Money Category

Money in the news and how you are going to pay and pay and pay

The Extra-Wide Contact Lens

THE extra-wide contact lens:

Anyone who’s seen Japanese comics, cartoon videos or anime art is instantly struck by the common look of the girls – big eyes that, by making the rest of the face look small, add the cuteness and sex appeal prized by many Japanese men. Since no amount of cosmetic surgery will make actual human eyes larger, some girls are trying another way to up their cute quotient: extra-wide contact lenses!

Posted: 11th, August 2008 | In: Money, Strange But True | Comments (6)

Spot The Chocolate Chips

WOT chocolate chips?

Spotter: Tim Tam

Posted: 11th, August 2008 | In: Money, Photojournalism | Comments (2)

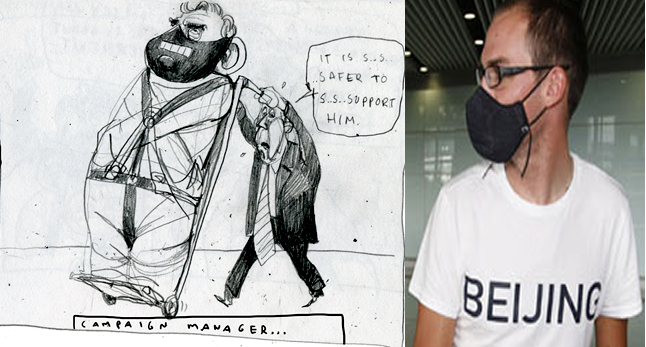

Nazi Olympic Fakes In China

YOU can buy anything in China. It might not be the genuine artilce, but it can be yours.

YOU can buy anything in China. It might not be the genuine artilce, but it can be yours.

On sale in Macau – flags of fall the nations…

What did you do in the Olympics, papa..?

Posted: 10th, August 2008 | In: Back pages, Money | Comments (10)

Credit Crunch: Halifax Makes Positive Move

CREDIT Crunch Watch: Anorak’s look at credit crunch in the news:

“Crooning banker Howard Brown has been axed from the Halifax ads because he is too cheery for the credit crunch” Daily Telegraph

Goodbye Howard, You came. You sang badly in an effort to get people to get into debt. You went, perhaps, to get a new job dancing and singing as people have their homes repossessed…

Posted: 10th, August 2008 | In: Broadsheets, Money | Comments (4)

Madeleine McCann: Greedy Newspapers Banking On Maddy In Brussels, And Naming Rights

MADDIE WATCH – Anorak’s at-a-glance guide to press coverage of Madeleine McCann, Kate McCann and Gerry McCann…

MADDIE WATCH – Anorak’s at-a-glance guide to press coverage of Madeleine McCann, Kate McCann and Gerry McCann…

DAILY EXPRESS (front page): “MADELEINE: I SAW HER ON MONDAY”

“Guard tells police she was in a Brussels bank”

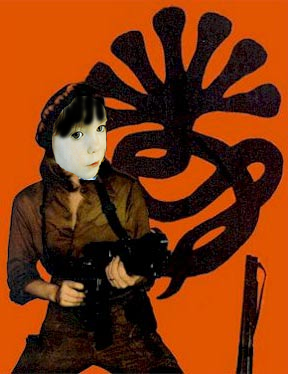

Can Madeleine McCann be the new Patti Hearst? What of the theory that she was kidnapped by freedom fighters, the Symbionese Liberation Army, and is being trained in covert operations and crime?

A bank worker in Brussels reported seeing Madeleine accompanied by a woman of North African appearance on Monday morning.

To Belgium, one of the low countries.

THE SUN (front page): “MADDIE: SEEN FIVE SAYS AGO.”

Read the rest of this entry »

Posted: 9th, August 2008 | In: Broadsheets, Madeleine McCann, Money, Tabloids | Comments (69)

Global Warming: The Rug

GLOBAL warming is..:

GLOBAL warming is..:

Global Warming contrasts the comfort and softness of a rug with a thorny problem that is specific to our time. Following the age-old tradition of using rugs as a means for communication and a cultural record, NEL is portraying global warming in a scene that invites us to reflect on our impact on today’s world.

And it covers you floor, too…

Posted: 8th, August 2008 | In: Money | Comments (2)

No Jumpers At RBS And Bankers Guess On Interest Rates

WHY is it that if the financial sector is down we are all supposed to feel down?

WHY is it that if the financial sector is down we are all supposed to feel down?

The FT’s Samuel Brittan is right to say that the financial sector is not the whole of the economy.

Financial services account for about 12 per cent of UK gross national product. The “wholesale” sector – from which the current crunch originated – contributes just under 4 per cent, although more than that of any other European Union country except Luxembourg.

Beaten by Luxembourg… The shame. First Eurovision. Now this. What it means is that if banks are doing badly, it need not be the be all and end all to all of us.

Read the rest of this entry »

Posted: 8th, August 2008 | In: Broadsheets, Money | Comment (1)

Britain Goes For Gold

AS The Croydonian points out: “From the wonderful people who had a fire sale of gold reserves, this:

[Sports minister Gerry] Sutcliffe, in Macao to visit the Team GB preparation camp, said competitors needed to come home with 41 medals and show the British public that the country’s £500 million investment into elite sport was “value for money

A little digging discloses that an Olympic Gold medal weighs around 250 grammes.

He calculates the gold being worth £4,461.82.

A small start, but it’s a start…

Image: Gordon’s smog mask

Posted: 7th, August 2008 | In: Back pages, Money, Politicians | Comments (2)

Amy Winehouse Is Six Times More Boring Than The Credit Crunch

CREDIT Crunch watch – making debt into a tabloid news story…

AMY Winehouse is six times more boring then the credit crunch. It’s in a survey. It’s a fact:

Stephen Waddington, managing director of Rainier PR, said: “At a time when many people are watching the pennies, it’s not surprising that the public have become tired of news about rock stars being odd, and pampered celebrities holidaying in exotic locations. The fact that Amy Winehouse is seen as six times more boring than the economy this summer illustrates this perfectly.”

Have drugs gotten cheaper yet..?

Posted: 6th, August 2008 | In: Celebrities, Money, Online-PR | Comments (2)

Women Can Have It All

PROFESSOR Jacqueline Scott compared studies of attitudes to working mothers over the past 25 years. Says she:

PROFESSOR Jacqueline Scott compared studies of attitudes to working mothers over the past 25 years. Says she:

“Opinions are shifting as the shine of the ‘supermum”‘syndrome wears off, and the idea of women juggling high-powered careers while also baking cookies and reading bedtime stories is increasingly seen to be unrealisable by ordinary mortals”

Old Mr Anorak’s current wife (pictured at the brigade;’s headquarters) says otherwise…

Posted: 6th, August 2008 | In: Money | Comments (20)

Credit Crunch Headline Of The Day

CREDIT Crunch headline of the day:

“We lost home in credit crunch…now we’re living in a pigeon shed” – The Sun

Good to know that in times of stress you can still rely on the generosity of a pigeon…

Posted: 6th, August 2008 | In: Money, Tabloids | Comments (2)

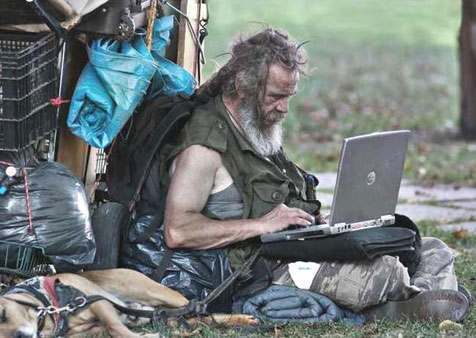

Anorak Is Working From Home

WORKING from home..

Posted: 6th, August 2008 | In: Money, Photojournalism | Comments (25)

Invest In Defence In A Housing Crash

IN the past three housing crashes, do you know which business sector has fired the better?

IN the past three housing crashes, do you know which business sector has fired the better?

Answer: Tissues.

No, not really. The answer is defence.

Read the rest of this entry »

Posted: 5th, August 2008 | In: Money | Comments (3)

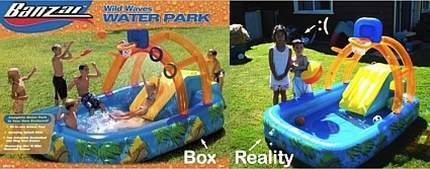

Midgets In Advertising: The Banzai Wild Waves Water Park

MIDGETS get work in advertising children’s toys:

Posted: 4th, August 2008 | In: Money, Online-PR, Photojournalism | Comments (5)

Australia’s Age Of Climate Change

THE AGE is hot on climate change:

If society is to confront climate change, it must change its behaviour and the way it conducts business.

The Age is very hot on the business of climate change:

The Age is rewarding a handful of its best Victorian Real Estate Agent clients with a special bonus: a trip to South America.

Last one to Cannes is a loser…

Posted: 4th, August 2008 | In: Broadsheets, Money | Comment

The Rubbish Police Are Coming To Your Bin

HEAR that rustling and grinding noise? It’s the sound of the “rubbish police”. No, not the Portuguese cops. This is the real rubbish police, and they’re coming to a wheelie bin near you.

HEAR that rustling and grinding noise? It’s the sound of the “rubbish police”. No, not the Portuguese cops. This is the real rubbish police, and they’re coming to a wheelie bin near you.

Read the rest of this entry »

Posted: 4th, August 2008 | In: Money, Tabloids | Comments (6)

Hello! Outbids Paedo Today For Pictures Of Knox Leon And Vivienne Marcheline

NEWS is that “Brad Pitt and Angelina Jolie have sold pictures of their newborn twins for a record £7.5million”.

NEWS is that “Brad Pitt and Angelina Jolie have sold pictures of their newborn twins for a record £7.5million”.

Reports the Mirror:

Hello! magazine secured the deal after a bidding frenzy with rival OK! to show photographs of Knox Leon and Vivienne Marcheline, three weeks old tomorrow.

Other magazines believed to have been in for the snaps, were Paedos Today, IVF Monthly and Voyeur Weekly.

A cheque from Russian website Kidz4Sale.com for the sum of £4.3billion is believed to have bounced…

Picture: 14

Posted: 3rd, August 2008 | In: Celebrities, Hello!, Money, Tabloids | Comment (1)

Carol Voderman And The Market For Celebrity Talent

CAROL Vorderman is worth what the market can stand:

But between them, Vorderman and the TV station have proved there is a market in talent – a fact the BBC’s trustees failed to grasp in their report on stars’ pay in June 2008. They concluded that performers like Jonathan Ross are not paid more than the market rate – even though the BBC won the auction for him by outbidding rivals.

The trustees did not realise that with so few buyers of talent (and C4 now proving it cannot bid with the big boys) the BBC is the market. And it did not realise that an employer creates the value of its stars by giving them formats and exposure – just as Channel 4 created much of Miss Vorderman’s value.

The Countdown experience should teach the BBC that wages go down as well as up. It is a lesson for boardrooms too.

The celebrity league table.

More Vorderman

Posted: 2nd, August 2008 | In: Celebrities, Money, TV & Radio | Comments (2)

Nancy Pelosi Purges Amazon

NANCY Pelosi has written a book. You can buy it through Amazon. It’s called Know Your Power…

Pelosi adheres to her illiberal fascism in every aspect of her life. It seems she wields her totalitarian “fairness doctrine” far and wide. Lone Pony is reporting that she is scrubbing Amazon of bad reviews – were there any other kind?

No..!

Nancy Pelosi had over 100 BAD reviews of her failed book disappeared from Amazon’s site yesterday!

Well, Amazon is in the business of selling books. And who buys a book knowing it will be crap? Ahem – I did once buy Learning To Fly by Victoria Beckham. And it was…

Posted: 2nd, August 2008 | In: Money, Online-PR, Politicians | Comment

Robert Reich’s Not The Summer Vacation

GIONG on holiday.? No, you’re not, says Robert Reich::

And even when we take those 14 days, we don’t always get paid for them. The Bureau of Labor Statistics tells us 1 out of 4 workers gets no paid vacation days at all. Every other advanced nation — and even lots of developing nations — mandate them.

There is no escape…

Credit Crunch Does For The Church

DO you hear bells?

Cathedral officials have denied accusations of financial mismanagement after admitting that a £103,000 bequest to pay for new bells had lost two thirds of its value in the credit crunch.

The legacy, consisting of shares thought to be in a high street bank, has lost £67,950 in value in the 18 months since it was made.

Posted: 2nd, August 2008 | In: Broadsheets, Money | Comments (2)

Innocent Smoothies Not So Innocent

INNOCENT smoothies for green smoothies:

Innocent Smoothies tells consumers on its website that “fruit always travels by boat or rail” because these methods use less fossil fuel than air or road transport per kilo of fruit. Customers are also told the drinks are produced in the UK.

However, the Daily Telegraph can reveal that the drinks are blended on the continent before being driven in dozens of tanker lorries hundreds of miles across Europe for bottling in the UK.

To mix the contents just so…

Posted: 2nd, August 2008 | In: Broadsheets, Money, Online-PR | Comment (1)

Pamela Anderson’s Abu Dhabi Penthouse Hotel

PNEUMATIC actress/singer/model/slash Pamela Anderson is to build a hotel. In Abu Dhabi.

“I’m building a hotel there. It’s environmentally friendly. I went there with the Make a Wish Foundation and met some great people there, and the royal family was really friendly.”

It will be built using “no fossil fuel”, claims silicon-toughened Anderson. How happy the locals must be:

The emirate’s 420,000 citizens, who sit on one-tenth of the planet’s oil and have almost $1 trillion invested abroad, are worth about $17 million apiece…

Say no to oil…

Posted: 1st, August 2008 | In: Celebrities, Money | Comments (14)

The £4 School Uniform For Today’s Youth

THE Express hails the arrival of the £4 school uniform.

THE Express hails the arrival of the £4 school uniform.

Costing just four of your British pounds, this uniform features shirt, trousers/skirt and knitted top.

The Climate Cops salute such frugality – what with there being a war on. And in turn Anorak salutes them and wonders if the uniform goes far enough.

Should we not be recycling old uniforms? Remember, parents, the Kinder Kops are watching…