Understanding The Eurodeal: All They’ve Saved Are The Banks And Saddled Us With Inflation

OF course, saving the banks is an inportant thing to do: a world without banks is one which is much poorer than the one we live in. However, really, last week’s eurodeal, that is all they’ve done: saved the banks:

OF course, saving the banks is an inportant thing to do: a world without banks is one which is much poorer than the one we live in. However, really, last week’s eurodeal, that is all they’ve done: saved the banks:

What the ECB can do is pull out all the stops to save Euroland’s €23 trillion banking system, and that is what it did last week by extending unlimited credit to banks (LTRO’s) to three years, halving the reserve ratio to 1pc, and relaxing collateral rules to allow banks running out of eligible “kit” to pawn almost anything at Frankfurt’s lending window.

This is the closest we have come a “game-changer” in two years of rolling crisis. The banks can play the “carry trade”, borrowing at 1pc until 2015 with gearing to buy Italian debt at 6.4pc. That is how you rebuild a shattered banking system, and how to finance governments covertly without breaching any Treaty clause.

Everything else is just, well, we’ll agree to agree about something some other time. This however does indeed work.

Basically, what a bank does is borrow at one interest rate and lend at another. And most of Europe’s banks need to have lots and lots more capital. Far more capital than anyone is willing to give them.

So, how do you get capital into the banks without anyone, investor or taxpayer, wanting to give them any?

Simple, you engineer it so that they can make big profits. Over here, at the ECB, you print new money and lend it to the banks at 1%. Over there, the banks go and buy government bonds which pay 6%. They then take these back to the ECB where they use them as security to borrow more money at 1%. And so on.

The actual profit rate here is enormous. You’ve got to put a little capital against Italian bonds at the moment: 1.6% of the value of the bond. So for every €million of capital you’ve got you can have €62.5 million of these bonds and loans from the ECB. You’re borrowing €62.5 million at 1% and lending it at 6%, this gives you a €3.75 million profit a year and that’s a 375% return on your capital.

Now try it with a €billion….or €10 billion. And it’s all guaranteed for 3 years.

So, as long as you don’t pay the profits all out to the bankers as bonuses, or to the shareholders as dividends, then the banks will end up with lots more capital. Hurrah!

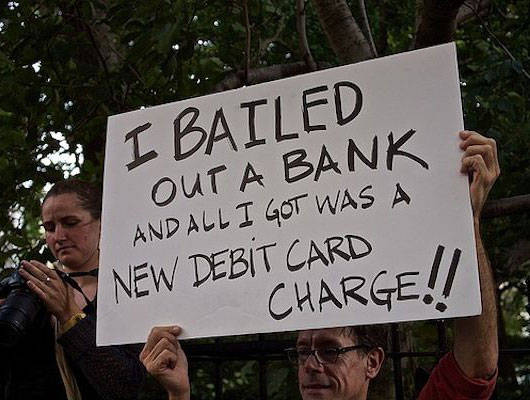

Who loses in this? Well, we do, naturally. The hoi polloi, for this will cause inflation at some point in the future. But, you know, the banks are saved and bugger everyone’s savings and pensions, eh? It’s not just the British Government that puts finance ahead of the people….

Image via

Posted: 12th, December 2011 | In: Key Posts, Money Comments (5) | TrackBack | Permalink