more thing – that’s the national median income.

And incomes vary over the country. More than that, the cost of living varies over the country. It’s not just housing either – a pint’s cheaper outside London, outside the SE, than it is within either of them. But we don’t account for that at all. And as anyone who has ever tried it knows, trying to live in London on £25,000 a year is very different from trying to live on that in Abergavenny is.

The reality is that many of those described as “poor” in Wales actually have a higher standard of living – well, except for being in Wales – than many of those in London on nominally higher incomes. Britain does have regional variations in wages but it also has large regional variations in costs. Once we account for those differences, both of those sets of differences, much of reported poverty simply disappears.

The biggest problem we’ve got with poverty in the UK is that we just don’t measure it the right way.

Provident Financial’s Nearly Bust, Not Overcharging On Those 5,000% Loans Then

One of the more difficult things to get people to do is make them understand the implications of their prejudices. One such is that all those Wonga-like companies offering high APR loans must be overcharging. APRs of 50%, 500%, 5,000 %, these must just be capitalist greed ripping off the poor, right?

The granddaddy of these firms probably being Provident Financial, starting out as a door to door operation well over a century ago rather than some internet upstart. But the logic and economics work the same way:

Provident Financial’s shareholders are hoping for better days ahead after the troubled doorstep lender unveiled a £331m cash call aimed at reviving the business after a torrid year.

But if the plutocrats are successfully ripping off the working man then why do they need to put more money in?

The update came alongside Provident’s much-anticipated annual results, which revealed a pre-tax profit drop of 67.3pc to £109.1m during a year that was the toughest in its 140-year history.

Well, yes, that’s a decent enough profit there. But on the capital that they’re employing it’s actually lower as a percentage than the average across British companies. They’re making less profit than normal industry, despite those sky high interest rates. Which does rather mean that those interest rates aren’t too high, doesn’t it?

The truth being that lending small amounts of money for short periods of time is a very expensive thing to do. Firstly, say you’re going to lend £100 to someone. Or £1,000? The decision making process will probably cost you about the same. So also the basic nuts and bolts of taking the application, sending the money out, setting up the repayment plan and so on. There are simply costs to doing this. Whatever, call this £10. Now note, that’s 1% of the larger sum, 10% of the smaller.

Then, of course, there’s the fact that not everyone repays all of their loan in full. whatever interest is charged has to cover that fact too. Finally, the way APR is calculated means that the arrangement fee, that £10, is counted as a fee that repeats and repeats through the year. If the loan is for a week then the APR calculation counts that fee 52 times to get to the annual rate.

A much simpler and more accurate method of working out whether these charges to borrow are too high is to look at the profits being made by those doing the lending. If those aren’t high – and that Provident Financial shareholders have to put more capital in shows they ain’t – then the lending rates aren’t too high either.

It just costs a lot to lend small amounts for short periods of time. Shrug.

Haven’t We All Got So Much Richer?

This little statistics rather surprised me. I should have known it but didn’t:

The average house price has soared by 7,578 per cent, from £2,100 in 1952 to £161,937 in 2012, according to Halifax. But in the 1950s, prices were much lower relative to earnings — around 3.5 times the average salary compared with 4.8 times over the past decade, so it was more affordable to get on to the property ladder.

OK, well I did know that. Houses have got more expensive relative to wages. It’s one of the ways in which you can say that we’ve not actually got richer over the generations: sure, wages have risen, but we’ve got to spend it all on a house.

It would have cost around £160 a year over a 20-year mortgage term to buy a typical home in 1952, but at that time around two thirds of properties had no hot water.

And that’s the important point. Sure, houses have got more expensive: they’re also less shit than they are. Central heating didn’t become even a luxury until the 1950s either, widespread adoption only coming in the 1960s. Which brings us to another complaint. We’re often told that a generation back one income could feed and house and raise an entire family. Now it takes two: so we’re no better off at all.

To which I would say bollocks. You can live a 1950s lifestyle on one income in the UK no problems. A house with maybe an inside lav, more likely than not no hot water, almost certainly no actual bath in a bathroom. And certainly no central heating: mebbe a coal fire in one or two rooms. Shitty food, no foreign holidays at all (this is still the era of a week’s camping at Scunthorpe). No meals out of course: it’s not just that no one could afford them, restaurants, other than those in expensive hotels, just didn’t exist (seriously, the expansion of Berni Inns in the 50s and 60s was the first experience of restaurants for many).

You can very easily live a 50s lifestyle on one single earner these days. The problem is that we all like being a great deal richer than that.

Kardashian balls: Kylie Jenner’s billion dollar tweet

All power, then, to Kylie Jenner, 20, half-sister to Kim Kardashian, who has issued the first billion dollar tweet: “Sooo does anyone else not open Snapchat anymore?”

Her message was liked more than 250,000 times. Around the same time, shares in Snap, which operates the social media app., dropped 6 per cent ($1.3bn).

Such is Jenner’s power that a role as share tipster must beckon. Kylie tips a few companies for greatness and – waboom!- their short-term share price rises sharply. You can debate why anyone would follow the advice of a woman who called her first child Stormi Webster later. But they do. So there.

Of course, there’s more to it that just Jenner’s tweet. Citigroup analyst Mark May has seen a “significant jump” in negative reviews of the app’s redesign. Over one million names appeared on an online petition asking Snap to keep the old look. Maybelline New York asked its followers if it should bother staying on the Snapchat platform.

But the story is out there – “Kylie Jenner’s pop at Snapchat wipes $1bn off value” (Times); “Reality TV star Kylie Jenner wiped $1.3bn off Snap’s stock market value after tweeting that she no longer used its Snapchat messaging app” (BBC); and “SNAPCRASH -Kylie Jenner wipes £1BILLION off value of Snapchat just by saying she doesn’t use the app any more” (Sun).

When later on Jenner tweeted “Still love you tho snap”. The stock did not rally. Last night shares in Snap closed down $1.13 at $17.51.

Still, it’s good marketing for Jenner and Snapchat, which now appears to be relevant. It’s almost as if – as if! – it was all a spot of PR…

Posted: 23rd, February 2018 | In: Celebrities, Money, News | Comment

Save the Children accused of putting business before women

Justin Forsyth resigned his post as chief executive at Save The Children because he made, in his words, “unsuitable and thoughtless” comments to three younger women. The evidence is in a “barrage” of text messages the current deputy executive director at Unicef sent female staff in which he appraised their looks and clothes. Mr Forsyth was never subjected to a formal disciplinary hearing. Save the Children says it did examine Mr Forsyth in 2011 and 2015. And that was it. Back then whatever he did was deemed to be ok. Now it isn’t.

Forsyth is a forgettable looking chap with the looks of a minor public school’s cricket coach. “I made some personal mistakes during my time at Save the Children,” he states. “I recognise that on a few occasions I had unsuitable and thoughtless conversations with colleagues which I now know caused offence and hurt.”

Were they thoughtless? Or was he thinking, you know, with his manhood? It’s pretty hard to bang out a text without engaging any brain power. Unless it was instinctive and Forsyth was operating on the same level as a sponge reacting to the presence of water or a puppy on the vicar’s leg. Where does flirting slide over into sexual harassment? A YouGov survey tells us that over a quarter of 18 to 24 consider winking “always or usually” sexual harassment – the figure falls to 6% for over-55s. Two thirds of the same think the same of wolf-whistling – for over 55s it was 15%. Nottinghamshire police consider wolf-whistling a “hate crime”.

“When this was brought to my attention on two separate occasions,” Forsyth continues, “I apologised unreservedly to the three colleagues involved and my apologies were accepted and I thought the issue was closed many years ago.”

Well, it wasn’t closed. One woman tells the BBC: “The complaints of harassment were not treated with the appropriate degree of seriousness. It seems there was more interest in preventing the exposure of misconduct than in protecting its female employees from predatory behaviour.”

The PR is now in full cry. Following new that Brendan Cox was not best behaved when he worked at Save The Children, the charity tells everyone: “We apologise for any pain these matters have caused and sincerely hope that the complainants feel able to help us with the review in the coming weeks.”

We apologise for the reactions. But not for doing anything wrong. Indeed, we urge the alleged victims to trust us. Only we can get to the bottom of things. Adding: “This is so that we can better support our skilled and highly valued staff as they help change the lives of millions of children around the world every day.” Translation: we’re great. Sure some of your charitable donations will go on staff reviews, PR and guff. But keep giving!

Lisa Armstrong prepared to part with her half her fortune to get shot of Ant McPartlin

When Ant McPartlin’s lawyers thrash out any divorce settlement with his estranged wife Lisa Armstrong, they may refer to the Sun’s reporting on the family fortune.

In today’s paper the news is that Amanda Holden and Alesha Dixon have been “comforting” Lisa and offering “real support”. That news of their good hearts should emerge just as Britain’s Got Talent, the show on which the pair work as judges hits the PR circuit, is surely coincidental and not opportunistic tosh pulled from cynicism’s deepest mine.

Of more interest is that Sun’s news that Ant is “prepared to part with half his £62m fortune”. You might suppose that money accrued by childhood sweethearts who’ve ben married for 11 years would belong to both of them. The message could be: “Lisa is prepared to part with half her fortune”?

And it’s not £62m. Well, not according to the, er, Sun it isn’t.

One thing is clear: in the tabloids the money is always his and not hers.

Posted: 16th, February 2018 | In: Celebrities, Money, News, Tabloids | Comment

Stuntwoman wigs out over men in drag taking her jobs

Does pulling on a wig and acting like a woman make you a woman? In Hollywood there’s a backlash against wigging. It’s when men pull on wigs, dress like women and perform stunts in place of the female star for TV and movies. the thinking is, perhaps, that the stunt men in wigs are more expendable than the actress.

But stuntwomen – well, one stuntwoman – say wigging is preventing her getting work. It’s a man doing a woman’s job. Deven MacNair, a Los Angeles-based stunt artiste, is looking to sue Hollywood’s acting union and a production company because a man in drag did a stunt she could have done.

“The practice is so common, ” she says. “It’s historical sexism – this is how it’s been done since the beginning of time.”

Fair enough. We can’t have men in wigs taking jobs women can do, even if it they do well enough to earn them plaudits.

This man’s job is to climb down London’s sewer network and blast away “fatbergs” that clog it. Have there been any calls recently for gender equality in the sewage clearance sector? Because the sewage industry seems to be dominated by men: perhaps it’s time to address this? 🤔 pic.twitter.com/CRrWWdSgAX

— Martin Daubney (@MartinDaubney) February 10, 2018

And let’s make it law that 50% of all primary school teachers are men, too.

Studies in the mafia’s lemons

Big news on Mafia money. Queen’s University, Belfast declares on February 7 2008:

Researchers from Queen’s, in collaboration the University of Manchester and the University of Gothenburg, have uncovered new evidence to suggest that the Sicilian mafia arose to notoriety in response to the public demand for citrus fruits.

Who knew? Well , in 2012, this academic paper produced at the university of Gothenburg us:

In this paper, we study the emergence of an extractive institution that hampered economic development in Italy for more than a century: the Sicilian mafia. Since its first appearance in the late 1800s, the origins of the Sicilian mafia have remained a puzzle. In this paper, we develop the argument that mafia arose as a response to an exogenous shock in the demand for oranges and lemons, following Lindís discovery in the late 18th century that citrus fruits cured scurvy.

And this from 2009:

And improbable as it sounds, the birth of the Cosa Nostra, in part, was down to…the lemon…

The first evidence we have for the Mafia is in an account by one Dr Galati. Galati was certainly not the first to be persecuted by the Mafia, but he was the first person to leave a detailed account of his dealings with them. In 1872 Galati came to inherit a pristine four-hectare lemon grove only a ten-minute walk from Palermo. However, all was not well inside its walls. Its previous owner, the doctor’s brother-in-law, had died of a heart attack following a series of threatening letters. Some time before he died, he learned that the sender of these letters was a warden on his own grove, Benedetto Carollo, who had dictated them to someone who was literate. He said that he swaggered around the grove making wild threats against Galati and it was well known that he creamed at least twenty per cent off the sale price. He even stole coal for the steam engine. Eventually lemons started to go missing from the grove. Orders couldn’t be met and the grove got a bad reputation. Carollo was trying to ruin the grove so as to buy it himself. Galati sacked him and hired a replacement.

Some ‘good friends’ of Carollo’s came around and advised that Galati should take him back, but Galati refused.

At approximately 10pm on 2 July, 1874, Carollo’s replacement was shot several times. The hitmen had built a platform behind a stone wall so as to shoot him in a winding back lane. This method became a staple of early Mafia hits. The police were called and they tactfully ignored Galati’s convictions that it was Carollo, arresting instead two men who had no connection with the victim and then promptly releasing them. He received a series of threatening letters, seven in all, which said it was a disgrace for a ‘man of honour’, such as Carollo, to be fired.

Eventually he was forced to flee the country after a series of attempts on his life.

And there’s a book:

As Helena Attlee writes in her history of Italian citrus, The Land Where Lemons Grow, “the speculation, extortion, intimidation, and protection rackets that characterize Mafia activity were first practiced and perfected in the mid-19th century among the citrus gardens of [Palermo].” In fact, the association was so strong that some historians and political economists now think the group actually arose directly from the citrus trade: life gave them lemons, and they made organized crime.

And another book:

Ever since it was born in the fragrant lemon gardens of Palermo a century and a half ago, a sworn brotherhood has pursued power by cultivating the simple, terrible art of killing people with impunity.

That cutting-edge research, then, bit of a lemon…

Spotter: Tim Worstall

Manchester United’s Sanchez accepts a 16-month suspended jail sentence for tax fraud

How’s Alexis Sanchez fitting in at Manchester United? Pretty good. The new Manchester United striker has accepted a 16-month suspended jail sentence for alleged tax fraud. This means he’ll avoid a trial. He will repay the full amount plus interest.

The BBC:

The ex-Barcelona player faced going to trial in Spain over unpaid taxes amounting to around 1m euro (£886,000). The unpaid taxes derive from image rights deals in 2012 and 2013. When Sanchez, 29, was first accused in 2016, his agent said the Chile forward had “fully obeyed” laws and his image rights income “has been declared”.

Sanchez now earns £14m a year after tax. United pay his tax bill so any future alleged miscalculations might be best avoided.

You wonder how playing a man with such a record impacts on Manchester United’s brand values. We looked up what those values are. On the always entertaining Red Cafe, a conversation headlined “What are Manchester United’s ‘values’?” tells us:

Personally for me it’s hard to look at the modern iteration of United without seeing commercialism written all over it. They must be the only club in the world with an “official noodle partner” for Christ’s sake.

This idea of United being “different” is a bit pretentious for me given they are probably the most commercial football club in the world and commercialism is seen by many as the biggest issue in football behind corruption.

…

Agree with the OP that the club is entirely about profit and it will remain that way I’m afraid.

…

We are different because of our history. From Munich to the Busby Babes, to the 70s and 80s of the club. Then the 26 years of SAF. We are a unique club. We have done things differently with our attacking football, our breading of youth, which has continued with the call up of Lingard into the squad. We do have ethical values. We won’t sack LVG if we feel he is doing a good job just because a shiny new manager (Ancelotti/ Pep in this case) has come along. We really tried with Moyes even though after just a few months we all knew he was out his depth. That season could have been saved but we stuck to our guns and kept faith in him.

Now we have coaching staff with Giggs and Butt in it. We have ambassadors such as Charlton, SAF, Robson, Cole. We have kept with traditions and have tried to maintain the culture throughout the club.

It’s what makes me proud to be United.

That was then. But it’s something to hold on to next time the ‘keeper bypasses the defence and smacks it long to the front players. For many people, football’s all about the money. Now pass the official prawn sandwiches round…

Posted: 7th, February 2018 | In: manchester united, Money, Sports | Comment

New Leeds United badge looks like an advert for Gaviscon

The news Leeds United badge – the one on which the club claims to have consulted 10,000 people (how many of whom are Leeds fans is not know but I’d guess none) – looks like…the design on a bottle of Gaviscon, the treatment for upset stomachs.

Posted: 24th, January 2018 | In: Money, Sports, The Consumer | Comment

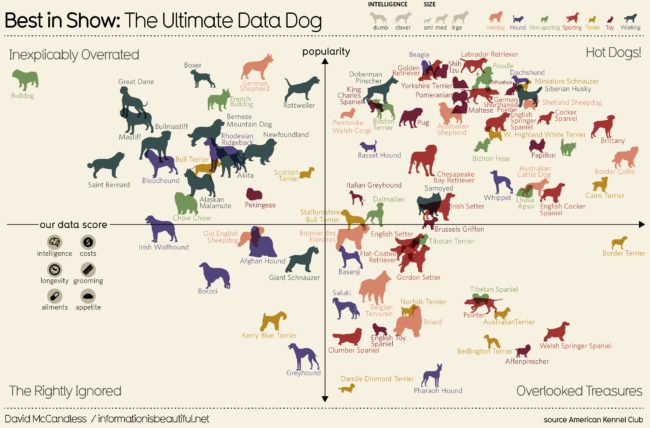

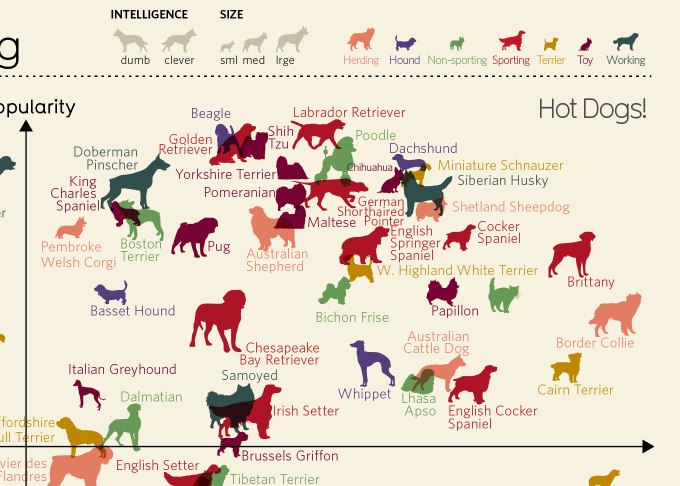

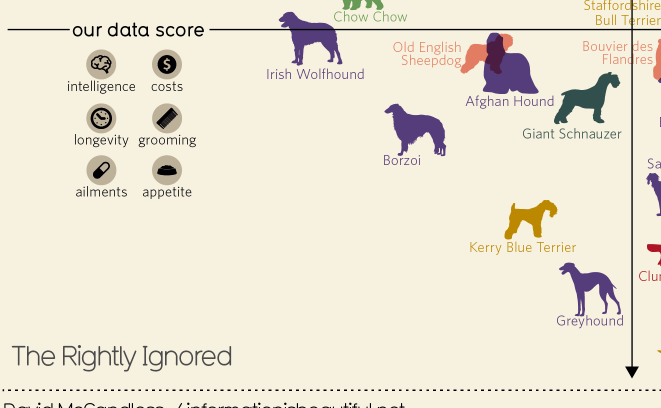

Data proves that owning a bulldog is for idiots

Thanks to David McCandless we know which dogs make the best pals. Considering six facts – intelligence, costs, longevity, grooming, ailments, and appetite – McCandless crunched the numbers and concluded that bulldogs are not worth the effort an expense.

Spotter: Knowledge Is Beautiful

Posted: 23rd, January 2018 | In: Money, Strange But True, The Consumer | Comment

Sex with a plastic doll in Gateshead cost twice as much as a London prostitute

How much does on-the-clock sex cost in the UK? You can get a shag for £4 in Liverpool; £25 in London; and alcohol and cigarettes in Newcastle. Grim stuff. Bug not as desperate as the blokes spending £50 shagging used sex dolls in Gateshead. The Daily Mail reports:

Businessman selling sex dolls offers customers a £50 ‘try before you buy’ scheme for a half hour session at an industrial estate in Gateshead Customers can ‘test drive’ sex dolls at the industrial site in Gateshead for £50

Service was launched in December and business has had a ‘few’ customer since

The owner tells BBC radio:

“We’ve sold used dolls for a long time, which may come as a surprise to some people, but each one goes through anything from a one-hour to a five-hour [cleaning] process. It’s as clean as can be.”

Spotter: Daily Mail

Posted: 21st, January 2018 | In: Money, The Consumer | Comment

Insurance or the NHS: who pays for the rising cost of childbirth?

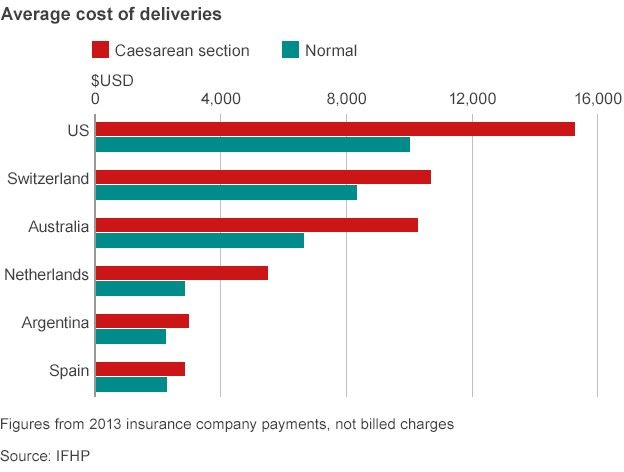

What does it cost to have a baby on the NHS? The Guardian says: having a baby without complications costs £2,790; having a baby with complications costs £5,000. Those figures are supplied by the Nuffield Trust, an independent charity. The Mirror says it would cost you “tens of thousands of pounds” to have a baby were it not for the NHS.

Would it? Would you all really pay tens of thousands of pounds to have a child?

In the Guardian, another question arises today: “Why does it cost $32,093 just to give birth in America?” The inference, of course, is that the NHS does it much better and much cheaper that any other alternative system.

The answer to the Guardian’s question is simple: there’s insurance that covers it. It’s less about what it costs than it is about who pays the bill and how it’s paid. Indeed, in paragraph five, the paper notes that “insurance typically covers a large chunk of those costs”.

And then this:

Medicaid, a program available to low income households that covers nearly all birth costs….Childbirth Connection put the average out of pocket childbirth costs for mothers with insurance at $3,400 in 2013.

But things do look pricey in the US. The BBC has this graph from 2015:

Prof Gerard Anderson of the Johns Hopkins Centre for Hospital Finance and Management explains the costings:

“If you can make more money as a doctor by ordering more tests, you are going to order them and therefore patients end up getting more tests.

“You also pay a fee for services a la carte in the US so if you are worried about the pain of the childbirth and have an epidural, you’ll have to pay for it. If you ask for a painkiller after giving birth, you’ll have to pay for it. And all those costs rack up.”

Money is the incentive that encourages more expensive care? The piecemeal approach can create a higher final bill. The NYTimes reports:

Recent studies have found that more than 30 percent of American women have Caesarean sections or have labor induced with drugs — far higher numbers than those of other developed countries and far above rates that the American College of Obstetricians and Gynecologists considers necessary.

And here’s the hook. Anderson explains;

“If you don’t have health insurance in the US, hospitals and doctors will ask you to pay three to four times what someone with insurance will pay for the same service because no-one is negotiating rates on their behalf.”

Matt Yglesias drools over the possibility of getting the entire country under the government’s healthcare thumb. Medicare is a particularly revealing program idea in this respect. At a deep level, the left sees all of us as the equivalent of senior citizens, dependent on the benevolence of government for our needs and wants. Of course, they will provide our needs as they see fit – they’re good people, you know. And so much smarter than the rest of us. There will be none of that wasteful drug spending we now have. How dare Americans spend their own money on treatments they actually want? It’s inefficient! This remains the key template for liberals: citizens as permanent supplicants. Those who do manage to look after themselves? Don’t worry. They’ll tax you till you really do need the equivalent of Medicare. And expect you to be grateful for it.

Is the NHS efficient, providing heath care at the points of need? Not always. It spend lots of money on other stuff. In 2014, the NHS’s future was outlined in a policy document:

‘The first argument we make in this Forward View is that the future health of millions of children, the sustainability of the NHS, and the economic prosperity of Britain all now depend on a radical upgrade in prevention and public health… The NHS will therefore now back hard-hitting national action on obesity, smoking, alcohol and other major health risks. We will help develop and support new workplace incentives to promote employee health and cut sickness-related unemployment.’

Does your private quack do that? Would you want them to? Would you pay them to?

And is it fair to take one part of your ‘cradle to grave’ health needs out of context?

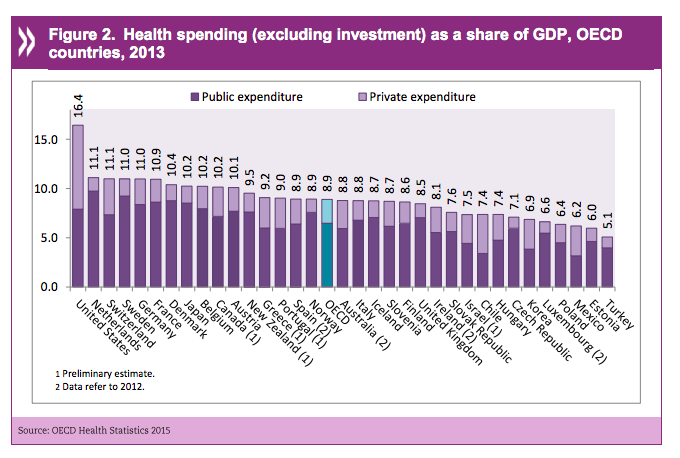

The OECD tells us that the UK spends less on health as a share of GDP than the USA:

The message seems to be: if you can afford it, get insurance and read the small print. If you can’t, be poor enough to qualify for help but don’t expect many of the optional extras. And then ask if the NHS – a tax-funded, free at the point of delivery healthcare provider – serves the needs to the patient best, how it compares to foreign alternatives and if we shouldn’t be looking at other solutions, including better funding for community care?

If Harry Kane is worth 194.7m why is he playing for Spurs?

The facts are in and it’s clear: Spurs striker Harry Kane,24, is the third most valuable player in the world. Well, he is according to CIES’ Football Observatory, which calculates that Kane is worth 194.7m euros. Ahead of him are Paris St-Germain’s forward Neymar, 25, and Barcelona’s Lionel Messi, 30.

In euros, this is the Top Ten:

1. Neymar (PSG) – 213m

2. Lionel Messi (Barcelona)

3. Harry Kane (Tottenham)

4. Kylian Mbappe (PSG)

5. Paulo Dybala (Juventus)

6. Dele Alli (Tottenham) – 171.3m

7. Kevin de Bruyne (Man City) – 167.8m

8. Romelu Lukaku (Man Utd) – 164.8m

9. Antoine Griezmann (Atletico Madrid) – 150.2m

10. Paul Pogba (Man Utd) – 147.5m

The most valuable Arsenal player is Alexandre Lacazette (Arsenal) – 97.6m. Which pretty much sums it up. As Arsenal tie themselves in knots over Alexis Sanchez and Mesut Ozil, the clear message is that both wantaway players should have been sold the start of the season. The Gunners rejected Manchester City’s £60m in the summer. Since then Sanchez has been average and Arsenal are now trying to offload him for £40m, which in the inflated world of football transfers equates to one uninspiring Alex Oxlade-Chamberlain . Ozil has said to be winding down his contract and thinking of joining Manchester United.

But as Arsenal’s palsied board, absentee owner and spent manager make a mess of things, Spurs fans should contain their delight. Harry Kane knows his value. His wages of £100,000-a-week are roughly a third what he over-hyped Paul Pogba gets at Manchester United. And Spurs win nothing. As Kane says, “I’ve always said, just keep progressing, keep getting better. We want to start winning trophies so that’s the aim. As long as the club keeps doing that then I’m happy here.”

But other clubs are winning trophies. And each week Kane and his agent know how much money he’s forgoing to remain at Spurs. “If a player wants to go then why would you stop him?” Kane adds. “He’s not going to be at the club, he’s not going to want to play every game, he’s not going to put his heart on the line.” See Ozil and Sanchez. And if he has a decent World Cup. next year it’ll be Kane…

Posted: 9th, January 2018 | In: Arsenal, Money, Sports, Spurs | Comments (4)

Ryan ToysReview: meet the 6-year-old YouTube multi-millionaire

Ryan is 6 and the host of Ryan ToysReview on YouTube. Last year he earned – get this – $11 million. Yah, and The Washington Post:

What has grown into a viral phenomenon began with a simple, unremarkable 15-minute video about a Lego Duplo train set. When his family started recording and posting the videos in March 2015, the 3-year-old barely had any views let alone reviews, according to a profile of Ryan in Verge. In his first video, he simply opened a Lego box, set up the blocks, and played with them.

“Ryan was watching a lot of toy review channels — some of his favorites are EvanTubeHD and Hulyan Maya — because they used to make a lot of videos about Thomas the Tank Engine, and Ryan was super into Thomas,” his mother, who declined to be named, told TubeFilter last year.

“One day, he asked me, ‘How come I’m not on YouTube when all the other kids are?’ So we just decided — yeah, we can do that…

If every child made toy videos like Ryan, and every child agreed to watch them all day, would all children be rich? During the 12 months, Ryan ToysReview counted over 8 billion views. How many children are there?

A thrilling story of how a man threatened with rape over a bogus debt got revenge

You know those terrible phone calls: we hear that you’ve been in an accident; we know you owe money; we are collecting a debt and you need to pay now. But don’t worry. Money is cheap and easy. Why not take out a payday loan? Bloomberg has a cracking story of how when one man was harassed by loan sharks for a debt he never owed he sought revenge. When a debt collector threatened to rape his wife, Rhode Island resident Andrew Therrien made it his mission to expose the scumbags running the fake debt scams.

A few minutes later, Therrien’s phone buzzed. It was the same guy. He gave his name as Charles Cartwright and said Therrien owed $700 on a payday loan. But Therrien knew he didn’t owe anyone anything. Suspecting a scam, he told Cartwright just what he thought of his scare tactics.

Cartwright hung up, then called back, mad. He said he wanted to meet face-to-face to teach Therrien a lesson.“Come on by, asshole,” Therrien says he replied.

“I will,” Cartwright said, “and I hope your wife is at home.”

That’s when he made the rape threat.

Therrien got so angry he couldn’t think clearly. He wasn’t going to just let someone menace and disrespect his wife like that. He had to know who this Cartwright guy was, and his employer, too. Therrien wanted to make them pay.

And so began the quest. And, boy, is it satisfying.

Eventually FTC charges were brought against the scam’s bigshot, one Joel Jerome Tucker. In October, Scott Tucker, Joel’s brother, “was convicted Friday of 14 criminal charges against him in connection to a $2 billion payday lending enterprise that authorities said exploited 4.5 million consumers with predatory interest rates and deceptive loan terms.”

Scott [Tucker], the oldest, was the brains. He’d served time in prison for a scam in which he’d pretended to work for JPMorgan Chase & Co. … Joel, tall and handsome, was a natural salesman. But when he was 21, he was selling furniture and working at a mini-mart, so hard up that he got arrested for bouncing a $12 check. (The case was dismissed.)

In the mid-1990s, Scott opened a payday-loan store and gave his brothers jobs.Lending money to people who don’t have any is surprisingly profitable. In states where such stores are legal, such as Missouri, they’re more common than McDonald’s franchises. … Scott pioneered what he thought was a clever legal loophole that would give him access to that market: He created websites that were owned on paper by an American Indian tribe, which could claim sovereign immunity from regulators. …

The loophole was ridiculously lucrative. Scott’s operation generated $2 billion in revenue from 2003 to 2012. He bought a private jet and spent more than $60 million to start his own professional Ferrari racing team. Around 2005, Joel split to start a company that would allow anyone to get into online payday lending—supplying software to process applications and loans and offering access to a steady stream of customers. All the clients had to bring was money and a willingness to bypass state law. Word spread around Kansas City’s country clubs and private schools that if you wanted to get rich, Joel Tucker was your man.

Brexit means we will all ‘starve’ says Downing Street winer maker

We are all going to starve because of Brexit. Over the newswires we read that the chief executive of Chapel Down, a Kent wine maker that supplies plonk to 10 Downing Street, telling us that Britons will “starve” if Brexit means an end to cheap fruit pickers imported from overseas.

Frazer Thompson opines: “The biggest potential impact of Brexit is on agricultural labour. Kent has had eastern Europeans picking fruit in recent years, but we’ll all starve if the labour issue is not sorted after Brexit.”

Dead. All dead. And you thank Brexit for it. But hold on moment, why don’t we – and let’s just toss this out there – trade with other countries who have lots of fruit? Says Thompson: “We want a resolution to allow us to have freedom of movement for labour to pick the fruit. This is something that affects all fruit farmers across the south-east of England. I’m hoping it will be sorted out and I hope they won’t close the doors, as if there’s no one to pick the fruit, we’ll have to import everything.”

So British fruit remains unpicked because it’s too expensive to pick here and because it’s less expensive to pick over there we import the stuff. So what’s the problem? Is that the English wine made from English grapes will be more expensive than the English wine made from Greek, Portuguese, Hungary or Romanian grapes? Or why not go outside the EU and buy grapes from places where labour is even cheaper, like Chile and South Africa?

Or why not get the fruit-pickers from within the EU zone visas?

Once upon a time, of course, fruit was picked by seasonal workers – you know, people who went somewhere to do a job and then moved on. But if the peasants are too expensive for the farmer, why not invest in a machine?