Money Category

Money in the news and how you are going to pay and pay and pay

Pensions Mis-Sold To Over 100,000

THE Financial Services Authority has revealed that around 120,000 people could be missing out on retirement money after being mis-sold pensions.

THE Financial Services Authority has revealed that around 120,000 people could be missing out on retirement money after being mis-sold pensions.

After a two-year investigation into transfers out of state earnings related pension schemes (Serps), the FSA has found that a large number of people who opted out of Serps in return for some of their National Insurance Contributions being rebated into personal pensions may have been wrongly advised to do so.

Approximately 1.5% of these people may have been too old to reap the benefits of moving out of Serps and are now out of pocket by around £7 per week.

However, the FSA said that it has found “no evidence” of widespread mis-selling.

So that’s alright then…

The £4m A Day Insurance Scam

ACCORDING to the Association of British Insurers, fraudulent insurance claims are costing the industry around £1.6billion a year – £4million a day.

ACCORDING to the Association of British Insurers, fraudulent insurance claims are costing the industry around £1.6billion a year – £4million a day.

The ABI, in its survey, also revealed that one in ten UK adults has admitted to cheating on an insurance claim.

Apparently, even fraud such as ‘bumping up’ the price of a damaged item costs insurers over £800million a year while overall almost £40 is added to the average premium in order to cover the costs to the industry caused by fraud.

ABI bigwig Nick Starling is not happy. Said he, “Honest customers should not have to pay for the cheats. Insurers are committed to reducing the fraud problem. We are devoting greater resources to weeding out the cheats and working together to detect and combat fraud”.

Lovely to hear such comforting words from such an honest and ethical industry…

Alan Ball Hit With Tax Bill

WITH the Ball family still grieving the death of their ’66 World Cup hero Alan, the Mirror now reveals that the tax-man has decided to kick them when they are down, slapping a whopping £83,200 tax bill on the sale of the footballing legend’s World Cup Winner’s medal.

WITH the Ball family still grieving the death of their ’66 World Cup hero Alan, the Mirror now reveals that the tax-man has decided to kick them when they are down, slapping a whopping £83,200 tax bill on the sale of the footballing legend’s World Cup Winner’s medal.

Ball sold his medal along with his England cap two years ago for £208,000 to help provide for his children after the death of their mother, Lesley.

However, with the cash subject to a 40 per cent inheritance tax bill as part of the England’s icon’s £1million plus estate, the family will now have to pay up.

Son Jimmy says: “I think the system needs looking at. That he was forced to sell the items that were very dear to him was bad enough but to have to pay tax on them was difficult for him to accept.”

At least it’s a situation the likes of Frank Lampard and Steven Gerrard will never have to face – they’ll never win a World Cup.

Green Tax On Buy-To-Let

APPROXIMATELY 850,000 people in the UK are lucky enough to own a buy-to-let property, but now these canny mini-property-magnates are to be hit with a £200 green tax.

The Government is set to introduce compulsory energy performance certificates from next year, a key part of the much-debated Home Information Pack, with buy-to-let landlords forced to employ energy inspectors to examine and then give their property an energy rating between A and G.

With the cost of the overall Home Information Packs reaching up to £600, including the cost of the energy certificate, many homeowners are putting their properties on the market before the June 1st deadline.

However, despite the extra costs, market research organisation Mintel predict to the number of buy-to-let homeowners could double to around two million in the next three years.

Empty houses – very green…

Posted: 9th, May 2007 | In: Money | Comment (1)

Gordon Brown’s In The Red On Tax Credits

HE may be about to finally get his wish and move into No. 10, but Gordon Brown is again facing widespread criticism, this time over his tax credits scheme.

HE may be about to finally get his wish and move into No. 10, but Gordon Brown is again facing widespread criticism, this time over his tax credits scheme.

According to reports, the Treasury is set to write off a ridiculous £2billion as uncollectable from the tax credits scheme, a figure four times higher than the Government disclosed a year ago – £5.8 billion has also been erroneously paid out to people who shouldn’t have received the money.

As if that wasn’t bad enough, the system has also been dogged by widespread fraud with 42 Inland Revenue officials either facing criminal investigations or criminal charges.

Indeed, according to the Public Accounts select committee, the tax credits scheme has suffered the highest levels of fraud and error in the whole of the government.

Shadow chancellor George Osborne has, not surprisingly, been quick to stick his oar in. Says he: “Tax credits are in Gordon Brown’s empire and he cannot blame anyone else for the appalling levels of error and fraud. This is incompetence on an industrial scale and it is the low-paid in our society who are paying the highest price. The chancellor leaves the Treasury trying to hide the cost of his mistakes while his reputation for economic competence continues to unravel.”

Things can’t only get better.

Picture: Hack

Posted: 9th, May 2007 | In: Money | Comments (2)

Capital Gains: London Property Most Expensive in World

LISTEN closely and you’ll probably hear the joyous sound of champagne corks popping across London today, as property developers celebrate the news that the nations’ capital now houses the most expensive residential property in the world.

A new report, by estate agency Knight Frank along with Citi Private Bank, reveals that the average cost of central London property is a whopping £2,300 per square foot. This compares to a cheap-as-chips £2,190 in Monaco and a practically free £1,600 in New York.

Topping the list of London’s most expensive ‘super-prime’ areas are the humble environs of Belgravia and Knightsbridge where prices can exceed £3,000 per square foot.

This year, 59 per cent of prime London sales have come from wealthy foreigners, mainly from Russia, America and the Middle East.

One doubts that they’ll have any problems with immigration.

Repossession, Repossession, Repossession

ACCORDING to new official figures released yesterday, it now costs a ridiculous seven times the average yearly wage to afford an average home.

ACCORDING to new official figures released yesterday, it now costs a ridiculous seven times the average yearly wage to afford an average home.

It has also emerged that house prices are at their least affordable level for a generation while mortgages are taking around 45 per cent of the average salary.

With interest rates set to rise again and council tax and general household bills going up, more and more homeowners will face the horror of repossession.

The Bank of England is predicted to raise interest rates by at least 0.25 per cent to 5.5 per cent on Thursday which will increase the pressure on homeowners even more.

Let’s see if the likes of Kirsty and Phil and Sarah Beeny can help us out of this one.

Paypass And Go

WE have already seen that the humble chequebook is about to get the heave-ho, but now it appears that even the existence of cash is under threat.

WE have already seen that the humble chequebook is about to get the heave-ho, but now it appears that even the existence of cash is under threat.

A new swipe-and-go pay card called Paypass, which is being introduced in September, will allow shoppers to pay for their goods (under £10 pounds) by simply tapping the card on an oval pad. With no need to enter a PIN number or give a signature, the system is set to significantly cut queues.

The system will also be added to new bank and credit cards when they expire but with the new Paypass system coming only four years after shops and restaurants had to pay for chip and pin, independent business could now have to spend over £15 million (or £50 each) to get an upgrade.

Does this mean that beggars will have to upgrade their outstretched hands too?

Blankety-Blank For The Cheque Book

ALONG with analog TV, smoking in pubs and belief in the British political system, it now seems that the humble chequebook is set to be consigned to history.

With high street chemist Boots joining the likes of Shell, Next and PC World in deciding to stop accepting cheques at around 1,5000 of their stores nationwide and with Tesco pondering a similar move with a number of trials in some of its supermarkets, the end may well be nigh for a form of payment that dates all the way back to 1642.

Apacs, the UK payments association, has found that people write less than two cheques a month and receive less than seven a year.

The Federation of Small Businesses, however, insist that cheques are still widely used to pay the likes of plumbers and builders while Help The Aged are concerned that the changes will hit pensioners who feel comfortable using cheques rather than chip and pin technology.

Still, expect a revival in ‘retro’ ‘old skool’ chequebooks amongst the uber-trendy in the coming years.

Posted: 7th, May 2007 | In: Money | Comments (2)

Home Work To Rule

NO commuting chaos, no need to change out of your pyjamas, indeed, no need to do much work at all. It’s no wonder that more and more people want to work from home.

NO commuting chaos, no need to change out of your pyjamas, indeed, no need to do much work at all. It’s no wonder that more and more people want to work from home.

According to a survey by the Skipton Building Society, half of the workers claim that they could do a better job from home.

With the average commuter spending £17,515 on petrol and £4,000 in parking fees (surely that’s unfair for people who travel by train and bus?), the cost of travel was cited by 16 per cent of people in the survey as the main reason why working from home would their preferred choice.

But what about the famed office ‘banter’, chatting about Big Brother over the water cooler, mindlessly surfing the web, getting a plastic sandwich from Sainsbury’s for your lunch and listening to the incessant ‘wackiness’ of the office ‘clown’?…

Sod it, I’m staying at home today.

£80,000 Hedge Dispute

IT’S a story that has been played out through history, neighbours who struggle to live in harmony, from ‘the Troubles’ in Northern Ireland to the conflict in Israel and Palestine. However, in Bury Road, Rochdale, the cause of the rift wasn’t years and years of historical and cultural complexities, but rather a simple hedge.

Barbara Buckley faces court costs of almost £80,000 after a dispute over a pruned bush escalated into a High Court defamation action.

Buckley sued next-door neighbours James and Melanie Dalziel after Melanie Dalziel had originally complained to the police of their neighbours’ pruning of the vegetation which divided the two houses.

Buckley, who claimed that she only trimmed the branches which were overhanging into her garden, accused Mrs Dalziel of “nagging” the police and that the couple were being malicious.

However, with the case being thrown out, Buckley now must pay her own court costs of £50,000 along with the £27,000 bill incurred by the Dalziels, who are now planning to move.

I wonder if Blair and Brown had the same problems on Downing Street?

Paying Through The London Eye: UK Is A Rip Off

THE UK may still be a major holiday destination but according to the Telegraph, the high prices charged by the country’s biggest attractions could discourage tourists from visiting Britain.

London Zoo, for instance, charges £51.50 for a family ticket, almost three times the price of a visit to Berlin Zoo. The London Eye, one of London’s most popular attractions, is three times the price of a trip on Vienna’s Riesenrad ferris wheel and 50 per cent more costly than a jaunt up New York’s Empire State Building.

Indeed, only Britain’s museums, which are free to enter, compare favourably.

Holiday Which? is also critical of British theme parks for overcharging families – “We feel the prices are particularly unfair, since apart from Legoland, children over the age of 12 have to pay full adult prices.”

But not to worry. Some thing in London are cheap. You can buy any number of drugs at a discount. Sure they are illegal but you are on holiday. When in Rome and all that…

The Grey Pound: Over 50s Worth £5trillion

RESEARCH by Abbey has found that the personal wealth of the over 50s in Britain has increased by almost 50% in the past five years and now stands at a whopping £5 trillion.

Although only 34% of the population is over 50, they own nearly 75% of the total wealth of the country, a percentage which is set to increase to 43% in the next 25 years.

While younger people are struggling with enormous mortgages and inflated house prices, the golden oldies have benefited from decades of rising house prices as well as the then free higher education system.

Head of savings at Abbey, Reza Attar-Zadeh, says: “If personal wealth and population continue to grow at current rates, the 50-plus demographic will become even more dominant”.

So let’s take back their free bus passes and make them pay like everybody else. And make sure gorgeous/vivacious etc. granny’s will is up to date…

Posted: 3rd, May 2007 | In: Money | Comment (1)

Accusations Of Homophobia In Financial Services

FINANCE giant Zurich was in the dock yesterday after being accused of deliberately destroying a small company run by the gay activist and entrepreneur Ivan Massow.

The Guardian reports that the Zurich group initially joined forces with Massow’s company to offer financial services to the gay community. However, it is alleged that Zurich then reneged on an agreement to make its own policies more gay friendly, a move which lost Massow Financial Services its customers and reputation, eventually leading to its collapse.

Massow has accused the banking giant of deliberately setting out to destroy his company, once worth £22m, after he ran a poster campaign in the 90’s criticising Allied Dunbar, now part of Zurich, of homophobia.

The case at the Bristol high court continues.

Hollywood Star Pays £4m to join The Circus

RESIDENTS of the picturesque town of Bath are steeling themselves for the imminent arrival of a bona fide Hollywood bad boy.

RESIDENTS of the picturesque town of Bath are steeling themselves for the imminent arrival of a bona fide Hollywood bad boy.

The Mirror reveals that Oscar-winner Nicolas Cage is coughing up £4m for a five-storey 18th century townhouse, once home to the Earl of Chatham.

The house, which includes an indoor swimming pool, forms part of the famous ‘Circus’, a curved millionaires row in the middle of the Somerset town.

The Mirror’s top investigative journalists managed to squeeze some highly confidential information out of a neighbour – “We’re told he has bought it but I don’t think he’s completed the sale yet. Our daughter saw him in The Circus six months ago.”

Such is the way with breaking hard news…

Insurance Scams On The Increase: PPI

AS we now know all too well, banks will do their utmost to squeeze every last penny out of their customers and now consumer group Which? has revealed that consumers are being tricked into buying expensive payment protection insurance (PPI) when taking out a personal loan.

Over half the companies investigated by Which? added PPI automatically to their quotes without informing the customer. Indeed, the latest figures suggest that there are around 20m policies currently active in the UK despite the fact that PPI is often sold to people who don’t need it.

The Office Of Fair Trading claims that only 20% of the total amount claimed for on PPI policies is actually being paid out, compared to 82% in the motor insurance industry.

Martyn Hocking, the editor of Which?, warns us: “If you are taking out a loan, make sure you know if the quotes you get include PPI. It is not compulsory so if you don’t want it ask the lender to remove it.”

Barbra Streisand: You Don’t Bring Me Money Anymore

LEGENDARY singer and gay icon, Barbra Streisand is planning to make a killing when she plays her only UK show this year.

LEGENDARY singer and gay icon, Barbra Streisand is planning to make a killing when she plays her only UK show this year.

According to the Mirror, the Oscar-winning superstar is set to charge fans up to £500 per ticket when she performs at the revamped Millenium Done, now known as the O2 Arena.

Those prices dwarf even the likes of Madonna, who charged up to £160 for her Confessions tour.

The show, on July 18, will include a 58-piece orchestra and a spokesperson for the singer tells us: “If you think that FA Cup tickets are going for £1,600, you get some sort of context.”

Babs Streisand banging out show tunes or Jose Mourinho dramatically hurling abuse at the officials at Wembley as Cristiano Ronaldo falls over theatrically. Which will be the more showy, camper and self-important?

Posted: 1st, May 2007 | In: Money | Comments (6)

Bank On God: Thou Shalt Not Go Bankrupt

SADDLED with enormous debt? Frightened you will lose your home? Well now there is a new, rather divine financial consultant on the block, ready to help you get your finances in order. His name is God.

SADDLED with enormous debt? Frightened you will lose your home? Well now there is a new, rather divine financial consultant on the block, ready to help you get your finances in order. His name is God.

According to the Telegraph, thousands of Americans struggling with debt are turning to church financial programmes which teach the Christian participants how to manage their money using a mixture of budgeting advice and Scriptural teaching.

One such programme has been completed by 350,000 American families, with each paying $80-$90 for the accompanying books and CDs.

Radio presenter Dave Ramsay, the face behind that ‘Financial Peace’ plan is convinced of its benefits. Says he: “Even if you’re not some kind of sold-out believer, you can relate to Proverbs 22:7, that the borrower is a slave to the lender. It’s like a Mark Twain saying.”

With the financially burdened participants still encouraged to cough up as much as 10 per cent of their income to the various churches involved, soon God will have enough cash to buy a Premiership football team.

And one good enough to come in the top dozen…

Money: Friends and Family Better Than A Pay Rise

THINK you‘ll never be able to afford that holiday home on the Cote d’Azur or that Bentley you always wanted? Well think again – simply pop ‘round to your mate’s house for a drink and then spend a few minutes at your mum’s, and you’ll be rolling in dosh.

Well, not quite, but according to a new survey published in the Journal of Socio-Economics, seeing friends and family every day is apparently worth the equivalent of an £85,000 pay rise. Even chatting to neighbours every so often makes us as happy as if we’d been handed a £37,000 increase.

However, beware! For a painful divorce can bring sadness equal to a debt of £139,000.

On average, according to the study, a person earning £10,000 per annum who sees their friends and family every day is as happy as someone earning £95,000 a year who only rarely sees their loved ones.

So there you go, keep avoiding your family and your mates and you’ll be able to pay off your debts, and maybe have a nice holiday, in no time.

Money Talks: New VoicePay Machines

FROM Big Brother’s Chantelle Houghton to Stephen Hawking, the humble voice is a many-splendored thing.

FROM Big Brother’s Chantelle Houghton to Stephen Hawking, the humble voice is a many-splendored thing.

But despite the fact many of us hate the sound of our own voice, a new service using our dulcet tones will be launched today to combat credit credit card and online banking fraud.

Under VoicePay, the brainchild of entrepreneur Nick Ogden, when a customer tries to use a credit card or access an online account, as well as having to enter the usual passwords and PIN number, the service will automatically phone the user to verify their identity.

The ‘VoiceVault’ voice recognition technology is already used by ABN Amro allowing people to even trade shares over the phone.

But how secure is it?

Expect impressionists Rory Bremner and Jon Culshaw to top the next Times’ Rich List.

Posted: 30th, April 2007 | In: Money | Comment (1)

Joseph And His Amazing Technicolour Dreamcoat: Any Rubbish Will Do

THE winner of the campest show on television has already bagged a big recording deal, before even being chosen by the public.

According to the Mirror, the successful contestant on the BBC’s Any Dream Will Do show will bag a £200,000 deal with Universal Records, a deal which has been secured by the diminutive Irish star-maker Louis Walsh, the man who will manage the show’s winner.

“The idea is to rush out an album of Joseph songs straight after the series ends. I’m sure it will be very popular”, gloats Walsh.

For Walsh and Andrew Lloyd Webber’s bank accounts, any rubbish will do.

Dearest Britain: A Two-Tier Economy

A NEW report from the Royal Bank of Scotland reveals that British shoppers are being ripped-off in comparison to their European and American counterparts.

The report in question, entitled ‘The Return Of Rip Off Britain?’, highlights that while Britons pay quite low prices for their weekly shop, when it comes to computer game consoles, branded electronic goods, alcohol, furniture and rail tickets, they are being left out of pocket.

The rise of a ‘two-tier economy’, where only the smartest consumers or those with access to the internet can find the best deals worries Martin Lewis of moneysavingexpert.com,.

Says he: “Companies have finally realised the ultimate economic dream where rather than offer one price for all, they charge customers what they are willing to pay. So you have information enfranchised consumers who get amazing bargains and very cheap prices, and then you get people who don’t, through ignorance or because they want to do it quickly, and pay masses more.”

Cash In The Surgery: Doctors’ Healthy Pay

ALL those years of medical school have paid off rather well for GPs, who, according to NHS figures published yesterday, earned £100,170, on average, in 2004-05.

ALL those years of medical school have paid off rather well for GPs, who, according to NHS figures published yesterday, earned £100,170, on average, in 2004-05.

With NHS negotiators underestimating the payments that GPs would be able to claim under the snappily-entitled Quality and Outcomes Framework contract, primary care trusts had to pay them over £300m more than expected in the first year, despite the fact that these family doctors now don’t have to provide care at night or at weekends.

A spokesman for the Department of Health says: “GPs are getting paid more because they are doing more. We invested extra funding in GP services both to improve services and reward GPs.”

No wonder GPs try to hurry you out of the surgery. They need time to count their money.

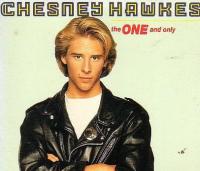

Mick Jagger On Top: Where Is Chesney Hawkes?

FROM Sixties rebels to bastions of the rock establishment, the Rolling Stones are as popular as ever with their bank manager still getting a lot of satisfaction.

FROM Sixties rebels to bastions of the rock establishment, the Rolling Stones are as popular as ever with their bank manager still getting a lot of satisfaction.

According to the Sunday Times rich list, to be published this weekend, the stadium giants rank as the richest band still on the road, with a combined fortune of £570m.

Not surprisingly, the svelte 63-year-old Mick Jagger is the top Stone, with £215m to his name while poor Ronnie Wood has to make do with a paltry £75m.

However the richest individual in music is one Clive Calder, former owner of Zomba, the independent label and former home to pop loony Britney Spears.

Calder, who now lives in the Cayman Islands, is worth a whopping £1.3bn. Andrew Lloyd Webber and Paul McCartney come in second and third respectively.

In the under 30’s list, the hideously naff violinist Vanessa-Mae Nicholson comes out on top, with £32m to her name.

But where is Chesney Hawkes?

Posted: 27th, April 2007 | In: Money | Comment (1)

An End To Free Banking

THE great bank charges debate rumbles on with the news that a full-scale inquiry is to be launched into the much-publicised illegal penalties imposed by banks on their customers.

THE great bank charges debate rumbles on with the news that a full-scale inquiry is to be launched into the much-publicised illegal penalties imposed by banks on their customers.

The Office of Fair Trading announced the inquiry yesterday.

However, while campaigners welcomed the news, the likelihood is that the banks themselves will, rather unsurprisingly, cover their losses by imposing charges elsewhere.

Leslay McLeod of the British Bankers’ Association warned consumers of the likely end to ‘free banking’ – “A lot of banks would like to keep free banking if they can. But a lot of them are going to have to examine the OFT’s conclusions and tweak their model accordingly.”

According to Which?, customers pay £4.7 billion a year in default charges.

But, unlike petty pickpockets and shoplifters, the big-wigs behind the illegal penalties will never end up being charged with anything, never mind go to prison.