Money Category

Money in the news and how you are going to pay and pay and pay

Churches Targeted In China’s Quest For Metal

IT seems that even the good Lord himself is powerless to stop thieves pilfering his many sacred homes across the land. According to the Independent, churches are increasingly being targeted by thieves eager to cash in on the current boom in scrap metal.

With demand for lead and copper increasing at a phenomenal rate, fuelled by China’s rapidly growing industry, one church a day across Britain is being robbed, with bells, lightning conductors and even entire roofs being nicked by ungodly criminals.

Ecclesiastical Insurance say they have received 500 claims, worth a total of £750,000, in the past 14 month alone, with many of these claims made for repeated thefts from the same churches.

Chris Pitt of Ecclesiastical says: “We’ve seen a marked worsening in the situation in the past year. These aren’t opportunists doing this. We had a three-tonne bell taken from outside a church. If they’ve stolen £2,000 worth of lead, that can have caused £50,000 worth of damage to the church.”

Inspector Stuart Edwards of South Yorkshire Police is equally concerned. Says he: “Between April 2006 and April 2007 we’ve had in the order of 20 attacks on churches.

“The crux of the matter is that thieves pay no heed to what type of premises it is. The problem with churches is that they’re often isolated so we don’t get people regularly reporting suspicious events to us. If we get a couple of prosecutions under our belts, it’ll act as a deterrent.”

Or maybe God is hoping to clean up on the insurance.

The End Of The Cheque Book

No More Cheque And Balances

FAST forward twenty years into the future to one of those cheesy TV nostalgia shows and you’ll probably see some nodding head, say Paul Ross, droning on about the chequebook on ’I Love 2007’.

“Weren’t they so naff?” he’ll quip. “People used to say ‘the cheque’s in the post’ and actually mean it!” How we’ll laugh.

With Argos joining the likes of Asda, Boots, Next and Currys in announcing plans to stop customers from paying by cheque, time is fast running out for the humble and once rather handy chequebook.

According to Argos, the fact that only 1 per cent of customer transactions currently involve cheques has forced the company to withdraw the facility from all of its 68 stores in the UK and Ireland, starting from July 28.

Supermarket giant Sainsbury’s is also reported to be reviewing their policy of accepting cheques, as the credit and debit card revolution continues. Indeed, according to bank payments body Apacs, consumers wrote a total of 4.9 million cheques in 2006, down from 5.3 million in 2005 and from 11 million in 1990.

But Help The Aged are worried by the trend. A spokesman says: “Cheques are the preferred way of handling money for quite a lot of older people. When a retailer stops accepting cheques, it takes away their choice.”

Fortunately for many of the more affluent OAPs, John Lewis, Marks & Spencer and Waitrose currently have no plans to phase out the use of cheques at their stores.

Who knows, like vinyl records, traditional gents barbers and pie and mash, the chequebook may become a must-have retro item for the fashion-conscious shopper.

Watch this space.

Posted: 18th, June 2007 | In: Money | Comments (2)

Lord Falconer’s Supreme Court At A Supreme Cost

THE Government’s plans to set up a new US-style Supreme Court is set to cost over £100million.

THE Government’s plans to set up a new US-style Supreme Court is set to cost over £100million.

Lord Falconer has revealed that the bill for converting the Middlesex Guildhall into the new all-powerful court will top £63million; the cost of furnishing the new courts with top-grade furniture, a vast library and computer equipment will add an extra £20million on the cost.

Additionally, the lower courts, currently based in central London, will move to Isleworth in the west of the capital, at a further cost of over £18million.

The court, which will be the highest in the land, is due to open in 2009.

However, many critics, including Tory Shadow Constitutional Affairs Secretary Oliver Heald, are not happy. Says he: “The Supreme Court will consist of the same people as the current Law Lords. They will simply be sitting in a building less than 300 yards away.

This move will cost a staggering £100million in set-up costs and millions more in running costs. Lord Falconer has clearly learned nothing from his attempt to run the Millennium Dome.”

The Millennium Dome?

Are there to be jugglers, fire-eaters and acrobats performing in the new courts?

Knowing what we do about High-Court judges and what they like to get up to, there’ll no doubt be plenty of hired entertainment, fun and wonderment for one and all at their new home.

Keep Off Barney Baloney’s Bubbles

IT’S difficult to champion the cause of a children’s entertainer.

IT’S difficult to champion the cause of a children’s entertainer.

They are inherently creepy. Yet in the case of 47-year-old Tony Turner, even his ‘crazy’ outfits and ‘wacky’ sense of humour can’t discourage us from sympathising with the former DJ.

You see, central to Barney Baloney’s (Turner’s ‘stage name’) act is a common-or-garden bubble machine. It forms the exciting climax of his show.

But no more. When Tony/Barney rang insurance companies for his public liability insurance this year, he was refused cover due to the apparent danger caused by the bubble machine.

A frustrated Tony/Barney tells us: “I rang six insurance companies in all and was turned down by every one. One even said some councils had banned bubble-making machines because they thought the soapy bubbles were lethal.”

A spokesman for the Association of British Insurers explained that there may have been accidents in the past involving children slipping on floors and that “insurance companies will look at the risk an activity presents when pricing for insurance premiums, usually by looking at past experiences”.

But Tony/Barney remains unhappy. Says he: “This whole health and safety business has gone too far. Kids eat jelly and ice cream and that gets on the floor and is slippy. Does anyone want to stop them eating that?”

That for later.

For now, the actors’ union Equity did eventually agree to insure Tony/Barney’s act. After taking advice he has decided to ditch the bubbles for good, leaving him with, in his own words, “a gallon of soapy solution”.

Posted: 14th, June 2007 | In: Money | Comments (2)

Working Families Cheated By Tax Credits

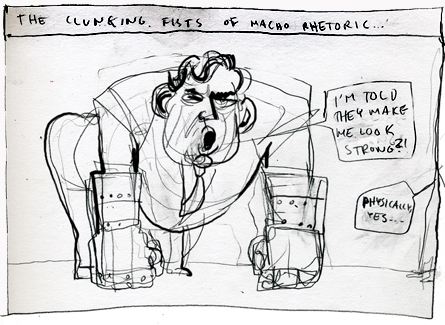

AS Gordon Brown prepares to take over as PM, one of his pet projects, the tax credits scheme, has come under even more fire, this time from former Labour minister Frank Field. (Pic: Poldraw)

AS Gordon Brown prepares to take over as PM, one of his pet projects, the tax credits scheme, has come under even more fire, this time from former Labour minister Frank Field. (Pic: Poldraw)

The scheme has been plagued by poor organisation, frequent overpayments and widespread fraud, but now, Field, in association with the think-thank Reform, has launched a damning critique of a system he claims “brutally discriminates” against two-parent families.

The study states that a single mother working 16 hours a week, after tax credits, earns a total weekly income of £487, while a two-parent family on the minimum wage would have to work 116 hours to earn the same amount.

Not surprisingly, the Treasury has been quick to deny the claims. A spokesman says: “Levels of financial support are determined by need – based on the number of children in the family and the household’s income. As a result of measures introduced by the Government, since 1997 households with children in the poorest fifth of the population are on average £3,500 better off per year in real terms.”

Still, Field’s claims that the present system is discouraging single parents from finding a partner or marrying will come as a major embarrassment to Brown in his final days as Chancellor.

What with rising interest rates, inflated mortgages and now this tax credits controversy, Gordie’s legacy is looking far less impressive these days. Bet he can’t wait to move next door to No. 10.

Posted: 14th, June 2007 | In: Money | Comments (2)

Channel 4 Hardly Pays At All In ‘You Say, We Pay’ Scam

FOLLOWING the highly embarrassing ‘You Say, We Pay’ phone shenanigans on the Richard and Judy show, a repentant Channel 4 vowed to offer refunds to cheated callers and give all the unclaimed cash, which was expected to run into hundreds of thousands, to London’s Great Ormond Street Hospital.

FOLLOWING the highly embarrassing ‘You Say, We Pay’ phone shenanigans on the Richard and Judy show, a repentant Channel 4 vowed to offer refunds to cheated callers and give all the unclaimed cash, which was expected to run into hundreds of thousands, to London’s Great Ormond Street Hospital.

However, according to the Sun, the channel has only donated a paltry £50,000 so far, despite the fact that only 3,000 people have claimed their money, with technical problems complicating the refunding process.

With allegations suggesting that around £32,000 a week was scammed out of players on the £1-a-call quiz, the £50,000 payment to Great Ormond Street, while better than nothing, still looks extremely miserly.

In responding to the claims, Channel 4 said that the £50,000 was an “ interim payment” and that more would a) follow, b) not follow, c) be forgotten about.

Posted: 14th, June 2007 | In: Money | Comment (1)

MoD Spend More On Dog Food Than On Feeding Soldiers

A BRITISH soldier’s lot is not an easy one, whatever your views are on the war in Iraq. (Pic: Beau Bo D’Or)

A BRITISH soldier’s lot is not an easy one, whatever your views are on the war in Iraq. (Pic: Beau Bo D’Or)

While politicians play war games from the comfort of their plush offices, soldiers are out on the battlefield, doing their leaders’ dirty work, often with inadequate armour, sub-standard weaponry and now it appears, without even a dog’s dinner in their stomachs.

Tory MP, Mike Penning, has obtained figures which show that a measly £1.51 a day goes on meals for troops, substantially less than the £2.63 which goes on food for military dogs. Indeed, even prisoners cost more to feed, at £1.87 a day.

Penning also claims that American soldiers are being fed high quality mean while British troops are forced to make do with cheap sausages and chips.

Says he: “‘I cannot believe that soldiers are risking their lives daily for the country, but are not being fed properly. I have spoken to a number of mums who are being forced to send out food to their hungry sons. When I was in the army, my mum sent me a cake but that was as a treat.”

However, an MoD spokeswoman has disputed Mr. Penning’s claims, arguing that “It costs significantly less to feed a dog than a person on operations. The mess rate for across all service personnel is £1.51 a day. It varies for dogs as it depends on the size of the dog and the nature of the work. But it works out at roughly 78p a day for an ammunition dog and £1.20 for a patrol dog. “

An ammunition dog? Don’t tell me they’ve started firing man’s best friend at the enemy?

Posted: 14th, June 2007 | In: Money | Comments (3)

Halifax Highlight Poor Home Security

‘THE Modus Operandi of a Burglar’ may sound like the title of a thrilling novel, but instead it’s the rather overly dramatic title of a new report sponsored by Halifax Home Insurance.

One suspects the author of said report, criminologist Martin Gill, got a little carried away with himself.

The study, conducted by Gill in association with Halifax, looked into home security in the UK and its findings will give the humble burglar quite a boost.

According to the report, 34 per cent of householders who do have an alarm fitted, rarely actually activate it; 33 per cent of neighbours presume that if an alarm is going off, it’s due to a fault in the electronics; 65 per cent of householders surveyed also confessed to regularly leaving windows ajar and doors unlocked.

Even more worryingly, burglars have apparently become highly skilled operators, learning such complicated skills as disabling alarms, dismantling patio doors and forcing open sash windows.

Professor Gill says, “This report shatters any preconception that burglary is an ‘unskilled’ crime. Indeed, the invention and attention to detail shown by this group of burglars shows that they are indeed extremely professional in the way they go about making your home their business.”

It almost makes you want to take up the profession yourself.

Posted: 13th, June 2007 | In: Money | Comments (2)

Stonycroft Is The Village Of The Damned

TIRED of high-pressure city living? Thinking of upping sticks and moving to the peace and quiet of the countryside? Well, before you make any rash decisions, you’d be advised to take a look at a new report from Liverpool University.

The study, written by Dr Francine Watkins and Ann Jacoby, and published in the ‘Health and Place’ journal, paints a rather less-appealing picture of rural living, where prejudice is rife and stress levels are surprisingly high.

Watkins spent three months undercover in a mystery village somewhere near the M40, which the report calls ‘Stonycroft’.

Working as a barmaid in the pub as well as joining the local Women’s Institute, Watkins came across a sizeable proportion of locals who have been shunned or isolated by locals for being the proverbial ‘only gay in the village’, having an affair or even for simply being a single woman.

Watkins says, “Public health practitioners should consider the problems of stigma and social exclusion sometimes faced by individuals in the rural idyll.”

Gay sex, affairs and single women? Sure she wasn’t watching reruns of Brookside…

Posted: 13th, June 2007 | In: Money | Comment (1)

Pinewood Profits Drop: James Bond In Catch 22

THE famous Pinewood Shepperton studios, birthplace of such classic films as The Red Shoes, The Ipcress File, Casino Royale and, erm, Basic Instinct 2, has been warned that delays to a number of major productions will seriously affect profits this year.

THE famous Pinewood Shepperton studios, birthplace of such classic films as The Red Shoes, The Ipcress File, Casino Royale and, erm, Basic Instinct 2, has been warned that delays to a number of major productions will seriously affect profits this year.

Cazenove, the house broker, lowered its pre-tax profit forecast for the film studios by a significant 13 per cent and now expects profits for 2007 to reach £8.5million, over £1million short of its previous target of £9.7million.

Pinewood chief executive, Ivan Dunleavy, is disappointed with the figures but blames delays to a number of projects.

Says he, “It is a setback, but it’s a timing shift and nothing more than that. As we have said in the past, it’s difficult to predict when particular productions will commence production. We have contracted a number of productions, they will start slightly later in 2007 than expected but they will be staying slightly longer in 2008.”

Ever since Pinewood was floated on the stock market three years ago under chairman Michael Grade, the company has been plagued by financial difficulties. However, Mr Dunleavy is optimistic about the future, pointing to Pinewood’s fast-growing television business.

Upcoming productions include the next James Bond blockbuster, with the working title Bond 22.

Sexism And The City For The Apprentice

WHILE The Apprentice contestant Katie Hopkins may have done herself no favours, Sir Alan Sugar’s scrutiny of her family and childcare situation belied a sinister sexism which still thrives in the City and indeed, all over the country.

According to new figures released yesterday, over 1,000 women a day are launching equal pay lawsuits, with many of the new cases being instigated by low-paid public sector female workers.

The rise of quicker tribunals and more ‘no-win, no-fee’ legal firms, along with European rules which now allow women to claim up to six years’ back-pay, have all triggered this enormous increase in lawsuits.

Helen Beech of Clarkslegal says, “Previously, equal pay tribunals saw cases last years, which made them costly for individuals and perhaps deterred them. But no-win, no–fee lawyers and the fine-tuning of the process mean cases can be pursued over a short period with minimal financial risk.”

An estimated 50,000 female council workers and an additional 10,000 in the NHS have now taken action, with the total bill estimated to reach £10billion.

Why can’t they just be grateful they have a job? And make us all a cup of coffee…

Posted: 13th, June 2007 | In: Money | Comments (2)

Mobility Scooters And Golf Carts Taxed By EU

AH, those Europeans, with their foreign ways and meddling little foreign hands. Now they have meddled with that practical if not fashionable form of transport, the mobility scooter.

AH, those Europeans, with their foreign ways and meddling little foreign hands. Now they have meddled with that practical if not fashionable form of transport, the mobility scooter.

The scooter, which has given many an elderly or disabled person a new lease of life, has been targeted by EU bean counters, who have decided to slap import duty on the vehicles, most of which are imported from Taiwan and China.

Until now, the scooters have been exempt from VAT for disabled users as well as being free of customs duty. But the introduction of an import duty has raised fears of a £250 price hike on the scooters, which currently cost around £2,500 each.

Ray Hodgkinson of the British Healthcare Trades Association is unimpressed by the ruling which he says treats the scooters as – get this – “go-karts”, albeit appalling slow ones. Hodgkinson also warns that the tax could end up bankrupting a number of companies.

The tax apparently comes on the back of suspicions that the scooters were being used as golf buggies.

Last one to the first green’s an arthritic old cripple…

Posted: 12th, June 2007 | In: Money | Comments (2)

More Mortgage Misery As Houses Become A Luxury

THINGS don’t seem to be getting any easier for homeowners and for those trying to get a foot on that increasingly elusive first rung of the property ladder.

According to the Council of Mortgage Lenders, mortgages are at their least affordable level for 15 years right now, as the recent spate of interest rate hikes start to kick in.

In April, first-time buyers were paying 18.7% of their income for mortgage interest payments, a significant rise on the 16.3% paid the previous year.

If that wasn’t bad enough, an increasing number of first-time buyers are also having to contend with stamp duty. Indeed, 58% of virgin homebuyers had to pay the tax in April, a rise of 7% on the previous year’s figures.

Unfortunately, CML bigwig Michael Coogan doesn’t see things improving for a long time. Says he: “Month on month we see affordability constraints for first-time buyers worsening, and with the impact of May’s interest rate rise still to be felt, many borrowers face higher costs in the coming months.”

It seems that the simple, basic common-or-garden house has now become a luxury item.

The Great British Car Sale Continues With Jaguar And Rolls-Royce

WITH MG and Rover sold to the Chinese, Bentley pawned off to Germany’s Volkswagen and Rolls-Royce and Mini snapped up by BMW, it now looks as though Jaguar and Rolls-Royce will become the latest Brit motoring icons to be sold off.

WITH MG and Rover sold to the Chinese, Bentley pawned off to Germany’s Volkswagen and Rolls-Royce and Mini snapped up by BMW, it now looks as though Jaguar and Rolls-Royce will become the latest Brit motoring icons to be sold off.

The decision by the struggling US car manufacturer Ford to put the famous British car operations up for sale has left union leaders fearing the worst for their workforce.

Ford reported a loss of $282million for the first three months of 2007 are currently undergoing major restructuring with the two iconic car companies deemed to be surplus to requirements.

20,000 jobs in total could go if the two companies are snapped up by asset-strippers and Dave Osborne of the Unite union is deeply concerned. Says he: “We find it difficult to understand why Ford would want to sell a successful, growing and environmentally improving brand like Land Rover. We are very concerned to hear these reports and we are seeking an urgent meeting with Jaguar and Land Rover. Our prime concern is the job security of our members.”

Expect the Sinclair C5 to be next.

£2 Hayfever Pill Too Expensive For NHS

NOTHING beats the great British Summer – the wasps, the Henmania, the inedible barbeques and of course, the hayfever.

Yet the NHS could have the cure to this annual affliction in the form of wonder drug Grazax. However, the new treatment, which could help transform the lives of the estimated 10 million hayfever sufferers in the UK, is being denied to patients because of a lack of NHS funds.

So far, the majority of NHS trusts have refused to fund the new £2-a-day pill, which works by building up the body’s tolerance to the protein in pollen which irritates the immune system.

A spokesman for Allergy UK says, “The hayfever season is getting longer and the condition can be very debilitating. This pill is very effective and it should be available. We need to see more funding for it.”

But with the drugs rationing watchdog NICE yet to consider Grazax for approval, each individual NHS trust has been left to decide whether or not to fund the drug, with the majority seemingly not interested.

Another summer of coughs and sneezes awaits us.

Posted: 12th, June 2007 | In: Money | Comments (2)

Britain Paying For Domestic Bliss

THEY were once the exclusive preserve of the very wealthy and the aristocracy, but now it seems that even commoners, apparently too lazy to clean their own house, are hiring domestic staff.

THEY were once the exclusive preserve of the very wealthy and the aristocracy, but now it seems that even commoners, apparently too lazy to clean their own house, are hiring domestic staff.

A new survey from Barclays has revealed that one in ten households in the country employs some kind of domestic help with 82 per cent of those who use household staff hiring cleaners, followed by 30 per cent who employ gardeners, 17 per cent who hire nannies and 16 per cent who apparently get someone in to “do the ironing”. (Is “do the ironing” a euphemism for something else? Although a euphemism for what exactly, I have no idea.)

The main reason given for using outside help in running a household is, not surprisingly, a lack of time as long working hours minimise the amount of leisure time available.

Indeed, 70 per cent of the lazy sods who hire domestic staff claim they don’t have time to the housework while 36 per cent admit they simply want to do other things.

A spokesman for Barclays Premier Banking says: “Long gone are the ‘upstairs downstairs’ days of domestic staff which were the preserve of the nobility. In the 21st century we are all trying to cram as much into our lives as possible and will think nothing of taking on the help we need to do this.”

We’re turning into a nation of lazy overweight coach potatoes. Well, at least those of us not employed as ironers are…

Posted: 12th, June 2007 | In: Money | Comments (4)

Scotland The Poor

A NEW report by the Federation of Small Businesses has put Scotland at the bottom of a list of 10 similar-sized countries in terms of its economic performance.

Countries with populations under nine million, such as Norway, Iceland and the Republic of Ireland were included in the study which focused on employment rates, health and education as well as overall economic performance.

The report blamed Scotland’s atrocious health and life expectancy statistics for the low ranking, with Scottish men living to 74.2 on average, over two years shorter than the UK average and Scottish women living to 79.3 on average, just under two years below the national average.

FSB Scotland’s Andy Wilcox warns Scottish politicians of the challenge ahead. Says he, “Coming as it does so soon after the election of an SNP government, this year’s index shows the new First Minister Alex Salmond will have his work cut out for him if he is to match reality with his aspiration of making Scotland healthier, wealthier and fairer”.

The report also ranked Glasgow City as the worst performing local authority north of the border, with the poorest record in terms of mortality, education and employment. But worst of all, it spawned Lorraine Kelly.

Posted: 11th, June 2007 | In: Money | Comments (2)

I Nd Bck Up: Northamptonshire Police Text For 02

HAVE things really come to this for the humble Bobby? In an effort to reduce the spiralling costs of using walkie-talkies, police have been advised to send each other text messages instead.

HAVE things really come to this for the humble Bobby? In an effort to reduce the spiralling costs of using walkie-talkies, police have been advised to send each other text messages instead.

The new scheme has been introduced in Northamptonshire after the cost of using O2’s new Airwave walkie-talkie system soared from £27,000 to £120,000 in just a year, a huge rise of 400 per cent.

As well as been encouraged to use text messaging, the put-upon Bobbies are also being trained to use fewer words when they really do need to use their walkie-talkies.

Supt Bob Smart said: “Hopefully this will help us reduce the costs to a reasonable figure.” Nope, too many words there, Supt Smart. Try again. Or text us your thoughts instead.

Posted: 11th, June 2007 | In: Money | Comments (4)

Al Hashimi And Kroenke To Check Out Gunners

THE race is on to make Arsenal the latest Premiership giant to succumb to foreign money.

THE race is on to make Arsenal the latest Premiership giant to succumb to foreign money.

With American billionaire Stan Kroenke continuing to sniff around the Emirates stadium, news that Mohammed Al Hashimi, the executive chairman of Dubai-based Zabeel Investments, is pondering a bid for the famous club will no doubt increase the pressure on the Gunners board of directors.

Al Hashimi originally had Liverpool in his sights, but after losing out to Americans George Gillett and Tom Hicks, he is now targeting Arsenal, a club already linked to a takeover bid from Kroenke.

The publicity-shy Kroenke’s interest in Arsenal lead to boardroom unrest and the subsequent departure of influential vice-chairman David Dein, the man who brought Arsene Wenger to the club. Since then, Arsenal’s future has looked rather less certain, with question marks hanging over the long term futures of Wenger and star players such as Thierry Henry and Cesc Fabregas.

However, with their new Emirates stadium and strong global image, Arsenal remain a highly attractive proposition and Al Hashimi doesn’t seem to have been put off by his Liverpool failure.

“I know the owners are very reluctant to sell but I see Arsenal as a very profitable club,” says Al Hashimi. “Liverpool was an opportunity which does not come along every day but we have to move on.”

With the financial muscle of the Dubai government behind him, Al Hashimi could well make a tempting offer. However, Arsenal’s board of old Etonians, bluebloods and traditionalists will still need a lot of convincing.

Property Ladder Missing First Rung: Low Housing Stock

WHAT with interest rate rises and inflated house prices, the lot of a first-time buyer is rarely a happy one. Now, to add to their problems, it seems that there aren’t a lot of properties out there anyway.

According to a report by Hometrack, one-bedroom dwellings, often a buyers’ first step on the property ladder, make up only 3 per cent (800,000 properties) of the housing stock in England and Wales. Houses with three or more bedrooms make up two-thirds of the current stock while last year, only 10 per cent of new build homes were one-bedroom.

Hometrack’s director of research, Richard Donnell, said, “The lack of smaller-sized homes, combined with strong demand from investors and first-time buyers, has led to a constant upward pressure on prices at the bottom end of the ladder. This in turn has led to the value of one and two-bed homes being compressed up towards the price of three-bed properties.”

The report also reveals that the price difference between an average three-bedroom property (£194,000) and a typical one-bedroom home (£141,000) has decreased significantly since the early 1990s, when the first rung of the ladder was far more accessible.

Women Getting Wealthier Than Men

IN a report that will have chauvinistic City boys kicking their Porsches in frustration, Barclays Wealth Management predict that women millionaires will outnumber their male counterparts by 2020, when, they claim, 53 of millionaires will be female.

The survey also reveals that female investors are more considered and conservative than their more income-driven and risk-taking male counterparts.

This rise in female economic power is also reflected in the 2007 Sunday Times Rich List, with 92 women making the list, an increase of 11 from the previous year.

Not surprisingly, banks are eager to attract this new female wealth, with Royal Bank Coutts, somewhat patronisingly running fashion weekends and networking events to appeal to rich women. Why don’t they have a cake sale as well? Or invite the Chippendales?

A large proportion of these highly successful businesswomen had their success after giving up work to raise children and then setting up ‘kitchen table’ companies that fit in with their lifestyles. Indeed, according to the London School of Economics, ‘kitchen table tycoons’ or ‘mumtrepreneurs’ have set up businesses with annual sales of almost £4.5billion.

But does all that money really make you happy? Well, erm, yes, according to the Barclays survey, with 80 per cent of women with assets of more than £500,000 claiming that their wealth had brought them greater happiness, with more leisure time, better health and greater job satisfaction. Thought so.

Anneka Rice Challenged Over Charity Show

THE sight of Anneka Rice running around in her trademark yellow jumpsuit piqued many a young boy’s interest in the opposite sex but now the TV icon is at the centre of (an admittedly medium-sized) storm over a charity CD.

THE sight of Anneka Rice running around in her trademark yellow jumpsuit piqued many a young boy’s interest in the opposite sex but now the TV icon is at the centre of (an admittedly medium-sized) storm over a charity CD.

The CD in question, entitled Over The Rainbow, was produced in conjunction with the revamped Challenge Anneka series with proceeds going to the Association of Children’s Hospices.

However, the Sun has revealed that only £2 of the £13.95 price of the collection, which includes contributions from such hum-drum stars as Michael Bolton, Lesley Garret and McFly, is actually going to charity.

The newspaper goes on to quotes an unnamed “reader” who says, “Throughout the show they kept going on about how profits go to charity, and it’s all about good causes. But then to discover that a measly £2 actually goes to the charity is outrageous. That’s less than 15 per cent — if you’re forking out nearly £14 for an album, it would be nice to think most of that money will go directly to the good cause.”

However, a spokeswoman for ITV has refuted the charges, claiming that the £2 in question was a higher donation than normal for a charity CD.

Others megastars on the CD include Duncan James, Curtis Stigers and Bonnie Tyler. It should only cost £2 to begin with.

Posted: 11th, June 2007 | In: Money | Comments (5)

Smoking Ban Hits Bingo: Unlucky For Some

AHEAD of next month’s introduction of the smoking ban, pubs and clubs are steeling themselves for what could be difficult times ahead.

AHEAD of next month’s introduction of the smoking ban, pubs and clubs are steeling themselves for what could be difficult times ahead.

The bingo industry in particular is expecting the ban to have a huge impact, with gambling group Gala Coral admitting that it expects to close around 12 of its bingo clubs if the impact of the ban in England is as severe as it has been in Scotland.

Since the no-smoking law came into effect north of the border, it has been the bingo industry that has suffered the most, with admissions declining sharply and prize money dropping. Additionally, players who would have previously frittered away their cash on the fruit machines during the interval are instead popping outside for a fag.

Gala’s rivals, the Rank Group, has already closed 15 of its 118 clubs since the smoking ban came into effect in Scotland but Gala’s chief executive Neil Goulden is playing a waiting game. Says he: “We will wait for six months and see where we are. We are going to get a drop in spend-per-head. But it is only temporary… Spend-per-head will recover within 12 months.”

However, Goulden, who is also chairman of the Bingo Association, admits that things will get hard for the industry. “We could have 200 clubs closing,” he says, “This could mean an enormous number of job losses and loss of amenity to local communities.”

Unlucky for some…

Posted: 11th, June 2007 | In: Money | Comments (2)

Super-Rich Ignore Green Concerns To Fly Private

DESPITE increasing awareness about global warning and carbon footprints, the uber-rich are eschewing time-consuming security checks, lengthy queues and the great unwashed and choosing to travel by private jet instead.

DESPITE increasing awareness about global warning and carbon footprints, the uber-rich are eschewing time-consuming security checks, lengthy queues and the great unwashed and choosing to travel by private jet instead.

The General Aviation Manufacturers Association has forecasted that worldwide deliveries of new business jets will almost hit the 10,000 mark over the next 10 years, almost double the production rate for the previous decade.

In the past, the USA and Canada have generated the vast majority of private jet sales, last year most orders came from outside North America, with China, Russia and India’s booming economies producing a new demand for high-class air high travel.

Private jets are, apparently, used mainly for high-powered business trips; European air traffic data reveals that Nice, Cannes and, er Mallorca are among the top destinations for ‘business aviation’.

Posted: 9th, June 2007 | In: Money | Comments (3)

Loyalty Kills – Supermarkets Using Cards To Destroy Local Shops

IT may look rather harmless, but to the small local retailer the supermarket loyalty card could be as dangerous as an army of shoplifters.

IT may look rather harmless, but to the small local retailer the supermarket loyalty card could be as dangerous as an army of shoplifters.

According to the Telegraph, supermarkets have been accused of using information taken from customer loyalty cards to identify where they have customers without a local store.

At a Commons Home Affairs select committee hearing into the rise of a ‘surveillance society’ in Britain, former Labour minister John Denham expressed his fear that the information on the loyalty cards was being used in an underhand and negative way by the supermarket giants. Says he: “I may want to shop at a supermarket but I may also want to keep my local district shopping centre. But it’s not being explained to people that this information could be used to put the local shopping centre out of business.”

Loyalty Management Group, which operates Sainsbury’s Nectar card, admitted that the supermarket chain could access data such as where its customers lived and where and when they shopped from the loyalty cards.

However, Tesco’s legal services manager tells MP’s, “The information is used primarily for the benefit of customers but I cannot give you great detail about how our insight teams may use it.”

How very helpful.