Money Category

Money in the news and how you are going to pay and pay and pay

Tesco Take Root In Gardening Sector

TESCO’S quest to takeover Britain continues with news that the supermarket giant is set to buy Dobbies Garden Centres.

The £156million bid has not surprisingly increased fears about the company’s growing dominance in the retail sector. Tesco already enjoys a 30% slice of the UK grocery market while it continues to expand its non-food ranges.

Chairman of the company, Sir Terry Leahy, claims the deal is in keeping with Tesco’s commitment to the environment. Says he: “The increasing popularity of gardening, and in particular the trend towards environmentally friendly products, makes this an attractive sector for Tesco to invest in.”

However, Sandra Bell of Friends of the Earth is having none of it, saying that the deal was “another example of Tesco trying to take over every aspect of our lives”.

Expect Tesco to bid for Friends of the Earth next week.

Posted: 8th, June 2007 | In: Money | Comment (1)

Duncan Cameron Picks Up £200million At Moneysupermarket

THE word ‘recluse’ inevitably conjures up images of bizarre and eccentric characters who live in fear of the world, tucked away hermit-like in some huge country estate behind barbed-wire fences and huge metal gates.

However, more often than not, the word is used by our beloved press to describe any celebrity or wealthy person who doesn’t play the game and open their doors to Hello! or appear regularly in Heat magazine.

Duncan Cameron is one such ‘recluse’, according to the Telegraph, albeit a very very happy and very very rich one at this moment.

The entrepreneur has just sold his stake in price-comparison website Moneysupermarket.com to his estranged partner Simon Nixon, with Cameron picking up more than £200million in the deal.

The two thirtysomethings originally started the company back in 1989 after Nixon persuaded Cameron to give up his computer studies course at Liverpool University to write software for his company.

However, over the years, the relationship turned sour as disagreements over the strategy of the company drove a wedge between them. Indeed, the two uber-rich geeks have apparently not spoken for five years and even hired City lawyers and bankers to thrash out the deal so no contact would be necessary between the two.

Cameron apparently spends his time concentrating on his passion for fine wines and fast cars. Hopefully not at the same time.

Sweet 16: Childless Couple Claim £125,000 In Imginary Children Scam

THERE’S only one thing that makes the Mail fume more than a couple of ‘scroungers’ who have 16 children and claim massive benefits. And that’s a couple of ‘scroungers’ who pretend to have 16 children and claim massive benefits.

THERE’S only one thing that makes the Mail fume more than a couple of ‘scroungers’ who have 16 children and claim massive benefits. And that’s a couple of ‘scroungers’ who pretend to have 16 children and claim massive benefits.

Say hello to ‘gambling addict’ David Wilshaw, 57, and his ‘alcoholic’ partner Nancy Stevenson, 58.

The Mail reports that the troubled twosome started the con when they legally applied for tax credits for two of Stevenson’s genuine children and nobody asked to see any form of identification.

The devious duo then proceeded to conjure up children Brian, Sandra, Gareth, Jason along with a whole coach load of fictitious siblings. Indeed, some of the names they chose were actually quite lovely – Miranda, Edith and Amber all sound like nice, if imaginary, young people.

However, after four years of deception and £125,000 in cash, the couple were eventually arrested at their home in Weston-super-Mare with both pleading guilty to a number of charges of fraud.

The couple, who also admitted to their involvement in various other petty-criminal activities, are set to appear at Bristol Crown Court for sentencing on June 25.

In his defence, an impressively brass-necked Wilshaw bragged that he was “doing a public service” by exposing the loophole. Have we witnessed the arrival of the new Alistair Campbell?

Britons Work Longest Hours

NOW all those massive bonuses pocketed by company directors and chief executives make sense. They can afford them because the rest of us are working are ourselves into an early grave.

NOW all those massive bonuses pocketed by company directors and chief executives make sense. They can afford them because the rest of us are working are ourselves into an early grave.

A report by the International Labour Organisation has revealed that over 600 million people around the world work excessively long hours with us poor Britons working longer than any other rich nation.

Overall, Peru top the rankings, with 50.9 of Peruvians working more than a 48 hour week. South Korea are next with 49.5 per cent while Thailand come in third with 46.7 per cent of their workers putting in overly long hours.

In relation to developed countries, where working hours are usually shorter, Brtions top the rankings with 25.7 per cent of us putting in more than 48 hours a week. Israelis come next (25.5 per cent), followed by Australians (20.4 per cent), the Swiss (19.2 per cent) and workers in the US (18.1 per cent).

Jon C. Messenger, co-auther of the study, has mixed feelings about the findings. Says he: “The good news is that progress has been made in regulating normal working hours in developing and transition countries. But overall the findings of this study are definitely worrying.”

Well, if he’s worried then I think we should all go home half an hour early today. We wouldn’t want to upset him even more.

The Bank Of Mum And Dad: Parents Help With First Steps On Property Ladder

WHERE would we be without our parents? Well, nowhere, obviously.

And while mum and dad can sometimes frustrate, irritate and drive us to despair, when it comes to taking those tentative first steps up the property ladder, often it is our parents who lift us up onto the first rung.

New figures released by the Council of Mortgage Lenders reveal that 46 per cent of first-time buyers under 30 are getting a financial helping hand from relatives, a huge increase on 1995’s figure of 10 per cent.

With an average home now costing seven times the average annual earnings, young people often have no option but to ask their parents for substantial financial help.

Parents in Northern Ireland are the most generous to their children, with 48 per cent of first-time buyers getting a helping hand, while mums and dads in London, where houses are the most costly, rank second, with 44 per cent of fledgling house buyers receiving help.

A CML spokesman warns that the growing involvement by parents in their offspring’s house buying could cause the market to become polarised.

Says he: “The more parents help their children to become homeowners, the higher house prices will be driven, and the more help the next generation of would-be homebuyers will need. The growing tendency for parents and other relatives to help young people become homeowners looks likely to sustain the number of first-time buyers for the foreseeable future.”

Mum and dad, if you’re reading this, I think you are the best parents in the world. By the way, I’ve seen this lovely house with a swimming pool just up the road. And if ever want to see me or the grandkids again…

Posted: 8th, June 2007 | In: Money | Comments (2)

Car Crime: Nigel Dowsett’s Guide To Customer Service

CAR salesmen, like middle-aged trainspotters and Cabinet ministers, seem to have an innate dodginess about them.

But while the majority of those involved in the motor trade are no doubt hard-working and honest as the day is long (probably), the behaviour of one Nigel Dowsett will have done little to improve the image of the industry.

After a customer, Andrew Barber, had changed his mind about purchasing a car from Dowsett’s showrooms in Dorset, the 49-year-old salesman went round to Barber’s house where he proceeded to unleash a tirade of verbal abuse, which culminated in the two mens’ heads colliding.

Barber is reported to have hurt his nose in the clash. Poor dear.

The victim’s wife, apparently more interested in earning a few quid on You’ve Been Framed than protecting her other half, caught the confrontation on video.

Weymouth magistrates court heard that the bad feeling had begun after Barber bought a 2002 Daewoo from Bowsett for £2,750. While Barber was allowed to drive his new purchase away before his cheque cleared, he almost immediately began having trouble with the car, which needed a wheel bearing replaced.

Dowsett then offered the unhappy customer £250 compensation, but Barber decided instead to cancel the cheque and return the car. At which point, all hell broke loose. Although admittedly that is rather over-stating the scale of the incident.

Dowsett was given a two-year conditional discharge and ordered to pay £50 compensation. £50? That’ll teach him.

Reversing Costs Police £2.3million

IT looks like thousands of policemen and women will be dusting off their L-plates and re-applying for their driving tests after it emerged that, over the last three years, officers have caused £2.3million worth of damage to their police cars – by reversing.

The figures, released by 31 different forces in England and Wales under a Freedom of Information Act request, reveal that most of the damage was caused by officers backing into bollards, parking poorly or bumping into buildings. In all, 105 officers were injured in the accidents, with most suffering shock and whiplash.

The figures, which cover the period between 2004 and 2006, are likely to be far higher as Britain’s biggest force, the Metropolitan Police Service, failed to divulge its traffic cock-ups.

With taxpayers forced to pick up the bill because of high insurance premiums and excesses which discourage forces from claiming for the damage, groups such as the Taxpayers’ Alliance are not happy.

Spokesman Corin Taylor says: “If police officers are constantly having minor car accidents, they shouldn’t be so hard on ordinary motorists. If they spent less time in cars and on the beat, they wouldn’t be having these accidents in the first place.”

It’s all a far cry from The Sweeney.

Posted: 7th, June 2007 | In: Money | Comment (1)

Whitehall Scumbags And Errant Fathers

FATHERS who fail to pay child support are to be targeted by a revamped Child Support Agency.

The agency has come under fire for its lack of organisation and failure to collect an estimated £3.5billion in maintenance. But now the Government is eager to crackdown on runaway dads.

Central to the new plans will be the naming and shaming of errant fathers with their details posted on a new-look CSA website. Guilty péres could also be fined and even have their names put on a credit blacklist.

Plans to impose curfews and confiscate passports are also currently being considered.

However, the names will only be published after consent from the mother has been obtained.

A senior Whitehall source says: “We will be writing to the first group of mums to get their permission. These dads are failing to pay maintenance for their kids and causing real hardship and misery. We want to hear what mums think about this. But we believe it is right to let people know what scumbags they are.”

What’s the world coming to – a senior official using the word “scumbag”.

Posted: 6th, June 2007 | In: Money | Comments (4)

Banksy Embraced In Multi-Million Pound Office Development

ONE man’s anti-social graffiti is another’s high art. Just ask self-styled ‘guerrilla artist’ or ‘urban node’, or whatever he calls himself, Banksy.

ONE man’s anti-social graffiti is another’s high art. Just ask self-styled ‘guerrilla artist’ or ‘urban node’, or whatever he calls himself, Banksy.

While talented kids around the country have ASBO’s slapped on them for tagging a wall, the much-celebrated and very wealthy artist du jour is positively encouraged to spray his pseudo-art-jizz all over the country.

Now, even property developers are jumping on the Banksy bandwagon with a major new office and shop development in Bristol incorporating one of his murals rather than destroying it.

The piece entitled The Mild Mild West features a teddy bear about to hurl a petrol bomb at riot police in a really really really clever and ‘subversive’ statement on, erm, the inherent violence in the stuffed toy community.

Gavin Carpenter, of Connolly and Callaghan, which owns the building in Stokes Croft, says: “I think people assumed the worst when they heard about the development. They thought the mural would go. But Banksy is very much the man of the moment and this will bring some kudos to the development.”

And money, of course.

Gary Hopkins of the city council is equally supportive of the artist. Says he: “Where there is good quality street art, other graffiti does not tend to encroach. That’s why we commission various murals around the city.”

But how do you judge whether it is ‘good quality street art’ or graffiti? Maybe it goes something like this – poor black kids make graffiti while rich white men make good quality street art.

Posted: 6th, June 2007 | In: Money | Comments (3)

Beckham For Banknotes Campaign Grows

FOR England fans, it’s like the last 12 months never happened. Golden balls himself has been recalled to the side in a move reeking of desperation by Steve McClaren, Michael Owen is once again looking a pale shadow of his former zippy self and the team in general is hideously under-performing.

FOR England fans, it’s like the last 12 months never happened. Golden balls himself has been recalled to the side in a move reeking of desperation by Steve McClaren, Michael Owen is once again looking a pale shadow of his former zippy self and the team in general is hideously under-performing.

With the Beckham hype machine well and truly back into overdrive, it has once again becoming rather difficult to avoid the star’s chiselled features and soon we may even be forced to look at his bonce whenever we open our wallets.

The former Manchester United star is one of a list of modern sportsmen, musicians and actors to have been put forward by the public as alternatives to the current crop of Britons who adorn the country’s banknotes.

With economist Adam Smith recently taking his place on the shiny new £20 note, critics are bemoaning the huge number of dead, white males on our money, while many are unhappy with Smith’s Scottishness – a spokesman for the Bank of England says, “We are the central bank for the UK. We don’t see why nationality within the UK should be an issue for us.”

According to the list of alternative icons, the British public want to ditch dead white males for, er, living white males instead. As well as Beckham, Robbie Williams, the Beatles (only half dead), Mick Jagger and Jonny Wilkinson are also high on the public’s wish list, as is Jimmy Savile (undead).

Expect Anorak’s choices of Bernhard Manning, Jerry Sadowitz and Nigel the Christian, Chelsea supporting butcher of Old Smithfield Market to get the nod…

Posted: 6th, June 2007 | In: Money | Comments (2)

Gardener Brian Somers Scoops £551,000 On A Fruit Machine

FORGET all that rubbish about gambling addictions and log on to an online casino now! Well, you may well want to after reading this.

Brian Somers, 39, gambled just nine pence on the Party Mega Jackpot game on the PartyCasino.com website but was shocked as six ‘smiley face’ signs appeared which revealed four ‘golden dollars’ and a winning sum of £551,000.

“All of a sudden the screen started flashing, it went berserk”, says Somers, “I thought, ‘I just can’t believe I have won that much from nowt’. I turned the computer off and even unplugged it. I then logged back on and saw $1,092,957.68 on the screen.”

Warren Lush from PartyGaming, which owns the gambling website tells us: “Nobody has ever won a jackpot so huge from such a little amount of money before. These days, what could you buy with 9p — nothing. Not even a cup of tea. We see winners every day but nothing like this.”

Father of one Somers, who currently earns just £200 a week as a self-employed landscape gardener, beat odds of 4,250,000-1 win the record jackpot.

Now, he plans to buy Sunderland season tickets for himself and his six-year-old son.

They’re not that expensive, are they?

Posted: 6th, June 2007 | In: Money | Comment (1)

Working Stiffs: One In Ten Men Downloading Porn At Work

WE all know that men are filthy and rather disgusting creatures. But now it seems that the male of the species is taking his obsession with sex into work with him.

WE all know that men are filthy and rather disgusting creatures. But now it seems that the male of the species is taking his obsession with sex into work with him.

According to Trust and Risk in the Workplace Study, nine per cent of male office workers download porn in the workplace, compared to 4 per cent of women who indulge in web filth.

The biggest vice remains the use of e-mail for office gossip, with men proving to be almost as bitchy as women, with 33 per cent of blokes resorting to e-mail tittle-tattle compared to 35 per cent of their female colleague.

The survey also found that downloading music is a growing office pastime with 31 per cent of men and 19 per cent of women using the likes of iTunes in the office.

According to researcher Dr Monica Whitty, of Queen’s University, Belfast, these web shenanigans can have serious consequences, with laptop users often “oblivious” to the potential security risks of using wireless technology.

“Almost two thirds of our sample would blame their employer if confidential data was stolen from their work computers”, she warns. “Given that security breaches and careless mistakes can lead to the loss or theft of confidential information, employers should be cautious when it comes to protecting confidential data.”

The survey also reveals that Australians are apparently the least likely to download porn at work. They must have enough at home already.

Posted: 5th, June 2007 | In: Money | Comments (3)

Cotswolds Council Eats All The German Pies

POOR old Gerrit and Angela Pies.

Having forked out the substantial sum of £2million for their dream home in the Cotswolds, the German couple have now been told that their Hollywood-style mansion may have to be demolished.

The Pies bought the house from builder Mark Rathbone, who had himself acquired the property for £485,00 in May 2005 before redeveloping it.

However, planning officers are now claiming that the design and size of the project is a radical departure from what had been originally approved, with the new 450sq m floor space over 150sq m more than had been agreed.

Townsfolk are also unimpressed with the mansion’s grandeur. Although they’re probably just jealous. Or suspicious of blow-ins.

The Pies are, not surprisingly, extremely distraught at the situation and have appealed to the council planners, saying, “We completed the purchase in good faith relying upon information supplied and we hope you will accept we are entirely innocent parties caught up in this dreadful situation. We would hope the council will try to avoid punishing us in this situation.”

A decision by the council is imminent. We await the outcome with, only very slightly, bated breath. Whatever bated breath actually means.

Posted: 5th, June 2007 | In: Money | Comments (2)

The £3million One Bedroom London Flat

THE most expensive one bedroom flat ever to go on the market in London is set to fetch over £3million, according to the Daily Mail.

The bizarre price tag put on the Belgravia apartment is, according to property experts, proof that the capital has now become detached from the rest of the country’s housing market because of the massive influx of foreign wealth and spiralling City bonuses.

Despite recent interest rate hikes, property prices went up in London by 2.3 per cent last month while year-on-year, prices have jumped by a huge 15.6 per cent.

So what do you get for your £3million? Well, there’s a large drawing room, a good-sized kitchen and that one solitary bedroom, with en suite bathroom, of course.

What about the neighbours? There’s Liz Hurley, Roman Abramovich and Roger Moore. And David Blunkett’s abode is within walking distance.

Even with only one bedroom, the Eaton Place apartment does boast a floor size of 1,400 square feet, about the average size of a four bedroom flat elsewhere.

Alex Stroud of Savills is non-plussed at the £3million price tag. Says he: “Personally, I would rather buy a wonderful one-bedroom flat than a mediocre two-bedroom flat of the same size. After all, who wants guests to stay?”

Friends? He’s an estate agent…

Posted: 5th, June 2007 | In: Money | Comment (1)

Credit Where Credit Is Due: The ATM Rip-Off

STOP right there! Step away from the ATM machine and put your credit card back in your wallet. That’s what consumer experts are now telling us to do, albeit in a far less dramatic and silly fashion.

STOP right there! Step away from the ATM machine and put your credit card back in your wallet. That’s what consumer experts are now telling us to do, albeit in a far less dramatic and silly fashion.

The advice follows new research which highlights the spiralling costs of withdrawing money from a cash point with a credit card.

The average annual percentage rate (APR) for withdrawing money with a credit card now stands at 23.48%, up a whole 2% from last November. Some greedy companies are even charging customers with poor credit ratings in excess of 46%.

Marc Gander, of the Consumer Action Group, is frustrated at the lack of transparency surrounding credit card charges. Says he: “There is no doubt that the whole business is built of stealth. The consumer does not really know what they are paying.”

While Sean Gardner of MoneyExpert.com warns consumers: “Borrowing cash on your credit card is incredibly expensive and unless it is really necessary we would urge people to think twice before doing it.”

Last year the credit card industry was threatened with legal action by the Office of Fair Trading over its excessive charges.

However, no matter what happens, the sad fact is that banks will always find some way of making even more money out of us.

What’s the alternative?

Posted: 5th, June 2007 | In: Money | Comments (2)

Cash For Honours Probe Costs Pass £750,000

SLEAZE is now as much a part of British politics as Peter Snow’s swingometer or John Prescott’s urbane charm. (Pic: Beau Bo D’Or)

And as the latest investigation into the dark underbelly of Parliament continues to probe, so the costs keep rising.

Scotland Yard has revealed that over £750,000 has now been spent on the ongoing cash-for-honours affair, a sum that includes staff salaries, overtime, equipment and expenses.

The figures were released, somewhat grudgingly, by the police after a Freedom of Information request, with only the overall total figure disclosed.

With three of the main suspects, Lord Levy, Ruth Turner and Sir Christopher Evans all re-bailed pending further inquiries, the cost of whole sordid affair looks set to continue to spiral.

Wonder if the taxpayer can flog a few peerages to balance the books?

Posted: 5th, June 2007 | In: Money | Comment (1)

The Future Of The BT Phone Box

LIKE the few remaining genuine left-wing Labour MP’s, phone boxes have become little more than quaint reminders of a bygone era.

However, despite the ubiquity of the mobile phone, a tiny handful of people still make use of the 64,000 traditional phone boxes across the land. And not just to sleep or lose weight in.

However, despite the ubiquity of the mobile phone, a tiny handful of people still make use of the 64,000 traditional phone boxes across the land. And not just to sleep or lose weight in.

Still, with the boxes struggling to make a decent profit, Ofcom have finally given BT the go-ahead to raise the price of a call from their retro booths.

The move comes after intense lobbying from BT, with the telecoms company arguing that unless it was able to charge some customers more, it would struggle to maintain the network of call boxes.

According to BT, 40,500 of its 63,795 boxes are unprofitable with the number of calls made from BT payphones more than halving in the last three years. In that period, the percentage of consumers using phone boxes has also dropped from three per cent to near zero per cent.

BT’s plans include lowering prices in some areas to try to attract more callers, such as introducing low cost calls to India in areas with high Asian populations.

Considering the hideous stench inside most of the boxes, maybe BT should introduce urinals into their booths as well. It’d make them more useful…

Posted: 5th, June 2007 | In: Money | Comments (9)

City Bosses Paying Less Tax Than Cleaners

WELCOME to Blair and Brown’s Britain, where millionaire City chiefs pay tax at a lower rate than the people who clean their plush offices.

A loophole in the law allows fat-cat chiefs of private equity firms to pay as little as 10 per cent tax on their earnings.

However, in a severe criticism of his fellow bosses, SVG Capital’s Nicholas Ferguson, has brought the issue out into the open.

Says he: “Any commonsense person would say that a highly-paid private equity executive paying less tax than a cleaning lady or other low-paid workers can’t be right. I have not heard anyone give a clear explanation of why it is justified.”

Following Ferguson’s attack, the Treasury has now been forced to finally get off its behind and look at ways of closing the unfair loophole. Although whether they actually do change anything remains to be seen.

The Lib Dem Treasury spokesman, Vince Cable, opines: “It is scandalous that there are many people on low or middle incomes who are paying more and more tax and yet you have very rich people paying only 10 per cent. It is Gordon Brown who has created this, despite supposedly being the father of social justice.”

Private equity firms make their money by borrowing millions to buy underperforming companies, before cutting costs (i.e. sacking half the staff), stripping assets and then selling them for massive profits.

And getting the cleaners in to spruce the place up…

The Path To Prosperity: Suing The Council For Damaged Dog Food Tins

IF you’re short of a few quid and of a litigious bent, then the east of England is the place to be.

IF you’re short of a few quid and of a litigious bent, then the east of England is the place to be.

According to figures acquired by the BBC, councils across the east of the country have spent millions of pounds on compensation for people who have been injured by tripping up on the pavement.

Since 2001, £6million, excluding legal fees, has been paid out by councils to members of the public. Claims include £43,000 for a leg injury and a whopping £3.28 payout after someone fell and dented their dog food tins.

However, Essex County Council was quick to point out that it successfully defends or rejects approximately 82% of claims against it.

Norman Hume of Essex County Council says: “It’s fair to say there’s an increasing compensation culture at play.” His council will “spend a record amount this year in Essex, something close to £75m on maintenance of our roads and footways”.

Barry Gibbs, of pressure group Taxpayers Alliance, says: “There’s an issue about what councils are paying out and whether they have robust enough procedures to check on the authenticity of claims.

“There needs to be clearer guidelines from central government on what are legitimate claims because ultimately all the cheques are signed by the taxpayer.”

I can feel a severe case of repetitive strain injury coming on…

In For A Penny: Ken Bates Back In Charge Of Leeds

BAD Santa, Ken Bates, has regained control of ailing giant Leeds United following a recount of votes taken at last week’s creditor’s meeting.

BAD Santa, Ken Bates, has regained control of ailing giant Leeds United following a recount of votes taken at last week’s creditor’s meeting.

The famous club, that reached a Champions League semi-final only six years ago, have seen their fortunes plummet, culminating in the club being put into administration and suffering relegation to the First Division in May.

After putting the club into voluntary administration with debts of £35million, the 75-year-old Monaco-based millionaire required 75% of creditors’ votes to buy back the club.

While a number of other consortia were apparently interested in purchasing the Yorkshire outfit, the former Chelsea bigwig can now move ahead with his plans to pay creditors just 1p in the pound of debts owed.

KPMG’s joint administrator, Richard Fleming, says: “I am satisfied that, in voting to accept this proposal, the creditors have approved a solution that allows the club to plan ahead for next season, reduced uncertainty for all those with an interest in Leeds United, provided some return to creditors and avoids liquidation.”

Bates originally bought a then debt-ridden Chelsea for £1 back in 1982. How’s that for inflation?

Posted: 4th, June 2007 | In: Money | Comment (1)

Illegal Bank Charges: The Test Case

ON rumbles the bank charges row. However, this time it’s those lovely banks that are planning a court case.

The financial bigwigs are reported to be considering taking a legal test care to finally end the ambiguities over claims for, apparently, ‘illegal’ bank charges.

A number of judges have been pleading with the banks to resolve the whole issue and clarify the law in the High Court, and now their wishes may be granted.

Following last month’s ruling in favour of Lloyds TSB over a customer who was claiming for ‘illegal’ bank charges, the whole situation remains somewhat up in the air.

However, with experts sceptical about the current Office of Fair Trading investigation into bank charges, it could fall to a test case at High Court level to once and for all clarify everything.

Campaigners estimate that the charges are worth over £4.7billion a year to the banks.

Posted: 4th, June 2007 | In: Money | Comments (6)

NHS Neglect: £20 to See Your Doctor In The Evening (Bring Wine)

IS this the beginning of the end of the NHS as we know it?

A group of family doctors is ready to propose a fee of £20 to be charged for evening or weekend appointments. Fears are rising that the founding principles of our health service are set to be fatally undermined.

The £20 charge, which will be proposed at an upcoming British Medical conference, is in response to recent calls for family doctors to justify their hefty salaries, which have jumped to an average of £106,000 per annum.

In 2004, new GP contracts saw 90 per cent of family doctors opt out of providing care in the evenings, at weekend and on Bank Holidays. But with agency doctors and local hospital filling the gaps, patients are growing increasingly unhappy at not being able to access their own GP.

Michael Summers, of the Patients Association, says: “The conditions that people suffer from out of hours are just the same as those they suffer from during the day. Why should they have a second-rate service? I have been campaigning for some time for the out-of-hours service to be overhauled. People will die otherwise.” (Presumably Summers isn’t threatening to murder people himself if he doesn’t get his way.)

However, Andrew Green, a Yorkshire GP, is all for the new charge. He tells us: “They are going to be people in employment, almost by definition, and to ask them to bear the extra costs seems reasonable. I do not think a fee of £15 to £20 would be exorbitant. This should not be paid for from general taxation.”

But don’t we pay for the doctor through tax already?

Posted: 4th, June 2007 | In: Money | Comments (2)

Water Companies Make £2billion Profits

THE British public is saddled with rising water bills and annual hosepipe bans, and water companies up and down the country are laughing all the way to the bank.

THE British public is saddled with rising water bills and annual hosepipe bans, and water companies up and down the country are laughing all the way to the bank.

New figures to be released this week by the big water and sewerage companies will show that the industry has once again enjoyed a major increase in profits.

South West Water’s parent group, Pennon, is expected to see its profits climb from £142million to £157million while the likes of Northumbrian Water and Yorkshire Water’s owner, Kelda, are expected to show increases of six and eight per cent respectively.

These figures will no doubt anger customers who have seen water bills rise at above inflation rates recently.

Industry regulator Ofwat expected to come under fire for failing to protect the needs of customers.

In 2005, the industry regulator announced that companies could increase their prices by more the current rate of inflation on condition that they invested in their own, rather leaky infrastructures.

However, while the amount of water from leaks has fallen, four out of 22 companies in England and Wales still fail to hit their leakage target, amounting to an incredible 3.6 billion litres of drinking water escaping out of pipes and mains every day.

And then they tell us to stop watering our gardens?

A spokesman for Ofwat says: “We set the prices as low as possible, while allowing water companies to make investments. Our primary objective is to make sure customers pay no more than they ought to.”

I’ve had enough. I’m going to turn my lawn into a wetland this summer and attract wading birds. Turn off the water and kills the birds? They wouldn’t dare…

American Idol Simon Fuller Bids To Buy Elvis Presley, Ali and David Beckham

SIMON Fuller, the rather wealthy little man who oversaw the rise of the Spice Girls as well as creating the Pop Idol phenomenon, is launching a $1.3billion joint-bid to acquire entertainment giant CKX.

SIMON Fuller, the rather wealthy little man who oversaw the rise of the Spice Girls as well as creating the Pop Idol phenomenon, is launching a $1.3billion joint-bid to acquire entertainment giant CKX.

Joining Fuller with the bid is Robert Sillerman, America’s 375th richest man and the former owner of SFX Entertainment. Sillerman is currently the largest shareholder in CKX and is set to make a presentation to the directors of the company with the aim of acquiring the group’s 97 million outstanding shares.

The company currently owns the name and image rights to Elvis Presley, which it bought from the rock’n’roll icon’s daughter Lisa Marie in 2005, as well as those of Muhammad Ali and a little known footballer who goes by the name of David Beckham.

Other famous names involved with CKX include Robin Williams, Billy Crystal and Woody Allen.

Expect Posh Spice to start angling for a role in Allen’s next movie. Maybe a remake of Annie Hall – with a dead shark skin bag…

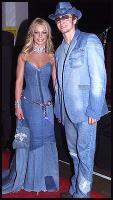

It’s All In The Jeans: The Denim Mao Suit

FROM hip young things to sad middle-aged men, jeans continue to provide the backbone to many a UK wardrobe and the denim domination looks set to continue with reports claiming that three pairs of jeans will be sold every second of every day this year.

FROM hip young things to sad middle-aged men, jeans continue to provide the backbone to many a UK wardrobe and the denim domination looks set to continue with reports claiming that three pairs of jeans will be sold every second of every day this year.

The research, from Mintel, reveals that Britons will splash out around £1.5billion on an estimated 86 million pairs of jeans by the end of the year, an increase of more than 40 per cent in the last five years. (You can have any pair of trousers so long as they’re denim.)

While designer brands such as Diesel and Nudie Jeans continue to excel, it is the phenomenon of own-label jeans, such as those made by George at Asda and Topshop, which have fuelled the denim boom.

Indeed, according to the figures, own-label sales grew by 41 per cent between 2004 and 2006, accounting for almost 25% of the market.

According to Mintel’s Vivianne Ihekweazu, “Jeans are the ultimate fashion success story. Today, we not only wear jeans lounging in front of the TV, but we are also happy to wear them for a night out on the town or for a day at the office. More recently, we have even seen celebrities wearing them down the red carpet.”

They still look rubbish on Jeremy Clarkson, though.

Posted: 1st, June 2007 | In: Money | Comment (1)