Money Category

Money in the news and how you are going to pay and pay and pay

Madeleine McCann: Luisa Todorov gets scoured

Madeleine McCann was not kidnapped by Luisa Todorov. “It wasn’t me,” says the woman. You will recall that criminologist Heriberto Janosch Gonzalez featured in the Daily Mirror beneath the words: “Maddie hunt woman” is a…”waitress”.

“Scotland Yard detectives want to speak to a female dressed in purple who was seen by two people standing outside the youngster’s apartment,” said the Mirror. And criminologist Heriberto Janosch Gonzalez “claims to have identified the woman as Bulgarian waitress Luisa Todorov”.

News was that 58-year-old Luisa and her husband, Stefan, 50, were working at the Ocean Club resort in Praia da Luz when Madeleine vanished in 2007. Both gave statement to the police at the time. “They both denied having any knowledge of the case and have not been spoken to again for over a decade.” Why police would have spoken with either of them again is moot, as the Mirror gave readers the side-eye and stated: “British police are now scouring the globe for the pair so they can ask them if they saw anything suspicious.”

Scouring the globe? Not looking to speak with them. Scouring. That’s what you do when you want to reveal what’s beneath the dirt and grime. You scour. Is “scouring” the way to find two innocent people? The paper then noted: “Luisa is believed to be the woman seen standing by a lamp post just outside the apartment at 8pm on May 3, 2007.”

Gonzalez was quoted:

“Examining all the known statements it seems highly likely the police are seeking the Todorovs. They are the only known people with a clear link to Bulgaria. I have been unable to trace them in Portugal and believe they could have moved away. It is widely known that many workers at the Ocean Club were made redundant so it is possible they went to Bulgaria seeking work.”

And to today’s Mirror news, we get an update. Get this:

A criminologist claimed to have identified Luisa Todorov as the mystery person police are said to be searching for. And we discovered she lives less than a mile from Praia da Luz in the Algarve, where Maddie disappeared.

She isn’t living in Bulgaria. No-one had to scour the globe to find her. And she isn’t the “woman in purple”. Indeed, who is? And why is she newsworthy? It was British expat Jenny Murat who introduced us to her. She said: “She caught my eye because she was dressed in purple-plum clothes. It struck me as strange. It’s so usual for anyone, particularly a woman, to be standing alone on the street in our resort, just watching a building. The next morning, we heard that a little girl had gone missing, and I later told police about the woman I’d seen right outside. I didn’t recognise her and don’t have a clue who she is, but she seems a bit suspicious.”

Murat is, of course, mother to the innocent Robert Murat, who was monstered and libelled. Odd that her words are now being used to zoom in on another foreigner living an working in Portugal. Indeed, it was Mirror journalist who introduced us to Robert Murat, telling readers that he found him “creepy”. Now Luisa is in the crosshairs.

These are some of the reactions to her name:

Madeleine McCann: Mystery ‘woman in purple’ sought by Met police identified as waitress – Indy

‘Woman in purple’ mystery witness tracked to Bulgaria. Waitress Luisa Todorov, seen twice near the holiday apartment on the night Maddie disappeared, could be a significant witness – International Business Times

Madeleine McCann mystery woman spotted outside Portugal apartment is identified – Leicester Mercury

MADDIE CLUES – Madeleine McCann cops hunt Bulgaria for waitress believed to be ‘woman in purple’ – The Sun

Madeleine McCann: Police hunt waitress believed to be mysterious ‘woman in purple’ – Daily Express

Today she tells the Mirror: “I’ve no idea about any woman in purple. It wasn’t me. I spoke to the police a long time ago about the Madeleine case. I don’t really want to talk about it, nobody around here does, it brings back lots of bad memories. Nobody knows what happened to her. If the British police want to speak to me that’s fine, but I don’t know anything.”

The restaurant worker, originally from Madeira, gave a statement to Portuguese police five days after Maddie’s disappearance, along with husband Stefan, 50.

He also worked at the Ocean Club resort, in the kitchens, and is believed to have returned to his native Bulgaria without being quizzed again.

He worked in the kitchens? But the Express told us:

Luisa’s husband Stefan Todorov, 50, was working at the Tapas bar, where the McCanns and their seven holiday friends were dining when Madeleine was abducted.

Over in the Sun, Luisa Todorov’s innocence is a “twist as waitress denies she is the mysterious ‘woman in purple’”. It’s not a twist, is it. It’s woman stating a fact.

Luisa Todorov was named as the woman that police wanted to speak to, after a shadowy figure was spotted by witnesses the night the three-year-old went missing.

Can you be “shadowy” dressed distinctively in purple and standing in full view?

But the hung continues. after all, the Indy reported:

Detectives working on Madeleine McCann’s case have travelled to Bulgaria in search of a paedophile’s widow known as the “woman in purple”…

On the evening of Madeleine’s disappearance an eyewitness saw a woman startng [sic] intently at the apartment block next to where the McCann’s were staying in Portugal.

The woman is believed to have been the wife of a man of a convicted peadophile, who has is now believed to be dead.

Such are the facts.

Posted: 27th, November 2017 | In: Madeleine McCann, Money | Comment

The pay gap for women and trans is about parenthood not gender

Trans issues are to the fore. The Government is looking at altering the Gender Recognition Act 2004 (GRA), which would permit trans people to change their legal gender without a medical process. Right now the rules are that a diagnosis of gender dysphoria is needed to begin the process. People seeking to change gender have to submit evidence that they have been in transition for at least two years.

It’s not about society, manhood and womanhood. It’s about the individual and individual wellbeing. The BBC’s Jenni Murray got into bother by saying that trans women were not “real women”. Feeling yourself to be women is not the same as being one, she opined. Countering that is Shon Fay, who writes beneath the Guardian headline: “Trans women need access to rape and domestic violence services. Here’s why – All women face similar dangers, whether trans or not, and it’s distressing that some people seek to drive a wedge between our rights.”

Growing up being perceived by others as a feminine gay boy certainly wasn’t easy, but once I transitioned, in my 20s, things radically changed. The flashes of misogyny I witnessed when I was younger are now, as they are for most women, a daily reality. Some of this is banal – like the men on dating websites who call me a “stuck-up bitch” or a “desperate slag” when I turn them down. Some is more structural: when I get into my 30s, the gender pay gap will widen and I will find myself on the “wrong” side of it.

Maybe not.

Vox reported:

The data tells us that this can’t be the entire story. It can’t explain why the wage gap is so much bigger for those with kids than those without. One 2015 study found that childless, unmarried women earn 96 cents for every dollar a man earns.

Which man? Because dad get more:

One of the worst career moves a woman can make is to have children. Mothers are less likely to be hired for jobs, to be perceived as competent at work or to be paid as much as their male colleagues with the same qualifications.

For men, meanwhile, having a child is good for their careers. They are more likely to be hired than childless men, and tend to be paid more after they have children.

These differences persist even after controlling for factors like the hours people work, the types of jobs they choose and the salaries of their spouses. So the disparity is not because mothers actually become less productive employees and fathers work harder when they become parents — but because employers expect them to.

Economist Claudia Goldin suggests more:

Many companies still richly reward people who are available and work long, continuous hours, Goldin says. They give premium pay to certain key players – mostly men who don’t take time off for children or aging relatives. So women or men who need flexible schedules obtain them “at a high price, particularly in the corporate, finance and legal worlds,” Goldin writes in her paper. Technology and science fields are better off in pay equity, as are certain health care careers. … “It isn’t, quote, a women’s issue,” says Goldin in an interview with Quartz. The pay disparity shows up equally when male MBAs need reduced schedules or time off for personal or family needs.

And then we can talk about class…

Posted: 22nd, November 2017 | In: Broadsheets, Money | Comment

Arsenal balls: after Mugabe Zimbabwe Gooners demand ‘Wenger Out’

As Robert Mugabe is toppled, protesters in the depot’s native Zimbabwe turn to the next great dictator: Arsenal manager Arsene Wenger.

Lest we forget:

Overstating the situation somewhat! pic.twitter.com/CMebS5nh3y

— Andy Kelly (@Gooner_AK) March 13, 2017

“I used to live in Zimbabwe and I’ve watched Robert Mugabe ruin the country, and Wenger is doing the same. He’s the Mugabe of Arsenal.”

Seems fair.

Posted: 19th, November 2017 | In: Arsenal, Back pages, Money, News, Politicians, Sports | Comment

Steve Mnuchin and his wife posing with dollar bills is wonderfully revolting

Steve Mnuchin, the US Treasury Secretary, and his fragrant wife Louise Linton (top notes of mink perineum and aviation fuel over a puppy farm base) walked into the Bureau of Engraving and Printing in Washington DC to see his signature on the new notes posed with the new lucre.

Not a Parody: These two bring the worst optics since the taxpayer-funded eclipse vacation to Fort Knox. Oh, that was them, too.https://t.co/Fn3coj4tdr

— Crooks and Liars (@crooksandliars) November 15, 2017

For purposes of identification, she’s the one dressed as Dick Dastardly’s getaway driver.

This is real pic.twitter.com/wX2gy5xlWf

— Yashar Ali 🐘 (@yashar) November 15, 2017

Go internet!

Fixed it. pic.twitter.com/bG2OxfUbtx

— ElElegante101 (@skolanach) November 15, 2017

Picking out wallpaper for the cognac-swirling room pic.twitter.com/gAqp6wostD

— Andy Richter (@AndyRichter) November 15, 2017

Steve Mnuchin and his wife show off their new line of luxury toilet paper pic.twitter.com/aoKa6WM0Ka

— jordan (@JordanUhl) November 15, 2017

So much going on in this photo but I am shocked to find out Steven Mnuchin’s wife killed Han Solo pic.twitter.com/Ic2GBIemGC

— Dusty (@DustinGiebel) November 15, 2017

This is real pic.twitter.com/wX2gy5xlWf

— Yashar Ali 🐘 (@yashar) November 15, 2017

Posted: 17th, November 2017 | In: Money, News, Politicians | Comment

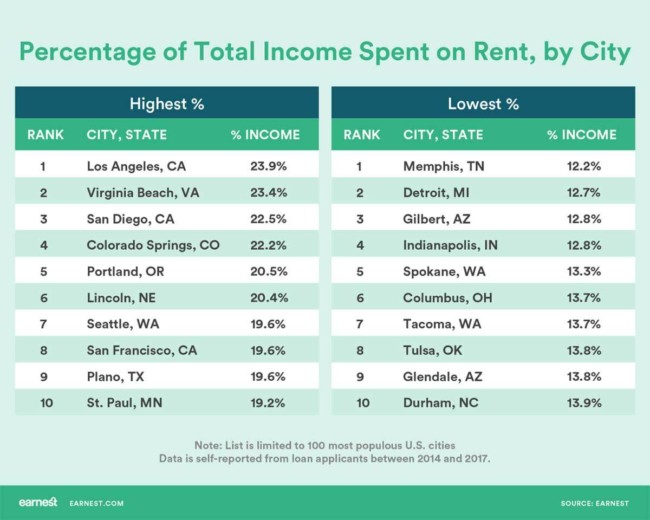

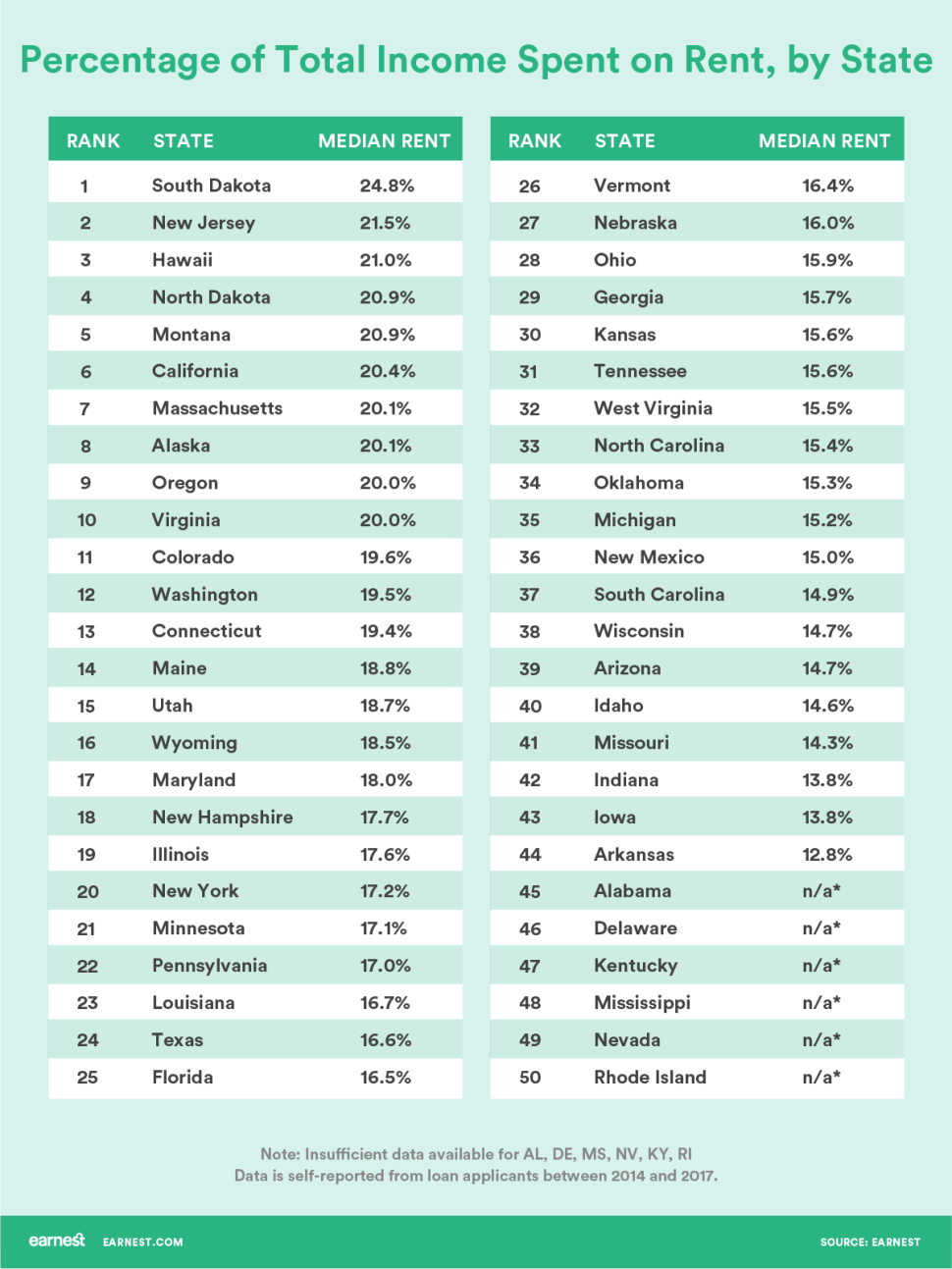

The cheapest State in the US for renters

According to Earnest, Californians spend the most on rent; West Virginians the least. But win terms of disposal income, South Dakotans spend a whopping 24.8% of their cash on rent.

B

Clickbait balls: Liverpool ‘favourites’ to sign Barcelona Mascherano in a market of one

Transfer balls spots this gem in the Daily Mirror’s desperate clickbait factory: “Liverpool favourites to sign Barcelona star in January transfer window.”

To reach this story, readers vault no fewer than three video adverts. The story is squashed between them:

The entire scoop is an exercise in total balls:

Liverpool have been made favourites to sign Barcelona star Javier Mascherano in January.

Ah, him. Is he still any good? Does he want to rejoin Liverpool? Who else wants him?

Mascherano’s contract at Barcelona is less than two years to run and he is understood to be considering an early exit.

Understood by whom? Dunno. The Mirror doesn’t bother to say. But it does note:

Liverpool have been made 6/4 favourites to sign him by Sky Bet, although River Plate are another option for the 33-year-old.

Why SkyBet have odds on Mascherano is not stated, nor how large the market on the move is. Although it is fun to see the Mirror plugging its rival – SkyBet is operated by the Sun’s owners. Once upon a time both red-tops were fierce rivals seeking out scoops and shockers – now they exist to fluff each other’s guff and get readers to bet on total nonsense.

We called SkyBet and were told that the bet does exist. And because it’s a ‘Special Bet’ or a ‘Request A Bet’ the odds can be triggered by one person requesting odds. Make the request and look back in wonder as your simple question makes it on to the pages of the self-declared”Intelligent Tabloid”.

The full odds are hereunder:

Since the Mirror published its story, the odds have not changed, which implies the market for Mascherano to Liverpool is no larger than a PR’s chequebook?

Posted: 14th, November 2017 | In: Arsenal, Money, News, Sports, Tabloids | Comment

Taxies levied on turnover will turn the lights off

Sky News economics editor Ed Conway has an idea about how the likes of Apple, Google and Facebook can be taxed when they operate a slippery system of moving services around the world and as a result pay about £3.45 in corporation tax on billions of pounds in profits. He writes in the Times:

The way we tax companies needs to be turned on its head. Abolish taxes based on a company’s profits and replace them with taxes levied on their turnover.

In which case, good luck getting gas and oil out of the ground – and investing in making things more efficient:

Might be better if governments invested in their own nascent unicorns and beat the all-conquering US tech giants fair and square.

Spotter: Forbes

Posted: 13th, November 2017 | In: Broadsheets, Money | Comment

Brexit Balls: Irish cheese panic

More fine anti-Brexit work in the The Guardian, where news is that people who eat non-organic butter and hum-drum Irish cheddar are going to be worst off once the country quits the EU:

Leaving the customs union in a hard Brexit scenario could lead to the price of meat doubling and the price of dairy, half of which is imported, rising by up to 50%.

How so?

A block of cheddar imported from Ireland that costs £1 now will cost £1.41 under World Trade Organisation rules, with Ireland being a major producer of cheddar. This would prompt a vicious economical cycle and a period of “runaway” food price hikes, he warned.

The quoted “he” is Gabriel D’Arcy, chief executive of dairy producers LacPatrick in Strabane in Northern Ireland. In May Mr D’Arcy said LacPatrick “had seen a 25pc surge in its sales into the British market in the wake of Brexit, due to its presence in Northern Ireland”. Not all doom and gloom, then.

And as for the Guardian’s words on WTO, well, the quoted price hike represents the maximum import tariffs, so-called ‘ceiling rates’ on ‘bound rates’ . You can charge less through ‘applied rates’. The Government could go further and charge no tariffs (aka tax), and make the populace’ richer’ by allowing them to keep more cash in their pockets by way of cheaper cheese.

No need to panic, then, and dash out to buy lots of Irish cheese. Guardian readers, of course, can stick with their runny brie.

Posted: 13th, November 2017 | In: Broadsheets, Money, News | Comment

Alex Wubbels: nurse assaulted by police gets $500,000

Remember Alex Wubbels. the nurse roughed up by police for doing her job? Well, she’s been awarded $500,000 for her ordeal. When she rightly refused police demands to take blood from an unconscious man, the police cuffed, her and dragged her outside. Gratifyingly, the police thuggery was recored on a bodycam.

Remember Alex Wubbels. the nurse roughed up by police for doing her job? Well, she’s been awarded $500,000 for her ordeal. When she rightly refused police demands to take blood from an unconscious man, the police cuffed, her and dragged her outside. Gratifyingly, the police thuggery was recored on a bodycam.

The money will be paid by Salt Lake City and the University of Utah. Detective Jeff Payne was sacked from his job with Salt Lake City police. No other police were busted – chiefly Payne’s colleague who stood by and watched it happen. Payne is taking his dismissal to appeal.

“We all deserve to know the truth, and the truth comes when you see the actual raw footage, and that’s what happened in my case,” says Wubbels. “No matter how truthful I was in telling my story, it was nothing compared to what people saw and the visceral reaction people experienced when watching the footage of the experience I went through.” Media matters.

Ms Wubbels has donated some of her compensation to a nursing union and plans to use the money to help other abused by police who can’t respect the law.

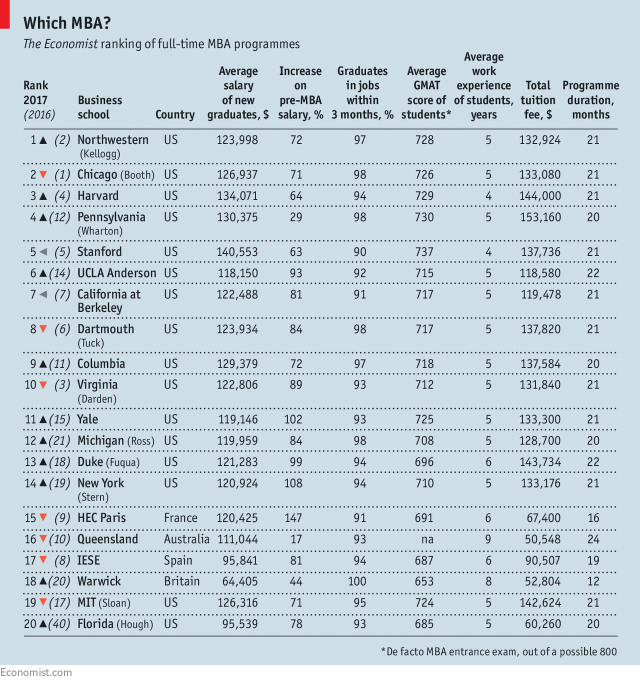

The top 20 MBA courses in terms of wages and cost

Does it pay to study for an MBA? These are the average tuition fees of the top ten schools is $134,600. It does pay to get an MBA – so long as you study for an MBA in the USA:

If you want to earn the big bucks, run a sought after MBA course:

All of the top ten slots in the ranking are now occupied by large, prestigious American schools, for which students are happy to pay extra. Their average tuition fee is $134,600, and has risen quickly in recent years. Employers, too, are willing to shell out for the best students. Their average basic salary was $127,300, a 70% increase on their pre-MBA pay cheques.

More at the Economist: full ranking and methodology.

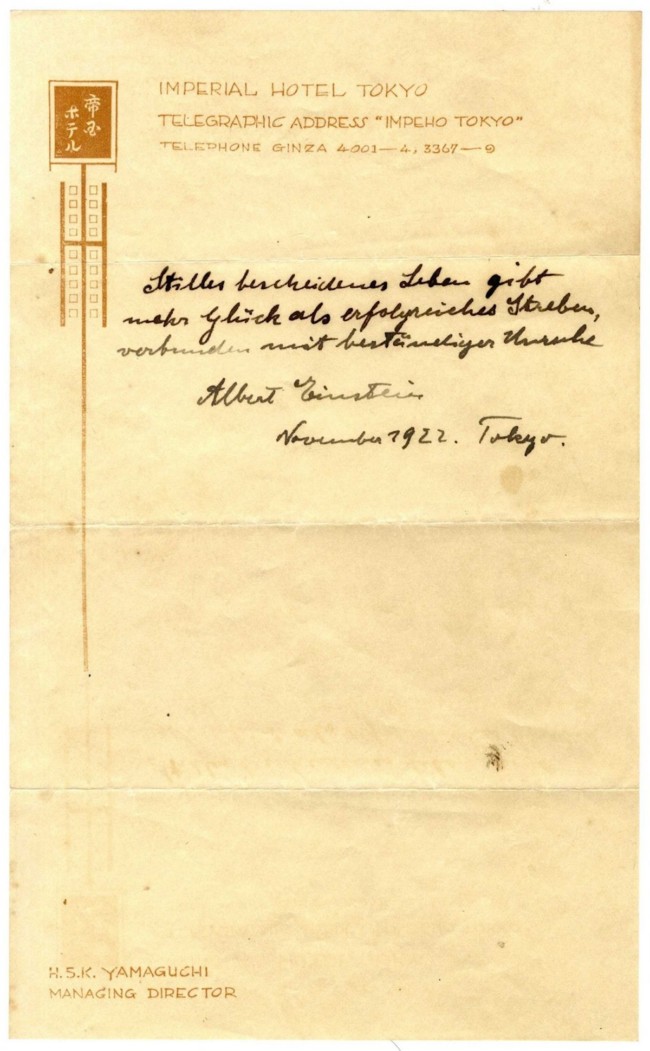

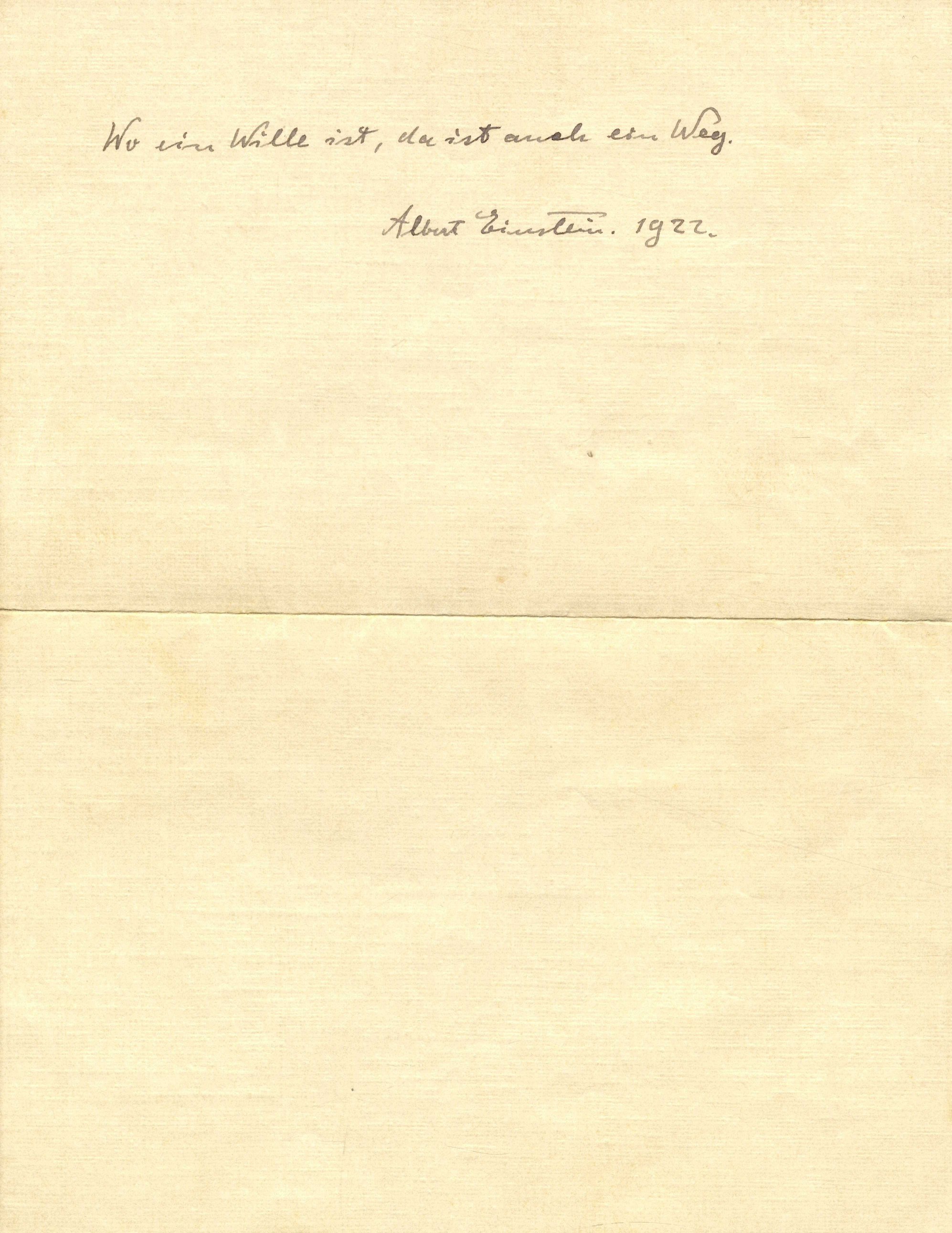

Albert Einstein’s tip to a bellboy sells for £1.3m

In November 1922, Noble-Prize winner Albert Einstein (March 14, 1879–April 18, 1955) was in Japan to deliver a series of lectures. At Tokyo’s Imperial Hotel, Einstein was greeted by a bellboy delivering a message. With no cash to hand, Einstein wrote a note on a sheet of hotel stationery and handed it to the man. “Stilles bescheidenes Leben gibt mehr Glueck als erfolgreiches Streben, verbunden mit bestaendiger Unruhe,” he wrote. (Translation: A calm and modest life brings more happiness than the pursuit of success combined with constant restlessness).

He told the messenger that if he was lucky, the notes would become valuable. On October 24, the courier ‘s nephew sold the letters at auction for $1.56m.

Via Winners and Flashbak, which has more.

Shock and horror as Facebook seeks to make a profit

What do you think of Facebook? It’s pretty good, isn’t it. You can post stuff about your dog, website or uniquely gifted children and watch as people write ‘Bless” and “OMG” beneath the images and breaking news. Having throttled post reach – the number of people who actually see a post from your Facebook Page on their timeline is typically around 5%; and then invited users to pay up to ‘boost’ that figure – Facebook is looking for new ways to charge its users. It’s pay-to-play.

Facebook is testing moving publishers’ posts out of people’s news feeds unless the companies pay thousands of dollars to reach their audience.

The new format is being tried in six countries, including Slovakia, Serbia and Sri Lanka, and moves any posts that do not come from users’ friends and family into a secondary feed unless they are paid for. Paid promotions still appear in news feeds as normal.

Pay or vanish.

The change could wreck the business models of small publishers who depend on organic sharing on Facebook for a large part of their audience. It could also have a big impact on larger companies such as BuzzFeed that create content designed to go viral on the site, as “likes” cause Facebook’s algorithm to promote them in news feeds.

Of course it’ll hurt publishers – that’s part of the idea. But if you pay, you an use the service.

Critics yesterday accused Facebook of devious tactics, in giving publishers a huge organic reach and only later charging for that audience.

It’s not a public service, however long and loud Facebook founder and majority owner Mark Zuckenberg tells us his site is a force for world good. It’s a money-making machine. Facebook wants global harmoney [sic].

Facebook has issued a statement (via Recode):

“With all of the possible stories in each person’s feed, we always work to connect people with the posts they find most meaningful. People have told us they want an easier way to see posts from friends and family, so we are testing two separate feeds, one as a dedicated space with posts from friends and family and another as a dedicated space for posts from Pages. To understand if people like these two different spaces, we will test a few things, such as how people engage with videos and other types of posts. These tests will start in Sri Lanka, Bolivia, Slovakia, Serbia, Guatemala, and Cambodia. We have no current plans to roll this out globally.”

One Slovakaisn user explains:

Biggest drop in organic reach we’ve ever seen. Pages have 4 times less interactions, reach fell by two-thirds https://t.co/KhAtCR0yvu

— Filip Struhárik (@filip_struharik) October 21, 2017

Posted: 24th, October 2017 | In: Money, News, Tabloids | Comment

The charity game: when sex with clients is ok

The charity business continues of amaze. The Sunday Times looks at the Leeds-based Yorkshire Mesmac charity, which, says the headline, “allows sex with clients”. And who are these clients at its centres in Leeds, York, North Yorkshire, Bradford, Wakefield, Rotherham and Hull?

A charity for child abuse victims, sex workers and gay men given more than £2m by the government, councils and police has told its staff they are allowed to have “sexual relationships” with the often vulnerable people they meet through their work.

Ah.

The organisation, based in Leeds, is being investigated by the city’s child safeguarding board after The Sunday Times obtained a copy of its “workers’ conduct policy” which states: “Sexual relationships are acceptable with service users initially met during work time”. Most health and social work organisations ban professionals from establishing relationships with patients and clients.

To which the Guardian adds, so as not to create confusion:

The rules do not relate to the charity’s work with children.

Mesmac’s chief executive, Tom Doyle, gets the right to reply:

“We understand that, viewed out of context of Yorkshire Mesmac’s suite of policies including safeguarding of children and of adults at risk, there is a possibility that this code of conduct could be misunderstood.”

The policy was now being redrafted.

Spotter: Times

Posted: 22nd, October 2017 | In: Broadsheets, Money, Politicians | Comment

Monarch: paper profits and discounts as capital for the super rich

Monarch Airlines is bust. And in the Sunday Times we get an insight into the bizarro world of the mega-mega-rich. Monarch is owned by private equity outfit Greybull.

Amid a battle for orders between Boeing and Airbus, Monarch secured a cut-price deal for 30 new planes — which later rose to 45. The market value of the aircraft was greater than Monarch’s agreed price, so creating a paper profit.

And then it got even better.

Greybull was able to persuade Boeing to release more than £100m of this trapped equity as cash, pumping it into the airline through Petrol Jersey.

Can it be that the seller gave discount as capital?

And why now did the firm bust? The Times notes:

Questions have been raised about timing. Monarch went down with £48m of cash in the bank, over which Greybull has a strong claim as primary secured creditor. Swaffield’s statement revealed that the cash pile was shrinking rapidly and would have been £20m by the end of the month. Greybull’s Marc Meyohas said the timing of the collapse “was influenced by Atol, not by us running out of cash”.

Fair enough?

“The families, Greybull, Petrol Jersey, however you want to put it, will have lost money on this deal,” said Marc Meyohas. “We are absolutely disappointed by the outcome. We do feel we have been responsible owners, but we have failed nonetheless.”

As for placing questions marks over the owners, well, is it fair to portray them as grinners, as the FT does?

Expect a lot to follow – little of which will help the poor sods now out of jobs and fretting about pensions.

Spotter: Times

Posted: 8th, October 2017 | In: Broadsheets, Money | Comment

Dong Energy to change name to…

Denmark’s Dong Energy is to rename. Dong, as I’m sure you know, stands for Danish Oil and Natural Gas. The new moniker will align it with a “profound strategic transformation from black to green energy”.

The new name is DIL… No. It’s Ørsted, in honour of 19th-century scientist Hans Christian Ørsted.

Which means DONG is now up for grabs!

Words are bad: Australians warned not to offend weak-minded women at work

The Diversity Council of Australia (DCA) wants to warn you about words. The DCA is an “independent not-for-profit peak body leading diversity and inclusion in the workplace”. The DCA are guns for hire. They will deliver a 2 hour talk at your organisation “by experienced DCA staff and consultants”. Does it cost? Yes:

Fees

$2,500 per session for DCA members.

$3,600 per session for non-members.

For small businesses of – get this – as low as one employer (can you offend yourself?) membership is $1,645 a year.

You will be told that using words like “abo”, “retard”, “poofter”, “fag”, “dyke” and “so gay” can be upsetting. Who knew? Also saying “hi, girl’ or “hi guys” is taboo.

“We want to get people thinking about the language they use in the workplace and whether it’s inclusive or excludes people,”says DCA’s CEO Lisa Annese. She offers an example. “A really good test is reversing the gender,” says Annese. “Would you walk into a mixed gender group and say ‘Hello ladies’ or ‘Hello girls’? No, because men would be offended. I used to use the word guys. I have both genders in my team and I out of respect for everyone, I think it’s much better if I say ‘Hi team’ as it includes everyone. It’s a small change.”

Women are so weak and easily offended that they need protecting from hearing the word “guys”. What an understanding view of women that is. These delicate types need safer spaces to work in. And who hasn’t met a modern Aussie male intimated by being called a ‘lady’? Well done DCA!

And “mum” is out, too. You should also avoid “drudge”, “slave” or “Filipino”, if you work in one of the smarter areas:

Billionaire donates £200m to investigate ‘baloney’ and spread bad science

Mega-rich Henry Samueli, a fan of “integrative medicine” (homeopathy) has donated – get this – 200m to UC Irvine. “The human body is a very complex and highly interconnected system. Therefore our healthcare needs to be looked at through a more holistic lens,” opines Samueli, who owns the Anaheim Ducks. “Our genetics, our surrounding environment, our nutrition, our physical activity and our mental state all play critical roles in our well-being.”

As someone who has been stricken by serious illness, I can says that I’m going with the science and the big machines over the pseudoscience, personal prejudice, propaganda, faith-based medicine guff that denies human progress in chemistry and physics.

Rebecca Watson is scathing:

Now they’ve given millions to UC Irvine, a public university, to set up a school for baloney….I mean “alternative medicine.” It’ll be called the “College of Health Sciences,” misusing at least three words in a four-word name, which is really pretty impressive.

I read about all this in a positively glowing article in the LA Times, which didn’t seek out a single voice to disagree with the idea that a college of baloney is a brilliant idea. The LA Times didn’t even consult the LA Times of six months ago, where they reported on another woman who took aconite as a remedy. That woman was hospitalized for weeks and then she died, because aconite is a poison. Susan’s aconite product must have been real homeopathy, meaning that it was just sugar water and there wasn’t actually any aconite in it at all. Otherwise, instead of getting better naturally from her cold she also would have fucking died, and then nobody would be giving millions of dollars to a public university to spread dangerous baloney.

As they say in Anaheim: Quack!

Spotter: BB

NHS wages: multiplier effect v opportunity costs

If you pay the NHS’s legion of workers more money, they’ll spend it and everyone will be better off. Anyone with even a rudimentary understanding of economics will recognise that as only partly true. But in the Guardian, it’s just a magical fact. Faiza Shaheen tells readers about the “muliplier effect”. She does not mention opportunity cost, of which more later:

Putting the direct costs of the pay cap to public services aside, there is also the so-called multiplier effect to consider. This means when you give someone a pay rise, there are larger positive implications for the economy because it can stimulate further rounds of spending. For example, if there is a £2bn increase in wages for NHS workers and they spend just half of this in shops, then shopkeepers will also receive income.

True. But why not just cut taxes and rates for shopkeepers. Same result, no? Around 2.7 million people work in retail in the UK. It is the nation’s biggest employer. Around 1.2 million of us work for the NHS.

In turn, this increase in income will mean shopkeepers are more likely to employ more people and increase salaries themselves.

Shopkeepers are booming. Will others want to get in on the boom and open their own shops, perhaps undercutting the existing outfits? Indeed, in May 2017 Chris Hopson, NHS Providers’ chief executive, told the Guardian: “Years of pay restraint and stressful working conditions are taking their toll,” he said. “Pay is becoming uncompetitive. Significant numbers of trusts say lower paid staff are leaving to stack shelves in supermarkets rather than carry on with the NHS.”

Back to Shaheen:

The treasury would then not just receive more taxes from higher wages among NHS staff, but also the VAT on extra goods sold, and on higher income taxes from jobs created elsewhere.

Of course, some of the State’ investment in NHS staff will return to central Government. But that misses the point.

The multiplier effect is thought to be higher for those on low-middle incomes, as they are much more likely to spend it than save it or put it in a tax haven. According to a Unison study based on International Monetary Fund figures, every 1% increase in public sector pay would generate between £710m and £820m for the government in increased income tax.

Tim Worstall notes:

That money has come from someone. Might be tax, might be borrowing, but those who had it would have also spent some portion of it into the economy. Even if we say that borrowing means it is obviously only coming from savings if those savings weren’t put into gilts then it would have been invested elsewhere instead.

What we actually want to know is what is the effect after this? This is known as the marginal propensity to spend (or save, the inverse). If we take tax off low paid people and give it to low paid people then the net effect is nothing. Because whatever the marginal propensity to spend of the poor is, it’ll be the same or those who lose money as those who gain it. If we take money off the rich then there will be a change. But that change is not the amount of money itself. It’s the difference between what the rich would have spent and the poor do spend. A useful rule of thumb here is some 15%. Upper middle classes might save 15% of any marginal income, the poor 0%, that’s the amount that spending rises by.

Do also note that this only applies to tax funded increases in such wages. If it’s from what is already being saved well, those savings would have been used to invest in some other thing if not borrowed by government.

Spotter: The Guardian

Posted: 19th, September 2017 | In: Broadsheets, Money | Comment

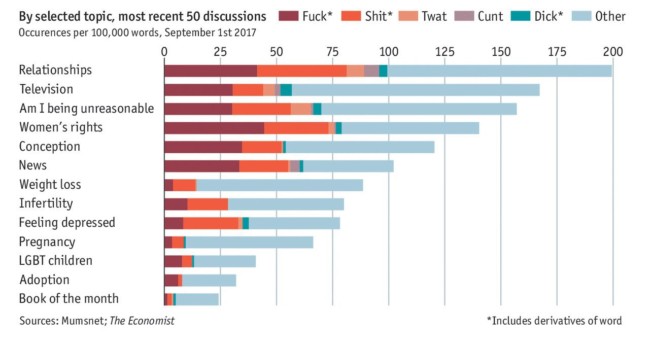

Mumsnet embroiled in swearing threat

According to Mumsnet, it is “the UK’s most popular parenting website”. It’s largely monetised through adverts. But the advertisers have begun to look at what the brands are appearing alongside. Turns out that mums who spend their days talking rubbish on Mumsnet are swearing. So ‘bad’ is is that the National Trust and Bulgari are threatening to pull their adds unless it stops.

The Economist has produced a chart of the sweariest places on the site:

Swearing is enjoyably versatile. And any moves to sanitise the web are regressive. But the marketeers are only calling for the kind of ban already enforced at football grounds and on the street: in 2016 Salford City Council introduced a Public Space Protection Order that banned swearing on Salford Quays, site of BBC Media City and new quayside homes. Caught using “foul and abusive language” around the Quays and suffer the consequences. The council said it was “satisfied the ban will improve quality of life” for those living in Salford Quays.

But will such a ban make Mumsnet better or worse? Should soft-porn Bulgari get its own house in order first?

To say nothing of the National Trust’s filth:

Spotter: Economist, Naked Capitalism

How to fire a freelancer

The Globe and Mail has canned “a number of” freelance columnists, including Tabatha Southey and Leah McLaren. The paper’s editor-in-chief, David Walmsley, thought it decent to sack them by form email.

Dear [Name]

I wanted to write you to let you know the results of a review The Globe and Mail has undertaken with respect to our freelance footprint. As a result I am sorry to tell you we will no longer be taking your submissions on a regular basis.

You are one of a number of freelancers affected. The review considered overall gaps and strengths in our current and future coverage plans and overall budget priorities.

I would like to thank you for the great work you have done for us over the years and wish you a continued bright future with your pen and pixels, wherever they take you.

Dw

In a reply to Walmsley, McLaren wrote back:

Dear David,

I wanted to write you to let you know the results of a review I have personally undertaken with respect to our How Not To Fire Someone After Seventeen Years of Writing a Column.

You are one of a number of managers affected. The review considered overall gaps and strengths in inexcusable management style, appalling jargon-filled memospeak and a complete lack of human empathy.

I would like to thank you for the great work you have done over the years in this regard and wish you a continued bright future in trying get some sleep at night.

Lm

Spotter: Craig Silverman, Canadaland

Spurs balls: ‘Gifted’ Eric Dier says he’s a role model

Tottenham Hotspur and England footballer Eric Dier has been talking about the astronomical amount of money paid in salaries and transfers. “It’s a very difficult situation,” said Dier. “People don’t realise how difficult it is for us to handle. It isn’t easy.”

It isn’t easy being young, rich, healthy and celebrated? Is it easier than other things, say, being old, ill, poor and frustrated?

He goes on: “I read something that Jamie Carragher wrote last year, talking about psychologists. He said we are extremely gifted footballers, not humans, or something along those lines. And I think people need to remember that sometimes. We’re normal human beings with a gift so it’s very difficult to handle all of those situations that happen in football with money and fame, etc.”

Make that gifted, young, rich, healthy and famous. To say nothing of humble. It’s tough. Dier is referring to a story former Liverpool player Carragher, now working as a TV pundit, wrote in the Daily Mail.

That brings me back to something Bill [Bill Beswick, a sports psychologist] told me. He said: “The normal man on the street thinks, because you are famous, you are an extraordinary person. You’re not. You’re an ordinary person with an extraordinary talent.”

And that is the point: we are all the same. We all have the same doubts, anxieties and insecurities. More than anything, we all know life isn’t easy.

Not gifted. Ordinary. But better than most at playing football.

“As for the money,” Dier goes on, “that’s the world we live in and it’s a business. If another sport was gaining that revenue all over the world its people would be earning similar amounts of money. I’m not saying I agree with it, I’m just saying that’s where the industry is at. It’s not Dembele’s fault that he’s good at football and someone is willing to pay £140m for him, it’s where the industry’s at and footballers are the last people to blame for someone wanting to pay that much money for them. They have no say in that.”

Footballers are the last people to blame for greed and high wages. It’s not them who agree to move clubs and sign the contracts?

“We could talk about this issue all day,” added Dier. “It’s so complex. Nowadays with social media up there and mobile phones, it’s constant. It’s 24/7 really. As footballers it’s extremely important because everyone knows we are role models…”

No, Eric, you’re not a role model. You’re a bloke who gets absurdly well paid for doing something many of us can only dream of doing for a living. A role model is a father, a mother, a guardian, a brother, sister and someone with whom you interact directly. A footballer on the telly is no more a role model than than a politician is. A footballer behaving well has no more effect on us than a football behaving badly – well, not unless you view the fans as suggestible dolts and thugs-in-waiting, which is how politicians and advertisers view them. Dier is not working for Public Health England.

He adds: “…we need to try to carry ourselves in the right way because thousands or millions of kids are looking up to you in a sense. I think every footballer takes that very seriously, their image from that point of view, and rightly so. But if you were to follow any 21-year-old or 22-year-old boy around for six months I’m sure you’d see a lot of bad stuff. So I think everyone has to realise that at the end of the day we are just young boys.”

No. You’re a grown man who wears shorts at work.

And then he just talks marketing tosh: “In football at 25 you are seen as being in the middle or your career but from a life point of view you are still a young boy so boys are going to make mistakes. So it’s how people handle that which is the real show of their character. But I think footballers in general as role models are really fantastic.”

Humility, thy name is Eric Dier.

Posted: 3rd, September 2017 | In: Money, Sports, Spurs | Comment (1)

Local News watch: Oldham Evening Chronicle shuts for good

Farewell, the Oldham Evening Chronicle (founded in 1854). The paper has closed after 163 years reporting on the borough. It’s a bitter blow for the staff and those on the Chronicle’s four monthly stablemates – the Oldham Extra, Saddleworth Extra, Tameside Extra and the Dale Times.

In June the Chronicle had a circulation of 6,408. One was bought by John Gilder, who had worked with the paper since 1981. He tells the BBC: “It will be sadly missed. It generates a lot of chat among local people. Before I found out, I popped into the shop and bought a copy without knowing it was the last one. I like reading a physical newspaper but very sadly it’s no more.”

Starbucks maternity leave makes baristas moan

When the BBC produced its list of earners, I’m sure you like me were aghast that not everyone earned the same. Also, footballers. Why is one paid more than another for doing the same job? Molly Redden is astounded. In a Guardian story sponsored by The Rockefeller Foundation, she says: “At Starbucks, your maternity leave depends on whether you’re a barista or a boss – One rule for corporate office employees, another for those who work in stores: unequal parental leave is splitting the company in two.”

So everyone at Starbucks and every other company, including The Guardian, should get the same perks. And what about the Rockefellers?

The Foundation was started by Standard Oil owner John D. Rockefeller (“Senior”), along with his son John D. Rockefeller Jr. (“Junior”), and Senior’s principal oil and gas business and philanthropic advisor, Frederick Taylor Gates, in New York State on May 14, 1913, when its charter was formally accepted by the New York State Legislature. Its stated mission is “promoting the well-being of humanity throughout the world.”

The Rockefellers were rich. Very rich. The Svabeniks, a family of three children with another on the way, are less well off. Redden writes of them:

Jess resents having to make the choice at all so soon after giving birth. As a retail employee of the country’s most profitable coffee chain, she is entitled to six weeks of parental leave at partial pay after Roman is born. (Her leave will probably be unpaid, since she has worked at Starbucks for less than one year.) But starting on 1 October, employees at Starbucks’ Seattle headquarters – just an hour’s drive from Jess’s home – and its other corporate offices will be entitled to 16 weeks of fully paid leave upon giving birth, and fathers or adoptive parents will get 12.

Announcing the new policy in January, Starbucks called it “reflective of our mission and commitment to be a different kind of company and put our people first”.

But the new policy doesn’t increase the length of leave for in-store workers who give birth, or for new fathers and adoptive parents, who will continue to get none…

As the company’s announcement received laudatory headlines, Jess joined a group of Starbucks baristas and store managers in asking the company: why are we treated differently

Why aren’t all workers paid the same?

“It is in no way fair to the average worker,” Jess says. “You can’t have corporate without us. So why would one have a better benefit than the other?”

America should offer paid maternity leave as in the UK. But the idea that all workers at a large company are of equal worth to the company is absurd.

Posted: 31st, August 2017 | In: Broadsheets, Money | Comment

Tim Cook and Apple beat the principal-agent problem

Apple shares are soaring. The iPhone remains the best and most desirable phone on the market. And with success comes money.

Tim Cook, the chief executive of Apple, has collected $89.6m as part of a 10-year deal that he signed as an incentive to keep the iPhone maker at the forefront of the technology industry after he took over the reins in 2011 from company co-founder Steve Jobs.

The stock package awarded to Cook in 2011 was originally valued at $376m, but is now worth much more because Apple shares have increased by six-fold since he signed the deal.

Apple Insider has more:

If Apple’s performance fell in the middle third of the S&P 500, Cook’s RSU award would have been reduced by half. Cook would have collected nothing if Apple stock finished in the bottom-third.

Apple and Cook are bound.

The principal–agent problem, in political science and economics, (also known as agency dilemma or the agency problem) occurs when one person or entity (the “agent”) is able to make decisions on behalf of, or that impact, another person or entity: the “principal”. This dilemma exists in circumstances where agents are motivated to act in their own best interests, which are contrary to those of their principals, and is an example of moral hazard.

Meanwhile, over at the Guardian, which repeats the story of Cook’s earnings from a newswire feed without mention of the penalties Cook faced for missing targets:

The Guardian has confirmed losses of £69m for the last financial year but said it was making significant progress in its membership scheme, with more than 50,000 people paying to sign up.

At least the newspaper now is trying to produce a viable business, asking readers to donate (no, not to pay, as the Times does):

The new editor of The Guardian is to be paid tens of thousands less than her male predecessor, according to figures published by the newspaper group.

Katharine Viner received a salary of £340,000 for 2014-15, putting her basic earnings well behind the £395,000 handed to Alan Rusbridger, whom she replaced last month as editor-in-chief of the paper.

Taking into account Mr Rusbridger’s other payouts from the group, where he was editor for two decades, the former newspaper boss took home £492,000 over the past year, £152,000 more than his successor.

And for his last seasons in charge:

The revelation of the pay gap came as Guardian News and Media, the publisher of The Guardian and The Observer, reported an underlying loss of £19.1 million for its latest financial year, a slight improvement on the £19.4 million it lost the previous year.

Performance-related pay can be perilous.

Posted: 30th, August 2017 | In: Broadsheets, Money, Technology | Comment

Ministers embarrassed by successful academies want leaders’ salaries capped

Would it shock you to know that the boss of a group of high-ranking schools earns £420,000 a year? Sir Daniel Moynihan, of the Harris Federation, a chain of 44 schools, is the country’s highest-paid chief executive of an academy trust. His annual wage is the sort of money a Premier League football take home every fortnight. But that’s not really a valid comparison is it. After all, both the footballer and the schools’ executive are in the private sector.

The Federation says on its website:

67% of all of our Academies inspected so far have been graded as Outstanding (compared to 20% nationally) with the rest judged as Good. 83% of our Secondary Academies have been judged as Outstanding so far.

In Primary education our Academies have been judged to be the top performing group of schools compared to all other local authorities and academy trusts in England, in both 2015 and 2016 by the highly respected Education Policy Institute.

At Secondary Harris Federation has regularly been named as one of the top performing groups in the country for disadvantaged pupils by the Sutton Trust charity.

The charity was created by Lord Harris, who acts as its sponsor. A dyslexic who left school early, his story is an inspiration:

Educated at Streatham Grammar School, he had to cut short his education at 15 after the death of his father in order to take over the running of the family business of three carpet shops. He went on to set up Carpetright, now a public company with over 600 branches across the UK and the rest of Europe.

But it;s no good, say Ministers seeking to stop “fat cat” salaries.

Sir Michael Wilshaw, a former chief inspector of schools, and Lord Adonis, a former Labour schools minister, told The Sunday Times that ministers must cap salaries for academy high-earners. Adonis wants to prevent anyone being paid more than £150,000, the salary paid to Theresa May.

Why should a public servant’s salary, moreover a politician’s, be the benchmark for someone working in the private sector, especially one doing such a good job?

The row comes as school budgets are being cut, teachers face a 1% pay rise and parents are being asked to pay for basics at state schools, including textbooks.

Adonis said: “It is a simple question of morality and use of public funding.”

Morality? Phew! good job its not about results.

Posted: 28th, August 2017 | In: Broadsheets, Money, Politicians | Comment