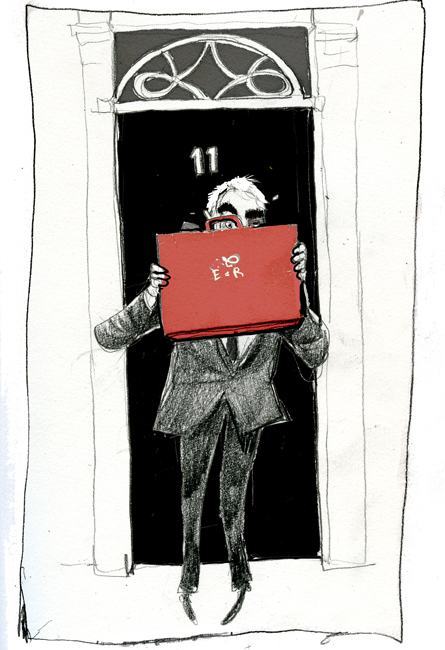

British Economy Goes Ka-Boom And Bust

BORROWING is up. Unsecured personal borrowing – mainly personal loans and overdrafts – rose by £2.4billion in February.

BORROWING is up. Unsecured personal borrowing – mainly personal loans and overdrafts – rose by £2.4billion in February.

That’s the biggest monthly rise in five years.

And there’s more. Just this month, there are planned rises in water bills, the TV licence, council tax (up by 4 per cent from April 1) and road tax.

Where do homeowners get the money from to meet these bills and satisfy mortgage demands? Answer: from expensive unsecured debt. And by cashing in their savings, such as the Individual savings account, and reducing pension contributions.

You can borrow secured debt if the bank will take on new business. But the bank’s business is funded by borrowing, and the cheap money is all gone. So, sorry no can do.

Indeed, lenders are vying to see which can offer the worst rates and attract no new customers. HSBC’s First Direct bank has stopped offering mortgages at all. That’s not really playing fair and surely a token rate of 8 or 9 per cent would have made First Direct look like they were at least trying.

As the aMil notes: “Yesterday morning there were 4,754 mortgage deals. By the end of the day, that had dropped to 4,329, according to the information firm Moneyfacts.”

Perhaps the best institution to borrow from is the Government, which has been taking more and more money from you. In 1997, the Government took 35.7 per cent of GDP in tax; this tax year the figure will be 36.8 per cent.

But writing a “Dear Gordon…” letter is unlikely to work, even if you enclose a photocopy of your bank statement and a picture of your children spilling out of a tiny hatchback car. Gordon will thank you for being green in your choice of vehicle and for supporting the postal service. Although if you tell him you’ve a rich relative on the way to that big housing estate in the sky, he may well pen you a thank you letter.

The one person who can salve the festering sore that is debt is Mervyn King and his Monetary Policy Committee. Will he reduce interest rates? If he does, he runs the risk of fuelling inflation. If he doesn’t, he runs the risk of doing nothing and looking like he’s just hoping for the best.

Thankfully, you can do something by backing rates to rise or fall. The chance of a rise is smaller than Nicolas Sarkozy in a Leotard. The fall is the tip, with a quarter-point reduction the money. Although a half-point fall is worth a look.

As for the FTSE, Billionaire investor George Soros said the financial crisis is the worst since the Great Depression and the markets will fall once more this year after a brief rebound, it was reported today.

Of course Soros is in the business of making money and if markets do tumble, you know that he do well. Maybe he’s talking it down for a reason? Says Soros: “The periodic crises were part of a larger boom-bust process. The current crisis is the culmination of a super-boom that has lasted for more than 60 years.”

Boom or ka-boom?

Posted: 4th, April 2008 | In: Money Comments (4) | TrackBack | Permalink