Money Category

Money in the news and how you are going to pay and pay and pay

Credit Crunch: SEC And Rating Agencies Is Not Easy Match

SOME will think this a good thing, I, along with others, will differ:

Seven of the world’s leading credit-ratings agencies have fallen under the regulatory auspices of the US Securities and Exchange Commission as part of the clampdown on the sector.

The SEC will now have full oversight of the work of the agencies, which were heavily criticised during the credit crisis for their apparent role in legitimising complex debt instruments by giving them healthy credit ratings.

As a result of the move, all of the agencies will have to disclose how they assign ratings, an issue which has proved to be controversial of late as the credit crisis took hold of institutional investment markets. The seven include the three major players – Standard & Poor’s, Moodys, and Fitch – as well as agencies less well known outside the banking fraternity such as A.M. Best and DBRS.

Now we do know that one of the causes of the credit crunch was the way in which the ratings agencies happily waved through all sorts of toxic junk as prime investment grade bonds and commercial paper. Tottering pyramids of ever greater complexity were then built on top of those ratings.

So having them overseen more closely by the bureaucracy would be a good idea then, yes? Well, not necessarily. For it dosn’t actually change the basic mismatch in incentives here. Bond issuers pay the ratings agencies, not bond buyers. So we’ve still got a he who pays the piper calling the tune problem here.

But rather more importantly than that, bureaucracies are not notably efficient at regulating fast moving markets. Look at the way the FSA is still scrambling after Northern Rock: the commercial paper markets and the depositors have already given their verdict and we’ve yet to hear anything of substance from the regulators. Worth remembering too that Enron was shut down by the markets when they uncovered the skullduggery long before any bureaucrat had even sharpened his pencil.

What we need is a change in the incentives the ratings agencies face, not another layer of box tickers.

Rip-Off Britain: Halo 3

AN excellent example of a traditional story here at The Telegraph:

Prices for the game in the US start at around $60 (£30), but the same basic edition of Halo 3 in the UK has a recommended retail price of £49.99, although many retailers, such as Amazon and Game, are selling it online for around £39.99.

Yes, it’s Rip Off Britain making an ever popular return. Slightly unfortunately, no one ever goes on to say why things are more expensive in the UK than the US, it’s just generally assumed that manufacturers, distributors and retailers are taking us all for mugs. However, let’s run through the numbers shall we?

That $60 price is the US Amazon one. So that’s already discounted and should be compared to the discounted one here, that £39.99. We also have VAT which is £5.96. So the actual price the retailer is trying to charge us is £34.04…not too different from the £30.00 in the US is it (no, the US price does not include sales taxes)?

So what explains the four pounds then? One is that silly but effective practice of pricing things at 1p under a number. Things are never sold at £40.00, £35.25 (ie, £30 plus VAT), but at £29.99, £39.99 and so on. The other is that it’s more expensive to sell things in the UK. You might not believe it, but we have a restrictive planning system, one which does not allow supermarkets and Big Box stores to pop up just anywhere, everything is thus just that little bit more expensive.

Rip Off Britain might even be true, but if it is it’s the Government doing the rip off, through taxation and regulation.

Posted: 27th, September 2007 | In: Money | Comments (2)

Credit Crunch: Northern Rock Rationalism

I SAID yesterday that I rather admired the bravado on display at Northern Rock as they continued to offer mortgages with high multiples of income and over the value of the security. But his story today shows that they’ve moved beyond bravado into the realms of pure stupidity:

I SAID yesterday that I rather admired the bravado on display at Northern Rock as they continued to offer mortgages with high multiples of income and over the value of the security. But his story today shows that they’ve moved beyond bravado into the realms of pure stupidity:

There are lots of logical reasons why Northern Rock should push on – regardless of the growing criticism – and pay shareholders their interim dividend.

For a start the cost of the 14.2p interim dividend is just £59m – “a mere drop in the ocean”, as one Northern Rock adviser put it, given the £3bn that the troubled bank has had to borrow from the Bank of England to prop up its broken business model.

It is also reasonable to point out that the dividend was promised weeks before the bank was plunged into chaos and that it won’t just be the board and senior management who miss out – small shareholders, frontline staff and pension funds will also be hit.

But the fact is that the Northern Rock situation is no longer about logic.

Well, yes, it is still about logic, but the logic of how people react, not the purer Cartesian logic, where we do what is correct. The dividend is indeed a drop in the ocean, it has already been promised and it comes from profits that really were made.

However, that’s not good enough: the directors need to be thinking a little more about how this will play with the less sophisticated man in the street. You can see it now, can’t you? Those fat bankers have run their business into the ground, they’re relying on the taxpayer to prop them up….and they’re still creaming off the profits?

The thing about banking is that it’s all about confidence. Northern Rock has lost that of the money markets, that’s why they’re in this mess, they lost the confidence of their depositors, as the queues showed, now they’re angling to lose that of everyone else in the country?

Posted: 25th, September 2007 | In: Money | Comment (1)

Credit Crunch: The Northern Rock Question

QUITE what is going to happen to Northern Rock is as yet unknown.

It seems pretty clear that it’s not going to survive long as an independent business, that’s for sure. There’s no way that the commercial paper markets are going to open up again for it, if, as and when, the Bank of England guarantee is withdrawn.

So that leaves only one of three options, someone else buys it, it goes bust or it is closed down in an orderly manner.

The thing is, there doesn’t seem to be anyone who wants to buy it: thus there’s going bust quickly or slowly:

For the time being, Goldman will take a back seat, leaving the rescue plan to Merrill Lynch, which is advising Northern Rock’s board. Merrill Lynch is seeking a buyer, but banks appear to have balked at the lender’s potential £20bn funding liability. The shares fell a further 22 to 172p yesterday as bankers said a white knight was unlikely to emerge.

The brand’s not worth much, the computer systems a little bit, but clearly no one’s very interested in the price tag, that £ 20 billion risk.

Goldman Sachs’ appointment is a clear signal that the Treasury is ready to seize control of the lender. Bankers say if a buyer cannot be found soon, the Treasury may wind up the bank, leaving shareholders with nothing. They added the lender’s £113bn of mortgage assets are unlikely to be sold as, at present prices, buyers would demand a 5pc discount that could mean a £5.65bn loss. With just £2.35bn of net assets, the bank would then be insolvent.

That could well be the end game: a work out. They can’t sell the mortgages because they would take a haircut on the price.

So Northern stops offering new mortgages and gradually, over time, as people pay off their old ones it shrinks until, some day thirty years or so in the future, the last person pays off the last month’s money and finally, we taxpayers are off the hook and Northern Rock disappears into history.

Credit Crunch: Northern Rock Offering Six Times Salary

YOU really rather have to admire the bravado on display here:

YOU really rather have to admire the bravado on display here:

Northern Rock stands accused of “reckless” lending after it emerged this weekend that the beleaguered bank is still offering mortgages of six times salary to potential borrowers.

Despite provoking the worst banking crisis for decades, the bank last week offered a reporter posing as a first-time buyer a £180,000 mortgage even though he had a salary of only £30,000.

The loan was at least £30,000 more than other leading lenders were prepared to offer. Repayments for the loan would have accounted for more than 60% of the fictional buyer’s take-home salary.

The reporter, posing as another potential customer, was also offered a so-called “negative equity mortgage” worth 117% of the value of the property he claimed to be interested in buying. The mortgages offered by other banks to the same potential borrower were significantly lower.

Don’t forget that this sort of lending is now being supported by the taxpayer’s money: even if it is at a high interest rate.

It’s also worth remembering that none of these loans (or rather, no more than usual) have actually gone wrong yet. The credit crunch and the run on Northern Rock were all caused by problems on their funding side, on their finding money to lend out. Now, with slowing house prices (or even the possibility of falls in them), we might actually find ourselves facing interesting times. What are people going to do with such loans when they’re losing them, not making them, money? Might they start to default?

If they do it will indeed be interesting times for of course, thanks to Alistair Darling, we taxpayers are on the hook for over £100 billion of such loans. Happy Days, eh?

Pic: Hack

Posted: 24th, September 2007 | In: Money | Comment (1)

Credit Crunch: Alan Greenspan Blames…

AS the Wall St Journal blog points out, Alan Greenspan has identified the true culprits in the current credit crunch.

AS the Wall St Journal blog points out, Alan Greenspan has identified the true culprits in the current credit crunch.

…former Federal Reserve Chairman Alan Greenspan sharply criticized ratings agencies for their role in the current credit crisis. “People believed they knew what they were doing,” Mr. Greenspan says in today’s German newspaper. “And they don’t.”

Still, he doesn’t think it’s necessary to strengthen rating-agency regulation. Essentially, they’re “already regulated,” he says, because investors’ loss of trust means the agencies are likely to lose business. “There’s no point regulating this. The horse is out of the barn, as we like to say.” Greenspan also said he believes that the volume of structured-finance products will decrease. “What kept them in place is a belief on the part of those who invested in that, that they were properly priced. Now everyone knows that they weren’t. And they know that they can’t really be properly priced,” said Greenspan.

Well, that’s a point of view, certainly. That it was the rating agencies which fell down on the job is true, but there’s more to it than simple incompetence. It’s a matter of the incentives they face.

They are paid by the people issuing the bonds: so there’s always pressure not to open up the bonnet and have a good old poke around in the engine. If somehow a method could be devised for the buyers to be paying the agencies then there’d be a great deal more diligence in working out how such issues were structured.

Quite how this can be managed though is a rather more difficult problem.

Posted: 24th, September 2007 | In: Money | Comments (4)

Northern Rock: John Betjeman, Panic And Gordon Brown’s Billions

NORTHERN Rock is in the mire. As Anorak reported yesterday, it is a victim of globalisation.

NORTHERN Rock is in the mire. As Anorak reported yesterday, it is a victim of globalisation.

It’s big news. And today we bring you our Northern Rock round-up.

DAILY TELEGRAPH front page: “Brown’s big gamble.”

Gordon Brown has “put his political credentials on the line” by guaranteeing all savings in Northern Rock accounts.

Well, not his money. Your money. Brown has put up $£21bilion of taxpayers’ money to halt the panic withdrawals.

No risk to your money, savers. So why wait in line to get your money back? Does Brown’s word count for nought?

As the Telegraph’s front-page picture shows, it’s not raining, the hoodies are back in school and Northern Rock customers are in the “hearing aid beige” years. Queue? Why not? You can always video Bargain Hunt.

Pages 2 and 3: “A British crisis in sensible shoes and orderly queues.” The spit of John Betjeman lives in the subs department.

The paper spots customers with fold-up chairs. This in not the last says of the Weimar Republic, we read. The slogan is ‘Better safe than sorry”.

Pages 4 and 5: “Security for savers comes at a price.” Savers taking their money from Northern Rock accounts may consider National Savings & Investments, says personal finance reporter Myra Butterworth. NSI is backed by the Government. But, then, so is Northern Rock.

Page 7: “A message from Northern Rock: Ya-boo suckers!”

No. Instead chief executive Adam J. Applegarth furrows his brow and offers his “sincerest apologies”.

“We’re open,” says the message.

DAILY EXPRESS front page: “As banks panic spreads Brown guarantees to pay out…with YOUR money.”

Page 4: “Has this Labour Government wrecked the British economy?” wonders the Express, inviting readers to phone in and vote “YES” or “no”. But what with the 25p call charge, we advise not calling and placing the money under your bed or in a watertight jar.

Page 5: “Rewards for board weeks before crash”. Mr Applegarth secured a 10% pay rise, his salary up top £760,000.

DAILY STAR page 2: a phone vote: “DO NORTHERN ROCK BOSSES DESERVE A BONUS?” Er..?

THE INDEPENDENT front page: “Banking crisis: the fear spreads.” And it’s being spread by the Indy.

Don’t panic!

Billions have been stripped off banks shares. Is Alliance & Leicester next? What about Bradford & Bingley.

Page 2: “Fear spreads to other banks”.

Page 3: “Patience, good humour and touch of the Blitz spirit.”

The Indy is in the queue. Is that Vera Lynn in line? Are Northern Rock Germans?

THE SUN front page: “Don’t panic. YOUR CASH IS SAFE WITH NORTHERN ROCK, SAYS CHANCELLOR.”

Alistair Darling has issued his “Dad’s Army-style message”.

Pages 10 and 11: “KEEP ON ROCKING.” No surrender. Although Ian King, the Sun’s business editor, says “failure not an option”. It rarely ever is. Failure is just what happens when you are not successful.

DAILY MIRROR front page: “Government’s Northern Rock guarantee: ‘EVERY PENNY IS SAFE’..So what should you do with YOUR cash?”

Well. Is it’s safe, why do anything? Leave it with the Rock.

Page 6: “ROCK SOLID.”

See.

Page 10:2 “What should you do with your money?” Well, as the Prime Minister says, leave it in Northern Rock and don’t panic? The Mirror doesn’t really offer much advice, only that the bank is OK, you should pay no attention to the people demanding their money and consider the 40p you spent on the Mirror a shrewd investment.

THE TIMES front page: “A £28bn cheque to stop the panic.” That’s £7bn more than the Telegraph’s headline figure.

Pages 6 and 7: “Panic infects other mortgage lenders as fears grow about exposure to crisis”. Look at those Alliance & Leicester shares dive, dive, dive. It really is just like the Blitz.

Page 7: “A catastrophe has been averted,” says Anatole Kaletsky. “Credit is rooted, quite literally, in the Latin credo ‘I believe’,” notes Kaletsky. All very good, but people will believe in different things. And the grey heads believe they should stand in line and get their money (see images in all papers).

Page 8: In any case, Northern Rock sponsors the Newcastle Falcons rugby union team. And thanks to England’s showing in the rugby World Cup, rugby union is now as popular as squash. Geordies should remain loyal to the local business, says the message.

And in Swindon they continue to queue.

DAILY MAIL front page: “BLACK MONDAY. As frightened savers continue to besiege Northern Rock, Labour, in a desperate U-turn, takes the unprecedented step of guaranteeing them their money. With another two banks wobbling, the critical question remains: Will this stop the panic?”

Pages 4 and 5: “Who’s next? The three big names in the frame…” Alliance & Leicester. Bradford & Bingley. Paragon. Start queuing now. But do not panic! DO NOT PANIC!!!

Pages 6 and 7: “Could bank go for just a penny a share?” Shares in Northern Rock have fallen. But they have further to go. Wanna buy a bank? Start saving – although not with the Northern Rock, obviously…

THE GUARDIAN front page: “Spread of banking panic forces ministers to guarantee savings.”

Pages 4 and 5: “Queues grow as weekend of worry takes toll.”

More worry to follow…

Posted: 18th, September 2007 | In: Money | Comments (6)

Northern Rock And Halifax Customers Are Victims Of Globalisation

WE need to return to pre-globalisation days when a man’s building society was in his locale, and strictly for locals.

WE need to return to pre-globalisation days when a man’s building society was in his locale, and strictly for locals.

The site of Northern Rock customers queuing for the money in Swindon serves as a warning to one and all.

But for some is comes too late. Take the case of Graham O’Brien, profiled in the Sun.

Mr O’Brien, 29, is a customer at the Halifax. Mr O’Brien chooses to live not in West Yorkshire but in Collyhurst, Greater Manchester.

He calls his bank to check on his account. “I answered all the security questions every time I phoned and they still wouldn’t accept I was Graham O’Brien,” says Graham O’Brien.

He has been marked down by the system as a “suspect”. The trouble is not the details provided but in the pitch of Mr O’Brien’s voice. In short, his voice is too high and he sounds like a woman.

“It has been unbelievable,” says he. “I feel I have been humiliated.”

A Halifax spokesman apologises, offering Mr O’Brien an equivocal “Were’s thus muck thus brass.” And a cautionary: “If thar ever offered owt, tek it tha might not want it na but tha cud need it later.”

Mr O’Brien remains with the Halifax. But given the reed-like properties of his voice we urge him to consider switching his account to the Chorley Building Society and so keeping things simple…

Posted: 17th, September 2007 | In: Money, Tabloids | Comment (1)

100 Ways To Save Money: Use Your noodle On Cheap Calls

THE Daily Mirror has one of those articles that try to make you save your cash by making money FUN. Are you having fun yet? Let’s see…

THE Daily Mirror has one of those articles that try to make you save your cash by making money FUN. Are you having fun yet? Let’s see…

In 100 Wacky Ways To Save Your Cash, the paper tells its readers how to save money.

One way – and one that is inexcusably overlooked – is not to spend 40p a day on the dire Mirror and read Kerching for free instead. Or Anorak.

So to the list. And the top way of saving money is…

No, it’s not to make full use of your ISA tax allowance or open a pension fund. Nor is it to use your noodle for cheap calls.

The top way the Mirror thinks you can save money is by “keeping tights in the freezer overnight before you wear them can make them last longer”.

This is followed by the sage advice to wear a pair of cotton gloves to pull on your tights and so prevent snagging. Crucially, the Mirror overlooks how much the gloves cost or any tips on how much you should spend on them. I suggest going to the petrol station – on your hands – and taking the plastic gloves they give away for free. You should then drop your tights in the garage’s deepfreeze, atop the lollies, and wait for a good hour.

The Mirror’s next tip is to put olive oil in a pepper shaker. This ensures less oil is dispensed with each shake. This also ensures that you have to shake the vessel more times than normal to get what you want and thus burn more energy and so have to eat more food. And good food does not come cheap. You may also find cause to toss the pepper shaker against a wall, which will only cost you more cash in the long term.

But now you have the gist of things. And realise that the Mirror knows less about saving money than Imelda Marcos.

The trick with saving money is to ensure that you – and study this well – do NOT spend more than your earn make full use of your tax breaks.

Who knew?

Well, not the Mirror which advices readers to cut Brillo pads in half, use bottles for rolling pins (but not empty champagne bottles, mind) and turn leftover salad into a soup. An utterly disgusting and inedible soup.

More tips to follow…

Posted: 11th, September 2007 | In: Money, Tabloids | Comment

Chelsea’s Roman Abramovich Does Not See The Light

THEY say he sleeps upside down with his head in pot of molten gold.

THEY say he sleeps upside down with his head in pot of molten gold.

They say his London home is powered by 2,000 eunuchs chewing on white tigers’ testicles.

They say Roman Abramovich did enter the Andrew Martin shop in Walton Street, South Kensington and try to buy a lamp.

He offered his polonium credit card. And it was declined. A witness, says the Times, saw all. They say Abramovich was “very polite about it”.

They say rivers started to run backwards and Britain’s richest man did walk on his hands in circles.

So they say…

Posted: 4th, September 2007 | In: Back pages, Broadsheets, Money | Comment (1)

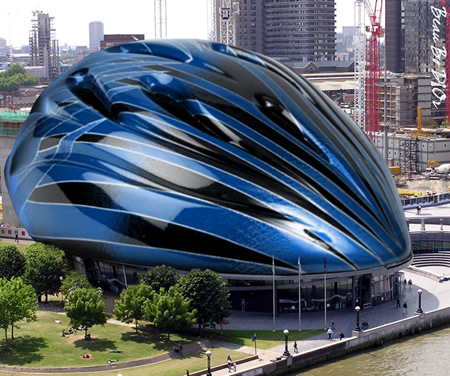

Ken Livingstone’s Triple Charge For 4x4s

FROM his futuristic Thames-side bunker (see Beau Bo D’Or‘s pic), Red Ken is once again considering another fiddle with the congestion charge. And not surprisingly it’s the drivers of the infamous Chelsea Tractor that are in his sights.

FROM his futuristic Thames-side bunker (see Beau Bo D’Or‘s pic), Red Ken is once again considering another fiddle with the congestion charge. And not surprisingly it’s the drivers of the infamous Chelsea Tractor that are in his sights.

Livingstone has announced a new consultation into potential higher charges for vehicles “that make the biggest contribution to global warming”.

These proposals would mean that drivers of gas-guzzlers could pay more than three times the current £8 a day charge while they could also lose their entitlement to the residents’ discount which is currently worth 90 per cent.

The result would be that drivers using large cars inside the zone would have to cough up £6,500 a year. On the other hand, the least polluting vehicles would get a 100 per cent discount and not pay any congestion charge at all.

Ken says: “By proposing these changes to the congestion charging scheme, we are encouraging people to take into account the impact on the environment of their choice of car. The highest CO2 emitting cars – like some of the so-called Chelsea tractors, high-powered sports cars and luxury executive cars – can produce twice as many carbon dioxide emissions as the kind of car driven by the average Londoner.”

Time for the reintroduction of the Sinclair C5. And Boris Johnson…

Posted: 8th, August 2007 | In: Money | Comments (6)

What Links Gordon Brown, Weymouth And Foot And Mouth?

GORDON Brown wants us to love Britain. (Pic: Beau Bo D’Or)

GORDON Brown wants us to love Britain. (Pic: Beau Bo D’Or)

Gordie wants us to bleed red, white and blue British blood, to speak the Queen’s English, to have a Union Jack tattooed on our arses and to holiday in these fair isles.

Yet, according to a new survey by Mother & Baby magazine and Mothercare, holidaying by the seaside in Britain is nothing sort of a Great British rip-off.

Of the 2,000 parents surveyed, approximately 75 per cent said that a trip to the seaside cost too much, with basic hotel rooms costing £120 and ice creams going for £3. Overall, the parents felt “fleeced” even on a day trip to the seaside, which costs an average of £84.

Much of the dissatisfaction stems from the perceived lack of service offered to those with children. Indeed, almost 75 per cent of respondents think holiday hotels see babies and young children as a nuisance, with one in five claiming that they had been turned away by hoteliers simply because they had youngsters with them. And 66 per cent also bemoaned the poor quality of meals available for children.

Mother & Baby editor, Elena Dalrymple, says: “’It doesn’t seem British hotels have moved much beyond the Basil Fawlty model. All most families really want is a decent-sized room, preferably with en-suite facilities, good food for the children and themselves and a clean, welcoming environment. Surely that’s not too much to ask?

With so many threats now from terrorism to global warming, more families want to holiday at home.”

Blackpool emerged as the worst place for a family holiday, with Hastings and Bognor also faring badly. Wonder if we’ll ever see Gordie and family spending his hols in a three-star hotel in Bognor?

Brown cancelled his holiday in Weymouth (he usually goes to Cape Cod) because of the Foot and Mouth crisis, the root of which has yet to be established.

You don’t suppose… No. As if… Would he be that cynical?

Posted: 8th, August 2007 | In: Money | Comment (1)

Passenger Behaviour on Amusement Rides: An HSE Study

THE Mail is livid. Plus ca change.

THE Mail is livid. Plus ca change.

This time it’s a report for the Health and Safely Executive that has the newspaper tutting and shaking its head violently.

The report, entitled ‘Passenger Behaviour on Amusement Rides’, cost £110,000 and took almost a year to produce. Some of its conclusions are admittedly rather obvious: “’The most commonly observed behaviour was one and two handed waving, turning of the head/trunk and pointing. The most common motives were communication, exhibitionism, curiosity and thrill enhancement.”

Hence we commend to the HSE’s attention this gem.

The report also finds that young adults tended to show “increased levels of exhibitionism and thrill enhancement” and that females were more likely to wave than males. (See Her Majesty and Danny La Rue.)

However, the HSE is defending the costly report, saying: “’There was a gap in knowledge about passenger behaviour and the information can be used by ride designers and operators to reduce accidents.”

The Health and Safety Laboratory, who carried out the study, last week produced another £12,000 tome on whether placing a towel on the bathroom floor helps to prevent slipping.

Maybe, just maybe, the Mail has a point.

For Cheap Phone Calls Don’t Use Patientline – Use Noodle

ONLY four months have passed since Patientline, the hospital phone and TV services company, decided to increase the cost of its calls by a massive 160%. But now, the firm have decided to do an almighty U-turn and cut the costs of its calls again.

In April, call charges were increased from 10p to 26p a minute by the company in a move that causes outrage amongst patient groups. However, now the charges are to return to the 10p rate while the minimum call charge is set to drop to just 10p, below even the pre-April figure of 20p.

So what have Patientline decided to change its mind? Because of its “dedication to making people’s stay in hospital easier” of course! Well, that’s what the company themselves say.

However commercial director, Charlotte Brown, is a little more forthcoming, admitting that the ridiculous price hikes had put people off using the service. Says she: “It was clearly a mistake for us to put the price of outgoing calls up.”

Patients should be using their Noodle, anyway.

Arise, Camelot Again

ALAN Dedicoat deserves some kind of honour. Maybe a knighthood or a Blue Peter badge at the very least. Something to reward him for his sterling efforts. (Pic: Beau Bo D’Or)

ALAN Dedicoat deserves some kind of honour. Maybe a knighthood or a Blue Peter badge at the very least. Something to reward him for his sterling efforts. (Pic: Beau Bo D’Or)

Alan who, you say? Alan Dedicoat, for God’s sake – the National Lottery announcer who desperately tries to inject some drama into sentences like “this week’s lotto machine is Pegasus, the fifth time its been used in the last seven and a half weeks” before flirting with Jenni what’s-her-face.

Anyway, whether Alan is alive or a recording from beyond the grave, Camelot have once again won the right to run the massive nationwide gambling craze for another 10 years, with the new licence starting in 2009.

Camelot, which has run the Lottery since its launch in 1994, had faced competition from Indian company Sugal & Damani for the licence. But according to a National Lottery Commission spokesman, “Camelot was selected after rigorous scrutiny” as there was “a strong probability that Camelot would achieve higher sales” than Sugal & Damani.

Currently, around £2.2billion is earmarked from Lottery funds for the Olympics. So let’s all keep gambling so that property developers, has-been athletes and Seb Coe can have their day in the sun.

Ricky Gervais: Fringe Benefits

THE backlash against tubby comic Ricky Gervais started the minute people realised that he actually was David Brent.

From sickeningly false modesty over his success to his penchant for kissing the backsides of the rich and famous, Gervais is struggling to win back the public’s sympathy, particularly after his cringe-making Princess Di concert on-stage death. (Relive the horror here.)

Now, the millionaire star has been accused of latent greed, after tickets for his Edinburgh Fringe Festival show were priced at £37.50 a pop. It doesn’t sound very ‘fringe’ to me.

Posted: 7th, August 2007 | In: Money | Comments (2)

Smexting And Noodle Talking Is Cheaper Than Texting

IT’S not only the nation’s lungs that are enjoying the smoking ban, according to mobile giant Orange. It seems that phone companies are also reaping the benefits of the ash-free pubs.

As smokers are forced outside to enjoy their guilty pleasure, they are also using their time-outs to text before heading back in for another pint.

Indeed, in the first two weeks after the introduction of the ban back in July, the number of texts sent rose by a staggering 7.5million across the Orange network.

Figures reveal that while 512 million texts were sent in the last two weeks of June, the total rose to 519.5 million in the first two weeks of July.

Nick Bonney of Orange says: “We see it as a halfway house for ostracised smokers – they can enjoy a cigarette and stay in touch with their mates.”

The company’s marketing boffins has even come up with the phrase “smexting” to describe texting outside the boozer when having a smoke.

If only they bloody banned texting in public places as well. Particularly trains. I’d love to see passengers pop outside of a moving train to text their loved one that they are “almst hme”.

However, the more switched on phone users will, no doubt, also have checked out Noodle by now – where talking is cheaper than texting!

It’s A Snitch Up: Metropolitan Police Pay Covert Human Intelligence Sources

GRASSES, snitches, squealers, police informants and narks are costing us with their blabbing – to the tune of a not very tuneful £2.2million a year. And that’s only in London. (Pic: Beau Bo D’Or)

GRASSES, snitches, squealers, police informants and narks are costing us with their blabbing – to the tune of a not very tuneful £2.2million a year. And that’s only in London. (Pic: Beau Bo D’Or)

This rather hefty figure comes courtesy of the Metropolitan Police, and refers to crime season 2006/07 when said amount was paid out in rewards for information about criminals operating in the capital and in other areas.

An additional £134,961 was also spent on “informant related expenditure” which includes accommodation, travel and the (large amounts of) food for police handlers. (Do police really need handlers? Actually, they really probably do, don’t they?)

Assistant Commissioner Steve House defends the figures and the fact that a breakdown of the expenditure had been kept secret.

Says he: “Most of our informants are doing this purely for money and they are involved in the criminal lifestyle and their lives are often at risk. The lack of transparency is to a certain extent deliberate. Informants, or as they are now called, Covert Human Intelligence Sources, are covert assets.

“It is not good sense to tell too much about any covert assets. We do not give too much detail…other than to say that Tony Blair was not necessarily spying for the Vatican.”

The last bit was made up, by the way.

I think…

Mobile Phone Companies Told To Clean Up Their Act: Use Your noodle

THERE is something inherently uncool about a bluetooth headset. While the wearer may feel that they are the star of some futuristic James Bond movie, they look like either: a) a care-in-the-community enthusiast or b) an utter utter idiot.

THERE is something inherently uncool about a bluetooth headset. While the wearer may feel that they are the star of some futuristic James Bond movie, they look like either: a) a care-in-the-community enthusiast or b) an utter utter idiot.

Anyway, whether you prefer the futuristic ear-piece to the old-skool handset, there is a fair chance that you have been “slammed” by a phone company. “Slammed” is the term that the Guardian uses (in an apparent ‘street stylee’) to describe how phone companies sneakily lock customers in to expensive contracts or switchyou to a new supplier without your consent.

However, with an average of 400 complaints a month about the behaviour of phone companies clogging up their inbox, Ofcom have finally decided to act with the unveiling of a new, but voluntary code of practice aimed at curtailing the dodgy end of the mobile industry.

Under the new code, mobile networks will no longer be able to fob off irate customers with excuses that the problem is the responsibility of a third-party company that sold them the new phone or service. Already Orange, O2, T-Mobile, Vodaphone have signed up. Although you really should check out noodle to get the best out of your phone: cheap calls.

Tony Herbert of Citizens Advice is pleased at the introduction of the new guidelines. Says he: “The number of mobile phone problems seen by CAB increased by 84% in the nine months from April to December last year to around 6,000 in total. Many of the cases reported involve people being browbeaten into accepting a new mobile phone, being sent a phone against their express wishes, or being hoodwinked into agreeing to a new mobile phone contract.”

There’s nothing worse than being browbeaten and then hoodwinked.

Posted: 6th, August 2007 | In: Money | Comments (4)

The Titanic Watch: DNA Of The Dead You Can Wear

WHEN you think of the Titanic, what pops into your head you? A dreadful disaster which could’ve been avoided? A dreadful movie which could’ve been avoided?

WHEN you think of the Titanic, what pops into your head you? A dreadful disaster which could’ve been avoided? A dreadful movie which could’ve been avoided?

Well, for Swiss jeweller Romain Jerome, the Titanic ship, which took 1,500 victims to their untimely deaths, means the chance to charge wealthy customers a small fortune for a little piece of history.

The Geneva-based jewellers have produced watches made from the salvaged hull of the Titantic, which has been blended with modern shipbuilding steel to make the casing of the timepieces.

The expensive watches, which range in price from £4,500 to £75,000, will be marketed under the tasteful name Titanic-DNA in a limited run of 2,012, a reference to the 100th anniversary of the disaster which is coming up in five years’ time.

Yvan Arpa, chief executive of Romain Jerome, says in the Mail: “We wanted to make a watch that had history and this is the rarest, most historical metal we could get hold of. The idea came to me when I visited a friend and he had a piece of the Berlin Wall on his mantelpiece. I wanted to incorporate that idea of owning history into a watch. This watch will give people the chance to carry a piece of history on their wrist.”

And a very heavy piece of history by the looks of things. One that could probably, rather ironically, drag you down to the bottom of the ocean.

Rumours that the company is also working on a diamond-encrusted executive toy made with the twisted remnants of the terracing from the Hillsborough disaster have yet to be confirmed.

Posted: 6th, August 2007 | In: Money | Comments (2)

Post Office Threatens Postmasters

WITH post offices closing, local shops usurped by supermarket giants, church attendances dropping and pubs turfing out their smoking clientele, Britons will probably find a better sense of community on Facebook than on their high streets.

The plan to close 2,500 rural post office branches in the next 18 months is set to have a devastating affect on small communities throughout the country and now it has been revealed that unhappy postmasters who speak out against the closures are being threatened with having their £60,000 compensation pay-outs rescinded.

The Mail also reveals that Post Office bosses told postmasters exactly how to answer questions from worried customers, warning that undercover staff are making sure they complied.

A letter sent out to postmasters says: “Representatives of Post Office Limited will visit branches at random, on an anonymous basis, to ensure these key messages are being delivered in an accurate and professional manner. Any compensation package offered to you if your branch is selected for closure shall be subject to you having complied, and continuing to comply, up to the date of closure.”

By the end of 2008, almost 40 per cent of all post offices open when New Labour came to power in 1997, will have been closed, reducing the number from 19,000 to approximately 11,800.

Postman Pat will be kicking his black and white cat.

Posted: 3rd, August 2007 | In: Money | Comments (2)

Iraq War Costs £2,000 A Second

MORE than £2,000 a second – that’s what the Iraq war is costing the US and the UK taxpayer. (Pic: Beau Bo D’Or)

MORE than £2,000 a second – that’s what the Iraq war is costing the US and the UK taxpayer. (Pic: Beau Bo D’Or)

It should make us all feel proud and honoured that our hard-earned cash is bringing freedom, prosperity and peace to the Iraqi people. But will we ever get so much as a “thank you”? I doubt it. The sheer cheek of some people!

Washington’s Congressional Budget Office has estimated that £250billion has been spent on combat operations in Iraq with the total increasing by an incredible £5billion every month. Britain is currently coughing up £80million a month, which despite looking quite paltry compared to the US figures, still works out at £31 a second.

Analysts in Washington claim that the war could eventually cost over £500billion and the Mail is quick to put his figure in perspective, saying that America recently pledged £18million to the UN refugee agency, an amount that would pay for less than three hours of military operations in Iraq.

John Spratt, chairman of the US House Budget Committee, says: “We’re actually spending more and more each year on the war. It’s an ominous indication the costs are continuing to rise.”

Let’s hope peace-loving Gordon Brown can get us out of this unholy mess. Oh, wait a sec, he was one of the guys who put us in it in the first place, wasn’t he?

Energy Customers In For The Long Haul And Curtail Switching

THERE is annoyance to be found in the way health clubs tie you in to long-term contracts.

You’re paying for the use of their facilities, so surely you should be able to quit whenever you like – usually when you realise that you can only be bothered to go once a fortnight. Now energy companies have been given the green light to impose their own long-term contracts on us.

Regulating body Ofgem’s decision to remove the rule that ties a customer to an energy supplier for just four weeks has, not surprisingly, lead to fears that the big six energy providers will impose scary year-long minimum contracts on their customers.

Ofgem claim the restrictions have been removed in an effort to encourage the power companies to step up the introduction of energy efficiency measures and smart meters in their customers’ homes.

Said an Ofgem spokesman: “We see this as a very positive thing for consumers. We consulted widely on this issue and all the interested parties have agreed that its removal will stimulate future investment in energy efficiency measures.”

However, Joe Malinowski of switching website TheEnergyShop.com, is, understandably, unimpressed. Says he: “Everyone’s in favour of more energy efficiency measurers, but equally there’s now nothing to stop the power companies making all new customers sign up for a minimum of 12 months – regardless of whether they agree to such measures or not. Ofgem said this will increase competition but this could backfire on the regulator if it allows prices to stay high and reduces the number of people switching suppliers.”

Expect the energy companies to start cashing in straight away.

Harry Potter And The Fool And His Money

THE Sun reports that Harry Potter competition winners are selling their signed first editions of the new book on eBay for up to £3,000. 1,7000 copies of the book – Harry Potter and his Army of Sad Adult Fans – were signed by former Jamiroquai star JK Rowling for young fans who won a draw on publisher Bloomsbury’s website.

But now the books are appearing on the auction website.

Guilty sellers can expect a plague of newts or something to fall upon their houses. (No, I haven’t read any of the books.)

Posted: 1st, August 2007 | In: Money | Comment (1)

“Dopey Derek” Ladner Scoops Double Lotto Win

THE Mirror calls Derek Ladner “dopey”, however, one imagines that the lucky Lotto winner doesn’t really care what anyone calls him anymore.

The 57-year-old is no doubt celebrating at this very moment after winning a £1million double share of the jackpot after buying two winning lottery tickets.

The married father-of-one had bought a second ticket, using his usual numbers again, after simply forgetting that he had purchased one already. But that absent-mindedness proved incredibly lucky for Ladner when the £2.4million jackpot was split between five winning tickets, and he had two of them – worth £479,142 each.

Camelot said yesterday: “This chap has doubled his money after winning two shares of the jackpot. He is the first person to win twice in the same draw.”

Ladner, from Redruth in Cornwall, and his wife plan to spend part of their winnings on a luxury holiday and doing up their home.

A friend of the winner says: “We’re all going to rib him about being crowned Britain’s first bad memory lotto millionaire. He’ll never live it down.”

He might not live it down but he’ll probably be on the look-out for wittier friends.

Posted: 1st, August 2007 | In: Money | Comments (4)