Money Category

Money in the news and how you are going to pay and pay and pay

Gordon Brown Taxes Us £6.60 An Hour

FOR every hour that you worked last year, £6.60 (on average) was collected in taxes by the Treasury. This is more than even the minimum wage.

FOR every hour that you worked last year, £6.60 (on average) was collected in taxes by the Treasury. This is more than even the minimum wage.

These figures, calculated by the Daily Telegraph, are over £1 up on figures from five years ago and illustrate the huge tax burden placed upon Britain’s families.

Overall, figures from HM Revenue and Customs’ recently published annual report, put the Government’s total tax take at a whopping £423billion, £25billion up on the previous financial year.

Not surprisingly, campaigners such as Corin Tayor of the TaxPayers’ Alliance, are disappointed. Says he: “Gordon Brown has stealthily increased taxes faster than earnings and these new figures are another shocking indictment of just how over-taxed people are. The Chancellor needs to wake up and give families relief from the record tax bills they are facing.”

Shadow chancellor George Osborne is also less than happy. Says he: “This tax-per-hour figure brings home just how much people are paying Gordon Brown in taxes. No wonder we’ve got the highest tax burden in our history. The real tragedy is that so much money is then wasted.”

A sheep-shelter in the Cotswolds has been sold for £325,000. Who said the property market has gone maaaad?

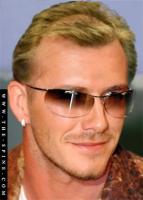

David Beckham’s £50million McClaren’s England Appeal

WHILE England boss Steve McClaren fumbles around for a saviour, David Beckham’s already ballooning bank account could swell to the tune of an extra £50million. (Pic: The Spine)

WHILE England boss Steve McClaren fumbles around for a saviour, David Beckham’s already ballooning bank account could swell to the tune of an extra £50million. (Pic: The Spine)

Beckham will cash in if he can inspire his wilting countrymen to Euro qualification.

According to the Telegraph, the former Manchester United icon’s recall to the England squad could trigger a whole new set of lucrative sponsorship deals. But it could also put his Los Angeles future in doubt.

PR guru Max Clifford looks at Beckham’s MLS career . Says he: “If in the next couple of games he really makes a name for himself again you can see a situation where he is going to say ‘why on earth am I doing going to Los Angeles?’ which is basically a retirement plan.”

However, neither wife Victoria, desperate for promotion to the Hollywood A-list, nor LA Galaxy manager Alexei Lalas will be too thrilled about their star man’s England recall.

Commenting on Beckham’s inclusion in the latest England squad, Lalas tells us: “I don’t want to stand in the way of a player representing his country but we have to be prudent and understand they have to be the appropriate games. But from a business perspective, it is not the greatest news as we are selling a team with David Beckham in it and a lot of people are excited about seeing him play with the Galaxy.”

Rumours are that the dismal and desperate McClaren is set to recall Gary Lineker, Glenn Hoddle and Bobby Charlton.

Roman Abramovich has decided to stop throwing his money at Chelsea in order to make them successful. So where does that leave Jose Mourinho? And whose money will he use instead – Ashley Cole’s?

Posted: 28th, May 2007 | In: Money | Comment (1)

Glazers Deny United Sale

A SPOKESMAN for Manchester United owner Malcolm Glazer has moved to refute a story in the Mirror which claims the American billionaire is set to sell the club after profits fell short of expectations.

The Glazer family took control of the Red Devils less than three years ago, amidst a barrage of protest by United fans angered by the £790million sale of their beloved club.

However, with the vast majority of anti-Glazer sentiment proving to be nothing more than hot air, it was soon business as usual again for the Manchester giants who, this season, secured the Premiership title for the first time in four campaigns.

The Mirror claims that the relationship between the club’s management and the Glazers has become fraught, with the Flordia-based owners now looking for a way-out. The paper quotes a “well-placed City source” saying: “What we’re all hearing is United hasn’t turned out to be what the Glazers thought it was. When they paid so much, they were convinced a lot of money was to be made. Buying United wasn’t about owning a football club, but a business decision and from an investment point of view it’s been little short of disastrous.”

However, according to the Glazers’ spokesman: “There is not a grain of truth to this story – the family is committed to the long-term ownership of the club.” So there you have it. Or not. Depending on what you believe.

According to the Home Office, organised criminal gangs are raking in a rather impressive £15billion a year in profits. Maybe one of them could buy United if the Glazers do decide to sell.

Elderly Face Home Care Hike

WITHOUT home care many of the nation’s elderly wouldn’t be able to live relatively independent lives, but with councils planning to raise fees – in many cases by more than 100 per cent – a large number of OAPs may be forced into homes, or go without the care altogether.

WITHOUT home care many of the nation’s elderly wouldn’t be able to live relatively independent lives, but with councils planning to raise fees – in many cases by more than 100 per cent – a large number of OAPs may be forced into homes, or go without the care altogether.

A survey commissioned by the Telegraph has found that older people will face an average increase of 29 per cent in home care fees this year, with a quarter of councils planning rises of more than 40 per cent. London’s Brent and Lewisham councils top the list with their respective fees set to treble.

With home workers often providing the only regular form of human contact for the aged, these increases could have a devastating effect on the nation’s half-million pensioners who receive council care at home.

David Walden of the Commission for Social Care Inspection says: “If charges are so high that people don’t access the services, that could have a deleterious effect on people’s health and we would be concerned about that.”

Councils claim that the increases are linked to the current financial crisis in the NHS, with health trusts, eager to wipe out their £512 million deficit, trying to make council taxpayers foot the bill for services which the Health Service should be providing.

Whatever happens, there’s no way my Nan is coming to live with us. She’s a bloody nightmare.

You can pick up almost anything on eBay these days, even a heart valve. However, the £300 life-saving device was eventually removed from the site by bosses.

Liverpool Break The Bank For ‘Snoogy Doogy’

FOLLOWING their disappointing defeat at the hands of Milan in the Champions League Final, Liverpool are ready to splash the cash in order to rebuild Rafa Benitez’ side.

FOLLOWING their disappointing defeat at the hands of Milan in the Champions League Final, Liverpool are ready to splash the cash in order to rebuild Rafa Benitez’ side.

With Manchester United close to signing Bayern Munich’s Owen Hargreaves for almost £20 million and Chelsea expected to continue their policy of big name buys this summer, the pressure is on the Anfield club to keep up with their Premiership rivals.

With owners George Gillett and Tom Hicks desperate for Liverpool to mount a serious challenge for the domestic title as well as in Europe, the likelihood is that Benitez will spend some serious money in the summer.

While the likes of Barcelona’s Samuel Eto’o, Valencia’s David Villa and even West Ham’s Carlos Tevez all possible targets, another name, according to Gillett, has come into the frame. Says he, “If Rafa said he wanted to buy ‘Snoogy Doogy‘ we would back him.”

And who said Americans know nothing about ‘soccer’?

The very hairy and very smug Noel Edmonds is set to pocket £400,000 for fronting a new Sky One quiz show – “Are You Smarter Than A 10-Year-Old?”. Yes I am, actually.

Posted: 25th, May 2007 | In: Money | Comments (6)

UK Houses 65% Overvalued: Property Crash

MANY of us have an inflated view of ourselves. And we all have an inflated view of our houses.

According to the snappily named Organisation for Economic Co-operation and Development, UK property prices are up to 65% too high and are among the most inflated in any major world economy.

The OECD also warns that a subsequent slowdown is long overdue and that a property crash could not be ruled out

Capital Economics’ Ed Stansfield points to lower borrowing costs and a shortage of new property as reasons for the UK’s decade-long property price explosion, although he puts the overvaluation of the housing market at a minimum of 15 to 20 per cent.

With experts predicting that the Bank of England could raise interest rates to 6 per cent by the end of the year, homeowners may well be forced to dig even deeper to pay the mortgage.

Will this property madness ever end? Expect the homeless to start paying rental on their shop doorways.

MPs are backing an attempt to erase the word ’McJob’ from the dictionary. It’s not like there are more important issues to address, is it?

The Uncovered Truth About Travel Insurance

THE advent of cheap-as-chips flights (as long as you book six years in advance) and low budget hotel deals have allowed a whole generation of Britons to travel to exotic destinations across the world, something they wouldn’t have been able to do 20 years ago.

However, while the price of travel insurance has also followed suit, many travellers embark on their holidays with as little practical cover as Dawn French in a string bikini.

Research group Defaqto found that while some policies are now available for as little as a fiver, many fail to provide adequate cover.

Brian Brown, the report’s author, warns, “Before you sign up to a cheap policy, consider whether the insurer would actually be able to pay any claim.” He is also critical of insurance policies which set “single item” limits sometimes as low as £150. Says he: “If you lose a £400 camera you only get £150. After paying the excess, you might end up with just £75.”

The report commends Boots, Churchill Insurance, Direct Travel and Norwich Union for their good value while the Post Office also gets the thumbs up, despite its higher prices.

Or you can follow the lead of 10 million other Britons and not bother to get any travel insurance at all. Sure you’ll be fine. Honest.

Rise Of The Snooper State: Grass Up A Neighbour

AS New Labour continues its seemingly unending quest to extinguish the last remnants of the nation’s community spirit, the Home Office publishes proposals which could see members of the public financially rewarded for informing on their neighbours who may be involved in such heinous crimes as benefit fraud and cigarette smuggling.

AS New Labour continues its seemingly unending quest to extinguish the last remnants of the nation’s community spirit, the Home Office publishes proposals which could see members of the public financially rewarded for informing on their neighbours who may be involved in such heinous crimes as benefit fraud and cigarette smuggling.

The system is based on a US scheme in which informants receive between 15 and 30 per cent of seized assets (in successful cases) and ministers are now pondering whether or not it could be imported into the UK.

Since its inception in the States in 1986, 11 billion dollars has been seized by the authorities and the wonderfully-monikered home office minister Vernon Coaker says: “It seems to have been successful in the US. We are asking is it applicable in this country, is it something that people would find acceptable and is there a workable model? We think it would be irresponsible for us as a Government not to look at what people are doing overseas.”

How much would you get for grassing up a bank for its illegal charges, I wonder? 15 to 30 per cent of the cash sounds good to me.

UK cinema siren Keira Knightley has accepted £3,000 in libel damages from the Daily Mail over suggestions that she had an eating disorder. The damages, which the svelte star will match, will be donated to ‘Beat’, the eating disorder and mental illness charity. Isn’t she great.

Government Selling Of Canals And Waterways

THERE’S nothing more relaxing than a walk upon a peaceful riverbank.

Look, what’s that over there – it’s a vole gnawing on some reeds, and there – a mummy duck and her newly-hatched ducklings on their morning swim. But wait, what’s that over there? Why, it’s a bloody great supermarket backing onto the water.

Yes, in its continuing quest to suck the soul out of Britain, the Government are contemplating selling off the nation’s canals and waterways.

British Waterways, the government-controlled body, currently looks after 2,200 miles of canals and rivers with its portfolio recently valued at over £500 million. However, the government estimate that all the towpaths and land alongside Britain’s canals could be sold for around £1 billion.

British Waterways currently relies on the Department for Environment, Food and Rural Affairs (DEFRA) but is eager to become less dependent on the body and seek more commercial freedom and any sale of such prime land would no doubt attract the major property developers and the ubiquitous supermarkets.

Expect to be shopping in Sainsbury’s in a gondola before too long.

The council in the Royal Borough of Kensington & Chelsea are doing their bit to stem the tide of corporate imperialism by making a stand against chains such as Starbucks and Costa Coffee.

Posted: 24th, May 2007 | In: Money | Comment (1)

£48million Divorce Payout For Axa’s Charman

THERE are plenty of things you could buy with £48million – a football club, a peerage or even a two-bedroom (unfurnished) flat in central London.

THERE are plenty of things you could buy with £48million – a football club, a peerage or even a two-bedroom (unfurnished) flat in central London.

Beverley Charman, ex-wife of insurance magnate John Charman, will no doubt be pondering these purchasing choices after a court upheld her massive divorce payment.

Mr Charman, head of the Axa Insurance group, had challenged the £48million settlement, claiming that it was “grotesque and unfair”. However, in response, lawyers for his former partner argued that the House of Lords had already set down guidelines for big money divorce rulings in which the family assets should generally be divided equally.

While Mr Charman’s legal team argued that as he had created most of their wealth, he should therefore keep the lion’s share, appeal judges Lord Justice Thorpe and Lord Justice Wilson ruled in Beverly Charman’s favour.

Mrs Charman says: “I acknowledge that the sum awarded to me is huge by any standards, but the court of appeal has decided that it fairly reflects the contributions made by John and me during our 28-year marriage. I am relieved that the appeal is over, and I hope that John and I can now concentrate on building our new lives.” And splurging all that cash.

Mrs Chapman could follow Mr Bean’s lead and cough up £500,000 for a classic D-Type Jaguar.

Government’s £125million Criminal Assets

WHO says crime doesn’t pay?

What with the luxury mansions, limited-edition Bentleys, wads of cash and the jet-set lifestyle, surely there must be something in the whole crime lark? Just ask the big banks.

However, a number of the nation’s criminals are having to go without the trimmings of their success after the Home Office released details of the £125 million in seizures it has made in the last year, including mansions, cars and even racehorses.

Conveniently, that figure matches the target set out by the Government for 2006/07 and paves the way for the Home Office to announce even greater powers to confiscate criminals’ ill-gotten gains.

Jeremy Outen of the Prime Minister’s Strategy Unit is pleased with the results but is eager to achieve more. Says he: “But I think we have a long way to go. Asset seizure is not yet at the heart of law enforcement. It is still more of an afterthought in many forces. Obtaining money is the motive behind three-quarters of offences in the UK, so targeting criminal wealth could have a much greater effect. But this is good start.”

So if you see a humble Bobby living large and racing around the streets in a souped-up Lamborghini with a racehorse in the back seat, you’ll know here he got it from.

Michael Jackson isn’t short of a bob or two, but the bizarre self-proclaimed ‘king of pop’ has put his comeback Las Vegas shows in doubt after demanding to be paid £100 million. He’s bad.

Squatter Harry Hallowes Joins Hampstead Elite

ORGANIC Fairtrade beers were spat out in horror and copies of the New Statesman flung away in anger as news spread around the leafy streets of Hampstead that a homeless man – yes, a HOMELESS MAN – had moved in.

ORGANIC Fairtrade beers were spat out in horror and copies of the New Statesman flung away in anger as news spread around the leafy streets of Hampstead that a homeless man – yes, a HOMELESS MAN – had moved in.

Seventy-year-old Harry Hallowes had been squatting on a secluded corner of Hampstead Heath – home to furry little animals like Bill Oddie and George Michael – for more than two decades.

But now, the Land Registry have decided to give Hallowes the title deeds to the 65ft by 13ft plot, thus marking the end of a three-year dispute between Hallowes and property developer Dwyer.

The developers had wanted to – surprise surprise – build luxury flats on the land but failed to evict the Heath-dweller at the court hearing, which instead ruled that as Hallowes had lived on the plot for 18 years, he was entitled to ownership of the land.

The delighted Hallowes tells us: “’I absolutely love it here. I’m delighted to get the title deeds. But I always expected to be given them. I didn’t expect any other outcome. I won’t be having a bird sanctuary or anything like that. Maybe I’ll build myself a house to live in, everybody else around here seems to love building houses.”

The plot is estimated to be worth around £2 million.

I’m off down to Regents Park to set up home. Ciao…

Newcastle United are said to be shocked at billionaire businessman Mike Ashley’s bid to take over the famous club.

Posted: 24th, May 2007 | In: Money | Comments (9)

Pay As You Throw: Bin Tax Spies In The Rubbish

CCTV cameras watch our every move across the urban landscape, spy drones hover menacingly above us and disembodied voices tell us to pick up the crisp packet we drop – welcome to New Labour’s Orwellian nightmare.

The control freaks in the government have now decided to furnish rubbish bins with microchips which can monitor just how much waste we are producing.

According to the Telegraph, more than three million households in Britain are equipped with the technology, increasing fears that we are about to get hit by new ‘bin-tax’ which will penalise householders who fail to recycle.

However, an opinion poll for Channel 4’s Despatches programme, which will be aired tonight, reveals that 62% of the population currently oppose the idea of a ‘pay-as-you-throw’ tax.

68 councils across the land have forked out millions on the new hi-tech bins although according to the Local Government Agency, all modern bins now come fitted with the technology as standard while almost all the current microchips were “inert”. We believe them.

Keeping with the Big Brother theme, Google are planning to create the most comprehensive database of personal information ever created.

Mark Keenan £65 Divorce-Online Hits Our Screens

IN a move that will have middle England decrying that this is the end of civilisation, while secretly making a mental note of the phone number on the screen, adverts for cut-price divorces are to be beamed into our homes for the first time later this month.

IN a move that will have middle England decrying that this is the end of civilisation, while secretly making a mental note of the phone number on the screen, adverts for cut-price divorces are to be beamed into our homes for the first time later this month.

Divorce-Online, the brainchild of Mark Keenan, offer cheap and maybe even cheerful divorces for £65 plus VAT, with couples posted all their forms to sign and even spared the hassle of attending court.

Their adverts will be broadcast on digital channels as well as YouTube and Keenan is convinced that he is providing a worthwhile and ethical service. Says he: “We do a good, professional job for people and provide an alternative to high street solicitors, and we just charge a tenth of the price. The number of marriage breakdowns is sad but these are already happening. We just help people keep more of their money to benefit themselves and their children.”

In responding to criticism that the cut-price divorces could encourage more people to spilt, Keenan also tells us: “I’ve never had someone ring me up and say, ‘My wife’s just annoyed me, I want a divorce right now.'” Although surely he’d be delighted if they did.

A recent survey found that uncontested divorces usually cost between £850 and £2,500, rather more than Divorce-Online’s £65, which is about the price of a five month subscription to the Playboy Channel for newly single men…

No stranger to divorce himself, professional Scientologist Tom Cruise has splashed out on a £50,000 custom-built Italian motorbike, no doubt to help him escape the persistent rumours about his ‘colourful’ private life.

Barclaycard Penalises Small Spenders

NO matter what fines they have to pay, no matter how much justice we think we are getting, the big banks will always find a way of getting their own backs.

NO matter what fines they have to pay, no matter how much justice we think we are getting, the big banks will always find a way of getting their own backs.

Barclaycard are the latest company to formulate a new get-even-richer-even-quicker-scheme which could involve charging customers £20 if they don’t use their cards enough.

The credit card giant are currently pondering the idea which would affect around one million customers. With Lloyds TSB already penalising its credit card-shy customers with a charge of £35, the likelihood is that this kind of carry on will become standard practice.

A spokesdrone, I mean spokesperson, for Barclaycard says: “We think this is a fair approach and gives customers a choice. We will do everything we can to improve the deal we give people, encourage them to use our card, not someone else’s and avoid fees. As a last resort, we are considering a fee for a minority of customers that simply do not use their card.”

How’s that for service?

Uswitch’s Nick White is less positive. Says he: “Implementing a fee for inactive credit card customer is not the key issue here, the problem is the level of transparency displayed around the criteria used to select the customer charged. Without this, customers do not know how to manage their credit card account to ensure they do not fall into this category in the future.”

Surely its time to bring back the bartering system – one pig for a garden makeover or a box of carrots for high-speed broadband installation etc.

While multi-millionaires such as Jamie Oliver, who himself is looking a bit tubby these days, continue to lecture the poor about their diets, the price of some vegetables have risen by more than a third, with last summer’s heat wave the culprit.

Banks And Estate Agents Cop Record Complaints

WE may somewhat revel in our image as a nation of whingers, but when it comes to banks and their petty thievery we are totally justified in complaining and, according to the Financial Ombudsman Service, we are now speaking up for ourselves in record numbers.

WE may somewhat revel in our image as a nation of whingers, but when it comes to banks and their petty thievery we are totally justified in complaining and, according to the Financial Ombudsman Service, we are now speaking up for ourselves in record numbers.

The FOS has revealed that this year it was currently handling about 1,000 complaints a week concerning those pesky bank charges, compared to the 10 it received on average last year.

Another popular group of people, estate agents, have also been targeted by consumers, with the Ombudsman for Estate Agents revealing that he had received 8,472 calls from consumers in 2006, an increase of 41% from the previous year.

However, despite the rise in enquiries, ombudsman Christopher Hamer reveals: “When viewed against the number of house sale transactions in a year, frequently quoted at 1.2m, the number is still thankfully small.”

I say we target lollipop ladies next. Just for the laugh.

Labour deputy leadership hopeful John Cruddas kept things rather low-key when he launched his campaign in a hall which cost just £31 to hire. How very humble. How very un-New Labour.

Posted: 23rd, May 2007 | In: Money | Comment (1)

Studs (Studzinksi) Up For The Tate Modern

THE American-born London-based banker John ‘Studs’ Studzinski has given £5 million to the Tate Modern – the largest gift in the museum’s history.

THE American-born London-based banker John ‘Studs’ Studzinski has given £5 million to the Tate Modern – the largest gift in the museum’s history.

Now the modern art mecca is appealing to other loaded City boys to cough up for its £215million extension with Paul Myners, the chairman of the Tate’s trustees, hoping that the growing “unequal distribution of wealth” in London would encourage the big City hitters to fund the modern art mecca’s new giant glass ‘Cubist’ extension.

But surely this “unequal distribution of wealth” would be better addressed by giving the money to the poor rather than to museums mainly frequented by the well-off?

Then again, multi-millionaire Myners is chairman of the Guardian Media Group and global property giant Land Securities, so he’s hardly in touch with the needs of the capital’s erm, non-millionaires.

As for ‘Studs’ Studzinski, the Telegraph describes him as a ‘colourful character’, which is usually code for something.

Still, the reportedly uber-Catholic philanthropist, who is famed for his extravagant parties at his Chelsea home, apparently often works in homeless shelters across the capital.

Colourful indeed. Grey even…

Studzinski’s fellow rich American, Democrat nominee hopeful John Edwards, is in hot water for charging a university £27,500 for a talk.

HIP HIP Hooray: Home Information Packs On Hold

THE monumental disaster that is the Government’s ill-conceived Home Information Pack scheme was thrown into even more disarray yesterday after the Government’s Minister for Opus Dei, Ruth Kelly, performed an embarrassing climbdown and put the whole scheme on hold.

The controversial sellers’ packs, which include all kinds of property details and an energy-efficiency rating, will still be introduced, although two months late and only for houses with four or more bedrooms.

Critics have now warned that wily estate agents and house sellers could try to escape the £300-£600 cost of a HIP by categorising their fourth bedroom as a study or a boxroom or maybe even a transcendental meditation space, thus adding more chaos to the situation.

Kelly blamed a lack of accredited inspectors needed to carry out the energy performance certificates despite the fact that only last week her deputy, Yvette Cooper, dismissed criticism that there wouldn’t be enough snoops.

So where does that leave all those home sellers who rushed through sales in order to dodge paying for a HIP?

But on a brighter note, journalists and sub-editors appreciate the opportunity for some easy puns.

No details, as yet, have been released on whether or not there will be a HIP replacement…

Posted: 23rd, May 2007 | In: Money | Comments (7)

Harassment At The Halifax

BANKS – helpful institutions which keep your money safe or ‘legitimate’ cartels that fleece you for every penny they can get? Who are we to say?

Anyway, the banking industry is set to lose even more fans after it was revealed that the Halifax has been harassing one Alison Turner for unpaid overdraft charges she didn‘t owe.

The mum of two from Plymouth received a total of 33 phone calls and letters from bank staff demanding she pay back the £775 in charges even though the bank had already agreed to wipe them out.

However, like thousands of people all over the country, Turner decided to fight back, bringing a legal action against the Halifax under the Protection from Harassment Act.

She won. And is expected to receive a cash payment after the bank agreed to settle out of court.

Hurray for justice.

A bruised and sullen Halifax mumbled tersely, “We have no comment other than it’s settled.”

What, nothing about it being an isolated incident, computer problems, staff retraining etc. etc. ?

Posted: 23rd, May 2007 | In: Money | Comment (1)

Road Pricing Targets 4x4s

THE ubiquitous 4×4 may give its owner a sense of prestige as they look down from on high at the great unwashed beneath the wheels, but these heavy-duty Chelsea Tractors block the roads and are far more likely to injure anyone they hit. They are about as eco-friendly as an oil spill.

THE ubiquitous 4×4 may give its owner a sense of prestige as they look down from on high at the great unwashed beneath the wheels, but these heavy-duty Chelsea Tractors block the roads and are far more likely to injure anyone they hit. They are about as eco-friendly as an oil spill.

And so it is that drivers of these gas-guzzling giants could face higher road pricing charges under proposals released by the Government.

The draft Local Transport Bill has a strong environmental slant and insists that councils who propose a pay-as-you-drive system will have to take each car’s green credentials into account.

The bill follows Ken Livingstone’s plans to introduce a £25 congestion charge in London for larger cars.

However, critics have branded the new bill a “Trojan Horse” for a planned nationwide scheme of road pricing.

The AA’s Paul Walters is particularly concerned about the proposals to give passenger transport authorities a say in any road pricing scheme. Says he: “These authorities are not directly elected and we fear they would be at the very least one step removed from the ballot box.”

Meanwhile the alternative to driving is to walk (and inhale the fumes), cycle (and get run over) or pay a fortune to take the slow train and wait and wait and wait for the relief driver to return from his toilet break…

Getting Shopped Online At Work

WHERE would we be without the internet?

Well, probably still here, although not reading this, obviously.

Instead we’d be far more bored, twiddling our thumbs and firing rubber bands at the geek across the desk from us. Yet, let’s be honest, we would be far more productive at work,…and richer.

According to a survey by Play.com, office workers are spending more than eight working hours a month shopping online – the average every employee spends £15 per month online during the working day.

Why do workers feel the need to splash their cash online? The number one reason given was that it makes work more fun. Other reasons submitted include – buying presents for your office lover, wasting time in the office and stopping family members from keeping tracks of your purchases. Office lovers? Hiding things from our families? What a seedy nation we are.

The Sun quotes “office worker and online shopaholic” James McShaw. Says he: “I order from online stores at least once a week when I’m meant to be working and get it delivered to my office for convenience. The only problem is that I don’t seem to take a lot of it home, especially as my girlfriend would go nuts if she knew how much I was buying.”

Well she’ll be going nuts now James. If she reads the Sun, that is.

OAPs Get A Second Life

AGEISTS all over the Britain can no longer bemoan the nation’s old folk and pose the question: “Just what do they contribute?”

The old dears contribute a whopping £59 billion each year to the economy.

The eye-opening figures are included in HSBC’s Future of Retirement study, a major undertaking which interviewed over 20,000 people in 21 countries.

The study found that, worldwide, more and more over-60s are eschewing retirement and staying in employment and more older people are providing financial, practical and personal care than are receiving it.

In the UK, the state takes around £5.5 billion in tax each year from people between the age of 60 and 80; a staggering £50 billion of caring support is provided by UK retirees each year.

Help The Aged’s David Sinclair is more downbeat. Says he: “This report shows many older people are leading full, active lives and that pensioners are increasingly becoming aware of their contribution to society. That’s fantastic. But for large numbers of older people in the UK the reality is still quite different. Many UK pensioners face barriers to an active lifestyle – ageist attitudes, badly thought out transport planning and an increase in public toilet closures.”

Still, be nice to Grandad and Grandma as you never know how much cash they have under their beds.

The likelihood is that most people who partake in the online virtual world ‘Second Life’ are under 65, but these geeky gamesters could now have to start paying real taxes after a US congressional investigation into the strange alternative universe.

Money Growing On Trees At Chelsea Flower Show

THE housing market may well be showing signs of cooling, but when it comes to gardens the price of that little piece of outdoor heaven continues to go through the roof.

THE housing market may well be showing signs of cooling, but when it comes to gardens the price of that little piece of outdoor heaven continues to go through the roof.

At this year’s Chelsea flower show, a two-storey timber children’s den with central heating, double glazing and a balcony is going for £35,000; conservatories worth £100,000 are also on show.

According to Phillipa Jones, who sells African art for upmarket gardens, “People are getting fed up with just doing the house up, so they are saying ‘let’s decorate the gardens’, and sculptures are now a large part of that.”

The Royal Horticultural Society will also show you how to spend £300,000 on a garden makeover.

About a quarter of the price of Alan Titchmarsh’s appearance fee at the event.

Posted: 22nd, May 2007 | In: Money | Comments (2)

City Bends To Flexible Working Hours: Home Office Free iPods

THE high-pressure world of the City is finally grasping the concept of work-life balance. (Pic: Bo Beau D’Or)

THE high-pressure world of the City is finally grasping the concept of work-life balance. (Pic: Bo Beau D’Or)

According to a new report by the campaign group Working Families, more and more City firms are allowing their senior managers to benefit from flexible working patterns.

Focusing on 23 senior managers at some of the City’s top companies, including Morgan Stanley and Credit Suisse, the study found that a policy which encourages job-sharing, three-day weeks and working from home will benefit the employer by boosting enthusiasm, loyalty and effectiveness in the staff.

However, the report also warns that a suspicious attitude to flexible working hours still remains in many of the top organisations.

Author of the report Pam Walton says: “Organisations are beginning to accept that in many of these jobs it is outputs that matter; where and how you do it should not be the issue.”

Then again, if City firms thought they could make even more money by allowing their staff to be naked and work up a tree, they’d do it.

In another management incentive, the Home Office have given twenty of their top civil servants iPods on which lessons in leadership have been downloaded. Total cost – £8,800.

The £8,000 Fraud Of The Dance

AUDACITY is a word that springs to mind in the case of cheating dancer John Dennis.

According to the Mirror, the 47-year-old continued to claim £8,000 in disability benefits while teaching dance classes four times a week at three schools and two dance studios.

Dennis, from Llandewi Brefi, Cardiganshire, claimed his knees had been destroyed by arthritis and even hammed it up using walking sticks.

He had initially started to claim both living allowance and incapacity benefit after sustaining an injury while working as a stage dancer. However, even after recovering from his injuries he continued to pocket the extra cash. After four years, his dance of deception came to a sudden halt when investigators received a tip-off.

Yesterday at court in Aberystwyth, Dennis was in no mood to dance when he was sentenced to 200 hours community service.

Commenting on the case, a Work and Pensions spokesman says: “There are no excuses for taking money that isn’t yours.”

Unless you are a bank.

Spare a though for another shyster, this time in the rather more sinister form of jailed crime boss Terry Adams. The poor dear is claiming that he has been ruined by a £5.5 million legal bill.

Posted: 22nd, May 2007 | In: Money | Comment (1)