Money Category

Money in the news and how you are going to pay and pay and pay

The euro continues to Fall Apart: six of 17 member screws over by the currency

SO. We had Ireland go bust when they made the single most stupid decision of the last decade: to guarantee all the debts of all of their banks. Those debts having been caused by too low an interest rate for the economy, that single interest rate that a single currency necessarily causes, as a result of being in the euro.

SO. We had Ireland go bust when they made the single most stupid decision of the last decade: to guarantee all the debts of all of their banks. Those debts having been caused by too low an interest rate for the economy, that single interest rate that a single currency necessarily causes, as a result of being in the euro.

Portugal went bust and needed a bailout simply because the single interest rate made it too easy for the government to borrow oodles of cash to blow.

Read the rest of this entry »

Posted: 6th, July 2012 | In: Money | Comments (4)

We have not been exporting manufacturing Jobs – it’s the machines, dummy

WE have not been exporting manufacturing jobs. Richard Sennett, a professor of sociology at LSE and professor of social science at MIT, writes in the Guardian:

WE have not been exporting manufacturing jobs. Richard Sennett, a professor of sociology at LSE and professor of social science at MIT, writes in the Guardian:

It’s no mystery why Europe is short of work. Save on its northern rim, Europe 30 years ago began exporting manufacturing jobs to other parts of the world

I do worry about the old Alma Mater at times you know. This is one of the senior professors at the place I did my economics degree. And it is difficult to be more wrong than this and still have the intellect to walk and fart at the same time.

Read the rest of this entry »

Posted: 5th, July 2012 | In: Money | Comments (2)

This latest euro bailout won’t work either – here’s why

THE last couple of years have been something of a sad sight: we keep seeing the EU stumbling from one attempt at correcting the euro mess to another without ever quite reaching the point where they’ve solved it. This is essentially because there are only three solutions: break up, inflation or fiscal union (also known as Germany paying for Spain, Italy, Portugal and Greece). None of those options appeals to enough people to be enacted.

THE last couple of years have been something of a sad sight: we keep seeing the EU stumbling from one attempt at correcting the euro mess to another without ever quite reaching the point where they’ve solved it. This is essentially because there are only three solutions: break up, inflation or fiscal union (also known as Germany paying for Spain, Italy, Portugal and Greece). None of those options appeals to enough people to be enacted.

Read the rest of this entry »

Bob Diamond strikes to the heart of The Establishment

WITH the style and grace of a petulant Italian footballer, the quitting Chief Executive of Barclays Bank, Bob Diamond is going all out to bang it into the back of the Bank of England’s net today, according to the Guardian.

WITH the style and grace of a petulant Italian footballer, the quitting Chief Executive of Barclays Bank, Bob Diamond is going all out to bang it into the back of the Bank of England’s net today, according to the Guardian.

There are many other targets in Diamonds sights.

The Guardian says Diamond, who yesterday resigned from Barclays one time sponsors of the UK soccer Premier League, was expected to fight tooth and nail for his reputation when he today appears before a powerful committee of MPs.

Read the rest of this entry »

Posted: 4th, July 2012 | In: Money | Comment (1)

Nell Diamond tweets Bob Diamond’s survival

BOB Diamond’s daughter is called Nell Diamond. She is one letter off being a tribute act to Neil Diamond. Nell’s in the news because her dad has resigned his job as head scapegoat at Barclay’s, and she told George Osborne and Ed Miliband to “go ahead and #HMD”.

BOB Diamond’s daughter is called Nell Diamond. She is one letter off being a tribute act to Neil Diamond. Nell’s in the news because her dad has resigned his job as head scapegoat at Barclay’s, and she told George Osborne and Ed Miliband to “go ahead and #HMD”.

HMD, we learn, is an abbreviation for Hold My Dick.

Read the rest of this entry »

Crazy Bob Diamond’s signed – now blame Ed Miliband and Ed Balls for the LIBOR mess

SO. Bob Diamond has done it, resigned as CEO of Barclays, fallen on his sword and signed on for the dole we assume.

SO. Bob Diamond has done it, resigned as CEO of Barclays, fallen on his sword and signed on for the dole we assume.

However, there’s a lot more to come out about this LIBOR rigging scandal than most seem to realise at the moment. For example, we’ve got Ed Balls running around the place insisting that there must be a full, judge led, inquiry into what really happened. Ed Milipede seems to be shouting for the same thing.

Read the rest of this entry »

What newsnightis Paul Mason talking about? BBC economics editor is ignorant about economics

I FIND this very difficult to understand. Paul Mason is the economics editor for Newsnight at the BBC. And yet he appears to know very little about the subject of economics. I’ve not lived in Britain for decades so I’m not really sure whether this is normal for the BBC or not. He tells us that this generation is going to be poorer than the last one:

I FIND this very difficult to understand. Paul Mason is the economics editor for Newsnight at the BBC. And yet he appears to know very little about the subject of economics. I’ve not lived in Britain for decades so I’m not really sure whether this is normal for the BBC or not. He tells us that this generation is going to be poorer than the last one:

This generation of young, educated people is unique – at least in the post-1945 period: a cohort who can expect to grow up poorer than their parents.

Either he’s got some very secret information about what future economic growth is going to be like or he’s spouting nonsense.

Read the rest of this entry »

Posted: 2nd, July 2012 | In: Key Posts, Money | Comments (2)

Facts state Obama and Democrats save the US economy and reduce debt

WHO wins on the US economy? Richard J. Carroll analyses the US Presidents since Harry S. Truman:

Five out of six Democrats reduced the national debt as a percentage of GDP, while four out of six Republicans raised it. The story is similar on budget deficits, with five of the top six performances recorded by Democrats and four of the bottom five recorded by Republicans. With respect to GDP growth, three of the top four performers were Democrats and four of the bottom five were Republicans. In reducing the poverty rate, the top three were Democrats and two of the bottom three were Republicans. The Democrats also had a better record on employment. Republicans had better records on reducing inflation, achieving four of the top five performances, while Democrats had four of the bottom five showings. Republicans also did well in lowering tax revenue as a percentage of GDP, claiming the top five spots.

Read the rest of this entry »

Barclay’s all our fault say Labour – Lord Tunnicliffe confesses

BARCLAYS banks greed and bad practice is Labour’s fault. This was always fairly obvious but now someone has come out and said it:

BARCLAYS banks greed and bad practice is Labour’s fault. This was always fairly obvious but now someone has come out and said it:

Lord Tunnicliffe, Labour’s deputy chief whip, accepted that his party was responsible for gaps in the law left by the financial regulation regime introduced under Gordon Brown.

His remarks undermined the demands of Ed Miliband, his party’s leader, for a criminal investigation into alleged wrongdoing at Barclays and other banks. During a House of Lords debate on the scandal, Lord Tunnicliffe, speaking for the Opposition, said: “Criminal sanctions are extraordinarily difficult to bring about because of the burden of criminal law.

“It is fair to say though that you can’t find them in the current legislation. And, yes, OK, it’s our fault.” He added quickly: “I hope my leaders don’t hear me say that.”

That what was going on was not illegal is indeed the fault of those who wrote the laws which governed the City. That it was going on without the regulators finding out or doing anything if they did is also obviously the fault of those who wrote the regulations and hired the regulators.

Read the rest of this entry »

Barclay’s and Conning Libor – what really happened

YOU’LL have seen the stories all over the place about Barclay’s ‘fessin’ up to having tried to manipulate Libor.

YOU’LL have seen the stories all over the place about Barclay’s ‘fessin’ up to having tried to manipulate Libor.

Just as background, Libor is the rate at which banks lend to each other. It’s also the rate at which huge numbers of financial contracts are set by. Libor plus 3% wouldn’t be unusual for a commercial loan for example. So, if Libor is wrong then the interest rates on those tens of trillions (maybe hundreds of trillions) of other contracts are also wrong.

And we know that Barclay’s tried to manipulate that Libor price. Sometimes in order to try and make money on those tens (or hunreds) of trillions of contracts and sometimes just to make the bank itself look less risky in the Crash.

Read the rest of this entry »

Posted: 28th, June 2012 | In: Money | Comments (2)

Video Games are now hiring economists

I KNOW, I know, it’s not quite what you would think is a sensible idea four years after the Great Financial Crash. But video games companies are starting to hire economists to help them design the games.

I KNOW, I know, it’s not quite what you would think is a sensible idea four years after the Great Financial Crash. But video games companies are starting to hire economists to help them design the games.

Here’s one such job ad. They really are looking for an academic economist to help them work out how to write the rules for the games.

This isn’t though to do with Angry Birds and the like. This is about the big online games where there are thousands, perhaps millions, of players. Certain of the games companies have got seriously out of their depth here. Once you start introducing money into the games, the ability to find gold, use that gold to buy powers or attributes, even feed real money in to buy gold, then you’re facing all of the same problems that central banks do in the real economy.

Read the rest of this entry »

Posted: 27th, June 2012 | In: Money, Technology | Comment

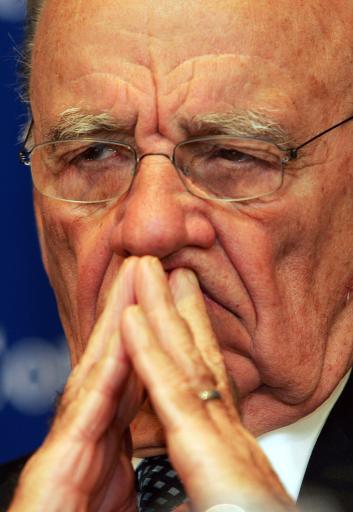

Is Rupert Murdoch going to split up News Corporation? Yes. Probably

THERE are several stories around today that Rupert Murdoch is warming to the idea of splitting up News Corporation. This isn’t a new thing at all: it’s that Rupe is warming to it that is:

THERE are several stories around today that Rupert Murdoch is warming to the idea of splitting up News Corporation. This isn’t a new thing at all: it’s that Rupe is warming to it that is:

Rupert Murdoch’s News Corp could be split into two companies, separating its publishing assets from its entertainment arm, it has been claimed.

Sources say a final decision on the New York-based firm had yet to be made, but that Murdoch was warming to the idea.

The real point behind this is that newspapers (and to some extent book publishing) are a dying business. Films, TV and satellite however are vigorously growing ones. There’s no real reason why the two should be inside the same company. And good reasons why they should not. Quite apart from anything else, sweating out the last profits from a dying business is a very different thing from making the needed investments to enable a growing one to continue growing.

Read the rest of this entry »

Why we should increase banking bonuses at RBS / NatWest

YES, isn’t it a quite lovely fuck up at RBS/NatWest at the moment? The entire computing systems messed up as a result of someone trying to improve them. The answer is, of course, that we should increase the bonuses paid within the bank.

YES, isn’t it a quite lovely fuck up at RBS/NatWest at the moment? The entire computing systems messed up as a result of someone trying to improve them. The answer is, of course, that we should increase the bonuses paid within the bank.

Not to the people who currently work there, of course. Rather, to the people who are going to come in and take over from those incompetents:

It also occurs to me that the best way for RBS to prevent a reoccurrence of this is to pay Good Money to find and recruit a small number of really good engineers from Google, Amazon, Microsoft etc. (all famed for their uptime and reliability – yes, even Microsoft) and give them free rein to fix software, processes and people. Give them a large, meaty bonus conditional on measurable reliability improvements and comprising a significant proportion of RBS shares. Perhaps this is one case where public and FSA wouldn’t object to large “banker bonuses”.

Read the rest of this entry »

Posted: 25th, June 2012 | In: Money | Comments (2)

Why are the Nigerian email scams so obvious?

WHY are the Nigerian email scams so obvious? Because they’re obviousness acts as a very good idiot filter.

WHY are the Nigerian email scams so obvious? Because they’re obviousness acts as a very good idiot filter.

Amazingly, this useful information comes from Microsoft: something of a first from that organisation:

“An email with tales of fabulous amounts of money and West African corruption will strike all but the most gullible as bizarre,” he writes. “It will be recognized and ignored by anyone who has been using the Internet long enough to have seen it several times. It will be figured out by anyone savvy enough to use a search engine [and] won’t be pursued by anyone who consults sensible family or fiends [that’s Microsoft’s typo], or who reads any of the advice banks and money transfer agencies make available.

“Those who remain are the scammers ideal targets,” the paper proclaims, as “A less outlandish wording that did not mention Nigeria would almost certainly gather more total responses and more viable responses, but would yield lower overall profit.”

The basic argument is this: in order to be able to scam people out of their money you need to be able to find the stupid and gullible people.

Read the rest of this entry »

Posted: 22nd, June 2012 | In: Money | Comments (4)

Jimmy Carr’s tax avoidance was never going to work – here’s why

YES, of course, it’s been a lovely chuckle. Jimmy Carr snarled at Barclay’s for dodging taxes and then is revealed as someone who has been doing his best to do the same. Yes, I know, I know, Polly Tonybee’s kids went to private school, as did Alan Rusbridger’s I think; Ken Livingstone still hasn’t managed to provide a full tax accounting even though the election’s well over. Richard Murphy, the nationally known tax expert, reportedly, has been shown to have used exactly the schemes that he denounced as “tax abuse” in a report for the TUC.

YES, of course, it’s been a lovely chuckle. Jimmy Carr snarled at Barclay’s for dodging taxes and then is revealed as someone who has been doing his best to do the same. Yes, I know, I know, Polly Tonybee’s kids went to private school, as did Alan Rusbridger’s I think; Ken Livingstone still hasn’t managed to provide a full tax accounting even though the election’s well over. Richard Murphy, the nationally known tax expert, reportedly, has been shown to have used exactly the schemes that he denounced as “tax abuse” in a report for the TUC.

It’s all very amusing really, isn’t it? But the question I have about all of this is, well, why are they so damn bad at dodging taxes? Take Carr for example: unless he’s about to do something very strange indeed then he’s not actually been able to dodge any tax. He’s delayed having to pay it, yes, this is true, but not actually dodged it.

Read the rest of this entry »

Would you prefer Zuckerberg or the KGB has your information?

WOULD you prefer Zuckerberg or the KGB has your information? I think this might be the worst business plan I’ve seen yet this year. Worse than the Harriet Harman Valentine’s Day Mask, worse than the Wayne Rooney version of Trivial Pursuit (that was not about Wayne, but limited to questions the authors thought Wayne might be able to answer). The Kremlin is to launch its own online network:

WOULD you prefer Zuckerberg or the KGB has your information? I think this might be the worst business plan I’ve seen yet this year. Worse than the Harriet Harman Valentine’s Day Mask, worse than the Wayne Rooney version of Trivial Pursuit (that was not about Wayne, but limited to questions the authors thought Wayne might be able to answer). The Kremlin is to launch its own online network:

The Kremlin is planning to create its own Facebook-style social network, where users with personal accounts will be able to upload content and discuss the issues of the day.

Read the rest of this entry »

Posted: 20th, June 2012 | In: Money, Technology | Comments (4)

Let’s blame the economic collapse on Jimmy Carr and Take That

HAVING shone a harsh light on Jimmy Carr’s tax affairs, the Times leads with “Taxman v Take That”. No, not a fight to the death – in which case we’d place a fiver on Take That – rather news that Gary Barlow, Howard Donald and Mark Owen, three of the group’s members, invested “at least £26m in a “scheme that…is a mechanism for tax avoidance“.

HAVING shone a harsh light on Jimmy Carr’s tax affairs, the Times leads with “Taxman v Take That”. No, not a fight to the death – in which case we’d place a fiver on Take That – rather news that Gary Barlow, Howard Donald and Mark Owen, three of the group’s members, invested “at least £26m in a “scheme that…is a mechanism for tax avoidance“.

The Times believes that Carr and Mark Owen’s private tax matters are important enough to be front-page news.

It’s all about loans: the client loans money into a scheme, in Take That’s instance, one run by Icebreaker Management Services, who then loans the money back to the client’s companies. As a loan, the money is not liable for tax.

Read the rest of this entry »

Barroso blames it all on America – only the German banks went bust first

SO, Barosso, the President of the European Commission has this to say about the current euro disaster:

SO, Barosso, the President of the European Commission has this to say about the current euro disaster:

“This crisis was not originated in Europe … seeing as you mention North America, this crisis originated in North America and much of our financial sector was contaminated by, how can I put it, unorthodox practices, from some sectors of the financial market.”

Which is interesting because it’s complete tosh.

Read the rest of this entry »

Posted: 19th, June 2012 | In: Money | Comment (1)

Tax avoider Jimmy Carr says tax avoiders are pigs killing the country (video)

JIMMY Carr is best known for his jokes about Rupert Murdoch contracting genital diseases from a demonic louse. In other news, Jimmy Carr is on the front page of the Times (prop. R Murdoch), the subject of a story about tax avoidance.

JIMMY Carr is best known for his jokes about Rupert Murdoch contracting genital diseases from a demonic louse. In other news, Jimmy Carr is on the front page of the Times (prop. R Murdoch), the subject of a story about tax avoidance.

Alexi Mostrous writes:

Thousands of wealthy people in Britain pay as little as 1 per cent income tax using “below the radar” accounting methods, part of a tax avoidance industry that costs the country billions of pounds.

Tax loopholes are not always accidents. Whisper it: they are part of the tax structure. They might even be deliberate:

An investigation by The Times into tax avoidance begins today with the exposure of a single Jersey-based scheme that shelters £168 million a year from the taxman. Jimmy Carr, the comedian who performed for the Queen at the Diamond Jubilee celebrations this month, is understood to be the largest beneficiary of the K2 tax scheme.

Read the rest of this entry »

Posted: 19th, June 2012 | In: Celebrities, Money | Comments (3)

Greece votes and Spain gets it – Spain’s bond yield kills the euro

IT was supposed to be that if the “right” Greek party won the election then the pressure would be off Spain and Italy: for the euro would be saved.

IT was supposed to be that if the “right” Greek party won the election then the pressure would be off Spain and Italy: for the euro would be saved.

The “right” party in Greece being anyone other than Syriza essentially, as the other two that had even a hope (Pasok and Ne Democracy) have already agreed that they’ll do the right thing and keep Greece paying its debts and in the euro.

So, that happened: New Democracy squeaked past Syriza and the euro is saved! Spain is safe!

That’s Spain’s 10 year bond yield at 7.1 per cent according to Bloomberg’s composite data.

Ooops!

Read the rest of this entry »

Posted: 18th, June 2012 | In: Money | Comment (1)

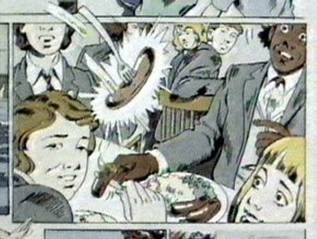

Victory for Martha Payne: politicians and media screw bureaucrats

YOU may or may not have been aware of the story of young Martha Payne. 9 year old up in Jockland who started posting pictures of her school lunches to her blog. You know the sort of thing, still live haggis with deep fried neeps. A decent backgrounder here.

YOU may or may not have been aware of the story of young Martha Payne. 9 year old up in Jockland who started posting pictures of her school lunches to her blog. You know the sort of thing, still live haggis with deep fried neeps. A decent backgrounder here.

But what you really want to read is this and this. How Argyll and Bute banend her from taking pictures in the dinner hall.

The first is the response of some twattish jobsworth in the union or the bureaucracy snarling at the temerity of anyone at all critiquing their serving up of whatever the hell is easiest for them.

Read the rest of this entry »

UK Uncut are ignorant idiots says Judge

UK Uncut are ignorant idiots says a Judge. While we knew this it’s interesting to get the conformation from a senior and respected retired judge. He didn’t put it in quite these words of course, but that is the gist of his message.

UK Uncut are ignorant idiots says a Judge. While we knew this it’s interesting to get the conformation from a senior and respected retired judge. He didn’t put it in quite these words of course, but that is the gist of his message.

We all remeber UK Uncut going off on one about how Vodafone dodged £6 billion in tax. The problem is that’s not really quite what happened. As the National Audit Office report released today points out:

Sir Andrew Park’s overall conclusion is that the settlement reached was a good one and represented fair value for the wider taxpaying community. Had the Department not reached a settlement, the case would have gone to litigation. In Sir Andrew Park’s opinion, company D had a good chance of winning both of its two arguments: the motive test defence and the Cadbury Schweppes defence. If it had won on either of these, the outcome would have been that it had no tax liability at all relating to subsidiary D’s interest income.

Read the rest of this entry »

Justin Bieber’s perfume sold to Elizabeth Arden: is he being ripped off?

JUSTIN Bieber’s perfume, Justin Bieber’s Girlfriend, has been sold to the company Elizabeth Arden. All seems fair enough on the face of it, brands change hands all the time.

JUSTIN Bieber’s perfume, Justin Bieber’s Girlfriend, has been sold to the company Elizabeth Arden. All seems fair enough on the face of it, brands change hands all the time.

However, there’s a little wrinkle to it. The company which used to distribute it, Give Back Brands, is supposed to be a non-profit. And as far as we know it’s not just the profits of the manufacturing company, but also the profits of the personality behind the brand, which are given to charity.

Read the rest of this entry »

Posted: 13th, June 2012 | In: Celebrities, Money | Comments (5)

So We Should Stop Wind Turbine Subsidies Immediately

THERE’S a report out, a briefing note if you prefer, from the Grantham Institute, about just how lovely onshore wind power is. You can read it in full here if you like. It’s the usual sort of piffle we’ve come to expect from these sorts of people. Everything’s just great as long as we ignore all of the costs and shuffle them off to the side there and ignore them.

THERE’S a report out, a briefing note if you prefer, from the Grantham Institute, about just how lovely onshore wind power is. You can read it in full here if you like. It’s the usual sort of piffle we’ve come to expect from these sorts of people. Everything’s just great as long as we ignore all of the costs and shuffle them off to the side there and ignore them.

But there is one point they make which really, really annoys. If what they say is true then we should immediately stop any form of subsidy to wind power. But I’m sure they would be entirely horrified if anyone actually suggested this.

What they say is that wind power is pretty much competitive with gas fired ‘leccie already. And it really really will be in only a couple of years.

Read the rest of this entry »

Posted: 12th, June 2012 | In: Money | Comments (3)

Don’t Build the High Speed Railway from London to Birmingham!

IT’S just so lovely when you trun out to be right, isn’t it? Gilligan’s got a piece showing that the cost benefit calculation for the HS2 high speed train from London to Brum is entirely cock:

IT’S just so lovely when you trun out to be right, isn’t it? Gilligan’s got a piece showing that the cost benefit calculation for the HS2 high speed train from London to Brum is entirely cock:

But the internal DfT report, “Productive use of travel time and the valuation of travel time savings for business travellers,” says that most of these supposed gains are illusory. It says that the DfT is relying on the “unsupportable” assumption that time spent on trains is unproductive and demands “major changes” to the “1960s” method used to calculate the HS2 business case. No such changes have been made.

With laptops, wi-fi and smartphones now making long-distance train carriages an extension of the office, the actual amount of extra work produced by HS2 may be almost nil, the researchers find.

In order to make it wortwhile building something like this there has to be some benefit. To someone, somewhere. And the assumption has been that by getting to places faster all those lovely highly paid people in first class will be able to do more work. Less time just sitting on a train and more time doing something.

Read the rest of this entry »

Posted: 11th, June 2012 | In: Money | Comments (2)