Posts Tagged ‘banking’

The financial crisis is over; US Fed raises interest rates, ECB ends QE

Most of us have noted that the past decade hasn’t been all that hot on the economic front. That grand and resounding crash back in 2008 has led to government and bank finances being near obliterated, the follow on effects being not much to no economic growth, wages stagnating and so on. The good news though is that it’s all pretty much over.

Yes, a decade is a long time, yes, it’s even possible that different economic policies would have made recovery faster. Even, that not having the excess in the first place would have meant no crash. But it is still good news that it does, finally, seem to be over.

To think like an economist for a moment – yes, OK, so we all insist they don’t know anything. And yet they are the only experts we’ve got about this economy type thing. And they will be saying that these two events mark at least the beginning of the end. We’re now properly into recovery, rather than continuing crisis.

The US Federal Reserve has voted to raise the target for its benchmark interest rate by 0.25%, citing solid economic expansion and job gains.

The widely-anticipated decision will lift the target for the central bank’s benchmark rate to 1.75%-2%, the highest level since 2008.

When the economy goes kablooie the first thing we do is lower interest rates. The counterpart to that, the other side of the coin, is that when the economy has recovered and we’re worried again about inflation, not that kablooie, then we raise interest rates. Among economists who are not central bankers there’s a little muttering about whether interest rates should rise right now, or perhaps in a month or two – for the US that is. But that they should rise is agreed, the crisis is over and recovery well under way.

The European Central Bank said on Thursday it will end its unprecedented bond purchase scheme by the close of the year, taking its biggest step in dismantling crisis-era stimulus a decade after the start of the euro zone’s economic downturn.

When you’re really in the hole and you can’t reduce interest rates any further then you have QE. No, don’t worry what it is, it’s just what you do when there’s deep economic doo doo ahead. And if you stop doing QE then that’s the indication we need that the doo doo has been avoided, we’ve turned the corner and we’re back on the upturn. It’s not as good a sign as raising interest rates again but it’s a necessary precursor to it at the very least. The US stopped QE a few years back, has even started to reverse it – not something the ECB is starting to even talk about yet – and it took them a few years to then raise rates. So Europe is perhaps three or four years behind the US in recovery here, something which sounds about right to be honest.

The other way to put this is that if the crisis were over we’d be stopping QE and raising interest rates. We are stopping QE and we are raising interest rates, thus we should conclude that the crisis is over.

Dear Guardian readers, Ede & Ravenscorft is not for investment bankers

Former BBC journalist Paul Mason offers guidance to Guardian readers: “How to blag a job in finance: buy some black shoes and talk like an aristocrat.”

Big news any of my friends who worked on the LIFFE floor – including ‘The Professor’, so nicknamed because he had two A-levels (grades C and D) -, no, it wasn’t sarcastic – and those from very non-aristo backgrounds (hard to fake being a toff if you’re Jewish, black or Asian) working throughout the money markets.

Mason, however, has honed in on investment banking:

There’s supposed to be a war for talent. If so, it became pretty clear last week why Britain’s investment banks are losing it. The recruitment filter, revealed in a report from the Social Mobility Commission, works like this: you can only join the customer-facing part of an investment bank if you went to one of four public schools; got a first from one of five universities; and possess “sheen”.

Yes, sheen. And polish. No matter how good you are, if your tie is not right or your suit does not fit like a glove, you are destined to take your excellence somewhere else.

Big news: people with lots of money prefer dealing with people who grow up at ease with lots of money and who succeed in academic studies. But the best part of this article in the picture used to illustrate the unfairness of it all.

The label on the shirt says “EDE & RAVENSCROFT”. Who are they? Well;

We provide ceremonial robes for all occasions, dress the judiciary (including providing handmade wigs) and ensure that graduates from all over the world look their best at graduation ceremonies.

You don’t wear brown in town. And you don’t wear an Ede & Ravenscorft shirt in investment banking. Of course, had the Guardian’s picture editor gone to the right school, they’d have known that.

Spotter: Tim Worstall

PS : jobs at The Guardian, this way!

Posted: 7th, September 2016 | In: Broadsheets, Money, Reviews | Comment

Michael Lewis Says High Frequency Trading Rips Off Investors. Michael Lewis Is Clearly Wrong

THERE’S been a bit of a furore over in the US about the new Michael Lewis book. He’s saying that all this high speed trading (that’s the stuff done by computers in nanoseconds) is just a rip off of the average investor. The sad thing is that he’s got it entirely wrong.

What HFT does do is add more liquidity to the markets. That is, there’s just more people buying and selling as a result of their activity. Because their activity is buying and selling, so obviously there’s more of it going on.

Read the rest of this entry »

Making The Bankster Swine Pay For What They Did To Us

THERE’S a fairly strong current of thought these days that we must make those bankster bastards pay for what they did to us and the economy. Hanging a drawing is sometimes thought to be too kind. However, those bankers complaining about what is being done also have a point. For what is being done is the banking levy and it’s not actually being applied in the right way:

In an interview with The Telegraph, Richard Meddings said that the levy, imposed on banks by the Treasury since the financial crisis, is unfairly focused on two banks — Standard Chartered and HSBC — which did not receive any taxpayer-backed support during the financial collapse.

“Standard Chartered went through the financial crisis without any assistance or help from government and there’s something awkward I think, or challenging, when the UK exchequer is taking a levy fundamentally on Singapore deposits being lent to fund Singapore deposits, or Bangladeshi deposits,” he said.

“I think given the hard target that exists for the amount the levy requires, as international banks have shrunk the assets booked in the UK, and as the definitions have changed, excluding in the main insured deposits, so Standard Chartered pays proportionally more than Lloyds, say, and so I think the structure of the levy is now clearly disproportionate.”

Read the rest of this entry »

Why Mo Farah lost: the cost of banking regulation

I THINK we’re all agreed that Britain’s latest hero, Mo Farah, should be allowed to have what he wants. I think we’re all also agreed that we want to stamp out tax evasion, drub money laundering and the abuse of the financial system by the big banks. Unfortunately it appears that we cannot have both at the same time.

Farah has been running a campaign to get Barclay’s to continue to service money transfer companies. There’s around 1,000 of them in the UK, they’re often used by immigrants to send a bit of cash to the old folks back home. Such remittances are in fact the largest reducer of poverty in the world. Vast sums flow through these systems. However, they’re only vast sums in aggregate: most of the actual remittances themselves are a couple of hundred quid or so. And that’s where the problem comes in:

A number of the world’s largest banks have pulled back on operations in profitable emerging markets as international anti-money laundering rules tighten.

Barclays’ decision follows a similar action by HSBC in the wake of its record $1.9bn settlement with US authorities over money-laundering allegations.

Barclay’s was one of the banks offering the basic banking services to those money transfer firms. They’re now a great deal less willing to do so: in fact, they’ve cut some 250 from the list they’re prepared to deal with, leaving only 25 that they will deal with. This list of 25 doesn’t include any at all in Somalia which is what Mo Farah is pissed about.

But the thing is, why should Barclay’s risk the sort of fines that HSBC had to pay? And it’s important to note that no one ever did prove that HSBC was laundering Mexican drug money: rather, the proof was that they weren’t running their bureaucratic system to check that they weren’t laundering Mexican drug money properly. So, what’s a bank to do? Refuse to deal with people who cannot follow the regulatory rules? Or keep open an essential lifeline to a poor country like Somalia?

Well, obviously, we do all demand that the bastard banks obey the law so yes, it’s the Somalis that get screwed.

There really are costs of regulation of an industry you know.

You can’t have safer banks and more spending at the same time

ONE of those little conundrums of life, that you can’t have two desirable things at the same time.

I think we’d all agree that we’d like to have safer banks. You know, ones less likely to go tits up when the gamble away some fraction of their money. Excellent, that means that they have to have more capital.

I think we’d all also agree that we’d like banks to be lending more to people. For banks lending to people is what pulls us up out of recession. However, it’s really very difficult indeed to have both at the same time:

Europe’s smallest banks will have to undergo the biggest transformation by 2018 to meet the new Basel III regulations, according to research by the Royal Bank of Scotland.

Up to €2.6tn will need to be cut from the balance sheets of smaller banks in Europe, which could potentially lead to another contraction in lending to small and medium-sized businesses.

However, Europe’s largest banks will also have to shrink their assets by €661bn and raise a further €47bn of capital to meet the regulations.

Read the rest of this entry »

How cutting bankers’ bonuses buggers up bankers’ pay

ONE of the odder parts of the furore over the banks, greed, financial crashes and what causes them is this idea that if we cut bankers’ bonuses then everything will be better. The problem with this idea is that everything has more than just the one effect: and those side effects can be worse than the original problem anyone is trying to cure.

As with these caps on bankers’ bonuses:

Hundreds of the highest earners at HSBC could be in line for a bumper pay rise as the lender tries to swerve a new bonus cap from Brussels.

The chairman of HSBC admitted yesterday that it was considering plans to hike salaries for employees to ensure they do not leave for better paid jobs with US or Asian rivals.

Douglas Flint, who received a £2.4 million package last year, said the lender would ‘comply with the law’ but needs to ‘remain competitive’.

Read the rest of this entry »

Posted: 6th, August 2013 | In: Money | Comments (3)

You can’t regulate the banking system just by regulating the banks

THOSE Big Bad Bankies, screwed up the entire world economic system and impoverished us all. Of course, what should happen is much greater regulation of what the banksters are doing with or money.

Which might even be true in fact. However, the problem is that you can’t actually regulate the banking system just by regulating the bankers. Because there are all sorts of companies out there that have money and which can and will step in to do business when we prevent banks from doing it.

Hedge funds using debt-trading strategies honed on Wall Street are expanding at a record pace as they profit from risks big banks are no longer taking.

Read the rest of this entry »

What we have done about banking and what we will do about banking

I KNOW, I know, I’m a shoddy apologist for the banksters and all other neoliberal thieves going. But I do keep trying to point to the effects of things.

I KNOW, I know, I’m a shoddy apologist for the banksters and all other neoliberal thieves going. But I do keep trying to point to the effects of things.

For example, you know we were all told that excessive speculation is what made prices jump around all over the place? And in one market at least, that speculation was stopped:

Trading volumes in sovereign CDS have plummeted as much as 50%, according to traders, four months on from a European Union-wide ban on speculative positions came into force.

Data from Citigroup and the DTCC showed that the net amount of outstanding CDS for all EU sovereigns has sunk 27% from around €124bn in mid-2012 to about €98bn. This follows the ban on “naked” short positions in sovereign CDS – that is positions that are not hedging an underlying position – having kicked in last November.

Read the rest of this entry »

How the piggy bank got it name

WHY is it caalled a piggy bank? Megan Cohen knows (it’s nothing to do with pigs):

In [the Midde Ages], when the question of where to keep money arose, people didn’t typically have the option of a local bank. Instead, the answer oftentimes involved keeping their valuables in a vessel made of pygg.

What was pygg, exactly? Pygg, a word with Old English origins, was a type of dense orange clay, popular in Western Europe for its use in the creation of a wide variety of containers, jars, and cups. The common name for these containers was “pygg jars.” As the pygg jars were fairly ubiquitous, they were used for storing a variety of items, including money.

Pigs and banking fits, doen’t it?

Why don’t we all move our bank accounts more often?

WHY don’t we all move our bank accounts more often? It’s one of these very strange things about the British economy. We’ve a number of national banks. It’s easy enough to move one’s bank account yet very few of us do so. But we all also complain interminably about how the bastard banks rip us off.

Read the rest of this entry »

Posted: 9th, November 2012 | In: Money | Comments (3)

The stupidity of new banking regulations

IT’S said of Generals that they’re always ready to fight the last war. That they would have been just perfect at fighting WWI in 1939, that in 1914 they knew just how the Crimean War should have been done. But at least they did actually work out how to deal with the last one: this is more than can be said for the people trying to reform banking right now.

IT’S said of Generals that they’re always ready to fight the last war. That they would have been just perfect at fighting WWI in 1939, that in 1914 they knew just how the Crimean War should have been done. But at least they did actually work out how to deal with the last one: this is more than can be said for the people trying to reform banking right now.

European banks will be forced to split out risky business such as proprietary trading under proposals set out in a report on how to make the region’s lenders safer.

The report produced by a European Union advisory group, chaired by Bank of Finland Governor Erkki Liikanen, recommends a series of changes to the way banks are structured and funded to make it easier for them to be wound down if they get into trouble.

Under the proposals, proprietary trading, which involves banks attempting to profit from trading using their own shareholders’ funds, will in future have to be placed within a separate legal vehicle to ensure that it poses no risk to a lender’s deposit-taking business.

Read the rest of this entry »

You want to bash the bankers? Move your bloody bank account you fool!

I’LL admit to being a little confused about this campaign:

I’LL admit to being a little confused about this campaign:

Angry bank customers have been voting with their wallets and bombarding co-ops, building societies and credit unions with applications for current accounts over the past week, after the NatWest computer meltdown and the Barclays rate-rigging scandal.

Data compiled by the campaign group Move Your Money UK shows an explosion in requests to switch from large high street banks to smaller alternatives that consumers hope will take a more ethical approach. Charity Bank, which lends its savers’ money to charities, has seen a 200% increase in depositors; the Ecology Bank has had a 266% jump in applications; and Triodos, a Bristol-based “sustainable bank”, a 51% increase.

Read the rest of this entry »

Posted: 11th, July 2012 | In: Money | Comments (2)

What to do when a bank wrongly deposits millions in your account

TWO stories on banking errors. The first involves the €18m deposited into Laura Hughes’s bank account. Hughes, of Athenry, Co Galway, was surprised to see the new balance in her Ulster Bank account of €18,099, 425.99 – a figure that includes the 35c she had saved before the windfall.

TWO stories on banking errors. The first involves the €18m deposited into Laura Hughes’s bank account. Hughes, of Athenry, Co Galway, was surprised to see the new balance in her Ulster Bank account of €18,099, 425.99 – a figure that includes the 35c she had saved before the windfall.

Hughes moved €9,000 into another account. She thought about buying a new Nissan Micra car. She says her “gut instinct wouldn’t let me do it”. Then the bank shut down her account. How fair is that? They make the error and hen forcibly close your account?

Read the rest of this entry »

Posted: 7th, May 2012 | In: Money | Comments (8)

Brussels spouts more nonsense on bankers’ pay

THE latest nonsense coming out of Brussels is this, on bankers’ pay:

THE latest nonsense coming out of Brussels is this, on bankers’ pay:

Austrian centre-right MEP Othmar Karas has called for an end to massive bankers’ bonuses, which in some cases amount to 10 times the basic salary.

“We are looking at a set limit,” Karas told the parliament’s economic affairs committee in Brussels on Thursday (12 April). He explained that under his model, bonuses should not surpass a ratio of one-to-one on fixed salaries.

Now maybe it’s a good idea that bankers’ bonuses should be restricted. Maybe it’s not: I happen to think not but that’s just my view.

Read the rest of this entry »

Why Banking Regulation Doesn’t Work

WE’D all like it to work, obviously. We’d really rather prefer to have a few bureaucrats stopping them from going bust than having to throw hundreds of billions at them every generation for sure.

WE’D all like it to work, obviously. We’d really rather prefer to have a few bureaucrats stopping them from going bust than having to throw hundreds of billions at them every generation for sure.

However, the problem seems to be that such regulation doesn’t actually work:

The Financial Services Authority (FSA) has conceded that it was outwitted by hedge funds who realised that the bank’s loan book could not be as healthy as stated by the figures using the International Financial Reporting Standards (IRFS).

The regulator’s report found the “anticipation that large loan loss provisions might arise…. was highly relevant to the collapse in confidence in RBS in autumn 2008. And while this confidence effect was general across the banking system, RBS was particularly affected because of market concerns that its loan portfolio might be of relatively poor quality.”

But rather than blaming the “speculators” the FSA agreed their view was correct. “This perception of relatively poor loan quality (compared with some, but not all, other banks) was confirmed post facto by the scale of RBS’s provisions in 2009 and 2010,” it found.

This isn’t confined to the UK and the FSA either. Germany spent even more cleaning up their banking system than we did ours, Eire famously allowed the banks to bankrupt the entire country and in the US the SEC was just as gobsmacked as everyone else.

Read the rest of this entry »

Finding Complete Bollocks In The Guardian: Banking Balls

NO, no, I know, it’s not a total surprise is it, finding something in The Guardian which is simply complete, total and utter bollocks. And yes, it’s in the comments section but it is still important. Important both for who said it and for who believes it.

NO, no, I know, it’s not a total surprise is it, finding something in The Guardian which is simply complete, total and utter bollocks. And yes, it’s in the comments section but it is still important. Important both for who said it and for who believes it.

Of course banks handle deposits, but as anyone who has reviewed rates available to depositors for the last few years will know just how contemptuous banks have been of those who wish to use their services for this purpose. There is good reason for that: banks do not (and never have) needed depositors for enable them to make loans. The simple fact is that the money banks lend is created by them out of thin air. It’s offensively easy for them to do so. All that happens when someone asks for a loan is to credit a current account with the amount of the loan and debit a loan account with the same sum. That’s it: that is how 97% of all money in the UK is created, but as is clear, deposits play no part in that process. Instead banks literally create the cash they lend and can get away with this trick so long as people think they’re good for their promise to pay – which they will be so long as, as is now the case, the government clearly considers them too big to fail and explicitly and implicitly guarantees all they do. The insult to the injury is that having made this cash out of thin air they then charge heavily for it – vastly more than they pay for deposits. No wonder an organisation that can costlessly create what it sells is so profitable.

Bob Diamond acknowledges none of this, and the fact that much of the profit he and his colleagues supposedly generate is effectively licenced to them by the fact that the government has failed to claim for itself the right to he profit made on the creation of money; money which only the state can legitimise, but which banks have claimed for thei own benefit and which they have used to speculate at considerable social cost to society at large, as Adair Turner and others have noted.

Read the rest of this entry »

Posted: 4th, November 2011 | In: Money | Comments (5)

Maybe We Finally Get to Jail A Banker: The MF Global Dream

ARE we about to finally jail a banker? That would be nice, wouldn’t it? finally being able to sling into prison a banker or two?

ARE we about to finally jail a banker? That would be nice, wouldn’t it? finally being able to sling into prison a banker or two?

And it really could happen too. No, not because they lost all our money playing silly buggers with houses and the like, not because they’ve been lending money to Southern European spivs.

Rather, a company called MF Global has just gone bust. Used to be part of the Man Group (same people who brought us the Man Booker prize for books) but was sold off in 2007. Not exactly a really sexy company, it was a futures broker more than anything else. Basically ye people who took your phone order and went and did the actual trade for you if you wanted to lose your money in pork bellies and the like.

They brought in the ex-head of Goldman Sachs (and then Senator and Governor of New Jersey), a bloke called John Corzine, who decided to make it a much more sexy company. Instead of just processing orders for other people and taking a few cents on each, they’d start playing in futures with their own money and make fortunes!

Read the rest of this entry »

Posted: 1st, November 2011 | In: Money | Comment (1)

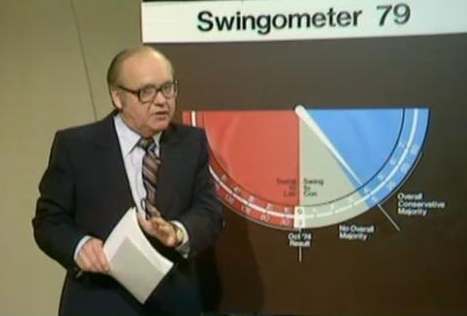

Bankers Awed And Humbled By BBC Election Speculation

BANKERS are today waking up to the realisation that the country is much changed. City workers are furious – and a little bit impressed – that the media is now the most speculative British industry.

BANKERS are today waking up to the realisation that the country is much changed. City workers are furious – and a little bit impressed – that the media is now the most speculative British industry.

Says one Goldman Sachs worker:

“I thought our predictions based on the flimsiest premises and half-baked statistics were irresponsible but watching the BBC’s election coverage has brought it back to me just how far the City has to go to catch up with a Jeremy Vine.”

Read the rest of this entry »

Taxpayers Pay Bankers For Advising On Failing Bankers

BECAUSE no-one at the Treasury has a clue how the City works, the failures in the grey suits hired the failures in the pinstripe suits to advise them:

BECAUSE no-one at the Treasury has a clue how the City works, the failures in the grey suits hired the failures in the pinstripe suits to advise them:

Four City investment banks have charged the Treasury at least £9 million in fees for advising the Government on how to stop the financial system from imploding, The Times has learnt.

In addition, UK Financial Investments (UKFI), the body set up to handle the Government’s bailed-out bank shares, spent £1.2 million of taxpayers’ money in the first five months of operation. It is believed that most of the money was spent on salaries for the handful of officials who operate UKFI, which is designed to be at arm’s length from the Government. UKFI is understood to have low costs outside salaries partly because it uses rooms within the Treasury as its headquarters.

The Treasury hired a swath of investment bankers for advice on how to stabilise the financial system and avert the collapse of more lenders. It also sought advice on how to help investment banks purge themselves of billions of pounds worth of bad debt on their balanace sheets.

Come the revolution, Gordon Brown will set up a department and a Revolution Czar…

Posted: 8th, June 2009 | In: Money | Comment (1)

Spanish Bank Pays Workers Not To Work

BBVA, Spain’s second largest bank, is letting staff to take five years paid leave to cut costs during the recession.

BBVA, Spain’s second largest bank, is letting staff to take five years paid leave to cut costs during the recession.

Instead of bank workers, customers will be met with a recorded voice that invites them to press button after button before picking a song that drives them insane.

Five years later the customer dies. But the bank lives.

Read the rest of this entry »

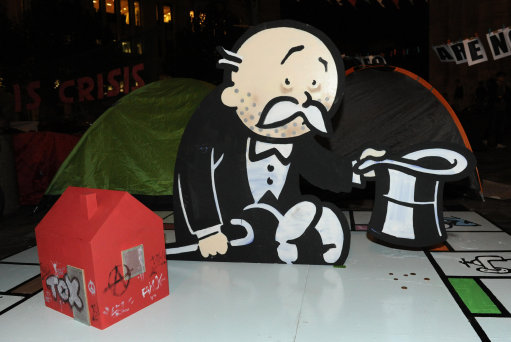

The BNP Punishes The Banking Pigs

RICHARD North looks at how the BNP is trying to capitalise on the banking crisis:

RICHARD North looks at how the BNP is trying to capitalise on the banking crisis:

You could pick any number of issues. Take, for instance, the latest terrorist threat, the effects of unrestrained immigration from the EU, or perhaps the insanity of votes for prisoners, driven by the European court of human rights.

Read the rest of this entry »

Posted: 10th, April 2009 | In: Politicians | Comments (2)

Russian Bank Hires Strippers

TO the Unibank, Russia, where your deposits and withdrawals – ooooh, missus – are serenaded by a gyrating stripper and her gyrating stripper chums in an effort to drum up new custom..

TO the Unibank, Russia, where your deposits and withdrawals – ooooh, missus – are serenaded by a gyrating stripper and her gyrating stripper chums in an effort to drum up new custom..

Read the rest of this entry »

Posted: 20th, March 2009 | In: Key Posts, Money, Photojournalism | Comment

How British Bloggers Ignore The Banking Crisis

BANKING crisis. What banking crisis. Anorak covers the matter, but not everyone does:

Well, a quick sample has Ian Dale looking at an arcane issue on the constitution. Tim Worstall, whose blog has a reputation for economic comment, deals with the vexed question of mothers of struggling families who are shunning ready meals and buying cheaper fresh food as the credit crunch squeezes household budgets.

Worstall, incidentally, is press officer for UKIP, but do not look to that party’s website for anything either.

Then Devil’s Kitchen laments the loss of a blogger – in his usual foul-mouthed way – while Conservatives Home features the official Conservative Party blog. CH is to be congratulated on finding the only political blog worse than the UKIP website.

Strangely, Guido Fawkes does deal with the financial crisis. In an economically illiterate piece, he notes that the government can flood markets with liquidity “but that won’t can’t fix insolvency” – seemingly unaware that we have a liquidity crisis, not a solvency crisis. He should stick to his tittle-tattle.

MP Nadine Dorries, fêted by the chatterati, has not posted since Thursday, when she was eulogising over David Cameron. “He will be a great man, has all the qualities needed to become the next Churchill, my own personal political hero,” she writes.

Archbishop Cranmer looks at a plan to renew Britain – if we have one left after this week – while the Spectator Coffehouse blog does … Mandelson. Not a sheep does allotments – we’ll need those – and Daniel Hannan gets annoyed about the EU using this crisis “to adopt a series of deeply integrationist new measures while not even attempting to enforce free competition among its members.”

New media – same old bollocks. Until the new Anorak is come…

Posted: 6th, October 2008 | In: Reviews | Comments (12)