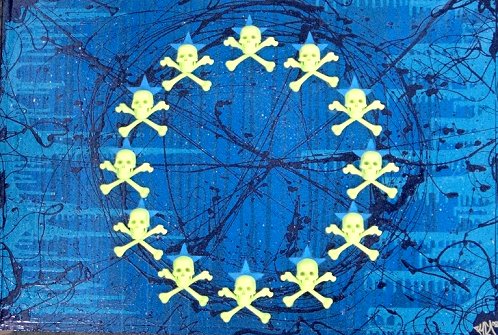

Posts Tagged ‘euro’

Your Eurozone crisis data point of the day – uncertainty kills us all

IF the euro were to fall apart the longer term repercussions would almost certainly be positive. The Southern countries would be free of the straitjacket of being forced to try and act like Germans.

IF the euro were to fall apart the longer term repercussions would almost certainly be positive. The Southern countries would be free of the straitjacket of being forced to try and act like Germans.

However, the getting from here to there is the difficult part. And as an example of quite how difficult it would be, here’s what Shell is doing right now:

Mr Henry is cited as saying that the Anglo-Dutch oil major would rather deposit $15bn of cash in non-European assets, such as US Treasuries and US bank accounts.

The firm is forced to keep some money in Europe to fund its operations, but is keeping the bulk of its reserve liquidity out of the eurozone to avoid growing macroeconomic risk, the report said.

Read the rest of this entry »

The euro continues to Fall Apart: six of 17 member screws over by the currency

SO. We had Ireland go bust when they made the single most stupid decision of the last decade: to guarantee all the debts of all of their banks. Those debts having been caused by too low an interest rate for the economy, that single interest rate that a single currency necessarily causes, as a result of being in the euro.

SO. We had Ireland go bust when they made the single most stupid decision of the last decade: to guarantee all the debts of all of their banks. Those debts having been caused by too low an interest rate for the economy, that single interest rate that a single currency necessarily causes, as a result of being in the euro.

Portugal went bust and needed a bailout simply because the single interest rate made it too easy for the government to borrow oodles of cash to blow.

Read the rest of this entry »

Posted: 6th, July 2012 | In: Money | Comments (4)

This latest euro bailout won’t work either – here’s why

THE last couple of years have been something of a sad sight: we keep seeing the EU stumbling from one attempt at correcting the euro mess to another without ever quite reaching the point where they’ve solved it. This is essentially because there are only three solutions: break up, inflation or fiscal union (also known as Germany paying for Spain, Italy, Portugal and Greece). None of those options appeals to enough people to be enacted.

THE last couple of years have been something of a sad sight: we keep seeing the EU stumbling from one attempt at correcting the euro mess to another without ever quite reaching the point where they’ve solved it. This is essentially because there are only three solutions: break up, inflation or fiscal union (also known as Germany paying for Spain, Italy, Portugal and Greece). None of those options appeals to enough people to be enacted.

Read the rest of this entry »

Greece votes and Spain gets it – Spain’s bond yield kills the euro

IT was supposed to be that if the “right” Greek party won the election then the pressure would be off Spain and Italy: for the euro would be saved.

IT was supposed to be that if the “right” Greek party won the election then the pressure would be off Spain and Italy: for the euro would be saved.

The “right” party in Greece being anyone other than Syriza essentially, as the other two that had even a hope (Pasok and Ne Democracy) have already agreed that they’ll do the right thing and keep Greece paying its debts and in the euro.

So, that happened: New Democracy squeaked past Syriza and the euro is saved! Spain is safe!

That’s Spain’s 10 year bond yield at 7.1 per cent according to Bloomberg’s composite data.

Ooops!

Read the rest of this entry »

Posted: 18th, June 2012 | In: Money | Comment (1)

Well, Greece is screwed whichever way it turns

LOOKS like any which way Greece tries to turn it’s screwed. If they try and stay in the euro then they’re screwed by a decade or more of this internal devaluation, this austerity. Things would get better if they leave, after the horrible shock of actually leaving.

LOOKS like any which way Greece tries to turn it’s screwed. If they try and stay in the euro then they’re screwed by a decade or more of this internal devaluation, this austerity. Things would get better if they leave, after the horrible shock of actually leaving.

Read the rest of this entry »

The euro is doomed, doomed I tell ‘ee

THERE’S been much head scratching about what’s going to happen to the euro. Will anyone manage to get thumb out of bum in time to actually save the thing (pretty simple to do, just get the ECB to print a few trillion euros and set off some nice inflation) or is it going to collapse in a heap?

THERE’S been much head scratching about what’s going to happen to the euro. Will anyone manage to get thumb out of bum in time to actually save the thing (pretty simple to do, just get the ECB to print a few trillion euros and set off some nice inflation) or is it going to collapse in a heap?

The betting is now that Greece is going to go: Chase puts it at a 75% odds. Paul Krugman is similarly gloomy:

Some of us have been talking it over, and here’s what we think the end game looks like:

1. Greek euro exit, very possibly next month.

Read the rest of this entry »

Posted: 14th, May 2012 | In: Money | Comments (4)

Why The Eurozone Is Screwed: Blame The European Central Bank

EVER wonder why the European economy is screwed?

EVER wonder why the European economy is screwed?

No, it’s not just the euro itself, not just the insane idea that 17 different nations could all share the same currency and the same interest rate. There’s also human agency involved. A large part of it is the fault of the European Central Bank.

Here’s Milton Friedman:

But when Anna Schwartz and I examined the history of that period in detail, we found that the situation was very different. In the United States from 1929 to 1933, the quantity of money declined by a third. Similarly in Britain, it declined till 1931, when Britain went off the gold standard. In France, the reason the contraction kept on until 1936 was because France insisted on staying on the gold standard and kept the money supply declining. To go back to the United States, at all times from 1929 and 1933, the Federal Reserve had the power and ability to have prevented the decline in the quantity of money and to have increased the quantity of money at any desired rate.

So in our opinion, the Great Depression was not a sign of the failure of monetary policy or a result of the failure of the market system as was widely interpreted. It was instead a consequence of a very serious government failure, in particular a failure in the monetary authorities to do what they’d initially been set up to do.

A bit wonkish, agreed, but the basic point being made is that if the amount of money in circulation starts to fall then the economy is going to fall, contract, along with it. So the first thing you have to do as a central bank is make sure that the money supply doesn’t fall.

Read the rest of this entry »

Yes, Europe’s Going Bust!

YES, Europe’s Going Bust! I think we all pretty much knew this was happening, there have been enough stories about it just recently. But it does really rather look like Europe really is going bust.

YES, Europe’s Going Bust! I think we all pretty much knew this was happening, there have been enough stories about it just recently. But it does really rather look like Europe really is going bust.

Eurozone finance ministers will on Monday night begin a frantic search for new sources of capital to boost the area’s main bailout fund to €1 trillion after the US and emerging powers refused to commit fresh funds at the G20 summit last week.

Here’s the thing you need to understand. That €1 trillion bail out fund, the one that’s going to save everyone and everything. They want to go and borrow the money for that €1 trillion bail out fund. And no one wants to lend them the money: quite wisely really.

Read the rest of this entry »

Posted: 7th, November 2011 | In: Money | Comments (3)

If The Euro Fails, Europe Fails: Hurrah!

ANGELA Merkel tells us that if the euro fails then Europe fails: to which the correct response is Hurrah!

ANGELA Merkel tells us that if the euro fails then Europe fails: to which the correct response is Hurrah!

Germany’s chancellor Angela Merkel today warned that the failure of the euro would lead to the fall of Europe as she outlined a plan to bail out Greece’s stricken economy.

However, rather sadly, this isn’t in fact true. If the euro fails it does not mean the failure of Europe, nor even of the European Union. It means just the failure of a particular idea of it. Sadly here can be a matter of taste of course: I’m so eurosceptic I’ve even stood as a UKIP candidate, a position that I’m aware quite a lot of you won’t share.

Read the rest of this entry »

Saving the Euro Could Bankrupt France

THIS saving the euro thing is decidedly difficult you know. The latest news is that if France does what might be necessary to save it, then France itself might go bust.

THIS saving the euro thing is decidedly difficult you know. The latest news is that if France does what might be necessary to save it, then France itself might go bust.

The U.S. ratings agency said late on Monday it may slap a negative outlook on France’s Aaa rating in the next three months if the costs for helping bail out banks and other euro zone members stretch its budget too much.

The warning, which sent the risk premium on French government bonds shooting up to a euro lifetime high, came as European Union leaders are preparing measures to protect the region’s financial system from a potential Greek debt default.

So here’s what the problem is. So Greece defaults, lots of banks lose money. Boo Hoo. But then maybe Ireland, Portugal will default? Still just Boo Hoo really. But, and here’s the biggie, this then puts pressure on Spain and Italy and if they default then the entire banking system goes down in flames.

Read the rest of this entry »

Good Sense On The Euro, Finally

IT’S not been all that fun watching our Lords and Masters running around like headless chickens over this euro crisis.

All along there’s been only a few viable solutions. The first is that those who shouldn’t be in the euro should bugger off out of it. But that would be a retreat from “ever closer union” and so wasn’t going to happen. The second is that pots and pots of money should be taken off Germans and sent the Mediterranean types.

Read the rest of this entry »

Posted: 22nd, July 2011 | In: Money | Comments (6)