Money Category

Money in the news and how you are going to pay and pay and pay

A Load Of Rubbish Tax In Birmingham

NOT content with bombarding us with high council tax bills and ridiculous parking fines, local councils have now found another way to squeeze every last hard-earned penny out of us.

NOT content with bombarding us with high council tax bills and ridiculous parking fines, local councils have now found another way to squeeze every last hard-earned penny out of us.

According to a report in the Times, fixed penalties of over £185,000 have been issued to people who have put their rubbish out too early for the binmen.

While another heinous crime of leaving your wheelie bin on the street, surely up there with child trafficking and arson, has also led to hefty fines.

Birmingham tops the list for these rubbish fines, with the city’s council issuing 592 penalty notices in the past 12 months.

Christine Melsom, founder of IsItFair said “Councils must be a little bit more forgiving. This is too stringent. A lot of people find it difficult to stick to a deadline if they are rushing out to work or they do not have a bin provided by the council”.

However, local Tory councillor Robert Alden is having none of it. Says he: “The bags attract rats and they can start to smell if they have food in them. These are the kind of measures we have to take to deal with these problems”.

So how should we deal with odious councillors then?

Posted: 13th, April 2007 | In: Money | Comment (1)

Taxman Wins Lottery

FOR one lottery winner, Lady Luck was only out the door when the Grim Reaper popped in for a visit and now his family will have to pay the price.

The good news is that £3.5 million lottery winner Bob Bradley won the jackpot on his 83rd birthday in March of last year.

The less good news is that on Sunday morning the D-Day veteran died, leaving his family with the added inconvenience of a 40% tax bill on his winnings.

While lottery winnings are not taxed, gifts above a certain amount are treated by the taxman as earnings. Under Treasury rules, the maximum someone can receive as a single gift is £3,000 a year and anything above the first £300,00 of Mr Bradley’s winnings is taxed at 40%.

According to the Telegraph, Wales’ oldest jackpot winner spent his last months living large, splashing out on £70,000 cars, motor homes and businesses.

Shop Scan Save – Schlep Drone Poor

IN a valiant effort to fight back against the supermarkets’ popular special-offer and loyalty card campaigns, a new mobile phone-based scheme is set to be launched across 17,000 local grocers.

The programme, called Shop Scan Save, is a modern twist on the coupon culture, with consumers receiving special offers, in barcode form, on their mobiles which they can then scan in from handheld displays in the shops.

With the likes of Unilever, Proctor & Gamble and Nestlé all signed up, the scheme is set to be rolled out in July and according to Marc Lewis, chairman of the The Light Agency, the company that will manage the data collected, the aim is to appeal to a new market.

Says he: “In the UK, coupons are seen as fairly tacky. There is the sense that people who use them are middle-aged women, earning less than £30,000 a year. We want to attract a more attractive demographic — in particular, men”.

Men who like to dress up as middle-aged women who earn less then 30,000?

Posted: 12th, April 2007 | In: Money | Comments (2)

No Poor Service At HSBC

IT seems that in the eyes of HSBC, the self-proclaimed “world’s local bank”, some customers just aren’t worth the bother.

The Guardian reports that the HSBC branch in the salubrious Canford Cliffs in Dorset has decided to offer face-to-face services only to its wealthier clients, with the great-unwashed having to make do with the cash withdrawal and automated paying-in machines.

The branch’s policy to only speak to customers with £50,000 or more in savings, a big mortgage or a salary of at least £75,000 has not surprisingly irked residents of the wealthy area, which includes the ‘millionaires’ row’ of Sandbanks, home to the likes of Portsmouth manager Harry Redknapp and computer millionaire Sir Peter Ogden.

Indeed, even the church are peeved with local vicar Reverend Jeremy Oakes proclaiming “Our church banks there and we have a collection on a Sunday but I don’t know what we’re going to do if they won’t accept it.”

“BANK BANS THE POOR,” announces the Mirror’s front page. “GREEDY BANKERS.” The bank made profits of £11billion last year, says the paper.

A HSBC spokesperson said “We are trying to treat everyone fairly – not everybody in the world is equal”.

Of course they are – it’s just that some are more equal than others…

Posted: 12th, April 2007 | In: Money | Comment (1)

Sun, Shopping And Sales

NOTHING improves your mood like a bit of good weather, particularly if you are a retailer.

According to figures from the British Retail Consortium, the good weather in March helped to boost sales by 3.9% compared to March 2006.

Clothing, DIY and gardening equipment (that will be used once before being dumped in the shed) drove the sales rise.

Food sales also strengthened in March although according to BRC director Kevin Hawkins, “Discounting and competition generally show no signs of easing off and many consumers are increasingly wary of making big purchases”.

While Global Insight economist Howard Archer warns that the growth in retail sales could make a rise in interest rates more likely in May.

Make debt while the sun shines, as the saying goes…

Rung up Debt – The Sixfold Mortgage

THE sea of debt threatening to submerge the whole of the country continues to rise with news that lenders are now offering mortgages equal to six times the salary to first-time buyers desperate to get their a foot on the property ladder.

Major mortgage lenders Halifax have revealed that the average price of a house hit £194,000 last year, over eight times the average wage of £23,600 a year.

According to the charmingly named Ron Stout of Northern Rock “As a result of more sophisticated credit assessment we can be more flexible to the specific circumstances of the borrowers, enabling more people to climb on to the housing ladder or climb up a rung.”

Welcome to the new phenomenon of the mortgage you will never be able to pay off.

Sickness Benefits – Back To Work

FEELING a bit hungover? Can’t seem to get out of bed? Considering taking the day off? Well think again you lazy selfish oaf, and hop in that shower. Your economy just can’t take it anymore.

“Sickies” taken by the nation’s work-shy ingrates are apparently costing the UK economy a whopping £1.6bn a year according to a poll conducted by the CBI and insurers AXA.

The poll of employers also revealed that the humble employee took, on average, seven days off sick in 2006, adding up to a total loss of 175 million working days.

Think of all the internet surfing and aimless staring into space which could have been achieved in that time?

The survey also showed that employers attributed around 12% of short-term absences to “sickies”, around 21m days lost at a cost of £1.6bn.

Colds, flu and back pain are among the top five most common causes of short-term sickness, so if you are planning to skip a day or two, use your imagination, as your boss is on to you.

And his back is starting to spasm.

Britons Love Soft Pawn

FACED with high-interest credit cards, greedy banks and high-risk loan sharks, large sections of the public are returning to the traditional pawnbroker to give them a helping hand with their finances.According to the Guardian, this ancient system of personal banking, famous for its three-balls logo, is making a major comeback thanks to internal reforms and the continuing rise in the value of gold. And – shock horror – it’s not only the riff-raff that are swapping their sovereign rings for a bit of extra cash, but the uber-sophisticated Guardian reading middle-classes themselves.

Chris Brown of pawnbrokers Herbert Brown points to the rise in prosperous families who wonder what to do with their valuable jewellery when going on holiday. “You can hide it in a sock or risk taking it with you”, he says. “But why not bring it to us as a pledge?”

What next, Hampstead liberals flocking to the high-street amusement arcade?

Meet The NEETs

WHAT with the education system in disarray, and young people, demonised and always in danger of a copping an ASBO, should it really come as a surprise that a “lost generation” of young people are destined to spend a lifetime living on government “hand-outs”?

WHAT with the education system in disarray, and young people, demonised and always in danger of a copping an ASBO, should it really come as a surprise that a “lost generation” of young people are destined to spend a lifetime living on government “hand-outs”?

The Telegraph says these hoodlums are costing the economy “billions of pounds a year in benefits, youth crime and educational under-achievement”.

All this comes from a new report by the London School of Economics for the Prince’s Trust Charity. The report claims that £3.65 billion a year is being spent on these so-called NEETS (people Not in Education, Employment or Training).

According to Martina Milburn of the Prince’s Trust, “There is also a major cost to young people in terms of their lives. If a young person gets on to benefits and stays there they are always going to be a drain on the economy.”

If only the young could be more like, well, princes. Anyone seen Prince Eddie recently?

Open Your Old Bank Accounts

CLEVERLY linking Easter with the idea of a ‘nest-egg’, the Mirror urges us all to “dig around your old bank books” in order to find sums of money that you may have forgotten about.

British Bankers’ Association chief executive Angel Knight tells us: “If you have an old bank account that you haven’t used for several years, look for it over Easter.”

Helpfully, the BBA will even help you track down your dusty account even if you can’t track it down.

And you should hurry. The paper says the Government has announced plans to rake in cash in “dormant” accounts and give it to “good causes”.

Shares In The Halifax’s Money

IN a story that is sure to warm the heart of, well, basically everyone, the Daily Mail reports that the Halifax has been on the receiving end of an embarrassing visit from the bailiffs as the bank charge crisis continues.

The bailiffs paid a visit to the bank’s West Yorkshire HQ carrying a court order for repayments of £1,900 to two customers ruled to have been charged unfair overdraft charges by the bank.

The rather aptly-named Paul and Darren Share, from Lancashire, had already been paid £3,000 of a £4,900 claim against the Halifax, but with the bank refusing to defend its claim before a county court judge, it was automatically ordered to pay in full.

Unless the dispute is resolved, the bailiffs could return to seize assets such as chairs, computers and maybe even more of the bank’s dignity.

The Great Easter Egg Race

WHAT does Easter mean to you?

A period of religious reflection? An opportunity to spend quality time with the family?

The key weekend in the Premiership?

Well, for the retail trade, the holiday has become nothing less than a battleground as stores slash the price of their chocolate eggs to entice shoppers.

According to the Guardian, ballooning British consumers will fork out around £220 million on 80 million Easter eggs over the holidays and the big supermarkets, eager to attract these chocoholic shoppers, are slashing the prices of the traditional chocolate egg.

With the likes of Tesco now selling two eggs at £1.49 in a buy-one-get-one-free promotion, it has never been a better time for the consumer to pig out.

Woolworths director Tony Page admitted Easter eggs are now “as near as dammit loss leaders. There is a lot of testosterone circulating inside the big grocers to get the best headline prices”.

Ah, the ‘testosterone’ fuelled world of Easter eggs, surely it must be the setting for the next Andy McNabb book or maybe another Die Hard movie?

A Grey Pound Saga

IT seems that it’s Club 50-90 rather than Club 18-30 where the real money is.

Saga, the company who organise holidays for the over-50s, has decided to land its staff a whopping £500 million windfall as its love-affair with the aged continues.

The company, according to the Telegraph, has appointed investment bank Close Brothers to advise them with its “future ownership options”, which may signal a stock market float in the near future, a deal which would value the grey-pound grabbing company at around £2.5 billion.

Saga, which started in 1948 by opening a seaside hotel in Folkstone, has gone on to add share trading and insurance to its holiday business and even runs an over-50s MySpace site called Saga Zone.

Like the sadly-departed Anna Nicole Smith, Saga know where they big money is.

Posted: 5th, April 2007 | In: Money | Comments (2)

British Lawyers Go West

US TV is full of legal dramas starring svelte and urbane lawyers balancing tough court cases and steamy office romances and now it seems that all that glamour and sex is tempting British legal eagles to join US firms.

Well, that and the extra cash.

The Times reports that last year alone, 71 partners left UK law firms for their American rivals in London with the vast majority moving for the substantially higher salaries.

According to Legal Business magazine, US law firms in the capital are outperforming their British counterparts with Sullivan & Cromwell, a New York-based firm with 56 lawyers in their London offices, the best-performing firm in the city.

Sick Phone Charges On The NHS Patientline

IT seems as though the nation’s “entrepreneurs” will do whatever it takes to squeeze every last penny out of the old and the infirm.

IT seems as though the nation’s “entrepreneurs” will do whatever it takes to squeeze every last penny out of the old and the infirm.

Following the recent furore over extortionate car parking charges at NHS hospitals, bedside phone services are now to rise in price by an incredible 160%, according to the BBC.

Private telecommunications company Patientline, who provide a large proportion of hospital bedside phones, have decided to increase the cost of calls from 10p per minute to a whopping 26p per minute.

The company themselves have, not surprisingly, defended the increases, claiming that the rises will allow them to significantly drop the cost of their more popular bedside TV packages.

However, Patients Association spokesman Michael Summers was fuming. Says he: “These people are ill, often recovering from operations, and the hike from 10p to 26p to phone out is really too much. People are going to be really upset with this.”

Two years telecoms regulator Ofcom launched an investigation into Patientline over high charges and although nothing came of it then, the company may well face more scrutiny now.

Posted: 4th, April 2007 | In: Money | Comments (3)

Lloyds Bank Wants A Sharia The Wealth

NEVER ones to miss out on a new sources of profit, banks are now turning their attention to the previously untapped Islamic business market.

According to the Guardian, Lloyds TSB has become the first mainstream bank to launch a sharia-compliant business account, introducing the ‘Islamic Business and Corporate account’.

The new service will be available to Muslim businesses throughout its network of branches with Lloyds director Truett Tate proclaiming “the entrepreneurial spirit in the UK is truly something to be proud of, and Muslim businesses are making a phenomenal contribution to this through their creativity and incredible work ethic”.

According to Islamic law, bank accounts should not charge or pay any form of interest, a rather good idea if you ask me, and one that surely should be applicable to any faith, or indeed no faith at all.

But watch out for those bank charges!

Liverpool Kops Good News

WHAT with a summer transfer fund of a reported £40 million and construction on a swanky new stadium about to begin, things at Liverpool FC are looking decidedly rosy.

WHAT with a summer transfer fund of a reported £40 million and construction on a swanky new stadium about to begin, things at Liverpool FC are looking decidedly rosy.

Even the players are enjoying their own bit of good fortune with their cash, with flame-haired full-back John Arne Riise learning yesterday that an embarrassing bankruptcy order against him had been lifted by a judge.

The 26-year old Norwegian had been declared bankrupt with debts of just under £100,00, despite earning a not-too-shabby basic wage of £50,000 a week.

The Sun reports that the case was linked to a dispute with Riise’s former agent Einar Baardsen and the while the bankruptcy, described by the Kop hero as “an oversight”, is now history, the dispute between the two men looks likely to rumble on.

Tesco Not So Local

THOSE lovely mega-supermarkets are at it again.

THOSE lovely mega-supermarkets are at it again.

The Independent reports that Tesco are being accused of “stretching the definition of local past breaking point”.

The retail giant has launched a last-ditch attempt to stop the Competition Commission from focusing on local markets in its new study of the grocery industry.

The CC is investigating whether or not supermarkets are excessively dominating local shopping and in response Tesco is arguing that “local” should mean as much as a 30-minute drive from a store rather than the traditionally accepted 10-to-15 minute journey.

The UK’s biggest supermarket chain also claims that the UK grocery market should be viewed as one single national market.

Is this what Tesco means by an “inclusive offer” to the shopper?

Posted: 3rd, April 2007 | In: Money | Comments (2)

Never Never Land – Britain Banks On Debt

IT seems that no matter how many warnings about heavy debt the humble householder and consumer are given, we just can’t seem to stop our lust for shiny, bright new things.

IT seems that no matter how many warnings about heavy debt the humble householder and consumer are given, we just can’t seem to stop our lust for shiny, bright new things.

According to a report by economist Marchel Alexandrovich – snappily entitled “The savings ratio turns negative – is a recession around the corner?” – households are now dipping into their savings in order to fund current spending, something that hasn’t happened on a major scale since 1989.

The Telegraph reports that figures from the Bank of England also show that families are borrowing even more against the value of their homes as their “appetite for debt returns”.

While the Guardian uses Bank of England statistics to reveal that Britons took £2.4 billion more out of their homes in the last quarter of 2006 as house prices rose again.

With families’ savings now falling for the first time since the late Eighties, a recession could be on the horizon, so too another rise in interest rates.

If only those shiny, bright new things weren’t so darn shiny, bright and new.

Upstairs Upstairs

ANOTHER elderly Brit who has been struggling to gets his hands on some cash is uber-posh luvvie Nigel Havers.

ANOTHER elderly Brit who has been struggling to gets his hands on some cash is uber-posh luvvie Nigel Havers.

The urbane 57-year old has finally won a large cash settlement from his late wife’s £2.3 million estate after a prolonged court battle, according to the Telegraph.

The actor, son of former Lord Chancellor Sir Michael Havers, began his legal battle after his wife Polly, who succumbed to ovarian cancer back in 2004, left most of her sizeable estate to her two sons with Havers only getting a share of their London marital home, poor fellow.

However, much to the delight of the actor, famous for his roles in Upstairs Downstairs, The Charmer, A Passage To India and not much since, he will now get his well-manicured hands on a tidy £375,000 sum as well as the proceeds from the sales of his late wife’s Mercedes along with a whole load of her jewellery.

However, despite his single-minded quest to attain a bigger slice of the estate, Havers has hardly been teetering on the brink of homelessness, as he currently resides in salubrious Holland Park with multi-millionaire divorcee Georgiana Bronfman.

Posted: 2nd, April 2007 | In: Money | Comments (2)

Pensioners Too Proud To Beg

GORDON Brown isn’t the only one currently suffering from a pensions-related issue, as according to the Mirror, more than 1.7 millions pensioners are failing to claim benefits as they are “too proud to beg” for the money.

GORDON Brown isn’t the only one currently suffering from a pensions-related issue, as according to the Mirror, more than 1.7 millions pensioners are failing to claim benefits as they are “too proud to beg” for the money.

Apparently application forms, which pry into the details of old folks’ savings, are putting them off claiming an extra £40 every week in pension credits.

Pension Rights Campaign secretary Margie Arts wants the whole system revamped with pensioners automatically given their benefits without having to wade through the paperwork “My members are proud people”, she said, “ and they don’t want to tell strangers what their personal circumstances are”.

Help The Aged’s Anna Pearson is also unhappy with the Government claiming that “nearly £2.5 billions of pension credit is now going unclaimed each year. More should be done to ensure information on claiming gets to those who need it”.

Posted: 2nd, April 2007 | In: Money | Comment (1)

Gordon Brown Pension Raider

‘NEW Labour’ and ‘spin’ sit as comfortably together as ‘bread’ and ‘butter’, ‘fish’ and ‘chips’ and ‘Pete Doherty’ and ‘bad hygiene” and now, once again, the Government is being accused of another gigantic spin, this time in relation to pensions.

‘NEW Labour’ and ‘spin’ sit as comfortably together as ‘bread’ and ‘butter’, ‘fish’ and ‘chips’ and ‘Pete Doherty’ and ‘bad hygiene” and now, once again, the Government is being accused of another gigantic spin, this time in relation to pensions.

Back in 1997, when Tony and Gordon were mere striplings, filled to the brim with hope and yet to be sullied by sleaze, war, more sleaze and more war, the Chancellor cut relief on company dividends in his first budget, a move which raised £5 billion a year from retirement funds but also lead in part to the number of people in final salary schemes falling from 11 million to just 4 million.

However, a decade on, and the episode is back in the news following the release of documents under the Freedom of Information Act on Friday, documents which reveal that the Chancellor had been warned about his plans to remove key tax benefits enjoyed by pension funds in that first budget.

However, while ministers had been insisting that Brown’s decision had been endorsed by the Confederation of British Industry, the CBI have now refuted that suggestion with director-general Richard Lambert accusing the Government of spinning the story. Lambert claims his organisation had “objected strenuously to the policy”.

The Times sees this latest embarrassment for the Brown as another reason why his move to No. 10 might not be such a smooth operation after all.

Shadow chancellor George Osborne has also vowed to lead a Commons debate on the issue, all of which is sure to turn the heat up on poor old Gordie.

Posted: 2nd, April 2007 | In: Money | Comment (1)

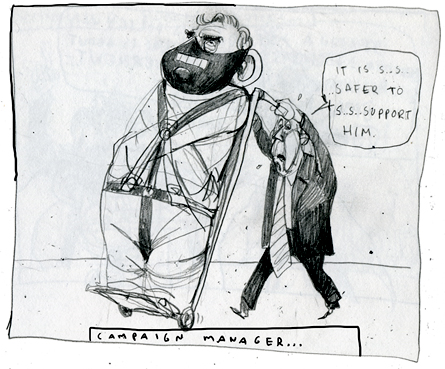

Gordon Brown’s In The Black, Tory Party Parties & Bob Kylie Tells All

Strapped For Cash

The fall-out from the recent Budget continues with government figures now showing that the disposable income of households grew last year at the slowest rate since 1982, says the Telegraph.

Ballooning mortgage payments and utility bills along with rising taxes are to blame. The Office For National Statistics suggests British families were losing an average of £22 each in the final quarter of last year.

This rather unimpressive news comes on the back of the disclosure that 5.3 million people would be worse off as a result of the Chancellor’s Budget last week.

Citigroup’s Michael Saunders puts it nicely: “The fruits of growth continue to go chiefly to the Chancellor and corporate profits, and not consumers”.

Cash On A Plate

Put away your tuxedos, party dresses and best hooray-henry guffaws, the era of the Tory fund-raising bash could be over.

The Mirror reports that the Conservatives are facing a ban on ‘cash for dinners’ banquets by the over-worked Commons Sleaze watchdog.

Reports claim that the party of Opposition have raked in over £1 million a year from their ‘lavish feasts’ in the House of Commons dining rooms, with voice-of-the-people David Cameron thought to have raised £100,000.

However, Standards Commissioner Sir Philip Mawer is likely to outlaw the practice and give the Tories a slap on the wrist for exploiting Parliament.

But isn’t that what all the political parties do? What are they without Parliament?

Kylie Should Be So Lucky

One of the great phenomena of New Labour’s Britain, the ‘consultant’, has a new king – step forward Bob Kiley.

The72-year old American, brought over by Ken Livingston to erm, ‘consult’ on London’s transport system, has admitted to receiving up to £737,500 over two and a half years for doing, in his words, “not much”.

According to the Guardian, the former CIA man, who also admitted to having a drink problem, quit his job as London’s transport tsar back in 2005 but is still picking up a rather hefty ‘retainer’ as well as enjoying the comforts of the £2 million grace and favour Belgravia townhouse Red Ken bought for him on behalf of Transport for London.

When asked about his continuing fees by the Evening Standard, Kiley’s reply is sure to embarrass Livingstone: “If you ask me what I actually do to earn my consultancy I’d have to tell you, in all honesty, not much”.

What price honesty?

Picture: Poldraw

Posted: 29th, March 2007 | In: Money | Comment (1)

United Kingdom Of Sainsbury

THE continuing plans to turn Britain into one giant supermarket were given another boost today when friend of the community Sainsbury’s published healthy new sales figures.

THE continuing plans to turn Britain into one giant supermarket were given another boost today when friend of the community Sainsbury’s published healthy new sales figures.

With a number of private equity firms reported to be planning an imminent takeover, the figures which show a 5.9% growth in sales in the 12 weeks to March 24th are sure to have the Sainsbury’s big-wigs dancing in the aisles.

Reuters finger Marks & Spencer as another company currently pondering a takeover bid for Sainsbury’s, who now have around 16.5 of the country’s 125 billion pound grocery market.

The Sainsbury’s group claim the impressive sales results are due to store refurbishments, a growth in the sale of Fair Trade products, a focus on healthy eating not to mention the sale of goods linked to the national “Red Nose” charity day.

Making money out of charity – another reason to love your big supermarket.

Posted: 28th, March 2007 | In: Money | Comment (1)

New Labour – New Poverty

IN a blow to Gordon Brown, new figures reveal that poverty is on the increase in these fair isles for the first time in six years, news that reflects rather badly on the Chancellor.

IN a blow to Gordon Brown, new figures reveal that poverty is on the increase in these fair isles for the first time in six years, news that reflects rather badly on the Chancellor.

The Guardian reports that the official figures, released by the government, show that the number of people living in poverty – calculated as those living on 60% of average incomes – rose to 12.7 million in 2005/06 from 12.1 million the previous year while the number of children living in poor families rose by 200,000 to 3.8 million.

Jim Murphy, the Minister for Welfare Reform tried to spin the dismal figures, “Despite these figures”, he faffed, “we have, over the past decade, had the fastest falling levels of child poverty in Europe”.

While that well-known friend of the poor, Shadow Chancellor George Osborne, lambasted the findings, “We need a different approach. Simply throwing money at the problem has failed”.

I for one would be delighted if they threw some money at me.

Posted: 28th, March 2007 | In: Money | Comments (2)